Markets regained momentum in May after retreating toward the end of April and welcomed softer inflation data, a strong jobs report, and healthy consumer-driven economic growth.

The CPI report in mid-May showed lower inflation than anticipated, supporting expectations for the likelihood of lower future interest rates.

Since consumer spending accounts for nearly 70% of U.S. economic output, ongoing broad-based strength in consumer spending has reduced the probability of an economic slowdown and, we believe, supports balance within most of our investment portfolios.

In this edition of Insights, we review monthly market performance, draw parallels between the current bout with inflation and the post-WWII era, and offer some perspective on the U.S. debt situation.

As always, we aim to offer insight into our thinking and how we seek to help you achieve your investment and financial goals.

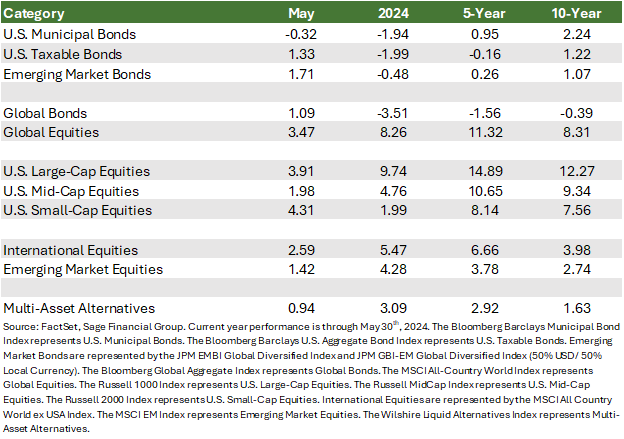

Market Overview

In May, market participants took a step back and re-evaluated the impact of the Fed’s restrictive monetary policy. In prior months, upside inflation surprises led investors to believe rate cuts from the Federal Open Market Committee (FOMC) were off the table and even the plausibility of a future rate hike. However, Chair Powell’s post-FOMC discussion in May reassured market participants that another rate hike remains unlikely.

Investors initially responded favorably to the April jobs report, which indicated a gradual easing in job growth and a slowdown in wage increases. U.S. Treasury yields declined across the curve, reflecting increased confidence in disinflation, resulting in a 1.33% return from investment-grade bonds in May.[1]

At the same time, floating-rate loans provided another strong 1.06% monthly return, supported by elevated coupons and economic resiliency, leading to a year-to-date gain of approximately 3.71%.[2] Municipal bonds fell 0.32% in May, lagging behind taxable peers. The supply of tax-exempt bonds continues to outpace investor demand, placing downward price pressure on this asset class.

After a challenging prior month, equity market performance was favorable in May. Earnings season saw U.S. and international companies exceed expectations, demonstrating their ability to withstand the current rate environment. Fundamental corporate strength has played a key role in driving stocks higher of late, as opposed to multiple increases that tended to drive market movement in 2023.

U.S. large-cap equities performed strongly in May. The Russell 1000 Index recorded a 3.91% increase, driven by impressive gains in mega-cap technology stocks. Nvidia, seen as a pure play on artificial intelligence enthusiasm, rose more than 25% this past month.

U.S. mid- and small-cap stocks also were positive in May, gaining 1.98% and 4.31%, respectively, with split performance relative to U.S. large-cap stocks. A lower Fed Funds Rate provides a tailwind for rate-sensitive small company stocks. Still, even though small-cap valuations are looking increasingly compelling relative to those of large companies, we expect that greater certainty around rate cut timing will be required before we are likely to observe sustained outperformance relative to large-cap stocks.

International equities, represented by the most widely referenced index, rose by 2.59%, while emerging markets climbed 1.42%.[3] A combination of better-than-expected corporate earnings and the likelihood of a European Central Bank rate cut in the near term pushed equity prices higher in Europe.

Policymakers in China are showing an increased willingness relative to their stance in recent years to support actions intended to address some of the country’s economic malaise, with an eye both toward stimulating economic growth broadly as well as specifically assisting China’s long-troubled property sector.

The International Monetary Fund (IMF) has upgraded its growth outlook for China this year from 4.6% to 5.0%. Though notable challenges remain, recent monetary and fiscal policy measures and the IMF’s more constructive assessment of the impact of these moves on growth for the world’s second-largest economy have positively impacted Chinese assets.

Inflation Slowing, Not Stalling

Higher prices have presented challenges for many over the last three years, when inflation first began to run above the Fed’s 2% target in April 2021. In retrospect, policymakers’ efforts to lower prices started too late, which in turn kicked off the most aggressive pace of interest rate hikes in 40 years.

The most recent reading of the Consumer Price Index (CPI) showed a 3.4% year-over-year advance, significantly below peak levels in 2022 but still above the Fed’s 2% long-term target.

The stubborn service components, including the cost of shelter and auto insurance, keep inflation elevated. This is much different from the COVID-19-induced supply chain issues that led to a sharp rise in the price of goods.

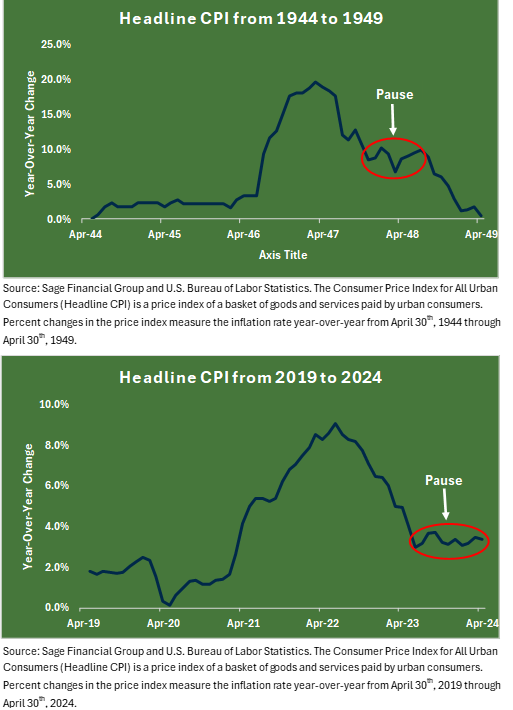

We continue to ask ourselves, “Will inflation return to the Fed’s 2% target? And, if so, when?” We believe that history offers some relevant insights.

In our view, an interesting comparison to the pandemic’s aftermath is the post-World War II period, when broad, war-induced supply shortages, tremendous pent-up demand, and the fiscal stimulus provided by the G.I. Bill led to inflation spikes in the U.S.

This post-war boom is similar to the recent experience of pandemic-related disruption, in which very loose fiscal policy threw an already strong economy out of equilibrium. After peaking in early 1947, inflation gradually returned to pre-spike levels, pausing several times along the way. We note that the current disinflation path has been following a similar course.

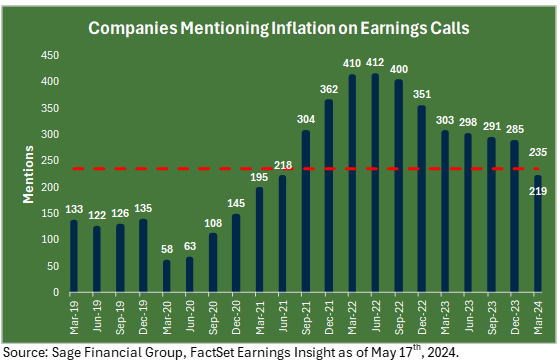

Corporate America is discussing inflation less and less frequently on earnings calls. The most recent earnings season marked the seventh consecutive quarter of fewer mentions of inflation, down to 43% from a peak of more than 80% of S&P 500 companies referencing inflationary impact on their business in 2022.

Less pressure from input costs, such as labor and raw materials, has contributed to a solid quarter for corporate profits. U.S. large-cap companies[4] are on pace to grow earnings by 5% year over year. This earnings growth has allowed companies to beat analyst estimates, increasing share prices.

In our base case, the probability of lower interest rates ahead is most likely. We believe interest rates have likely peaked for now, and the Fed’s next move lower is a matter of when, not if. That said, economic conditions remain dynamic. The U.S. economy is in strong shape today, and the upcoming months should provide key insight into the labor market’s health and price stability.

Right now, the criteria for a rate cut would include several sustained lower inflation reports and/or a cooling labor market. Equities have remained the primary drivers of portfolio growth. Key areas of corporate strength continue to come from companies integrating artificial intelligence to improve productivity, cut costs, and protect profit margins.

Fixed income continues to play a defensive role in portfolios, broadly protecting against periods of uncertainty. In the U.S., higher than typical current income levels should remain, but potential price appreciation from bonds would provide added value if both growth and inflation slow. A pause in inflationary pressures on the economy should provide a market tailwind.

At the same time, asset classes like floating-rate loans and private credit perform most favorably during periods of higher rates and strong growth as investors receive more income. Global bonds may play an increasingly important role if central banks across different economies begin to implement divergent monetary measures. Sage’s diversified approach is designed to allow investment portfolios to participate in market upside while protecting against market downturns.

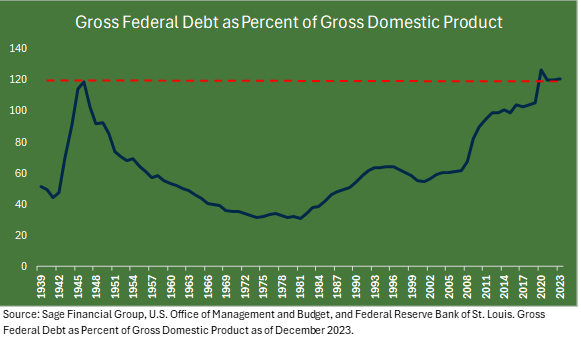

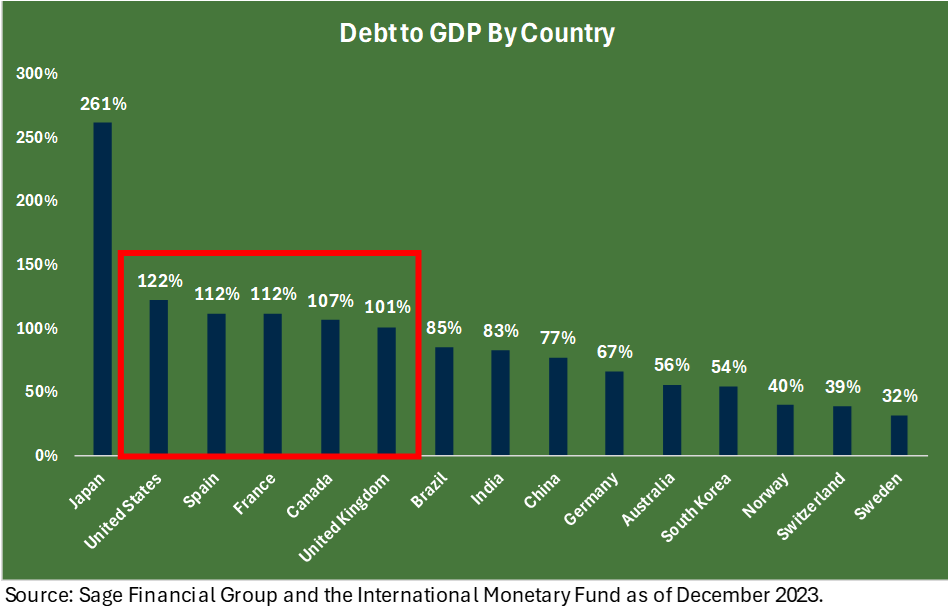

U.S. Debt Remains Problematic but Is Not Widely Viewed as a Problem

Another topic that casts a shadow of uncertainty over the strength and role of fixed income is the U.S. debt situation. We routinely speak to clients who reach out with concerns on this subject.

The question typically posed by clients can be boiled down, in perhaps not so many words, to, “When does the extent of U.S. government borrowing become such a problem that it threatens conventional assumptions about the future and, in turn, how we perceive market investing?” The truthful answer is that nobody knows for sure.

The growth of the U.S. debt situation has trended upward. In the decade following the Global Financial Crisis, the total debt doubled. Much of this debt growth has occurred over the last five years. From 2019 to 2024, total U.S. Debt has grown from $22 trillion to $34 trillion.

Historically, the U.S. debt-to-GDP ratio reached a similar level at the end of WWII to where we find ourselves currently, before declining over the next 30 years as a result of reduced government spending and generally strong economic growth.

Despite interest rate volatility starting in 2024, foreign buyers have maintained a stable positioning of U.S. Treasuries for various reasons. This includes robust demand from Japan, which is exiting a decade-long period of negative interest rates and experiencing current currency volatility. At the same time, China has gradually lowered its holdings of Treasuries but has repositioned into U.S. mortgage-backed securities.

The U.S. fiscal situation remains unsettling, but foreign investors continue to provide a firm backstop to prevent U.S. Treasury yields from spiraling higher.

We believe high-quality fixed income in the U.S. should remain a core component of portfolios. Prevailing yields reflect the market’s expectations of growth and inflation and do not appear to indicate concern about a deterioration of the U.S. government’s fiscal health.

High-quality fixed income, with higher starting yields, should perform well in the current environment, while performance from the asset class could become more impactful when the Fed begins to lower interest rates. As such, we prefer the risk-reward of bonds over cash, given the heightened reinvestment risk facing cash as rates decline.

Closing Thoughts

May has helped bring portfolio returns back on track, resuming much of the positive advances from Q1 that were interrupted in April. Recent domestic economic data releases suggest a modestly cooling economy exhibiting some promising, albeit still early, signs of disinflationary progress.

Though the precise timing of the start of rate cuts by the central bank remains unclear, there is much within the latest figures that indicate an environment increasingly conducive to rate cuts in the latter part of 2024.

While cash equivalent investments may in any moment appear to compare favorably on a risk-adjusted return basis to many conventional investment areas, we remain acutely aware of the risks courted in relying on cash equivalents for most long-term investment strategies.

We know how quickly cash can fall out of favor relative to bonds as the markets anticipate rate cuts, and the cost of late shifts from cash into a bond market that has already begun experiencing price appreciation. Similarly, we recall periods when money market assets looked attractive relative to risk assets, such as in 2008, just before a stock bull market began in March 2009 and lasted into March 2020.[5]

We concluded last month’s Insights by recognizing that stocks and bonds both periodically decline from time to time. This should always remain an expectation. While these fluctuations may be unsettling, our long-term approach and adaptability should provide a more consistent outcome.

Our adjustments across portfolio risk models are driven by well-considered tactics, both defensive and opportunistic. We would continue to urge against trying to time entries in and out of the markets.

If you have any questions or concerns, please do not hesitate to contact us. We appreciate your trust and confidence in our team and remain committed to helping you achieve your investment and financial goals.

Footnotes

[1] All performance shown is as of May 30th, 2024.

[2] Measured by the total return of the Morningstar LSTA U.S. Leveraged Loan 100 Index.

[3] International stocks are represented by the MSCI All Country World ex USA Index.

[4] Companies in the S&P 500 index.

[5] Source: Board of Governors of the Federal Reserve System through Dec. 31, 2023, as of March 7, 2024

Previous Posts

Learn More About Sage

Disclosures

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks, or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks, or assumptions should not be construed to be indicative of the actual events that will occur. These projections, market outlooks, or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, product, or any non-investment-related content referred to directly or indirectly in this newsletter will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer reflect current opinions or positions. All indexes are unmanaged, and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in managing an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her situation or any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.