February, with its extra day for the leap year, saw equity markets vault ahead.

Earnings season was in full swing throughout the month, with more than 97% of U.S. companies reporting quarterly results. In aggregate, these companies exhibited healthy profit margin growth and pricing power, buoyed by robust U.S. economic activity.

Despite a shared vigorous economic backdrop, fixed income and equity markets responded differently to the incoming monthly data. While bond markets began adjusting to the idea of sustained higher interest rates, equity markets looked past the rate climate and reached new highs.

In this edition of Insights, we review market performance, recap the quarterly earnings season, analyze the ongoing enthusiasm surrounding artificial intelligence, and provide a long-term perspective on international equities.

As always, we aim to offer transparent insight into our thinking and how we seek to help you achieve your investment and financial goals.

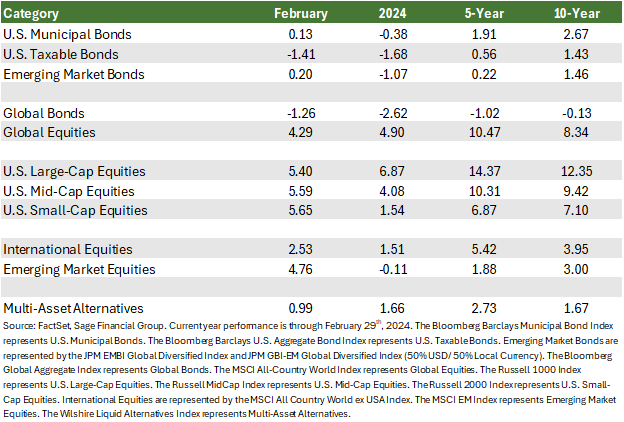

Market Overview

The financial markets absorbed a flurry of economic data at the beginning and middle of the month. Stronger-than-expected job creation figures and persistently elevated CPI suggested the Federal Reserve (Fed) would begin cutting rates later in 2024 than many market participants expected when the year commenced.

This less dovish position sent bond yields higher, resulting in lower bond returns in February. The bond “pivot rally” that began in the last few months of 2023 lost steam in February, with core bond returns declining by 1.41%. We still believe the Fed remains committed to a path toward lowering rates over the coming quarters and expect investors to shift away from cash as interest rates decline, making cash yields less attractive.

As we shared last month, stronger economic data rather than rising inflation expectations have pushed yields higher. This data has helped affirm a healthy economic backdrop that requires gradual rather than swift policy intervention from the Fed.

Emerging market bonds experienced a 0.20% return in February. Despite expectations for lower policy rates in developed markets continuing to push later in the year, key emerging market central banks remain on course to lower their respective rates later in Q1.

While uncertainty around the timing of Fed cuts created a brief period of elevated volatility for equities, investors ultimately experienced positive equity returns across domestic and global markets in February.

U.S. large-cap equities sustained their favorable momentum, returning 5.40% in February, driven in no small measure by investor excitement around companies linked to artificial intelligence. Nvidia, a Santa Clara-based company, eclipsed a $2 trillion market valuation, becoming the third-largest U.S. company and pushing the S&P 500 to another all-time high.

U.S. mid- and small-cap stocks staged a comeback, posting similar gains of 5.59% and 5.65%, respectively. Initially disheartened by the monthly CPI report and the fresh uncertainties regarding interest rate adjustments that it triggered, these stocks responded well to the positive earnings season.

International equities, represented by the most widely referenced index[1], climbed 2.53%, while emerging markets equities gained 4.76% in February. Despite technical recessions (defined as two consecutive quarters of negative GDP growth) in Japan and Germany, both stock markets reached all-time highs.

Chinese equities exhibited strength in February despite a one-week closure of local markets for the Lunar New Year. Accommodative policy from China’s central bank and a significant uptick in domestic tourism (up more than 19% relative to 2019) contributed to this positive performance.

Corporate America Focuses More on AI, Less on Supply Chains

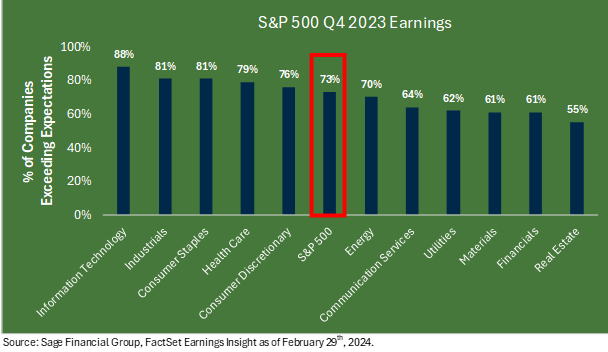

By the end of February, more than 97% of S&P 500 companies had reported earnings, with results that surpassed expectations for the season.

Though much attention has been placed on the “Magnificent 7” companies[2], more than half of every sector outperformed analysts’ earnings expectations. Moreover, 73% of companies beat Wall Street quarterly profit expectations.

Analysts forecast at the beginning of 2023 expected corporate earnings to grow by 3%, but companies have reported better than anticipated margins, with 8% year-over-year growth. This faster-than-expected profit growth has contributed to higher stock prices, with the U.S. stock market reaching an all-time high in February.

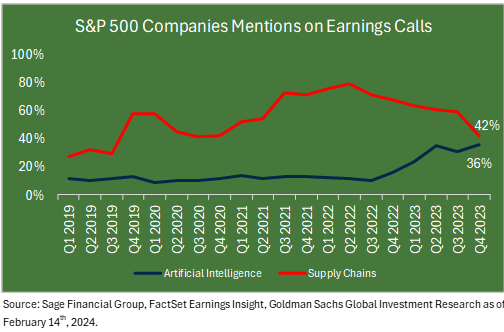

Two notable themes emerged during corporate earnings calls: a significant increase in the mention of artificial intelligence (AI) — by 36% of companies, compared to less than 10% just three years ago, and a decrease in the discussion of supply chain issues, which halved from peak levels of approximately 80% in 2022.

The attention on AI was most apparent in the technology sector, in which, according to Goldman Sachs Investment Research, more than 85% of companies discussed AI.

Simultaneously, supply chain normalization continues to unfold. This was a key theme we discussed in Sage’s 2024 Outlook, where we stated our expectation that productivity would alleviate pressures that began building in 2021.

While most companies cited improving supply chains and less disruption, this has been a less-discussed topic for several quarters. We expect to see an inflection point between AI and supply chain mentions next quarter.

We believe technological advancements and productivity will continue to drive economic growth and positively impact equity prices. As companies can do more with less, we expect profit margins to remain resilient or expand, bolstering stock and bond prices.

Healthy corporate earnings support our recommendation to remain invested in global equity markets, albeit balanced against the ever-present risk of unexpected downturns.

We selectively allocate to credit markets to gain exposure to corporations at a higher level of a company’s capital structure. This fully invested strategy should also find support from lower bond yields in the months ahead, which we expect will lead to a stronger total return relative to cash instruments.

Artificial Intelligence (AI) Euphoria

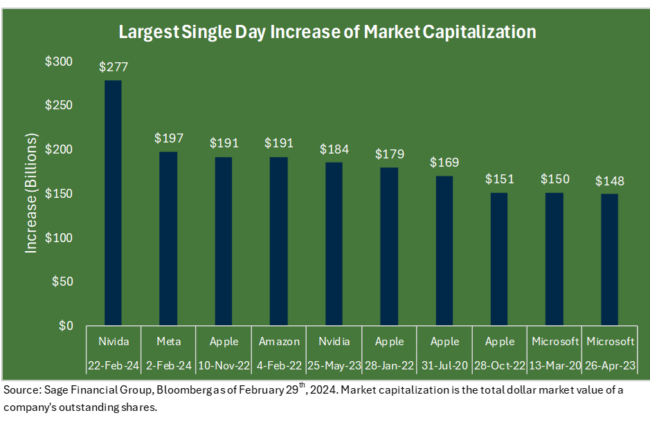

Investor enthusiasm for artificial intelligence reached new heights in February, exemplified by the dramatic increase in market capitalization for AI chip maker Nvidia (NVDA), which added $277 billion just one day after its earnings release on February 21st. For reference, this massive one-day move by NVDA was equal to 1.5 times Walt Disney’s entire market cap.

Market participants have looked at companies involved with AI and have become focused on the long-term growth potential. The economic opportunity set by AI could be tremendous, and technology touches a vast swath of sectors and industries across the globe.

AI’s clear and tangible benefits are already impacting the economy, and not just for technology companies. For example, healthcare providers adopt AI to enhance documentation and mitigate staffing problems by reducing the number of required patient visits.

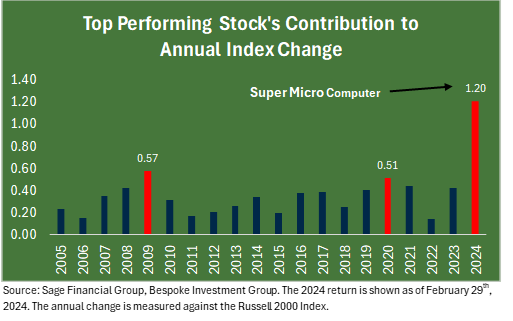

This excitement is not limited to mega-cap technology companies. Smaller companies have also gained attention from market participants. Super Micro Computer (SMCI) is a California technology company providing servers to larger companies like Nvidia.

SMCI was valued at $16 billion at the end of last year and has ballooned to more than $48 billion at the end of February. This now makes SMCI more than four times larger than the second-largest small-cap stock in the Russell 2000 Index.

Returns for Super Micro Computer have added over 1.20% to the Russell 2000 small-cap index’s performance this year. Since 2005, only two stocks have added more than 0.50% of the total performance contribution for the Russell 2000 Index. In both instances, these high-flying stocks returned their gains in the subsequent calendar year.

While we acknowledge ongoing excitement around AI-related stocks and note that maintaining exposure to U.S. mega-cap technology companies has been helpful to investment performance, we remain calm, focused, and dedicated to our long-term investment strategy.

The broader stock market currently is invested in companies tied to or affiliated with AI, including Sage’s portfolios. The technology continues to expand beyond data centers across multiple sectors. Influential companies in the space include Nvidia, Meta Platforms, and Amazon.

Collectively, these three stocks make up more than 10% of the U.S. large-cap equity market and are owned by one or more of the equity investments we recommend to clients. Additionally, U.S. large-cap equities are the largest component of Sage’s recommended equity allocations when they align with a client’s objectives.

While we believe that companies leveraging technology to improve efficiency and productivity will add enduring value over time, we also want to continue diversifying our portfolios with companies across various sectors to manage risk and be positioned to capture other parts of the market if and when narrowly directed AI excitement wanes.

Over the long term, a company’s fundamentals, not short-term market enthusiasm, should drive the value of stock prices. As legendary investor Benjamin Graham said, “In the short run, a market is a voting machine, but in the long run, it is a weighing machine.” By adopting a diversified approach, we believe we can capture gains across various industries benefiting from innovation, thus helping us seek to prudently position portfolios in pursuit of client goals rather than chasing short-term performance and trends.

Emerging markets stocks also benefited from AI and ended the month as a top-performing asset class. We recognize the significant role of international markets in semiconductor development, augmented by AI growth, exemplified by companies such as ASML (up approximately 30% in 2024). Emerging market companies provide critical input in the global production of semiconductors.

Many components of Sage’s investment portfolios have participated in the recent appreciation of AI-linked stocks. Over the long term, a company’s fundamentals should drive the value of stock prices.

Longer-Term Perspective: Further Potential Upside from International Equities

International equities continue to intrigue us. Given the increasingly concentrated U.S. stock market, where the top 10 stocks account for a new 50-year high of 33% of large-cap stocks, we find particularly compelling opportunities to diversify in Europe and Asia. In these regions, the top 10 stocks comprise 11% of the MSCI ACWI ex-U.S. Index, creating the backdrop for more potential upside.

Past performance does not indicate future results, which is a mantra about using history to inform the future. We hold this to be true in both practice and real-world experience. The first decade of the 2000s saw U.S. stocks underperform their international peers by 1.80% annually. Trends can change quickly but persist over prolonged periods.

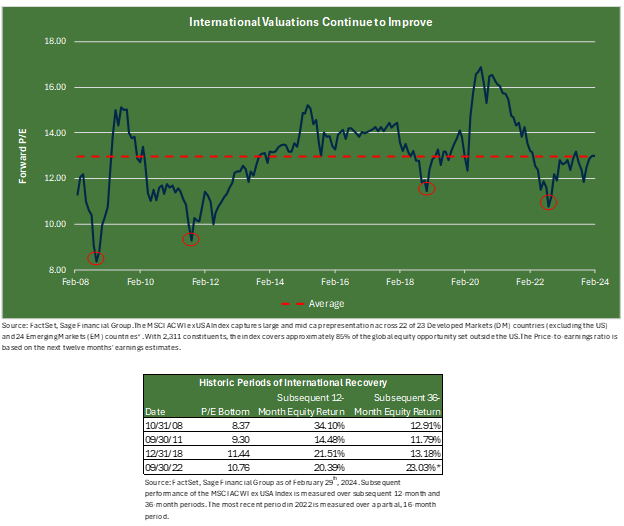

Since 2008, there have been four distinct months when international equities provided especially attractive buying opportunities. In each of these periods, the international P/E ratio bottomed before recovering. A recent bottom seems to have occurred in October 2022. As indicated below, returns from international stocks in all four cited instances were pronounced over the next 12 months after bottoming, and, in the three early cases in which subsequent full period data exists, provided well above average annualized outcomes over the next 36 months as well.

Non-U.S. equities offer expected value and diversification benefits that we believe can enhance portfolio returns in absolute terms and relative to the domestic market. In general, U.S. and international outperformance tends to rotate. We think maintaining a less concentrated composition across international markets can provide beneficial diversification if the narrow market leadership of U.S. large caps begins to fade.

Closing Thoughts

February was a productive month for risk assets as the broader economic backdrop remained healthy. Equities provided investors with favorable returns following an upbeat earnings season that overshadowed higher interest rates. At the same time, given evidence of robust growth and stubbornly persistent inflationary pressures, bond prices declined amid tempered expectations for near-term Fed rate cuts.

We were not among those expecting rate cuts to start this first calendar quarter, but we continue to believe lower interest rates remain distinctly possible later this year. The exact timing of the Fed’s first policy rate cut remains unclear, ultimately driven by the central bank’s perceptions of slowing economic growth and moderating inflation.

We encourage clients to maintain a long-term perspective amid market fluctuations and refrain from fixating on month-to-month data points or becoming immersed in the newest “hot” equity trend. Our commitment remains steadfast: together, we will strive to build and execute an investment and financial plan with your specific timeframe, risk tolerance, and needs to reach your goals.

Footnotes

[1] International stocks are represented by the MSCI All Country World ex USA Index.

[2] Microsoft, Apple, Nvidia, Amazon, Alphabet, Meta, and Tesla

Previous Posts

Learn More About Sage

Disclosures

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks, or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks, or assumptions should not be construed to be indicative of the actual events that will occur. These projections, market outlooks, or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, product, or any non-investment-related content referred to directly or indirectly in this newsletter will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer reflect current opinions or positions. All indexes are unmanaged, and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in managing an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her situation or any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.