Late last year, when we sat down to write the Sage 2023 Investment Outlook, we reflected on a year that tested investors’ resilience, patience, and focus. At that time, we anticipated that financial market conditions would normalize in 2023, albeit against a harsher economic backdrop. Indeed, in the first half of this year, we have navigated through periods of uncertainty and unease. As we share our Insights today, financial markets have performed well, and we remain cautiously optimistic about the months ahead.

In this edition of Insights, we highlight recent market performance, analyze the Fed’s “pause” at the June meeting, discuss the potential impact of artificial intelligence adoption, and emphasize that “time in the market” is more valuable than “timing the market.”

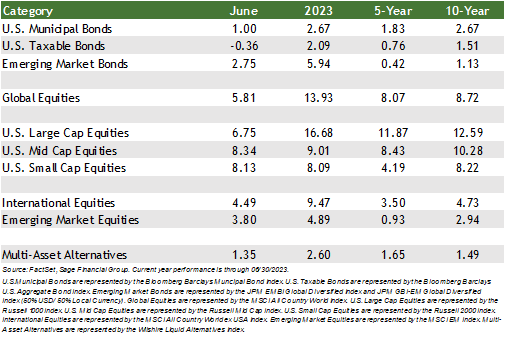

Financial markets rebounded in June, invigorated by the resolution of uncertainty about the debt ceiling and decreased banking volatility. Year to date, most financial market indices have performed solidly after a disappointing 2022.

U.S. and international stocks enjoyed positive returns in June. In the U.S., these returns were widespread across sector and company size, which has been rare this year, with investors preferring to pay attention to technology names and the potential opportunity of companies tied to artificial intelligence. U.S. large-cap stocks rose by 6.75%, while their small-cap peers pressed higher by 8.13%. Strength from smaller companies can be viewed positively as they typically derive revenue from the U.S. consumer and indicate a strengthened U.S. economy.

Stocks outside of the U.S. also demonstrated positive performance in June. Like the U.S., European Central Banks pointed to higher rates ahead as their economies appear in good shape. The most widely referenced international stock index gained 4.49%, and emerging market stocks rose by 3.80%. A meeting between U.S. Secretary of State Antony Blinken and several key leaders in China was received favorably by markets as a potential step in positive relations moving forward.

In June, high-quality bonds saw a negative monthly return of 0.36% as markets faced the escalating probability of interest rates that remain “higher for longer.” Even with signs of an extended restrictive monetary policy, the expectation is that most of the Federal Reserve’s policy measures have already been rolled out. YTD through June, the Bloomberg U.S. Aggregate Bond Index registered a 2.09% rise, indicating a positive return for the first half of the year. Illustrating the benefits of diversification, emerging markets debt delivered a 2.75% return in June, doubling the performance of comparable U.S. bonds in 2023. [1]

The Fed’s “Higher-for-Longer” Approach and Its Impact on Financial Markets

The Federal Reserve’s meetings every six weeks are typically eventful for markets. Over the past fifteen months, the Federal Open Market Committee (FOMC) has convened ten times, unanimously supporting increasing the target interest rate at each meeting. June marked a break from this cadence, as members concluded that an immediate rate hike was unnecessary.

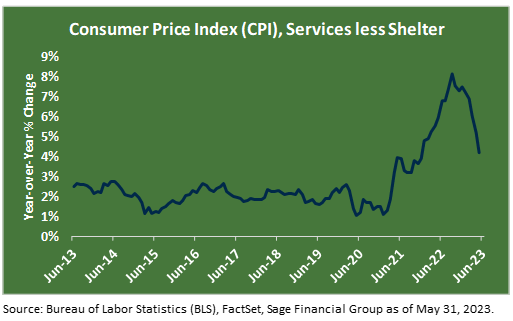

The Fed has been successful in slowing prices in rental housing and goods industries, but inflation in the service sector has shown to be stickier. The strength of the service economy gives policymakers the greatest hesitation about outright concluding tightening monetary policy, as demand remains strong for activities like healthcare, business services, dining, and travel.

Although market participants expected the pause in rate hikes, their response was tempered after Chairman Jerome Powell said, “Additional interest rate hikes may be appropriate and necessary.”

A key takeaway from these comments is that rates may remain higher for longer than expected. Driving this thought process is the Fed’s use of the term transitory, which in retrospect, was too quick, and now wants to err on the side of being more cautious.

This “higher-for-longer” approach to policy rates seems to be working to control economic activity, albeit slowly. Because monetary policy acts with a lag, the impact on the broader economy takes time to move through various industries. In some areas, growth is slowing as companies begin to announce layoffs and reduce unnecessary capital expenditures.

Committee members communicated that their decision process would remain data dependent, as they believe the final push to quash inflation could be the FOMC’s most challenging (see chart below).

From a market perspective, this higher-for-longer approach has led to muted but positive returns in the investment-grade bond market. Despite higher rates, equity markets have remained robust, primarily due to economic growth exceeding expectations. Taxable investment-grade and municipal bonds have returned 2.1% and 2.7% YTD, respectively. Our view is that future bond returns will increase as yields continue to rise across most pockets of the globe. For example, high-quality corporate bonds and high-yield bonds/loans have current yield-to-maturity levels of 5-6% and 9-11%, respectively.

In portfolios, we focus on allocating to fixed income as both an income opportunity and potential ballast in portfolios should the economy slow much quicker than anticipated. Over the past year, Sage has added to U.S. and global bond funds for many portfolios. In our view, yield has rarely looked this attractive to compensate investors since the Global Financial Crisis ended in 2009. At the same time, owning an allocation to bonds with longer maturities can provide price appreciation if rates fall quickly.

Unleashing the Power of AI: Implications for Financial Markets and Investments

Artificial intelligence (AI) has taken the corporate world by storm. Recently, corporate executives have frequently discussed artificial intelligence in their shareholder letters and investor calls. The message has focused on the potential of this technology for economic innovation and efficiency. Technology that can generate text, appropriately named “Generative AI,” has been the most recent fascination, as the applications may be so broad reaching.

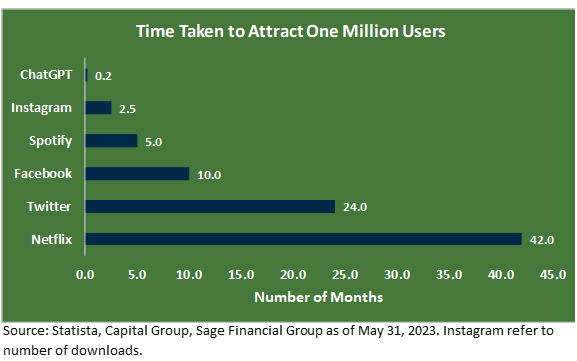

The most widely known generative AI program is ChatGPT, formally launched in November 2022. At the time, ChatGPT became the fastest-growing consumer application in history, achieving 1 million users in just 5 days (see chart below). Two months later, the application had already surpassed 100 million users.

It is still very early to know what the implications of ChatGPT and other applications of AI may be. First, we must recognize that artificial intelligence has been a critical part of our everyday lives for many years. Whether that be Google’s search engine or streaming Netflix’s latest offerings.

While there are still many unknowns, research from Goldman Sachs estimates that 25% of current work tasks could be automated by AI in the U.S. and Europe.[2] These tasks may be replaced by other, more productive tasks or occupations. Historically, the U.S. has been a global leader in AI, thanks to cutting-edge research at universities, a robust startup ecosystem, and investment by large tech companies.

From an investment standpoint, in our view, the impact of the technology may be very broad-reaching, thus creating both direct and indirect beneficiaries. We think that the overall economy will see a boost from this technology and that companies may be able to boost profit margins, thus helping stock prices.

The companies that benefit the most from this technology are high-quality businesses that adapt and invest in change while staying true to their main business. These could include companies such as:

- Those who provide the tools for artificial intelligence, such as chip makers and software platforms.

- Companies in control of large amounts of proprietary data to understand consumer behavior.

- Enterprises that use Generative AI to amplify the impact of workers. That is, companies that can create more work output per number of workers, thereby decreasing labor costs and increasing the ability to scale.

While these are all exciting developments, it typically takes longer than expected for new technology to make an impact. Thus, Sage’s expectations remain tempered, though optimistic that AI can create a more productive workforce that could result in a multi-year tailwind for financial markets. An economy that makes continued strides towards being more productive will ultimately lead to larger GDP and ultimately translate to higher expected returns in equity and bond markets.

Long-Term Perspective: Sticking to Your Financial Plan

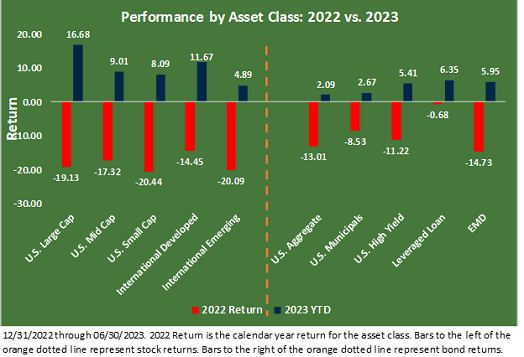

Because markets tend to overshoot to the upside and downside, selling stocks or bonds after a period of pain can increase the probability of missing future positive investment returns. Though 2022 saw nearly all asset classes post negative returns, this year has been a mirror image for performance. We continue guiding Sage clients toward customized plans created specifically for their goals.

- Equities: U.S. large-cap and international developed stocks were some of the weaker performers last year but have rebounded favorably in the first half of the year.

- Investors have been encouraged by the safety of the size of these companies’ balance sheets and diversified sources of revenue.

- Performance from mid- and smaller capitalization stocks has been limited due to the uncertainty around the banking sector and debt ceiling negotiations.

- Bonds: Double-digit negative returns from bonds seemed like an anomaly last year as it was the severity that was so surprising.

- While infrequent, intermediate-term investment grade bonds have posted negative returns in 11 of the last 98 years.

- An important point is that even as rates have increased this year, a higher starting yield has provided a buffer for total bond returns. A modest decrease in price can be offset by the generated income.

We understand that living through the portfolio performance experienced last year was painful. However, adhering to your financial plan and long-term investment strategies routinely proves to be a good approach during market volatility.

When investing, our belief is that stocks and bonds can complement each other when effectively integrated into a portfolio, as growth assets benefit during economic expansions while bonds appreciate during downturns. As the late Vanguard founder Jack Bogle said in 2018, “Don’t let these changes in the market, even the big ones change your mind and never, never, never be in or out of the market. Always be in at a certain level.” We, too, believe that these principles of patience, focus, and diversification form the core of a successful investment plan.

Closing Thoughts

We welcome the markets’ resiliency so far this year. At the same time, we want to remain prepared for a range of outcomes through diversified portfolios while seeking to benefit from opportunities with global markets to improve the return prospects for our clients’ portfolios. We will continue to remain focused on their financial goals, timeframes, and liquidity needs and make adjustments when appropriate.

[1] Emerging markets debt represented by the JPM EMBI Global Diversified Index and JPM GBI-EM Global Diversified Index (50% USD/ 50% Local Currency). U.S. large-cap stocks are represented by the Russell 1000 Index. U.S. small-cap stocks are represented by the Russell 2000 Index. International stocks are represented by the MSCI All Country World ex USA Index. Emerging market equities are represented by the MSCI EM Index.

[2] Based on the review of existing literature on the probable use cases of generative AI, Goldman (GS) classified 13 work activities (out of 39 in the O*NET database) as exposed to AI automation, and in the base case assumes that AI is capable of completing tasks up to a difficulty of 4 on the 7-point O*NET “level” scale. GS then takes an importance and complexity-weighted average of essential work tasks for each occupation and estimates the share of each occupation’s total workload that AI has the potential to replace. GS further assumes that occupations for which a significant share of workers’ time is spent outdoors or performing physical labor cannot be automated by AI.

Previous Posts

- Sage Insights: Take It To The Limit

- Our Perspective: The 2023 Debt Limit

- Sage Insights: Taking Stock of Today’s Climate

- Sage Insights: March Madness in the Banking Sector

- Our Perspective: Our Perspective: An Update On The Banking Industry and Interest Rates

- Our Perspective: Current Thoughts on the Banking Industry

Learn More About Sage

Disclosures

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks, or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks, or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks, or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, product, or any non-investment-related content made reference to directly or indirectly in this newsletter will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged, and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.