The month of March began with investors anticipating substantial policy actions from the Federal Reserve due to its increased focus on inflation. However, this swiftly changed as U.S. and global regulators stepped in to provide stabilizing intervention at five banks. Looking toward April, while risks remain, we are cautiously optimistic regarding the actions by regulators to contain systemic problems.

At a high level, the economy continues to offer mixed signals, particularly around inflation, banking, and the labor market. Nevertheless, with policymakers now more aware of the potential to cause financial stress through aggressive policy, we believe the probability of more accommodative monetary policy has moderately increased. In our view, this shift would be received well by financial markets.

At Sage, our approach has always been to prepare for a wide range of outcomes and scenarios to maximize our clients’ probability of achieving their financial goals. In this edition of Insights, we recap recent market performance, discuss developments and takeaways from the banking industry, examine potential impacts on the broader economy, and share some perspectives on market performance upon the completion of monetary tightening.

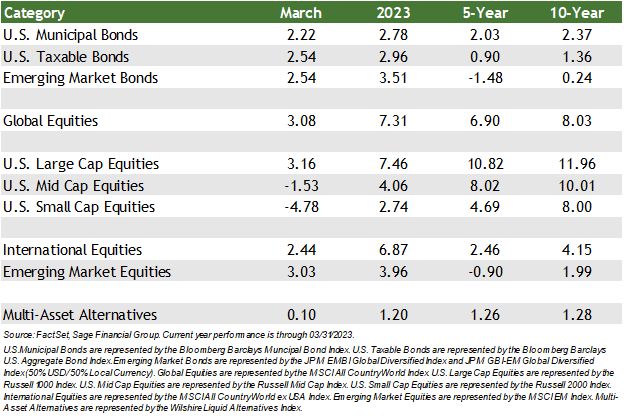

Diversification worked well for investors in March. After concerns regarding the banking system surged to the forefront, rates fell, and bond prices rose, while equities fell initially before rebounding by month’s end.

High-quality bonds rose 2.54%[1] in March, which provided diversification for equities and concluded the quarter up 2.96%. Bonds remained an attractive option for investors due to the Federal Reserve’s expected completion of policy tightening.

However, equity markets exhibited bifurcated performance:

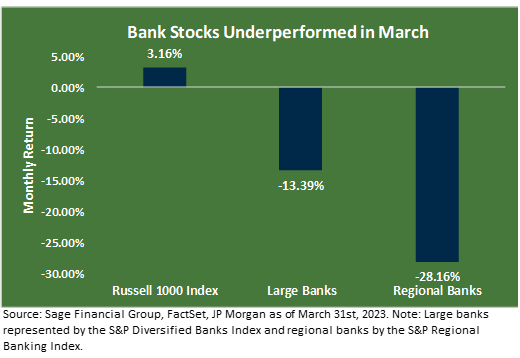

- Large-cap stocks in the U.S. rose in March by 3.16%, while U.S. small-cap stocks fell by 4.78% due to banking volatility. Financials and regional banking stocks comprise approximately 20% of the small-cap Russell 2000 index. Regional bank stocks declined 28% in March, while larger banks fell 14%.

- International stocks advanced in March. The negative impact of Credit Suisse’s collapse appears to have been mitigated in the near term through a government-negotiated merger with UBS. As a result, the most widely quoted international stock index moved higher by 2.44%, and emerging market equities gained 3.03%.

In March, U.S. regulators took over two regional U.S. banks, Silicon Valley Bank (SVB) and Signature Bank. These banks collapsed for unique and distinct reasons, but their struggles meant other regional banks came under the stress of deposit outflows. As a result, regional bank stocks fell more than 28% in March, and larger banks declined 13%.

We believe that the events that transpired at the failed banks resulted from characteristics unique to those institutions, as opposed to a widespread crisis witnessed in 2008. Specifically, these banks were at risk because of a high proportion of large business customers and poor risk management by leadership.

Still, these events called into question the banking industry’s stability, as the failure of financial institutions has been infrequent since the Global Financial Crisis. Yet, 2008 and its challenges do not seem like so long ago for many of us.

Policymakers understood that speed was required and acted decisively. Over a short period, the Fed, Treasury, and FDIC collaborated to restore confidence within the financial system and announced the government would protect U.S. banking customers by guaranteeing all funds, even those above the $250,000 FDIC limit.

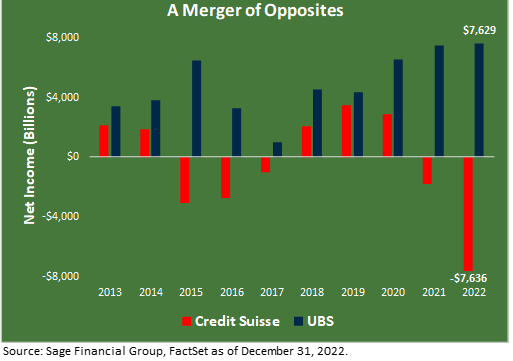

Across the Atlantic, Credit Suisse faced near bankruptcy before Swiss regulators worked to merge the faltering second-largest bank with Switzerland’s largest bank, UBS. The deal was designed to avoid further stress within the global banking system, and the Swiss National Bank provided UBS with a $100 million liquidity infusion to help stabilize the deal.

As we shared earlier in the month in a Sage Perspectives piece, Credit Suisse’s issues were not new and resulted from circumstances very different from those of U.S. banks. Specifically, Credit Suisse’s challenges were related to the bank’s profitability, not solvency. They involved material weakness in internal controls over financial reporting and the withdrawal of additional support from a key investor, the Saudi National Bank. Ultimately, this marriage of Swiss banks paired a profitable entity with one in relative decline over the past decade.

Overall, the unique circumstances of these banks, along with increased regulation and capital requirements stemming from the 2008 Global Financial Crisis, are reasons why we do not believe there is a severe threat to the banking sector. In contrast to 15 years ago, banks today are far more capitalized with less leverage than before the Global Financial Crisis.

Amid this uncertainty, bonds provided diversification by rising when equities were struggling. With uncertainty remaining, and the banking situation still fluid, market volatility will likely persist over the coming months and throughout 2023.

However, we believe the potential for future returns for investment portfolios has become more attractive, as global stock valuations are below their 25-year average. Please note that for clients who owned less traditional preferred securities, Sage recommended exiting the asset class earlier this year in favor of more traditional stock and bond positions. This benefited clients because preferred securities came under stress with the broader banking industry in March, falling by more than 9%.

Implications for the Broader Economy

Uncertainty in the banking sector has already created reverberations across the broader economy. For example, new issuances of stocks have been effectively closed since March 8, the day before Silicon Valley Bank was seized by U.S regulators. There is also less liquidity available for companies, which could lead to less investment from corporations.

Along with regulatory issues and concerns around the safety of deposits, exactly what comes next for the banking sector remains unclear. Since the Fed began raising interest rates in March 2022, nearly $600 billion in bank deposits have been withdrawn. Banks with less than $250 billion in assets account for approximately 60% of residential and 45% of consumer lending. While we think the systemic risk in other pockets of the economy seems unlikely, tighter lending standards in the future seem like a probable outcome, which could impact the broader economy.

In addition to capital markets, the team at Sage is keeping a close eye on two other metrics we believe serve as important gauges of the U.S. economy right now – household liquidity and the ability of households to meet obligations.

Within the U.S., deposits as a percentage of GDP are now below pre-pandemic levels. This implies that households have spent their pandemic-era savings, which could result in slower consumer spending at some point in 2023. Roughly two-thirds of U.S. economic growth is driven by consumer spending, making the topic of savings particularly important.

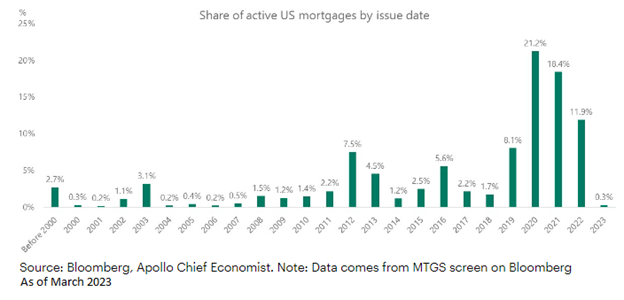

However, the housing sector in the U.S., however, may offer some positive news for consumer finances. In the last 20+ years, 60% of active U.S. mortgages were issued over the last four years. Moreover, they were issued at fixed and lower rates than today’s levels, meaning households are more likely to meet their obligations.

From a market perspective, stocks and bonds would both benefit from improved lending conditions. There is concern about tighter financial conditions, specifically due to small and midsize bank regulations and the impact of less lending over the coming years. Also, pressure from lingering inflation and accompanying higher interest rates could place additional strain on the banking system and subsequently weigh on investment returns in 2023. However, we believe stocks and bonds will see a boost by the end of 2023 due to less aggressive monetary policy from most global central banks.

As for portfolios, we are encouraged by the resilience of the financial markets and specifically see a better outlook for bonds in the coming years. In response, Sage has added high-quality bonds in the second half of 2022 and the first quarter of 2023, with promising early results.

Historical Perspective: Performance Around the Completion of Fed Tightening Cycles

We find it valuable to step back and focus on the historical perspective when there are fluctuations in the financial markets.

From this vantage point, Fed rate hiking cycles paint a positive picture: after tight Fed cycles conclude, equity and fixed income returns have tended to be healthy over the subsequent 12 months.

Following the completion of the last six Fed policy tightening cycles, U.S. equities (as measured by the Russell 3000 Index) have provided an average return of 19.6% over the subsequent 12 months and a positive return in five out of six years. Investment-grade bonds (as measured by the Bloomberg U.S. Aggregate Index) averaged 12.4% over the same period. This follows a historically negative year for bonds.

When bonds are appropriate, we continue to prioritize high-quality, short and intermediate-term fixed-income securities for clients, which we believe offer portfolios attractive levels of income and diversification through what we expect to be continued periods of equity volatility.

Closing Thoughts

In light of the recent market stress that occurred in March, we remain cautiously optimistic for the above reasons. While it may have been difficult to anticipate this situation, such unexpected events do occur from time to time.

Our clients’ portfolios are carefully crafted and managed to navigate through market fluctuations.

If you have any questions about the topics covered in this month’s commentary or wish to discuss any aspect of your goals or future, please do not hesitate to contact us directly.

[1] U.S. Large Cap stocks represented by Russell 1000 Index, Global Equities by MSCI All Country World Index, International Equities by the MSCI All Country World Ex-USA Index, Emerging Market Stocks by the MSCI Emerging Markets Index, and U.S. Investment Grade Bonds by the Bloomberg Barclay’s U.S. Aggregate Index. Performance as of 3/31/2023.

Previous Posts

- Our Perspective: Our Perspective: An Update On The Banking Industry and Interest Rates

- Our Perspective: Current Thoughts on the Banking Industry

- Sage Insights: Strong U.S. Economic Data and the Geopolitical Climate Stall Market Momentum

- Sage 2023 Annual Letter

- Sage 2023 Investment Outlook

Learn More About Sage

Disclosures

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks, or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks, or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks, or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, product, or any non-investment-related content made reference to directly or indirectly in this newsletter will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged, and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.