Dramatic news headlines can be unsettling, and we have seen our fair share this week. So as we head into the weekend, we want to follow up on the communication we sent Monday about the state of the banking industry and what it means for markets, the economy, and your investment portfolio. We hope this update provides you with a helpful perspective.

What Has Happened?

Since we posted earlier this week, five banks have required stabilizing intervention, and we have received mixed signals about inflation and the future course of interest rate hikes.

These situations are deeply intertwined, but it is helpful to approach them systematically to see through the noise.

The Banks

The banking industry’s stability was called into question this week by a series of events.

- U.S. regulators took over two regional U.S. banks that collapsed for unique and distinct reasons: Silicon Valley Bank (SVB) and Signature Bank, while Silvergate Capital also shut down;

- Credit Suisse, Switzerland’s second-largest bank and a global financial services firm, teetered on the brink of bankruptcy, forcing the Swiss National Bank to offer a $54 billion Swiss franc loan;

- and 11 major U.S. banks joined forces to prop up San Fransico-based First Republic Bank.

We believe these bank downturns were for company-specific reasons and do not indicate a widespread failure of the global banking system.

- SVB catered to private capital and venture-backed companies and was vulnerable to several recent market pressures.

- Based on tech-industry optimism, the bank’s deposits grew exponentially over the past two years. However, its investment of these deposits significantly declined due to its weighting toward fixed-rate security bonds, which have lost value due to higher interest rates in 2022-2023.

- At the same time, SVB’s technology, small-mid size business-heavy customer base withdrew deposits to fund their cash needs and to invest in higher-yielding investments, forcing the bank to sell its bond portfolio at a significant loss.

- The move led to a “run on the bank” where depositors quickly moved their deposits to other institutions.

- Signature customers, many of whom had cryptocurrency ties, also rushed to withdraw deposits.

- Silvergate recently announced a loss of more than $1 billion after the collapse of FTX, a large cryptocurrency exchange and one of its major customers.

- First Republic, much like SVB, Signature, and Silvergate, was uniquely vulnerable to headline-induced customer uncertainty due to its technology-based customers. Some of the largest banks in the U.S. pledged a combined $30 billion to help the bank meet its obligations to its depositors to demonstrate the industry’s resiliency as a whole.

- Credit Suisse’s problems are not new and are related to the bank’s profitability, not solvency, and circumstances very different from U.S. banks, including material weakness in internal controls over financial reporting and the withdrawal of support by its primary backer, the Saudi National Bank.

The unique circumstances of the five banks, along with the industry evolving since the 2008 Global Financial Crisis, with increased regulation and capital requirements, are reasons why we don’t believe that there is a severe threat to the banking sector.

- In addition, the Federal Reserve is considering implementing even stricter capital requirements for mid-size U.S. banks, focusing on banking institutions with $100 billion to $250 billion of assets. Typically, these requirements have been reserved for larger U.S. banks deemed systemically important.

- Governments and banking leaders responded swiftly to prevent the spread of uncertainty.

- In the U.S., the Fed, Treasury, and FDIC collaborated to restore confidence within the financial system and announced the government would protect U.S. banking customers by guaranteeing all funds, even those above the $250,000 FDIC limit. This depositor protection is sourced from the Bank Term Funding Program (BTFP), which the Treasury’s Exchange Stabilization Fund backs. The fund is $25 billion and can cover all uninsured deposits at every U.S. bank combined.

- While these takeovers provided relief for U.S. banking customers worried about access to their funds, the future of these banks remains unknown, and their investors are significantly impacted.

- Investors in each of the fallen banks have lost the total value of their equity positions.

- Senior Bank Management has been removed, and compensation packages terminated.

The Impact of Interest Rates

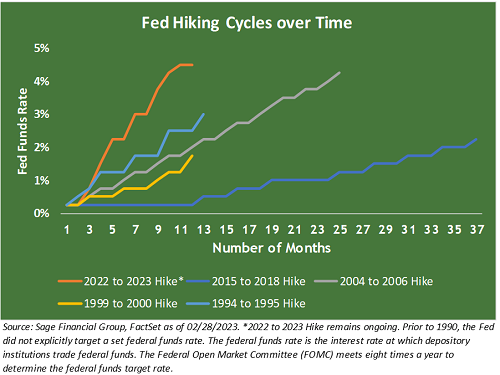

Over the past year, the Federal Reserve and global central banks have increased interest rates to cool down the economy and persistent inflation. The pace of these rate hikes has been historically elevated in the U.S. and followed a decade of artificially low rates.

The strategy has put significant pressure on banks in two ways. First, higher rates made bonds a more attractive source of investment income than cash deposits, leading to bank deposit outflows. Second, since some banks invest their deposits in longer-term bonds, they experienced losses as yields rose and bond prices fell. This was the case for SVB.

A primary goal for the Fed’s restrictive and aggressive monetary policy has been to slow down the economy and manage inflation, following the economic surge post the Covid pandemic and supply chain challenges post Russia’s invasion of Ukraine. Early last week, Fed Chairman Powell testified before Congress and suggested that interest rates may need to rise above previous expectations to help control inflation. But on Tuesday, monthly inflation and retail sales reports signaled that the economy might be cooling, and the Fed could consider slowing its aggressive path of rate hikes. The markets do not like surprises and were predictably more volatile.

We believe the probability of more accommodative monetary policy has increased, which could support the financial markets. Policymakers are now more aware of the potential to cause financial stress through aggressive policy, and a more neutral/accommodative Federal Reserve and European Central Bank, in the near future, would be a positive for markets.

What Does This Mean For Your Financial Plans?

When headlines are dramatic, it can help to take a step back and focus less on current events and more on your goals, time horizons, and investment strategy.

Sage has managed client investments through stressful times for over 30 years, and our approach has remained steadfast: we maintain a disciplined strategy that involves rebalancing (seeking to buy low and sell high) through market fluctuations, maintaining appropriate allocations of investments within portfolios, adding and/or subtracting from asset classes that we believe have become more attractive and/or less attractive as appropriate, all in support of our clients’ unique goals, time horizons, and investor profiles.

We believe this disciplined, diversified, and sensible approach will continue to create a higher probability that they will reach their financial goals.

Previous Posts

- Our Perspective: Current Thoughts on the Banking Industry

- Sage Insights: Strong U.S. Economic Data and the Geopolitical Climate Stall Market Momentum

- Sage 2023 Annual Letter

- Sage 2023 Investment Outlook

Learn More About Sage

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks, or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks, or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks, or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, product or any non-investment-related content, made reference to directly or indirectly in this newsletter will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please visit Our Accolades page or contact us directly.

© 2023 Sage Financial Group. Reproduction without permission is not permitted.