The cautious optimism we brought into April after the first quarter’s market momentum was tempered during the month because of challenges in both equity and fixed-income markets. Despite a positive start to the earnings season, equity markets retreated throughout the month, driven by the prospects of “higher-for-longer” interest rates and concerns regarding the persistence of inflation. The fixed-income environment grappled with interest rates steadily rising to approach levels last seen in October 2023.

In addition, economic growth statistics for the U.S. came in below widespread expectations and, with inflation showing no clear signs of easing, created macroeconomic crosswinds. A third consecutive Consumer Price Index surprise to the upside led to some head-scratching, as many economists thought that higher interest rates would slow the economy and, thus, more significantly decrease inflation. Despite these projections, the U.S. economy grew by 1.6% (annualized) in the first quarter, with a notably strong labor market and evidence of continued robust consumer demand for services.

In this edition of Insights, we review market performance, highlight recent solid economic data, and observe momentum in corporate deal activity.

As always, we aim to offer insight into our thinking and how we seek to help our clients achieve their investment and financial goals.

Market Overview

In the absence of a Federal Open Market Committee meeting (FOMC), investors sought direction from individual committee members regarding the path of U.S. monetary policy. In speeches toward the middle of April, policymakers echoed sentiments akin to those of Fed Chair Jerome Powell:

“These recent data do not materially change the overall picture, which continues to be one of strong growth, a strong but rebalancing labor market, and inflation moving down toward 2 percent on a sometimes bumpy path.”

Persistent inflation in the U.S. placed upward pressure on interest rates and fixed-income investments as markets reassessed the likelihood and magnitude of potential Fed policy easing in 2024. The timing of expected rate cuts was pushed further into 2024, helping to keep current interest rates high.

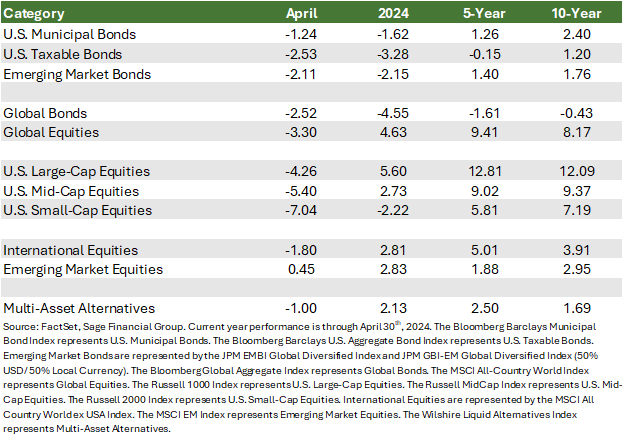

Elevated U.S. Treasury yields contributed to a -2.53% return from investment-grade bonds in April. Conversely, floating-rate loans gained 0.62% as higher coupons and tighter corporate spreads contributed to investor returns. Year-to-date, in 2024, floating-rate loans have gained approximately 2.62%. Municipal bonds also felt pressure from higher rates, which led to a 1.24% decline in April. However, they outperformed their taxable peers with attractive after-tax yields and positive fundamentals, which increased investor demand.

Equity market performance was disappointing for most of the month, as interest rates created a headwind for valuations by lowering future projections and present values. Investors closely monitored messaging by U.S. companies during earnings calls. Companies that guided expectations lower, such as Meta Platforms, which is investing heavily in artificial intelligence (AI), witnessed corresponding declines in their stock prices. Meanwhile, Alphabet (Google) announced its first-ever dividend, which led to favorable price appreciation.

U.S. large-cap equities performed better than their smaller company peers in April. The Russell 1000 Index fell 4.26% as rate-sensitive technology stocks relinquished earlier gains. Yet, the month ended with strong earnings reports from Google and Microsoft, who share a combined market cap of roughly $5 trillion. Both companies beat expectations in part due to the strength of their cloud businesses, which are driven by artificial intelligence.

U.S. mid- and small-cap stocks reversed their two-month streak of outperforming U.S. large-cap stocks. The two indices declined 5.40% and 7.04% in April, respectively. The selling pressure on these companies stems from the anticipation that higher interest rates could erode future corporate profitability.

International equities, represented by the most widely referenced index, outperformed U.S. Equities, decreasing by 1.80% while emerging markets experienced a gain of 0.45%.[1] In Europe, corporate earnings provided an upside surprise, as companies’ profit margins beat forecasts. Emerging market equities were aided by positive performance from Chinese equities, driven by restored optimism around the government’s commitment to relevant policies deemed supportive of China’s markets.

Positive Economic Data Lifts Treasury Yields

Heading into 2024, the prevailing market view was for an economic slowdown, as it was expected that the impact of higher interest rates would begin to work through the economy, unemployment would rise, and inflation would begin to fall.

Four months into the year, the incoming data seems to contradict that view. The U.S. labor market continues to experience growth month over month, while progress on slowing the pace of inflation appears to have stalled. In short, the U.S. economy continues to expand, leading market participants to temper near-term expectations around interest rate cuts.

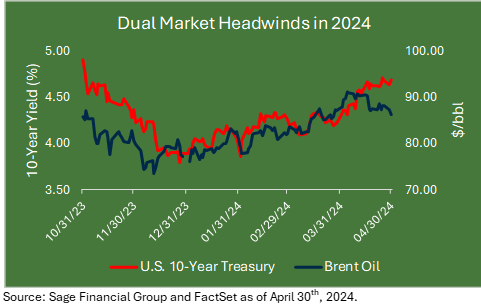

As recently as mid-October 2023, the U.S. 10-year Treasury yielded approximately 5%, the highest yield in over 15 years. Throughout the year, investors began to accept a “higher-for-longer” interest rate environment, in which the Fed would keep the Federal Funds Rate elevated.

Treasury yields declined more than a full percent in November and December as oil prices, a key influence on inflation, tumbled in lockstep. This was a favorable trend for markets into the holiday season.

Instead, the U.S. economy has shown remarkable resilience in 2024 through broad economic growth and hourly wage gains. Recent incoming data has prompted markets to reconsider the likelihood of a near-term Fed easing cycle.

From a market perspective, U.S. Treasury yields continued moving higher in April and are closely approaching the recent peak rate levels reached in October 2023. The market perceives inflation as gaining a second wind, potentially caused by elevated geopolitical tensions that have restricted the Federal Reserve from beginning to take measures to stimulate the economy. Higher yields have led immediately to lower bond prices but create the potential for higher future returns.

We believe the uncertainty surrounding the timing of the first Fed rate cut may contribute to more volatility in daily returns in the equity market. In our view, this creates an opportunity for investors with a diversified allocation to fixed income in the U.S. and abroad.

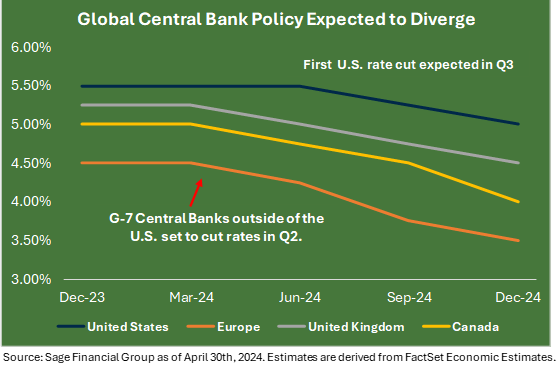

More directly, April showed an increased divergence of expectations regarding when G-7 countries begin to ease monetary policy through lower interest rates. Major central banks, including the European Central Bank, Bank of England, and the Bank of Canada, are expected to cut rates later this quarter. Meanwhile, domestically, the Federal Reserve remains in a wait-and-see period around the data.

Higher inflation categories in the U.S., including insurance and rental costs, are less correlated to drivers of prices in other developed markets. This suggests recent upside inflation surprises are not expected to occur outside the U.S. for the same reasons.

Investors can balance monetary policy divergences by diversifying across geographies that no longer raise and lower rates in a synchronized order. Lower rates outside the U.S. offer price appreciation from fixed-income instruments, as domestic fixed-income offers higher current income levels.

We caution investors to avoid becoming overly grim following three consecutive months of hotter-than-expected inflation and focusing on one singular outcome. Instead, we focus on preparing for a range of outcomes with the understanding that market conditions are dynamic. Our base case expects stable or lower interest rates further ahead. Still, we balance the risks of an unexpected rise in rates that may impact portfolios via diversifying across geographies and expanding the duration range across bond investments.

We believe the uncertainty surrounding the timing of the first Fed rate cut may contribute to more volatility in daily returns in the equity market. In our view, the unknown timing of Fed policy easing creates an opportunity for investors with a diversified allocation to fixed income in the U.S. and abroad.

Sage’s approach focuses on curating a portfolio with additive components and considering future monetary policy actions. This philosophy focuses on why the Fed is lowering or raising interest rates rather than imprecise market timing. We recently added investment-grade core bonds and higher-yielding floating-rate loans to client portfolios, where appropriate. This positioning could help provide portfolio diversification during periods of equity market selloffs.

Deal Activity Gains Steam

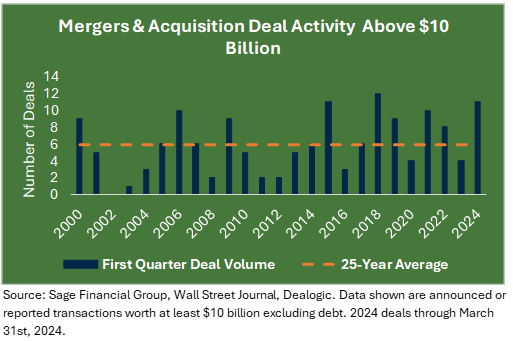

In our view, the prospects for M&A have improved in recent months, propelled by rising stock prices and a resilient U.S. economy. This year has seen several major transactions, with 11 deals worth $10 billion or more—the most since 2018—including KKR’s $11 billion purchase of healthcare analytics company Cotiviti and Apollo’s $11 billion purchase of Paramount’s film and TV studio.

Public firms are currently in the middle of quarterly earnings reporting. Corporate profits declined for three consecutive quarters before recovering in Q3 2023. If forecasts materialize, the current quarter will mark three-quarters of year-over-year earnings growth.

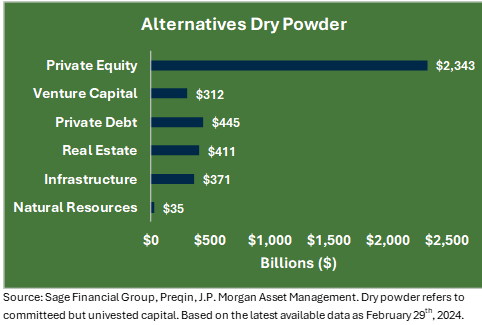

Deal activity is surging in no small measure because private equity, private credit, and real estate funds hold a record $3.9 trillion in “dry powder,” i.e., capital ready to be deployed relatively quickly toward this end. Further, market enthusiasm for innovative companies involved with artificial intelligence, healthcare, semiconductors, and software has helped foster a climate ripe for deal activity.

Market enthusiasm for innovative companies involved with artificial intelligence, semiconductors, and software is ripe for deal activity.

While higher interest rates and challenges posed by the current regulatory environment continue to constrain deal activity, an improving M&A backdrop should bode well for both public and private market ecosystems, potentially benefiting cyclical asset classes like small-cap and international stocks, real estate, and floating-rate loans.

Closing Thoughts

Months of negative stock and bond performance periodically occur. These environments can challenge an investment plan and raise questions about the merits of ongoing commitments to certain assets within a diversified investment portfolio. Yet, elevated volatility may also present opportunities to allocate to certain assets at lower prices.

We urge Sage clients not to let day-to-day market fluctuations distort their longer-term perspective. Our customized portfolio strategies are designed to help them achieve their financial and investment goals, notwithstanding inevitable periods of heightened volatility along the way.

Footnotes

[1] International stocks are represented by the MSCI All Country World ex USA Index.

Previous Posts

Learn More About Sage

Disclosures

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks, or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks, or assumptions should not be construed to be indicative of the actual events that will occur. These projections, market outlooks, or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, product, or any non-investment-related content referred to directly or indirectly in this newsletter will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer reflect current opinions or positions. All indexes are unmanaged, and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in managing an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her situation or any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.