As we reflect on the markets’ performance in March, we also mark the end of the first quarter of 2024. It has been a good start to the year. Equity markets maintained their positive momentum, steadily climbing upward, while fixed-income markets posted healthy returns in March despite a fluctuating interest rate environment during the first three months.

This strong performance continued to play out against a positive economic backdrop. The U.S. labor market remained firm as economic activity once again surpassed expectations. At the same time, year-over-year inflation continued to trend downward, albeit more slowly than widely forecasted.

A highly anticipated Federal Open Market Committee (FOMC) meeting on March 20th culminated with the Federal Reserve’s decision to maintain its policy rate as expected. Investors remain keenly focused on Fed Chair Powell’s language about future meetings, which continue to shape market sentiment and expectations.

In this edition of Insights, we review market performance, discuss recent guidance from the Federal Reserve, examine noteworthy trends from the “Magnificent 7” stocks, and provide a long-term perspective on investing in equities at or near all-time highs.[1]

As always, we aim to offer insight into our thinking and how we seek to help you achieve your investment and financial goals.

Market Overview

In his press conference after the March FOMC meeting, which determines monetary policy direction, Fed Chair Powell emphasized the Committee’s cautious approach. He acknowledged inflationary pressures remain but characterized them as bumps in the road rather than long-term obstacles. The Committee still expects to cut interest rates three times in 2024 to avoid holding the policy rate too elevated for too long.

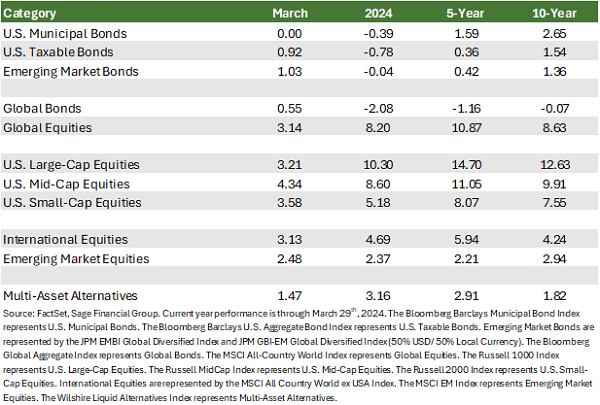

Bond markets responded positively to the interest rate environment and its forecast in March. A slight decline in Treasury yields contributed to a 0.92% return from investment-grade bonds. Emerging market bonds provided an additive 1.03% return. The Bank of Mexico’s first-rate cut since it began hiking in 2021 partly bolstered the asset class, as it signaled confidence in sustained downward inflation trends.

Equity markets continued to perform well as earnings expectations were revised upward, suggesting that stocks can navigate a higher interest-rate environment.

U.S. large-cap equities have reached all-time highs over 20 times so far this year. In March, the Russell 1000 Index climbed 3.21% despite downward pressure from previously outperforming stalwarts, Tesla and Apple.

For a second straight month, U.S. mid- and small-cap stocks outperformed large-cap stocks, posting gains of 4.34% and 3.58%, respectively. Chair Powell’s commentary restored confidence that rate cuts would still occur in 2024, which should reduce pressure on more cyclical companies within these indices.

International equities, represented by the most widely referenced index, climbed 3.13% in March while emerging markets’ equities returned 2.48%.[2] The Bank of Japan became the final global central bank to end a zero-interest rate environment, which we view as a positive step toward normalizing monetary policy.

China’s leader, Xi Jinping, met with several heads of U.S. companies to help instill confidence in business activity within the country. While this was a net positive, market participants remain hesitant about geopolitical developments and investing in China, especially given the upcoming U.S. election.

Federal Reserve Guides Market Expectations

Excitement stoked the financial markets at the end of 2023 as investors began anticipating a near-term rate cut from the Federal Reserve. Entering the year, many believed the first interest rate cut would be announced at the March FOMC meeting.

We sit here today, and no such action has occurred. Other major central banks, including the Bank of England and European Central Bank, have also refrained from lowering policy rates. Yet stocks and bonds performed favorably in March and for much of the first quarter of 2024. Why?

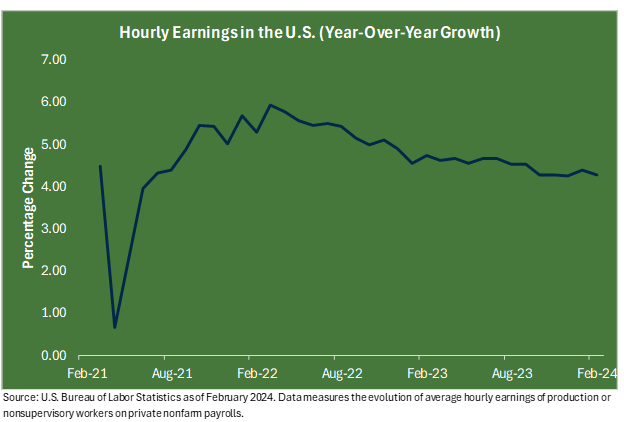

In short, economic resilience. So far, in 2024, both economic growth and hourly wage gains have exceeded expectations in 2024.

As is customary after policy meetings, Fed Chairman Jerome Powell took the podium and shared the Fed’s decision-making and thought process. His commentary focused on reassuring listeners that the U.S. economy remains on a healthy footing, with expected 2.1% GDP growth this year and an upward revision from December.

Powell used the time to comment on consecutive upside inflation surprises in January and February. His commentary referred to these two readings as “bumps in the road” and reiterated that the Fed still believes inflation will fall to 2.4% by the end of 2024.

Powell’s comment on the labor market during the press conference was particularly noteworthy. Powell said, “An unexpected weakening in the labor market could also warrant a policy response,” underscoring the Fed’s attentiveness to following labor market developments to inform the next steps.

Wage inflation remains a key area of focus. Beginning in 2021, as the economy began to re-open and recover, we saw upward pressure on wages as demand for labor increased.

If wage inflation declines, the FOMC is expected to gradually lower policy rates quarterly. We believe the first rate cut will occur at the June FOMC meeting, two meetings later than anticipated at the beginning of the year.

From this point, the Fed will likely continue to respond measuredly to subsequent rate cuts to maintain stability and underscore its apolitical perspective during an election year with heightened uncertainty.

The strong reported GDP growth numbers encouraged the markets, as the U.S. consumer is one of the key drivers of the global economy.

The month’s positive economic data, a continued expectation for rate cutting to occur this year, and the increasing unlikelihood of a U.S. recession help Sage remain constructive on equities and investors’ appetite for risk increase. On balance, we see merit in fixed income as a component of portfolios with higher yields offering increased income to buffer against unforeseen equity volatility.

However, we have also prepared for a range of outcomes. For example, should yields begin to fall, the potential price appreciation from fixed income and less correlated alternative investments should provide a better risk-return tradeoff than cash across various scenarios, including a challenging environment for equities. Sage has gradually added to investment-grade bond positions when appropriate over the last eighteen months.

Magnificent 7 Headwinds and an Expensive U.S. Market

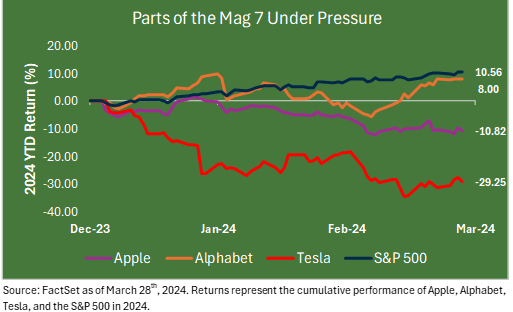

In 2023, a select few mega-cap technology stocks drove equity market returns. In 2024, this story has been more nuanced. Last year’s unchallenged “magnificent” leaders at the top of the S&P 500 are beginning to experience divergent performance.

- Alphabet has underperformed U.S. large-cap stocks following a muted period of acquisitions and an unsuccessful rollout of their Artificial Intelligence chatbot, Gemini.[3]

- Apple has faced regulatory headwinds. The Department of Justice and a coalition of state attorney generals filed an antitrust lawsuit against the company for allegedly placing limitations on its hardware and software outside of Apple devices.

- Tesla stock was one of the worst performers in 2024 Q1 as investors became concerned about the company’s global dominance in the wake of increasing competition from China and disruption in the European supply chain.

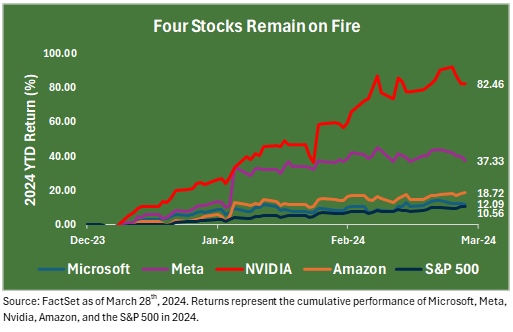

Microsoft, Amazon, Meta, and Nvidia continue to remain ahead of the large-cap index with robust earnings driven by artificial intelligence, while Apple, Tesla, and Alphabet are notably underperforming in absolute terms and relative to their technology category peers.

- Microsoft and Amazon have prudently exercised capital allocation and invested in profitable projects.

- Meta, which fell terribly out of favor with investors in 2022, bounced back strongly in 2023 and continues to shine at the start of 2024. Its business model is focused on cost discipline rather than distant, expensive future projects.

- Nvidia remains an investor favorite, rising to become the world’s third most valuable company.

Though the performance at the top has diverged, it remains clear by traditional metrics that the U.S. market is more expensive relative to history. Since 1996, U.S. large-cap stocks’ forward price-to-earnings (P/E) ratio has increased to 21x, reflecting a 27% premium above the historical average. As of March 31st, 2024, the top 10 stocks total 33.5% of the S&P 500 Index.[4]

We believe investors could begin to rotate out of these stocks over the coming months as the “non-Magnificent 7 “companies in the index are expected to outperform their celebrated counterparts in earnings growth by Q4 2024.

Despite trailing behind U.S. stocks, we believe international equities are attractive from a value standpoint and can enhance portfolio returns in absolute terms and relative to the domestic market. We believe the broader composition and more attractive valuations of this asset class can provide beneficial diversification if U.S. large-cap equity performance begins to fade.

Our investment philosophy prioritizes diversification over focusing too much on past or present winners because the markets change quickly. While U.S. large-cap stocks are among the biggest, if not the biggest, position in most Sage client portfolios, we maintain a disciplined approach to investing across asset classes. We believe this helps us prepare for a variety of credible scenarios that could unfold over different periods, such as this shift in favor among the mega-cap technology stocks.

Longer-Term Perspective: Keeping Focus and Looking Long-Term

A disciplined approach grounded in diversification across multiple asset classes, geographies, and long-term strategies can be beneficial as U.S. equity markets continue to reach new all-time highs.

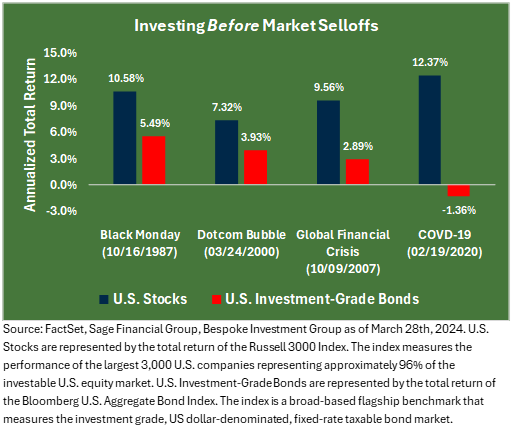

While the start of this year may have reduced market investors’ concerns about a significant market pullback, we remain watchful for signs of volatility and risk. History reminds us not to grow complacent. Looking back over the last forty years, we observe four significant, unexpected market selloffs: Black Monday (10/16/1987), the Dotcom bubble (3/24/2000), the Global Financial Crisis (10/9/2007), and COVID-19 (2/19/2020).

Market declines are inevitable; as these four examples illustrate, they can happen suddenly and over a short period. Recognizing this very real risk, your portfolio has been constructed in line with your time frame and investor risk profile to mitigate some of the anticipated downside consequences around inevitable corrections and retreats.

The graphic below shows the performance of U.S. Stocks and Investment-Grade Bonds on the day ahead of each market decline through the end of March 2024.

As we have highlighted over the years in Sage’s Insights, “time in the market beats timing the market” is not merely a catchy phrase. A resilient U.S. economy and prudent investment planning focused on individual goals, circumstances, time horizon, and risk appetite can provide a solid foundation to help navigate evolving market conditions.

Closing Thoughts

As we move into the second quarter of 2024, we look forward to building on the equity markets’ strong start to the year while closely monitoring the markets’ reactions to incoming economic data, which should inform the actions of the Federal Reserve and other key global central banks over the coming months.

The absence of an April FOMC meeting should allow financial markets to digest incoming domestic data rather than strain to pinpoint the precise timing of a Fed rate cut. While one month of economic data does not signify a trend, the behavior we observed in March could continue to broaden equity market performance away from mega-cap tech dominance.

We maintain a cautious yet optimistic outlook about market prospects, supported by a healthy economic backdrop. We are focused on identifying investments with strong performance potential that should benefit in this environment. While challenges may arise, our commitment to helping you achieve your financial and investment goals is unwavering.

Footnotes

[1] Magnificent 7 stocks include Microsoft, Apple, Alphabet, Amazon, Tesla, Nvidia, and Meta.

[2] International stocks are represented by the MSCI All Country World ex USA Index.

[3] U.S. large-cap stocks are represented by the S&P 500 Index.

[4] Valuation is measured by dividing a company’s current share price by its estimated earnings per share (EPS) over the next 12 months.

Previous Posts

Learn More About Sage

Disclosures

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks, or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks, or assumptions should not be construed to be indicative of the actual events that will occur. These projections, market outlooks, or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, product, or any non-investment-related content referred to directly or indirectly in this newsletter will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer reflect current opinions or positions. All indexes are unmanaged, and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in managing an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her situation or any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.