July was a continuation of the markets’ positive trajectory during the first half of the year. Financial markets extended their 2023 ascent last month, supported by inflation easing to the slowest year-over-year rate in more than two years. While the Federal Reserve raised rates to the highest level in 22 years, strong consumer confidence and the cooling of inflation provided positive signs that the Fed has progressed in the fight against higher prices.

In this edition of Insights, we highlight recent market performance, touch on the start of earnings season, and provide an update on the actions of the Federal Reserve.

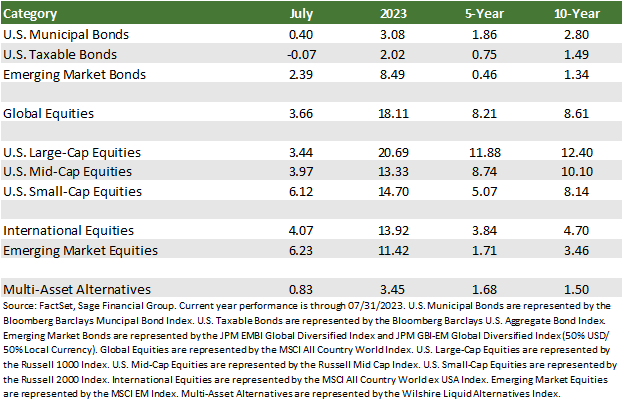

All major stock indices generated positive returns in July, with international equities as the leading performer, the most widely referenced international stock index gaining 4.07%, and emerging market stocks rising 6.23%. EM stocks performed quite well in July, despite a Chinese recovery that has lagged expectations. At the same time, China’s top leaders announced plans to stimulate the domestic economy “in a precise and forceful manner.” Thus, despite this slow recovery, there is optimism regarding stimulus in the world’s second-largest economy.

U.S., large-cap stocks rose by 3.44%, while their small-cap peers pressed higher by 6.12%. Similar to observations made last month, we view outperformance from smaller companies as a positive sign for the domestic economy as smaller companies derive more revenue from the U.S. consumer.

In the U.S., the breadth of market returns continued to widen away from the handful of technology names that drove returns earlier in the year. Notably, the financial sector, with smaller regional banks at the forefront, produced some of the strongest returns for the month.

In July, high-quality bonds provided a more muted return of -0.07%, although interest rates experienced fewer fluctuations over the course of the month. The monthly Consumer Price Index (CPI) report showed that fuel, automobile, and travel prices declined month-over-month, providing support for bond returns. A persistent point of strength in portfolios has been emerging markets debt, which delivered a 2.39% return in July, extending its sizable outperformance relative to comparable U.S. bonds in 2023. [1]

Quarterly Earnings: Consumers and Corporations Remain Resilient

This year, a resilient U.S. economy, boosted by consumers and businesses, has led to strong stock and corporate credit performance.

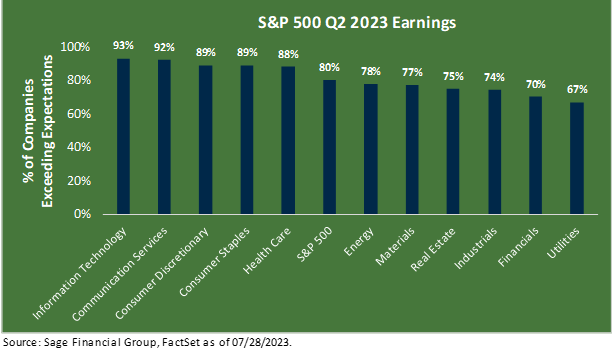

Earnings season for the second quarter is currently in full swing. As we approached the end of July, approximately half of U.S. companies had reported their financial results. Through July 28th, about 80% of reporting companies outperformed expectations, surpassing the five-year average of 77%.

Interestingly, the outperformance has not been specific to one sector. Instead, results have been more dispersed, suggesting corporations are seeing an improved environment, and an anticipated recession is not a foregone conclusion.

We think the strength has been partly due to debt levels and a shift back to spending on services after the pandemic.

Both consumers and businesses are not overly leveraged relative to history. Recent research from the U.S. Federal Reserve points to household debt as the smallest percentage of disposable income in nearly forty years.[2]

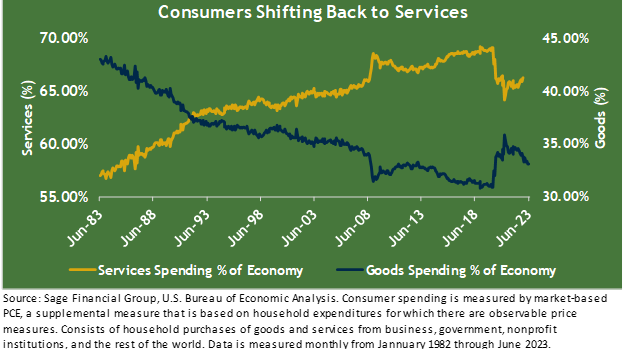

Moreover, as we observed at the end of last year, consumer spending on services, including travel and dining, previously increased to 70% of total spending before declining to nearly 60% in 2020.

But in 2020 and much of 2021, these activities were restricted, and consumers splurged instead on goods they could purchase online at home. As consumers slowly move back towards prior behaviors, the impact on core goods prices has alleviated pressure on the broader economy. Throughout 2023, prices of core goods have fallen.

This shift back to services has led to strong economic growth. On July 26th, the Bureau of Economic Analysis reported that the U.S. economy grew annually in the second quarter. Full-year economic growth in the U.S. is now expected to be stronger than previously anticipated by economists. Thanks to this broad growth, companies within the healthcare, consumer discretionary, and financial sectors are posting strong financial data. Charles Schwab, the once speculated beleaguered financial institution, reported strong earnings, which provided a helpful backdrop towards best understanding the stability of the regional banking system.

If corporate earnings season continues positively, we expect U.S. and international stocks to respond well, as the U.S. consumer is one of the world’s major growth drivers.

With that being said, we acknowledge that risks remain, and we should expect and be prepared for market volatility. While equities serve as a primary driver of investment growth, we continue to believe that a well-diversified portfolio is in our clients’ best interest because it is designed to protect against market volatility while helping them accomplish their financial goals.

Federal Reserve: Into the Homestretch

At their July meeting, the Federal Open Market Committee unanimously supported a 0.25% increase in the federal funds rate. This policy decision brought the Fed’s target rate to 5.25%, a sharp move from the near-zero level as recently as March 2022. This quick and decisive path of higher interest rates was orchestrated to slow down the economy to quell the most elevated period of inflation in over forty years.

In his post-meeting press conference, Fed Chair Jerome Powell welcomed the lower inflation recently witnessed but shied away from providing any sign of dovish policy as it could be misconstrued as an early victory lap. Powell reiterated a similar message delivered at prior pressers; the Fed will remain “data dependent.” Policymakers closely follow the impact of the rate hiking campaign as higher rates work through the economy.

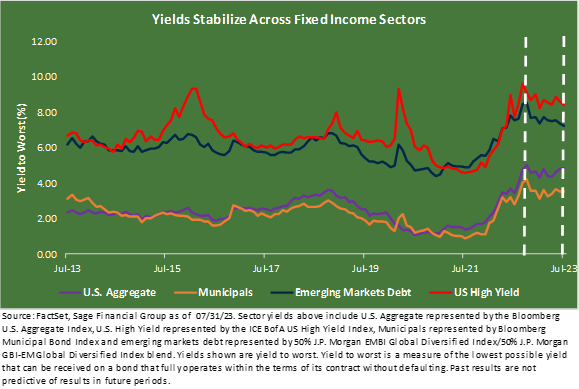

Putting expected bond returns into context, a typical bond’s total return consists of both the income paid and the fluctuation in the bond price. All else equal, higher rates are inversely related to bond prices, implying that bond prices fall when rates rise. Entering 2022, bonds were issued in a very low-interest rate environment, which had been the case for most of the period following the Global Financial Crisis. Now that bond yields have stabilized at a higher level, the increased income from bonds can provide a buffer to changes in the bond price.

Sage’s view is that high-quality bonds are more likely to provide a positive return over time, given today’s improved starting point. At the end of 2021, high-quality bonds yielded 1.75%.[3] As of the end of July, that yield was 4.85%. Thus, higher interest rates have translated to increased income levels for investors. Further, rates can fall during periods of uncertainty, and bonds provide additional diversification for portfolios away from equities if economic conditions weaken.

In this regard, investment-grade bonds could benefit later this year if there is a sharper-than-expected economic slowdown or recession and the Fed cuts policy rates more quickly than expected to stimulate economic growth. For these reasons, Sage has added high-quality bonds over the past year to portfolios with an allocation to bonds.

Closing Thoughts

So far, during 2023, financial markets have demonstrated remarkable resilience, with global equities and bonds rebounding strongly, while high-quality bonds advanced at a more muted pace due to rising interest rates.

Our portfolios have benefited by remaining firmly committed to our investment strategy and not making dramatic changes during times of high volatility, such as in 2022. We continue to remain focused on our clients’ financial goals, timeframes, and liquidity needs, and we make adjustments to their portfolios when appropriate.

[1] Emerging markets debt is represented by the JPM EMBI Global Diversified Index and JPM GBI-EM Global Diversified Index (50% USD/ 50% Local Currency). U.S. large-cap stocks are represented by the Russell 1000 Index. U.S. small-cap stocks are represented by the Russell 2000 Index. International stocks are represented by the MSCI All Country World ex USA Index. Emerging market equities are represented by the MSCI EM Index.

[2] Board of Governors of the Federal Reserve System (US), Household Debt Service Payments as a Percent of Disposable Personal Income [TDSP], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/TDSP, July 27, 2023.

[3] High-quality bonds as measured by the Bloomberg U.S. Aggregate Index.

Previous Posts

- Sage Insights: Getting Back on Track in 2023

- Sage Insights: Take It To The Limit

- Our Perspective: The 2023 Debt Limit

- Sage Insights: Taking Stock of Today’s Climate

- Sage Insights: March Madness in the Banking Sector

- Our Perspective: Our Perspective: An Update On The Banking Industry and Interest Rates

Learn More About Sage

Disclosures

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks, or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks, or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks, or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, product, or any non-investment-related content made reference to directly or indirectly in this newsletter will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged, and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her situation or any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.