Uncertainty has increased over the past week regarding the health of the U.S. banking industry, given the takeover by U.S. regulators of Silicon Valley Bank and Signature Bank. We want to share our latest perspective. This situation remains fluid as regulators, and government officials are closely working with the private and public sectors to provide a timely resolution.

We are confident that client assets are secure at custodians, such as Charles Schwab and Fidelity, and that the current banking situation will be contained. Below is an explanation and our perspective.

What is the history of Silicon Valley Bank?

- Silicon Valley Bank (S.V.B.) was founded in 1983, and its primary customers have been businesses that include early-stage startups, technology companies, and some high-net-worth individuals.

- S.V.B.’s deposits grew three times larger in just two years between 2020-2021, boosted by technology company funding. In fact, banking clients included nearly half of all U.S. venture capital-backed tech startups.

- As of year-end, Silicon Valley Bank was the 16th largest bank in the United States, with more than $209 billion of assets.

What happened to Silicon Valley Bank (S.V.B.)?

- At the beginning of 2022, the bank had a $120 billion investment portfolio of fixed-rate securities (bonds).

- These securities declined by ~15% in 2022-23 as higher interest rates put pressure on bond prices.

- By the end of 2022, bank deposits fell by 10%, as many companies that use the bank were burning cash, and early-stage funding dried up.

- Additionally, S.V.B.’s business-heavy customer base knew it could get higher yields on treasuries than cash and rationally withdrew money to invest in higher-yielding products. Because deposits were consistently declining, S.V.B. decided to sell $20 billion of its bond portfolio at a $2 billion loss and raise equity to cover the loss.

- However, depositors were spooked and quickly fled, leading to the “run on the bank.” The FDIC then stepped in, deemed S.V.B. insolvent, and shut down the bank.

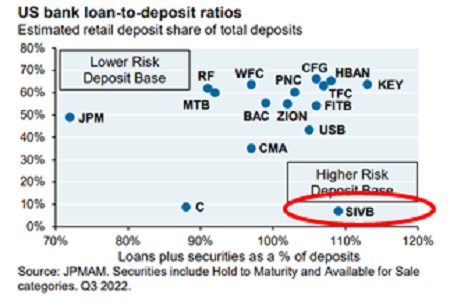

- A reasonable framework for bank riskiness is estimated retail deposit share of total deposits (lower is riskier, as retail deposits are stickier) and loans plus securities as a share of total deposits (higher is riskier). SIVB was the riskiest bank by a considerable margin.

What is the security of accounts held at Custodians such as Charles Schwab and Fidelity?

- Money markets, mutual funds, ETFs, and other securities custodied at Schwab and Fidelity are secure for the following reasons.

- Investors in securities are the owners of those securities, and the custodian’s health does not matter.

- Money market funds are securities and covered by SIPC insurance.

- Schwab and Fidelity money market funds have zero exposure to Silicon Valley Bank.

- Schwab and Fidelity have significant financial resources. For example, Schwab has:

- Access to significant liquidity with an estimated $100 billion of cash flow on hand with more than $300 billion of incremental cash available through short-term facilities, including the Federal Home Loan Bank (FHLB) and the newly created Bank Term Funding Program (BTFP).

- Diversified revenue streams compared to regional banks, including a higher mix of wealth management services versus traditional banking (deposits/loans).

- More than 80% of Schwab’s total bank deposits fall within the FDIC insurance limits, among the five highest ratios of the top 100 banks in the United States.

- This contrasts greatly with Silicon Valley Bank, which had over 90% of deposits above FDIC limits.

- Additionally, the company maintains $85 billion of investment securities, including U.S. Treasuries, maturing in 2023, which can help meet deposit needs if necessary.

- Regulatory Strength: At the end of 2022, Charles Schwab maintained a Common Equity Tier 1 (CET1) ratio of more than 20%, well above the minimum 4.5% requirement set by regulators.

- Common Equity Tier 1 refers to the highest quality of regulatory capital, which primarily includes the sum of common shares and retained earnings.

- Schwab’s stock price may be volatile over the near term as more regulatory costs are imposed on regional banks such as Schwab. Note Schwab’s stock price does not impact the security of client assets custodied at Schwab.

- Currently, Charles Schwab has a $100 billion market cap, which gives the corporation the ability to sell stock for additional capital if needed.

What Action has the U.S. Government taken?

- There were three big pieces of what the Federal Reserve (Fed), Federal Deposit Insurance Corporation (FDIC), and U.S Treasury announced over the weekend:

- All depositors of S.V.B. would have access to 100% of their capital as of today.

- A second bank, Signature Bank, failed. Depositors at Signature Bank will also have access to their money today.

- Creation of the Bank Term Funding Program (BTFP), a $25 billion facility to backstop bank liquidity. The funding for banks will be in the form of one-year loans to help bridge funding gaps.

- These announcements are positive. Together, they set a precedent for ensuring that depositors can access their money and provide a lending facility for banks to maintain capital requirements.

- For investors who have securities or deposits at banks, the Federal Government sent a clear signal that those assets are protected.

We will continue to closely monitor the situation and keep you informed with our perspective of any new significant developments.

Previous Posts

- Our Perspective: The Debt Ceiling

- Sage 2023 Annual Letter

- Sage 2023 Investment Outlook

- Sage Insights: Markets Bounce as Economic Growth Slows and China Adjusts Its COVID Policy

- Sage Insights: Federal Reserve Rate Hikes Persist, Political Volatility in China, and Perspective on the Journey of Investing

Learn More About Sage

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks, or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks, or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks, or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, product or any non-investment-related content, made reference to directly or indirectly in this newsletter will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please visit Our Accolades page or contact us directly.

© 2023 Sage Financial Group. Reproduction without permission is not permitted.