2022 in Review: A Year of Very Difficult Performance for Stocks and Bonds

When we sat down to write our outlook for 2023, we first reflected on 2022 — a year that tested resilience, patience, and focus. After three consecutive years of positive returns, markets quickly changed direction in 2022. By March, we found ourselves on a challenging path. Inflation continued to exceed expectations, the war in Ukraine brought human tragedy and exacerbated inflationary pressures on food and energy prices, a strong multi-year bull market in U.S. stocks left market valuations towards the higher end of their 25-year range, and the Federal Reserve’s decision to raise interest rates at the fastest pace of monetary policy in the U.S. over the last 40 years.

All of these dynamics brought instability to financial markets. In this piece, we’ll unpack the implications of that uncertainty and focus on how 2022’s slowing economy could impact the year ahead.

2022 Performance Recap

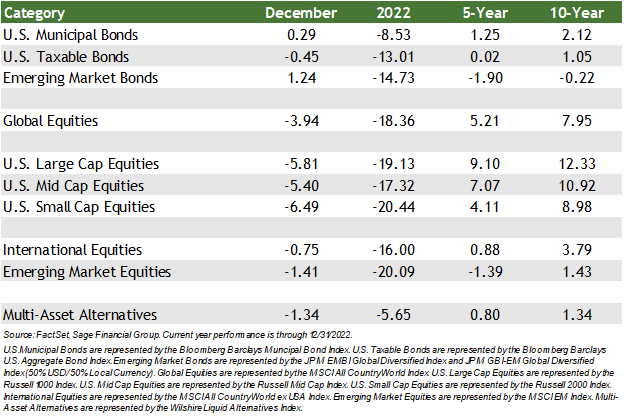

In fixed income, the sharp rise in interest rates caused high-quality investment-grade bonds to fall sharply and record their worst year in over a century. U.S. municipal bonds fell 8.5%, and taxable U.S. investment-grade bonds declined 13.0%. Emerging market debt fell 14.7% in 2022 as higher global interest rates and the strengthening of the U.S. dollar provided dual headwinds for the asset class.

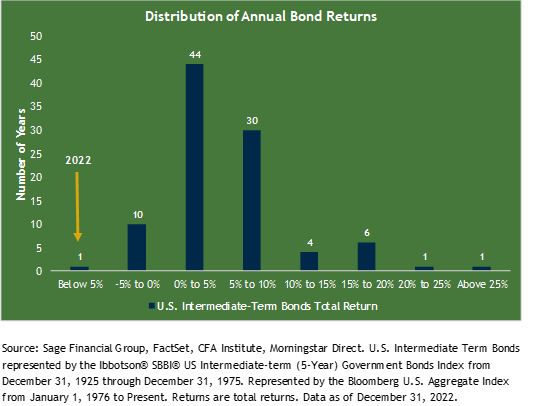

As shown below, 2022 was the worst calendar year for investment-grade bonds dating back to 1926. Over the last 96 calendar years, there have been only 11 negative years for investment-grade bonds, and this year marked the first decline of more than 5%. 2022 was truly “a one-hundred-year storm” for bond markets.

However, as we will detail later in this piece, we see a silver lining in today’s bond market. While higher rates hurt bond prices throughout 2022, at current yield levels, expected future total returns are higher than those experienced in recent years.

The U.S. equity market was also unkind to investors, as higher interest rates and the anticipation of slower future economic growth beat down global stock prices. U.S. large-cap stocks fell 19.1% for the year in what proved to be a meaningful reset of valuations. U.S. mid and small-cap stocks declined by 17.3% and 20.4%, respectively. International stocks fell 16.0%, and emerging market stocks declined by 20.1%.

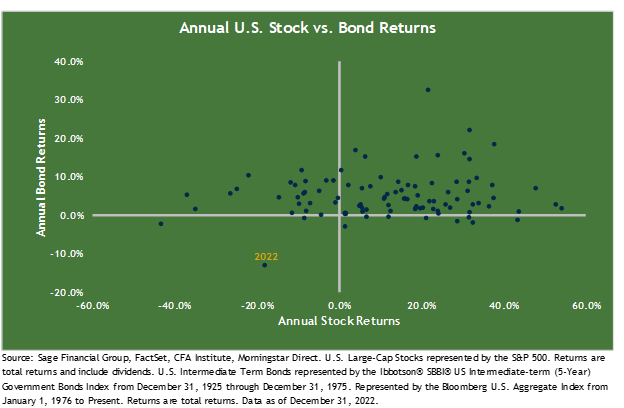

Typically, stocks and bonds can complement each other when effectively integrated into a portfolio, as growth assets benefit during economic expansions while bonds appreciate during downturns. Since 1926, there have been only three periods when stocks and bonds simultaneously provided negative investment returns. The first in 1931 was unusual, with Britain abandoning the gold standard resulting in a currency crisis. 1969, on the other hand, was eerily similar to today, with factors such as tightening of monetary policy, removal of the fiscal punch bowl, and an oil shortage at play. In 2022, we experienced the first calendar year in over 100 years that saw both stocks and bonds fall by double digits.

Sage’s approach to portfolio management remained steadfast throughout 2022. Rather than trying to time the markets or overreact to current events, we maintained a disciplined strategy that involved rebalancing (seeking to buy low and sell high) through market fluctuations and diversifying the allocation of investments within portfolios. In our view, this disciplined and diversified approach continues to create a higher probability that clients will reach their financial goals.

Beginning in early 2021, Sage made several changes to further diversify portfolios in anticipation that traditional asset classes would be challenged. As appropriate, we added numerous nontraditional funds, including alternative bonds, infrastructure, and real estate, in anticipation of an economic slowdown and the possibility of a recession. We also reduced clients’ exposure to more interest rate-sensitive equity funds where possible.

While it is important to pay attention to performance and continually consider how it could impact your unique financial picture, we don’t let volatility distract us from our investment objectives, time horizon, and client goals. Over the long term, financial returns are driven by economic growth, inflation, and productivity growth (i.e., innovation).

2023 Sage Outlook: A Return to Normal Amid a Slowdown

2022 was a year of pronounced market volatility and an aggressive Federal Reserve. In contrast, we believe that 2023 will be a year of more normalized market conditions, albeit against a harsher economic backdrop.

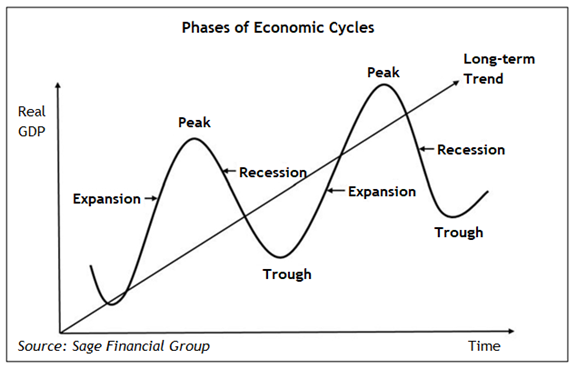

The Federal Reserve’s quest to tighten financial conditions rapidly expedited the speed of the current economic cycle. As a result, in our view, we entered 2022 during an economic expansion. The U.S. economy was operating with above-average growth, and the labor market exhibited record-low unemployment.

Moving forward, we expect below-average long-term growth as businesses continue to defend profit margins by cutting costs and eliminating jobs. We see this leading to a modest rise in unemployment.

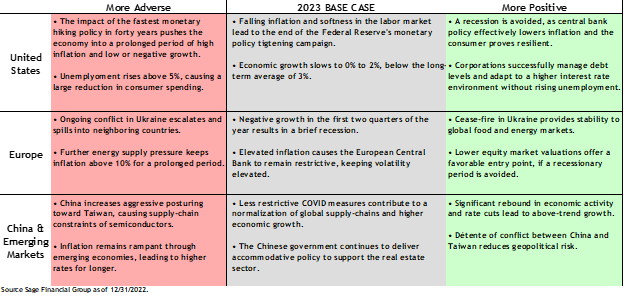

Sage’s investing framework includes creating scenario analyses for a range of outcomes, assigning probabilities to each outcome, and allocating capital accordingly. As we look into 2023, we have base case expectations and more positive and adverse ones.

Our base case is that 2023 will experience weaker economic conditions than 2022.

In the U.S., we believe the economy will continue to grow slowly, likely between 0% to 2% in 2023, which is below the long-term historical average of 3%. Additionally, we will keep a close eye on labor market conditions, as a rise in unemployment would likely benefit fixed income. Equity market implications are more dependent on the severity of the slowdown.

In Europe, it appears increasingly likely there will be consecutive quarters of negative economic growth in the first half of 2023. Though European growth was stronger than expected in 2022, energy-related supply pressures have caused double-digit inflation, which should require higher interest rates for longer. In addition, the ongoing conflict in Ukraine appears to be de-escalating, but a potential spillover to other pockets of the continent would have a pronounced negative impact on the economy.

In emerging markets, we expect growth to rebound following the conclusion of central bank hiking policies and the normalization of China’s COVID policy.

That being said, we don’t know what unforeseen developments may evolve, just as we could not have predicted COVID, Russia’s invasion of Ukraine, China-U.S. tensions, etc. Therefore, to guard against the unknown, client portfolios are constructed for many potential scenarios.

- More Positive: A market environment that surprises to the upside would likely include inflation that declines faster than expected, a weaker dollar, which could boost U.S. exports and prices for international assets (from a domestic investor’s perspective), and international growth.

- More Adverse: Conversely, a positive environment is not guaranteed. In our view, risks to economic growth include the elongated negative effects associated with rising interest rates, prolonged inflation in stickier pockets of the economy, and a rise of geopolitical tensions.

We highlight some of the key points in each case below.

Major Economic Themes

We believe three themes are likely to have a meaningful impact on the broader economy and, subsequently, financial markets:

- Theme #1: Personal Savings Remain a Tailwind but That May Fade

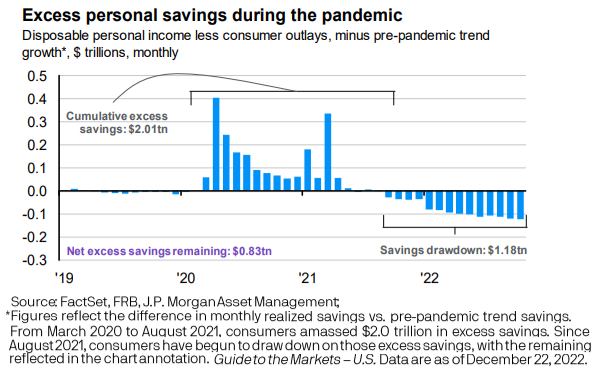

- Excess consumer savings are likely to run out in mid-2023. The pandemic era personal savings that have supported the U.S. consumer remain an economic cushion but are beginning to fade.

- Theme #2: Consumer Spending Behavior Returns to Pre-2020 Trends

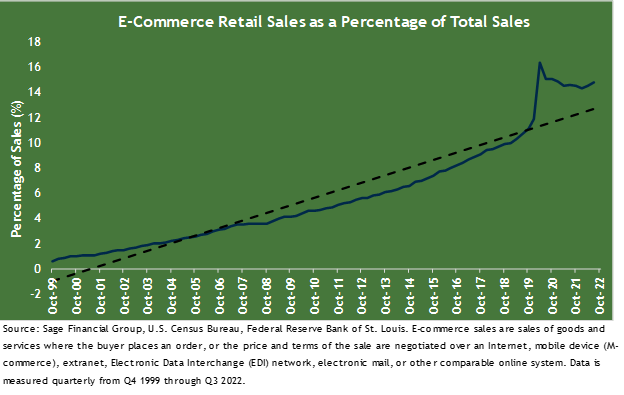

- The proportion of goods vs. services spending was thrown out of balance by the pandemic. However, we believe that longer-term trends toward services and e-commerce remain intact.

- Theme #3: The Fed’s Tightening Impacts Jobs

- The lagged impact of the Federal Reserve’s nine-month policy tightening campaign on the labor market and other areas will ultimately slow the economy.

Theme #1: Personal Savings Remain a Tailwind, but That May Fade

At the onset of the COVID-19 pandemic, the Federal government provided historical levels of fiscal transfers to boost household incomes. At the same time, the concept of “social distancing” became front and center in our lives, resulting in a lower level of household spending. Taken together, households accumulated more than $2 trillion in excess savings from March 2020 through June 2021. Since then, households have drawn down nearly $1.2 trillion to help offset the rising costs of goods and services.

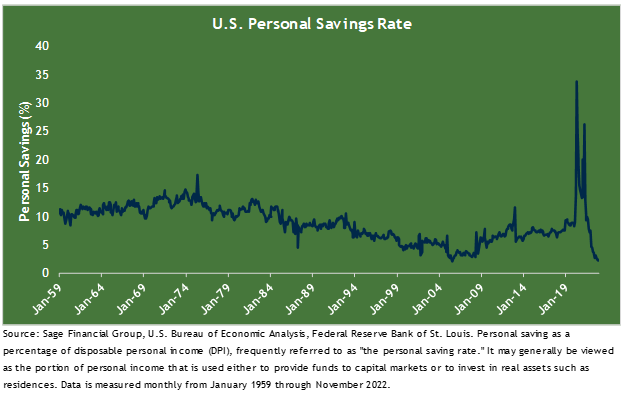

Looking back over time, the U.S. personal savings rate provides insight into how households cushion their wealth. The most recent report as of November showed the personal savings level hitting a 17-year low, with higher borrowing costs and inflation eroding financial buffers. We believe this is a reflection of households’ spending on vacations and experiences to make up for lost time, as well as those who are dipping into savings to make ends meet due to inflationary pressures.

Looking ahead, consumers will likely continue spending their excess savings, but the pressures of higher prices are clearly beginning to weigh on them. Thus, if the pandemic-era excess savings are depleted before incomes can catch up to higher prices, we may see a more pronounced decrease in spending. In the second half of 2022, real personal income levels rose 0.9%, highlighting continued resiliency throughout the economy.

Consumer spending comprises 70% of the U.S. economy, and a slowdown would temporarily weaken the economy and assets such as stocks and lower-quality bonds. In contrast, we would expect higher-quality bonds to fare well, along with select alternatives such as infrastructure and multi-strategy funds.

Theme #2: Consumer Spending Behavior Returns to Pre-2020 Trends

E-commerce was a key beneficiary of the shift in consumer behavior throughout 2020. Online retail spending spiked as most states restricted mobility. McKinsey estimates that U.S. retail sales grew by 40% year-over-year by the end of 2021. While the two-year period from 2020 through 2021 showed a steep incline in e-commerce retail sales, the industry has been in a consistent secular rise over the last 20 years. This coincides with the emergence of the internet, with companies targeting consumers by using new means of reach. We expect e-commerce to grow at the pre-2020 trend as retailers leverage digital and omnichannel platforms.

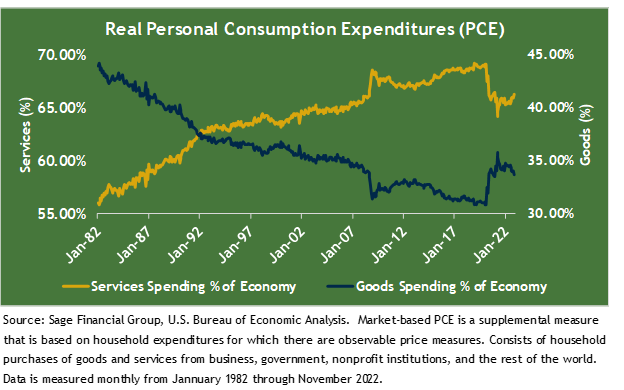

Over the last decades, consumer spending on services, including travel and dining, increased to 70% of total spending. But in 2020 and much of 2021, these activities were restricted, and consumers splurged instead on goods they could purchase online at home. Layer in several rounds of fiscal stimulus and durable goods, spending on cars and home appliances increased to 36% of total spending. As consumers slowly move back towards prior behaviors, the impact on core good prices should alleviate pressure on the broader economy. In the final months of 2022, prices of core goods fell. In fact, new and used vehicle prices declined each month since May of this year.

In our view, a return to the longer-term spending trend favoring services should alleviate pressure on the broader economy and could mean less inflationary pressures, as supply chains are built for the mix of goods and services purchased before the pandemic.

Theme #3: The Fed’s Tightening Impacts Jobs

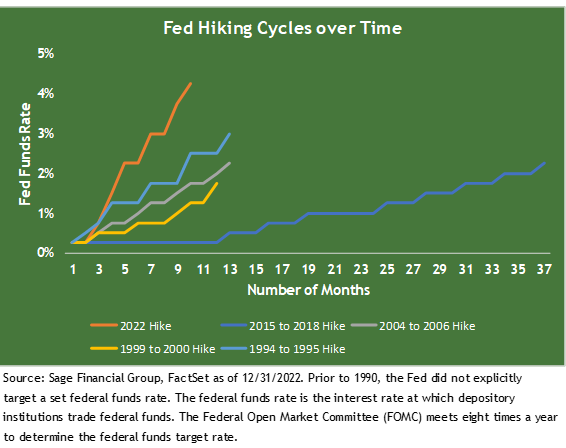

In 2022, the Fed Funds rate changed faster than it had in 30 years. So far, the impact of higher rates has been felt in sensitive segments of the economy, including falling home prices and reduced home sales. Initially, the labor market demonstrated resiliency. But as we approach a full year of higher interest rates, the shift will likely weigh on jobs.

For investors, “bad news is good news” is expected to be a prevailing theme for the first half of 2023. Put simply, a slowing economy remains the primary focus of the Federal Reserve. A softening of the labor market, including a rise in unemployment, will signal the Fed that it could end interest rate increases. This shift could benefit global equities. These rate hikes were a primary driver behind the worst calendar year for equities since 2008 and the most significant decline in fixed income in over 100 years. Following the final Federal Open Market Committee meeting of 2022, Chairman Powell announced, “We will stay the course until the job is done.”

The “job” remains a work in progress, with wage growth failing to keep pace with broad inflation year-over-year. There continues to be ongoing robust demand for laborers despite some companies initiating hiring freezes and/or aggressively cutting costs. For now, structural imbalances in the labor market could cause the Fed to remain restrictive despite falling inflation, at least until the supply/demand of labor is closer to being balanced. Encouragingly, while revenue growth may ease, companies are seeing increased relief on costs, partly due to improved staffing availability.

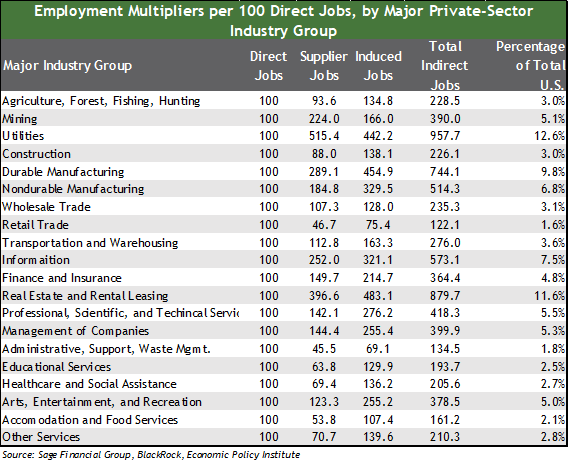

While official employment statistics remain somewhat strong, the Fed’s historic rate of tightening has significantly slowed the housing sector. From an employment perspective, real estate is the second largest sector in the U.S. when accounting for total direct and indirect jobs. Based on these figures, we believe that the sudden softness in real estate will filter into the official labor statistics in 2023, allowing the Fed’s hand to become steadier.

The U.S. labor market remains strong, with the most recent December jobs report highlighting 223,000 additional payrolls. Firm job creation has kept the consumer-driven economy in good shape but is expected to soften in the first half of 2023. Separately, if the Fed’s measures lead to only a modest rise in unemployment, a future period of rate cuts would increase the value/pricing of high-quality fixed income. All else equal, for bonds with limited or no assumed default risk, as interest rates fall, bond prices rise.

FIXED INCOME OUTLOOK: Historically, Higher Bond Yields Lead to Higher Returns

In the Federal Reserve’s resolve to fight inflation, it increased interest rates at an unprecedented pace in 2022, resulting in a 4.25% higher fed funds rate than at the beginning of the year. This record pace of tightening of monetary policy has begun to slow the economy, though at the same time, a silver lining of this rise is an increase in the potential for better future bond returns heading into 2023. We believe that current yield levels continue to provide an attractive starting point for investment-grade bond returns.

A key impact of the Fed’s measures to combat inflationary fears has driven the largest yield curve inversion in roughly 40 years. Inversions historically have preceded economic recessions and resulted from tighter monetary policy. Central bankers attempt to slow an economy while raising short-term rates. Over time, the market begins to doubt the effectiveness of this policy, and longer-term rates fall below short-term rates. On average, inversions of the treasury curve have lasted 12 months and most recently began in June.

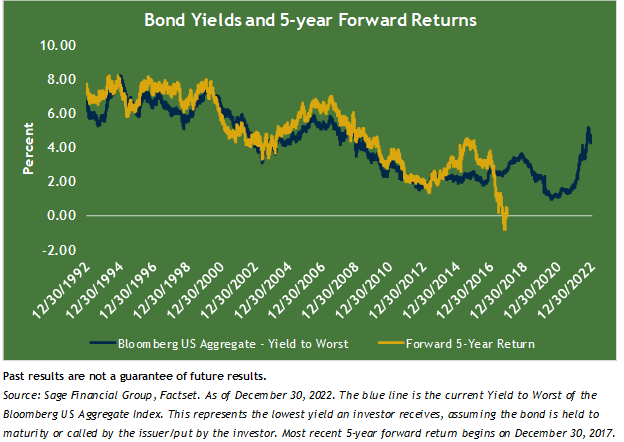

The impact of higher interest rates undoubtedly caused near-term pain for investors, but it has improved the outlook for fixed income going forward. All else equal, higher rates contribute to lower bond prices right away. However, over time the fixed interest from bonds can be reinvested at a higher rate, generating more potential income. Over a longer time horizon, the impact of a larger income return should offset the impact of a falling price return.

We continue to believe that the best approach is to hold a mix of bond types to prepare for various outcomes. There is an opportunity to own longer maturity bonds in a diversified fixed income allocation that offers considerable levels of income and potential cushion should equity volatility persist over the year. We are balancing this scenario against the possibility that the Fed continues to increase interest rates for longer than expected due to persistently high inflation. Historically, five-year returns of investment-grade bonds tend to track pretty closely to yield-to-maturity. Currently, investment-grade yields are north of 5% for the first time in a decade. In particular, if the Fed does become more accommodative in 2023 to stimulate the economy, we believe it is reasonable to expect mid-single-digit bond returns in the year ahead following a dismal year.

EQUITY OUTLOOK: Following a Reset in Valuations

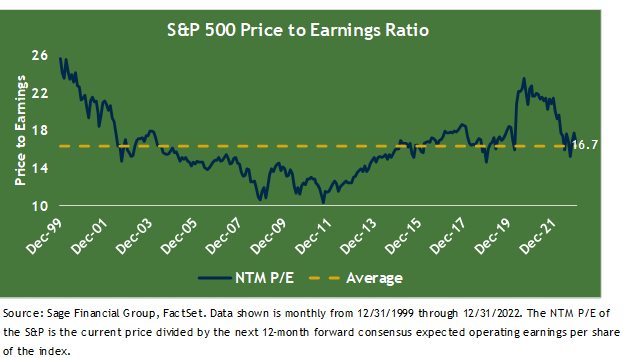

Equity markets concluded 2022 with the sharpest decline since 2008. Volatility persisted throughout the year, with the blame placed on restrictive central banks as valuations compressed by nearly 22%. As a result, the current next twelve-month S&P 500 P/E is now approaching longer-term averages.

While we expect a better return environment in 2023, the year is likely to be marked by the Fed’s tightening cycle on the real economy. In the year ahead, corporate earnings should drive equity returns. Profitable companies with the ability to generate stable cash flows should weather the potential for an economic downturn.

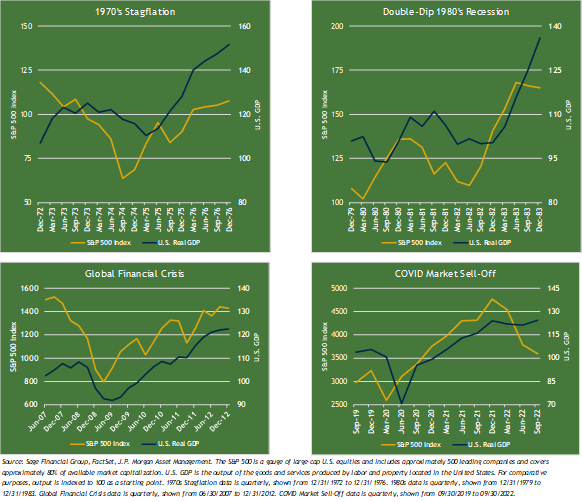

In the year ahead, corporate earnings should drive equity returns. Profitable companies with the ability to generate stable cash flows should weather the potential of an economic downturn. Markets anticipate changes in the real economy, typically between 3-12 months ahead of when they appear in economic data. We expect stocks to rally before the economic data turns uniformly positive. The charts below show this dynamic at work over the last 50 years. Over the four periods shown, the S&P 500 Index hit a low before the economy, as measured by GDP, followed suit.

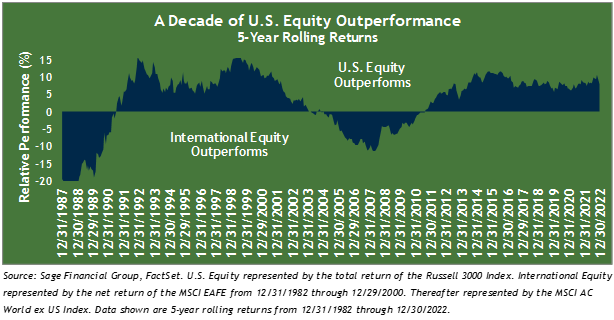

Following a year of significant financial market volatility, investors would be surprised to know that international equities outperformed U.S. equities by more than 2% in 2022. A tough victory to celebrate in a year that saw significant negative equity returns.

It has not always been easy to stand by our conviction that shifting capital into a geographically diversified allocation is prudent. Since 2011, U.S. equities have led international equities over any five-year period. However, the outperformance of U.S. vs. international equities tends to rotate over time (see chart below), and while risks remain, there are some recent positive economic developments to note around the world.

Within China, a recent policy pivot away from a Zero-COVID approach, along with fiscal support for the embattled property sector, now makes the world’s second-largest economy a potentially attractive investment opportunity as it appears poised for a strong recovery in 2023.

In Europe, data is holding up better than expected, equity market valuations are below historical averages, and elevated dividend yields offer a favorable entry point if a recession can be avoided.

Overall, we think that equity markets will have no shortage of headwinds in the year ahead, including slowing economic growth and a test of corporate earnings. This past year’s price declines are at least somewhat reflecting economic softness, and history shows market participants should also anticipate a rebound before the official statistics begin to reflect positive developments. However, we expect that the forward-looking nature of markets and much more reasonable valuations could help cushion downside volatility in 2023 and boost returns.

Concluding Thoughts

In 2022, financial markets suffered from the highest inflation levels seen since the 1980s amid efforts of central bankers to reduce price pressures. Across the globe, the drivers of inflation varied but generally can be attributed to elevated government spending, rolling COVID-related lockdowns in China, and the pressure of Russia’s invasion of Ukraine on food and energy markets. Combined, these dynamics brought instability to financial markets.

While we have a base case view, we prepare portfolios for a variety of outcomes. Right now, our reading of the economy shows continued tailwinds and headwinds. Nevertheless, we continue to believe in a global multi-asset class portfolio approach with an eye toward changes or moderate adjustments when appropriate to mitigate portfolio volatility.

Previous Posts

- Sage Insights: Markets Bounce as Economic Growth Slows and China Adjusts Its COVID Policy

- Sage Insights: Federal Reserve Rate Hikes Persist, Political Volatility in China, and Perspective on the Journey of Investing

- Sage Insights: Central Banks Seek Equilibrium, Europe’s Energy Problem, and A Broader Investment Perspective

- Sage Recognized for Commitment to Clients

Learn More About Sage

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks, or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks, or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks, or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, product, or any non-investment-related content made reference to directly or indirectly in this newsletter will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged, and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please click here or contact us directly.

© 2023 Sage Financial Group. Reproduction without permission is not permitted.