January’s market momentum failed to carry over into February as stocks and bonds relinquished some of the year’s gains. While investment returns remain positive overall, uncertainty surrounding the path of Federal Reserve policy and the geopolitical climate weighed on the markets.

The economy continues to offer mixed signals in certain segments, and, as we shared in recent communications, we believe that caution is still warranted in the near term. Sage’s approach has always been to monitor developments and build portfolios designed for various outcomes with a focus on helping our clients achieve their goals.

In this edition of Insights, we recap recent market performance, discuss higher-than-anticipated labor and inflation readings and geopolitical developments, and share some perspective on market performance around Fed tightening cycles.

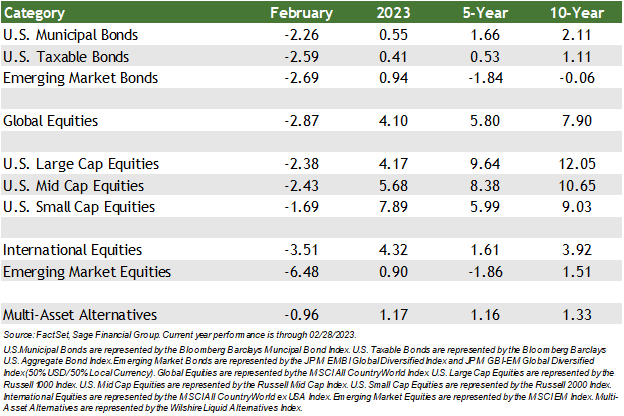

Performance Recap

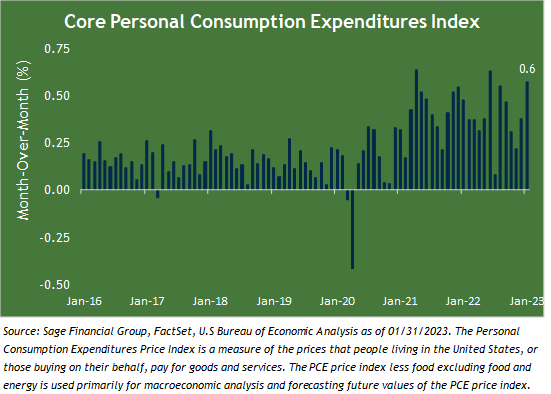

Following a strong start to the year, financial markets stalled in February, returning some gains from the previous month. At the beginning of the month, the job report and inflationary data continued to exceed expectations. To conclude the month, the Core Personal Consumption Expenditures Price Index, the Fed’s preferred inflation measure, rose 4.7% year-over-year, firmly above the central bank’s 2% target rate.

Investors showed little appetite to buy equities as the inflation picture remained mixed, as it became apparent that the path to the Fed’s goal of 2% to 2.5% may take longer than expected, potentially carrying over into 2024. Potentially, the Federal Reserve may not be as patient, raising the risk of slowing the economy more than needed leading to a so-called “hard landing.” Bond yields moved higher on the expectation that the month’s long trend of declining inflation may slow, and the Fed will remain aggressive until growth and inflation show clearer and more consistent signs of cooling.

- High-quality bonds fell 2.59%[1] in February, just one month after their second-strongest month since December 2008. Throughout February, interest rates increased as bond yields edged toward the Federal Reserve’s policy guidance at the end of 2022.

- Equity markets provided no reprieve.

- In the U.S., higher bond yields created a valuation headwind for equities, despite corporate America’s better-than-expected quarter and resiliency against a challenging earnings backdrop. As a result, U.S. large-cap stocks fell by 2.38%, and global equities (the combination of U.S. and international equities) declined by 2.87%.

- International stocks declined more pronouncedly as the three-month-long Chinese rally paused, and the most widely quoted international stock index moved lower by 3.51%.

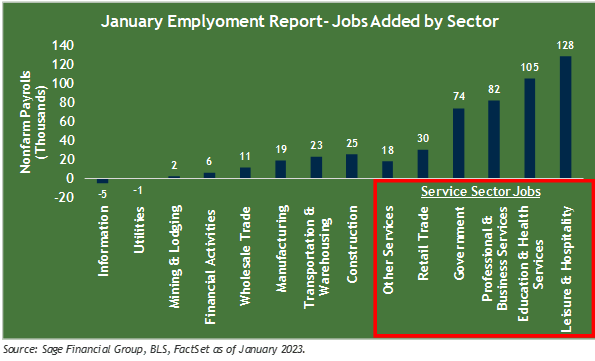

U.S. Labor Market and Inflation Remain Hot

In February, all eyes remained on the U.S. labor market and inflation. So far this year, the economy has shown bifurcated signs of re-acceleration. While the Fed’s ongoing monetary policy tightening cycle has slowed growth in areas such as housing and the sales of goods, the services economy is still booming. The U.S. economy reported a large employment figure this past month, with 517,000 new jobs added in January. These new jobs were concentrated in services sectors such as leisure & hospitality, professional services, and health care.

At the same time, inflation remained higher than desired. The Core Personal Consumption Expenditures Price Index (or “Core PCE”) grew at 0.6% in January, or 7.2% annualized — the highest monthly change since June 2022.

Higher prices were also seen in alternative inflation readings earlier in the month, including the Consumer Price Index (CPI) and Producer Price Index (PPE). While there could be some anomalies in the data, such as spikes in airfares, pet products, and new cars, most categories showed strong price gains.

Due to the larger-than-expected number of jobs added in January and continued elevated price pressures, we believe the Fed will remain aggressive until growth and inflation show clearer and more consistent signs of cooling. From a market perspective, stocks and bonds may react negatively in the short term to these signs of slowing economic growth and elevated inflation. Financial markets prefer somewhat softer growth and inflation statistics before they expect central bankers to begin implementing less aggressive monetary policy.

This dynamic could be seen in the drop in both global equities and bonds in February, which declined by 2% and 3%, respectively.

Despite market volatility due to aggressive monetary policy, we believe the potential for future returns for investment portfolios has become more attractive. As rates have risen, bonds are now providing more yield for income. Also, stock valuations are below their 25-year average, supporting future returns.

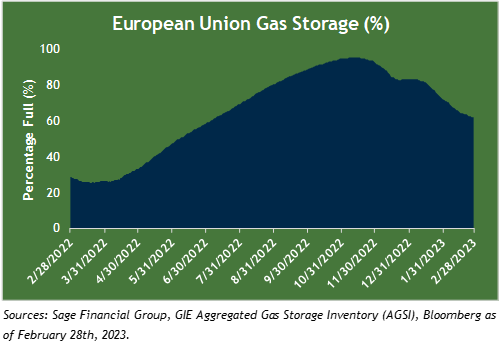

A Warm Winter and China’s Reopening Rally Stalled

Global economic activity has been influenced by an unseasonably warm winter in the Northern Hemisphere and China’s reopening over recent months. Previous fears of a European recession have abated as warmer temperatures contributed to less demand for oil and gas. Across Europe, this has hampered Russia’s plan to cut off natural gas and has had a reduced impact on the mobility of Europeans and the ability to heat their homes. At the same time, natural gas storage remains more than 60% full, well above the 10-year average of approximately 30% for February. As a result, natural gas prices have fallen more than 80% from peak levels.

Entering 2023, we expected emerging market growth to rebound as China’s COVID policy normalized. So far, China has nearly completed reopening transportation with subway and traffic congestion approaching pre-COVID levels.

Recently, however, China’s more vocal stance on the Russia/Ukraine War has stalled market sentiment as investors digest the implications of the world’s second-largest economy becoming more involved in geopolitical discussions. Ultimately, this could be a temporary setback and purely rhetoric as the reopening theme remains intact. However, this creates an additional risk that China may supply Russia with weapons, which we believe would be a more significant concern.

From a market perspective, international stocks were among the best performers in January but lost ground in February. Nonetheless, U.S. dollar trends are beginning to favor both developed and emerging international stocks, supported by valuations being more attractive than in recent history. Currently, our analysis points to most global central banks resuming a normalized monetary policy by the end of 2023, which we believe should boost international stocks and bonds.

Long-term Perspective: Performance Around Fed Tightening Cycles

Investors focus so keenly on global central banks and the Federal Reserve because of their sizable influence and potential to impact economic and market stability. Historically, when the Fed raises interest rates, this leads to less borrowing by consumers and businesses, as higher borrowing costs slow economically sensitive sectors such as real estate and automobiles. Higher short-term interest rates also make saving more attractive, potentially through investing in money market funds and short-dated bonds. As a result, less borrowing by consumers and businesses and more savings tend to lead to overall economic slowdowns and drawdowns in equity markets.

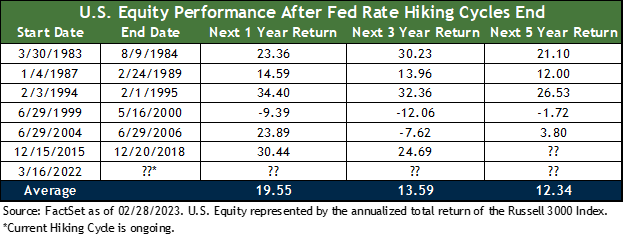

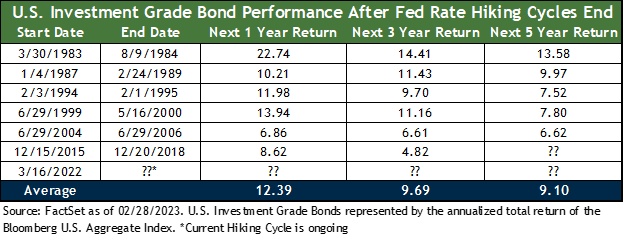

Historically, however, actions by the Federal Reserve typically put near-term pressure on the prices of stocks and bonds. After the Fed cycles end, equity and fixed income returns tend to be relatively healthy (1-, 3-, and 5-year returns following the hiking cycles below).

As shown below, the average one-year return of the Russell 3000 Index after a Fed rate hiking cycle is 19.55%. At 3- and 5 years, U.S. Equity markets returned 13.59% and 12.34%, respectively, annually.

Bond returns were also positive on average. Since 1980, 1-, 3-, and 5-year returns were 12.39%, 9.69%, and 9.10% after the Fed rate hiking cycles ended, recognizing that past performance is no guarantee of future returns.

While we cannot pinpoint when the ongoing rate hiking cycle will stop, there appears to be an end in sight. We continue to prioritize high-quality, short and intermediate-term fixed income as it offers portfolios attractive levels of income and diversification through continued periods of equity volatility.

Closing Thoughts

The year has started on a positive note overall, despite the dip in market performance in February. As we move deeper into the year, we believe that the fading pressure from central banks and resiliency from corporations will provide a tailwind for investment portfolio returns. We also believe that the more reasonable valuations today could lead to future returns more in line with our financial planning assumptions. Both of these factors leave us cautiously optimistic.

As always, we remain focused on using our research and knowledge about the forces that may impact portfolios to help our clients achieve their goals.

[1] U.S. Large Cap stocks are represented by Russell 1000 Index, Global Equities by MSCI All Country World Index, International Equities by the MSCI All Country World Ex-USA Index, Emerging Market Stocks by the MSCI Emerging Markets Index, and U.S. Investment Grade Bonds by the Bloomberg Barclay’s U.S. Aggregate Index. Performance as of 2/28/2023.

Previous Posts

- Sage Insights: Central Banks Slow Hikes, Corporate American Kicks Off Earnings Season, and Long-Term Perspectives on the Debt Ceiling

- Our Perspective: The Debt Ceiling

- Sage 2023 Annual Letter

- Sage 2023 Investment Outlook

- Sage Insights: Markets Bounce as Economic Growth Slows and China Adjusts Its COVID Policy

Learn More About Sage

Disclosures

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks, or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks, or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks, or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, product, or any non-investment-related content made reference to directly or indirectly in this newsletter will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged, and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.