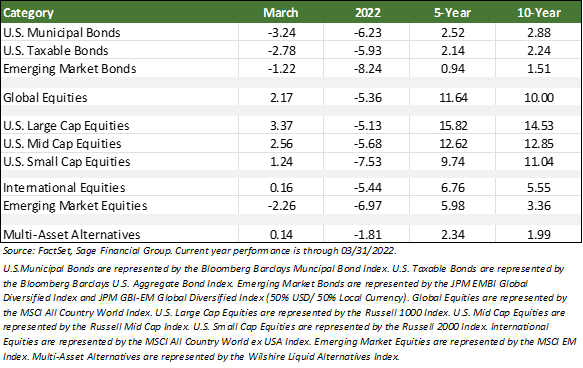

Unsurprisingly, March was a choppy month for the financial markets. Stocks rebounded from the sharp sell-off we noted in February that carried over into the first part of the month, while commodity prices jumped around unpredictably, and bond prices declined due to precipitously higher interest rates.

Looking forward, we see a reason to be optimistic. Despite higher rates and oil prices, we are encouraged by the predominantly strong economic backdrop in the U.S. and globally. Moreover, as we’ve reiterated in recent months, we continue to predict that companies will have a positive environment for continued revenue and earnings growth in 2022.

The MSCI ACWI Index, which represents global equities (i.e., both U.S. and international stocks), advanced by 2.17% in March. U.S. large cap equities rose 3.37%, and U.S. small caps rose by 1.24%. International stocks increased 0.16%.

In addition, core U.S. taxable and tax-exempt bonds ended the month lower by -2.78% and -3.24%, respectively. Bonds continued to be adversely affected by higher inflation, which has been one byproduct of the Russia-Ukraine war. The Federal Reserve’s decision to begin to raise interest rates, although expected, negatively impacted bond prices.

Federal Reserve Rate Hikes Aim to Cool ‘Overheating’ U.S. Economy

On March 16th, the Federal Reserve Open Market Committee (FOMC) announced its decision to lift short-term interest rates by 0.25 percentage points. This rate hike was the first since December of 2018 and marked the end of the zero-interest-rate policy in the United States. The Fed expects to raise rates throughout 2022 and into 2023.

This decision to increase rates was not unexpected and has been a long time coming. Our team has closely analyzed the potential impacts, and we’ve had many conversations with clients about what the hikes may mean for the economy and their portfolios. Ultimately, these steady rate hikes aim to control inflation by reducing the demand for goods and services. All else equal, higher borrowing costs should “cool down” an overheating economy.

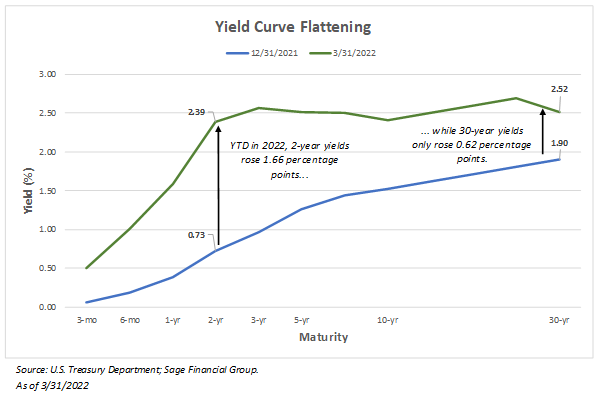

From an investment perspective, the path of the U.S. economy will determine the future returns of stocks and bonds. One indicator that economists monitor closely is the steepness of the yield curve. This metric is viewed as a proxy for growth, and our team has found it offers valuable insight into the “tone” of the market and investor sentiment.

Here’s how it works at a high level: An “inverted” yield curve occurs when shorter yields are higher than longer yields, suggesting that market participants are uneasy about future economic conditions. So, a steeper yield curve has historically indicated that market participants remain positive about future growth, while an inverted curve has indicated an upcoming recession.

The yield curve has flattened this year. As shown below, the U.S. Treasury Yield curve had significantly steepened to start the year. The spread between the 2-year yield and 10-year yield was 0.79 percentage points. Fast forward to March 31st, and this key interest rate gap has closed to just 0.11 percentage points.

To us, that yield curve suggests that growth may slow after the next two years of rate hikes.

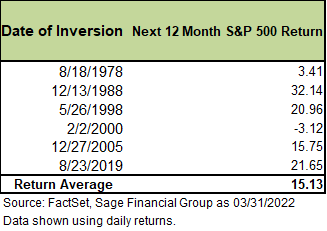

We would not be surprised to see the 2-10 spread invert in the coming days. However, that does not warrant rash or drastic action. Over history, U.S. large cap stocks have performed well on average in the 12 months following a yield curve inversion. For example, when the yield curve inverted in July 2005, U.S. large caps returned 15.75% over the following year.

When it feels like everyone is talking about the same economic indicator, as they have been with rate increases, it’s easy to narrow in on its impacts. The Fed has said it will raise rates steadily while relying on economic data to make policy decisions. We’ve taken steps to plan for those increases and understand their potential impact on portfolios. Rate hikes may weigh on economic activity in cyclical areas, and we expect consumers to grapple with higher borrowing costs amid tightening financial conditions.

From an equity market perspective, stocks tend to perform well in the early stages of rate-hiking cycles, largely due to the strong financial health of consumers and businesses. We continue to forecast that equities will perform well in most client portfolios despite higher inflation and rate hikes.

We agree with Chairman Powell’s assessment that the U.S. economy remains strong, given aggregate consumer demand, low unemployment rates, and the healthy cash positions on corporate and consumer balance sheets. For bond markets, despite the sharply higher rates, higher yields should help support future bond returns. Rates may continue to move higher in the coming months.

Our strategic position has been and continues to be to recommend bonds with less interest rate sensitivity than we would expect over the long term.

Russian-Ukrainian War and its Implications

We recognize that this invasion has an emotional as well as financial impact on us as well as our clients. We sympathize with those whose lives and livelihoods are under attack and mourn the direct loss of life and devastating displacements that have taken place. We know the suffering from this invasion, and its broader effects worldwide will be felt for years to come.

Russia’s invasion of Ukraine has continued to create unwanted risks within a global economy already battling elevated inflation. In addition, Russia and Ukraine are both important exporters of energy and food globally, and the invasion has created a new sourcing shock on top of an already fragile supply chain.

We continue to closely analyze the global implications through an economic and financial markets lens. While we hope for an immediate end to this war, we do not expect a rapid return to normalcy. The sanctions placed on Russia are extremely severe, including restrictions on government and top officials’ access to the banking system.

The implications stemming from these sanctions include higher commodity prices, more aggressive monetary policy to combat inflation, and the potential for an escalation toward broader conflict. We believe the consequences in the energy sector could lead to “stickier” inflation over time.

Here is some additional context around the potential future supply chain disruptions.

- According to the International Energy Agency, Europe derives 40% of its natural gas supply from Russia. European leaders cannot simply turn off the switch to gas that heats homes, stores, and factories.

- Russia is a top supplier of precious metals like palladium and nickel, both heavily used in manufacturing vehicles.

- Ukraine is a leading exporter of corn, iron ore, and wheat. A protracted conflict threatens to worsen ongoing supply-chain issues and potentially places pressure on food inflation.

One unpredicted outcome of the invasion is that many countries and companies formerly dependent on Russia are now changing strategy, creating new opportunities and greater economic resilience. For example, Germany is stepping up its fiscal spending plans, and European Union leaders are currently drafting energy independence plans. Energy independence would likely require huge investments from local governments, which would in turn boost employment, economic growth, and company profits. However, European fiscal policy has lagged far behind the U.S. in recent decades, a contributing factor to lower European equity returns.

The constant news coverage and widespread implications of the Russian-Ukrainian conflict can be hard to ignore. Here at Sage, we have devoted considerable time and resources to planning for various scenarios related to this invasion and other geopolitical realities. As we look to potential changes to client portfolios, we continue to recommend that most clients remain geographically diversified from an investment perspective. Sage seeks to construct portfolios for various scenarios, both in the U.S. and abroad.

We are closely monitoring the war’s impact on different parts of the economy and will make recommendations if appropriate. As we shared last month, our investment philosophy is anchored by a long-term view, and we diversify holdings with the expectation of elevated geopolitical risk from time to time. While current tensions could lead to some market fluctuations in the near term, we expect global growth to continue over the next three to five years.

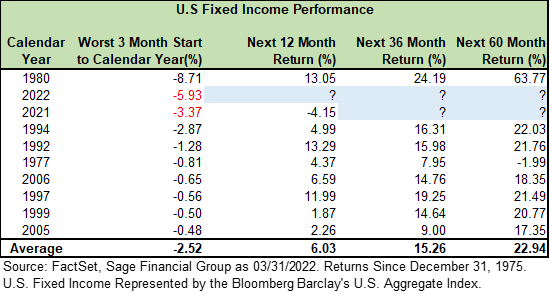

A Historically Bad Start for Bonds

When interest rates rise, fixed-rate bond prices fall. Unfortunately, yields have risen exponentially higher in 2022. Despite the expectation of stability, traditional bonds have experienced a historically bad start to the year.

Through the first three months of the year, the Bloomberg Barclays U.S. Aggregate Index has lost 5.93%. That is the second-worst start for bonds since 1975 (see chart below). Although every economic environment is different, our focus on the long-term compels us to revisit subsequent returns after past bad three-month stretches. What we find is encouraging. For example, during a period of rising rates in 1977, bonds lost 0.81% in the first three months of the year. Despite higher rates in the years that followed, bonds still managed positive returns on average over the next one- and three-year periods.

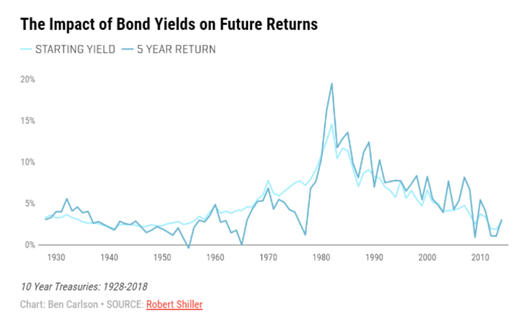

Over time, bond returns have generally followed the path of yields. As illustrated below, this relationship can be very close over time, and bonds rarely perform negatively over a five-year time horizon. While Sage has a lower allocation to fixed-rate bonds than we would expect over time, the history of bond returns shows that higher yields should help boost future bond returns in the long run.

Closing Thoughts

We continue to believe that the U.S. economy is on track for healthy growth in 2022. The financial positioning of both U.S. consumers and businesses is strong, and we expect it will boost economic activity over the next 12 months. A growing economy should provide a supportive backdrop for stocks.

Looking forward, we do not discount future risks as inflation may impact interest rates domestically, and the current geopolitical crisis in Ukraine may create a broader economic slowdown in Europe. We are closely monitoring these factors, and our advice to clients remains aligned with our core principles: stick to your financial plans and investment strategy, which have been designed to align with your unique goals, time horizon, and risk tolerance. Avoid the temptation for rash decision-making, especially when markets go through temporary periods of negative performance.

Sage constructs diversified multi-asset class portfolios for various scenarios, and we have planned for the potential for further equity volatility and higher interest rates. While March offered relief in some pockets of equity markets, our expectation is that the financial markets will continue to be unsettled, and we would expect investors to turn to high-quality bonds during uncertain times. Different components of portfolios are intended to provide a stable footing through uncertain periods.

We will continue to monitor your portfolio and recommend changes as we see appropriate. If you have any questions about the topics covered in this month’s commentary or wish to discuss any aspect of your goals and your future, please do not hesitate to contact us.

Previous Posts

Sage 2022 Annual Letter: A Year in Review

Sage 2022 Investment and Market Outlook

Insights: Russia’s Invasion of Ukraine, Navigating Volatility, and Upcoming Rate Hikes

Learn More About Sage

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks, or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks, or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks ,or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please click here or contact us directly.

© 2022 Sage Financial Group. Reproduction without permission is not permitted.