2023 in Review: A Bitter Start For Financial Markets With A Sweet Ending

Last year brought a collective rebound for major economies and financial markets. There were unsettling moments and expectations of a domestic recession that caused uncertainty and short-term discomfort, including the failure of a handful of banking institutions over a short period in March and war, with all its violence and distress, persisting on in Ukraine and erupting in the Middle East.

But it closed with a ““noteworthy financial markets rally” in the fourth quarter that provided an uplifting finish.

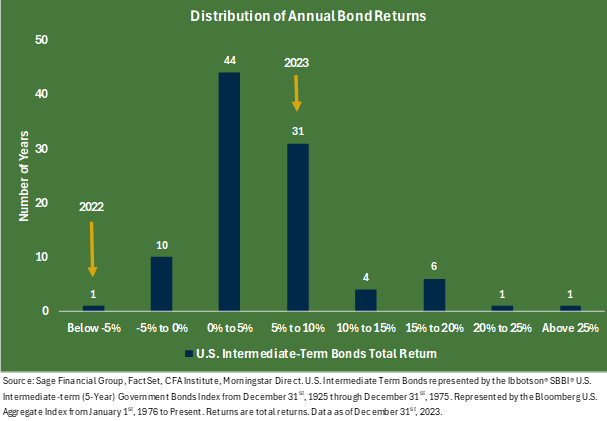

Investors entered the year still grappling with the aftermath of a challenging 2022, marked by widespread bear markets in major stock indices and the poorest calendar-year return on bonds in modern history. In 2023 interest rates climbed, then dipped, then soared through October.

Nonetheless, the U.S. consumer and economy proved particularly resilient. It appeared that the rate hikes adopted by the U.S. Federal Reserve (Fed), facilitated a decrease in inflation without triggering a recession. Global central banks, generally following a similar directional course on rates as the Fed, helped cool inflation while averting deep recession across the major economies. The markets regained momentum in early November, and we entered 2024 with a modest tailwind.

This piece delves into the nuances of market performance in 2023 and highlights the key themes shaping our investment outlook for 2024.

2023 Performance Recap

As we anticipated last January, asset class returns normalized in 2023. Three factors significantly impacted market performance: the continuation of restrictive global monetary policy, unexpected instability in the banking sector, and the emergence of artificial intelligence into the mainstream.

Fixed-income markets ebbed and flowed throughout the year, almost syncing with the seasons.

U.S. bond yields fell strongly in the first quarter of 2023 during the banking uncertainty. The yield on the U.S. 10-year Treasury Note declined from 3.9% to 3.3% in just three months. But the stress eased during the second quarter when U.S. regulators and the Fed provided a backstop for depositors concerned with the stability of U.S. banks. However, by the middle of the summer, it became apparent that most major central banks had not finished raising interest rates, and U.S. investment-grade core bonds fell back into negative territory.

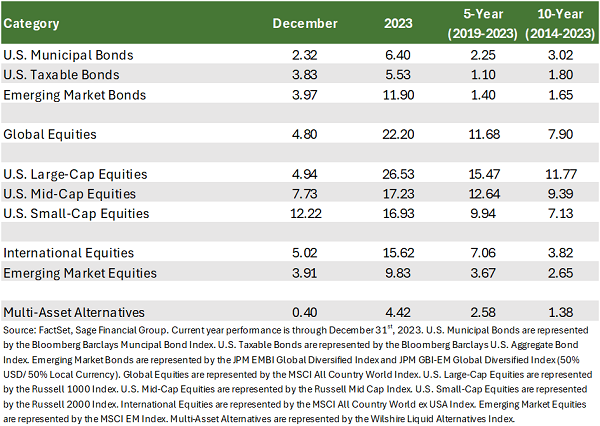

From mid-October onward, incoming data and constructive commentary from central banks that rate cuts could begin earlier than expected in 2024 led to a significant bond rally. Notably, U.S. municipal bonds increased 6.40%, taxable U.S. investment-grade bonds climbed 5.53%, while emerging markets debt stood out, returning 11.90% in 2023.

The positive signals from the Fed and others also propelled global equities higher in 2023.

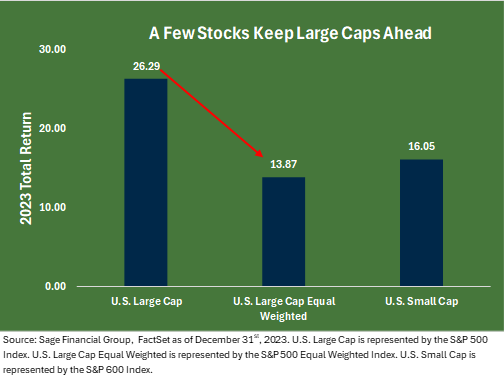

U.S. large-cap equities returned 26.53%, the second strongest calendar year gain over the last ten years, although an equal-weighted version of the index rose only 13.87%. This is reflected by the fact that U.S. large-cap equities were led by seven mega-cap technology stocks spurred by the markets’ growing excitement about the prospects for wider spread adoption of artificial intelligence (AI).

Known as the “Magnificent 7,” these large technology companies became investor favorites due to their resiliently high margin and sales growth. The seven stocks now make up 28.1% of the large-cap market cap but only about 20% of earnings.

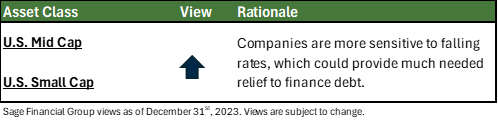

Mid- and small-cap equities struggled after the banking crisis and the Fed’s restrictive monetary policy. As we have noted before, higher interest rates have a more significant impact on smaller companies, which typically have more floating-rate debt than larger companies. It is also worth noting that smaller financial institutions represent a larger sector weighting within the mid- and small-cap indices.

However, similar to bonds, U.S. small and mid-cap equities rallied strongly after the Federal Reserve indicated it may ease rates in early 2024. Mid-cap equities returned 17.23% for the year, and small-cap equities returned 16.93%.

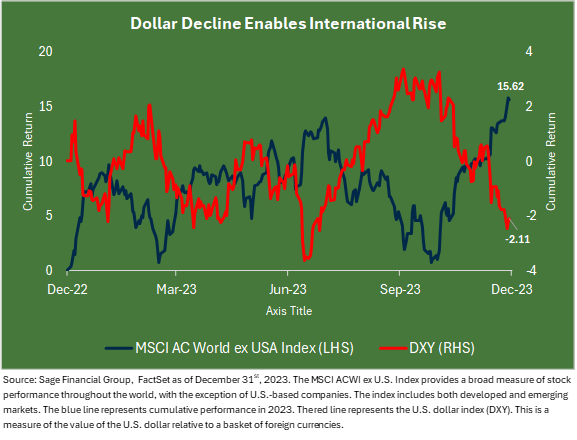

International large-cap stocks and emerging market stocks also posted strong positive returns of 15.62% and 9.83%, respectively. This reflects the ongoing preference of U.S.-based investors to overweight domestic stocks amid a strong U.S. dollar and global geopolitical uncertainty.

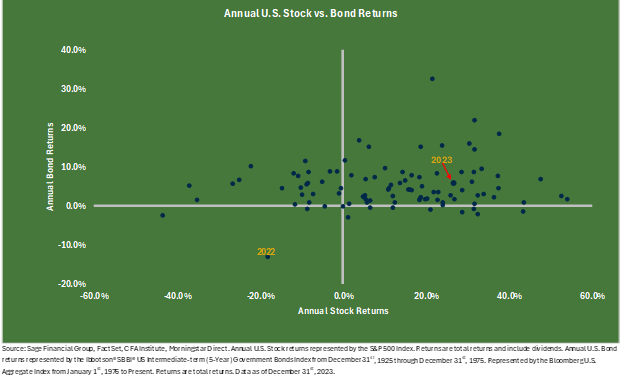

As the chart below illustrates, 2023 market performance is in the middle of the pack historically, while 2022 is in the far-left quadrant. After 2022 delivered an outlier year of negative stock and bond returns, this past year was a welcome experience for investors as both provided positive returns.

Throughout 2023, Sage proactively sought to enhance portfolios in anticipation of opportunities created by the relatively high yields on investment-grade fixed income. Specifically, where appropriate, we made tactical additions to U.S. and global investment-grade core bonds and rebalanced overweighted U.S. equities to be consistent with Sage’s target allocations.

We remain convinced that diversification allows our clients to participate in market upside while protecting capital during periods of volatility. In our view, combining a diversified portfolio and a disciplined commitment to your investment strategy increases the probability of achieving your financial goals and realizing the benefits of sudden, unexpected, strong market returns. For example, an investment in the S&P 500 would have realized a 10.7% return from 2007 to 2022. However, missing the ten best market days would have resulted in a return of only 5.1%, less than half of the return achieved by remaining fully invested in the market.[1]

We look to position client portfolios to protect and grow capital over time, mindful of each client’s unique financial circumstances and preferences.

While we are nimble and respond to current market trends and themes, we do not let volatility distract us from our core investment objectives and client goals. As we have said before, over the long term, market returns are driven by economic growth, inflation, and productivity.

Ultimately, 2023 was a year of recovery we are preparing to build on in 2024 and beyond. We faced challenges, but we also witnessed several unexpected positive economic outcomes. Perhaps most notably, the widely predicted economic recession has not materialized to date.

2024 Sage Outlook: Preparing for the Landing

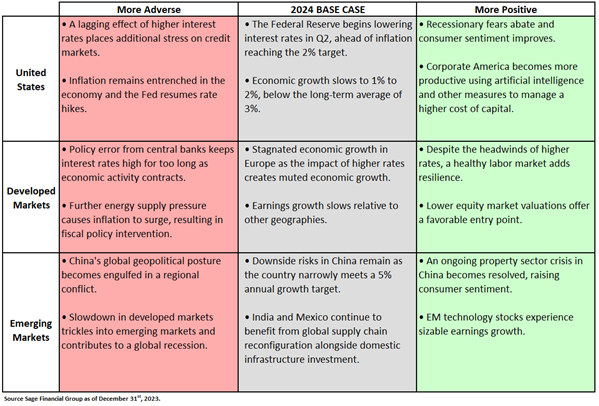

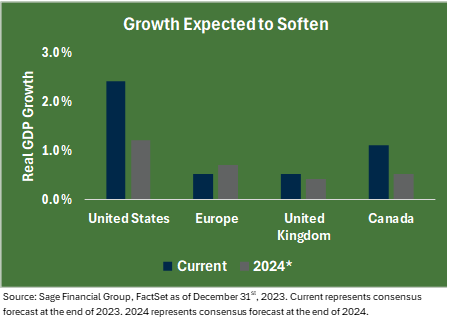

Our base case for 2024 is that attention will shift from elevated inflation to potentially slowing economic growth as the Fed and other central banks conclude their rate-hiking cycles.

In the U.S., we believe the economy will continue to grow, but in the range of 1.5% to 2.0%, modestly below the longer-term trend. While tight monetary policy is expected to ease over the coming quarters, the 2024 election cycle should keep both political parties from implementing impactful fiscal policy. We believe that economic growth and inflation impact financial markets more meaningfully than U.S. presidential election outcomes.

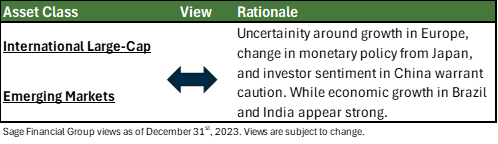

In developed markets, the story remains fluid around Europe and Japan. Optimism is muted in Europe as higher interest rates have dramatically lowered inflation but at the cost of consumer health. Focusing on shareholder-friendly practices has boosted corporate profitability and stock prices in Japan. However, the Bank of Japan appears poised to phase out a yield curve control program, with market implications unclear.

Although China continues to underwhelm investors, the spotlight within emerging markets has widened as India, Mexico, and Brazil take the stage. Balance sheet improvement across several emerging market countries and a realignment of global supply chains have provided some notable country-specific tailwinds.

In 2024, our approach will focus on positioning for unanticipated risks and evaluating various scenarios based on evolving market conditions.

Also top of mind will be the health of corporate America, potential anti-trust litigation headwinds for mega-cap technology companies, and the broader geopolitical environment, the course of which we should be able to anticipate ahead of time.

As in prior years, we set base case expectations along with more positive and adverse scenarios. We highlight some of the key points in each case below.

Major Economic Themes:

We believe three themes are likely to have a meaningful impact on the broader economy and, subsequently, financial markets:

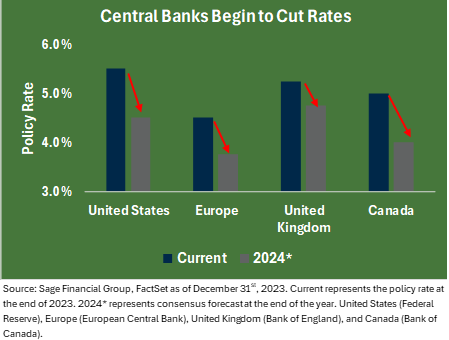

- Theme #1: Global Central Banks Begin to Cut Rates

- Global inflation begins to decelerate more uniformly, and rates could be cut several times in 2024.

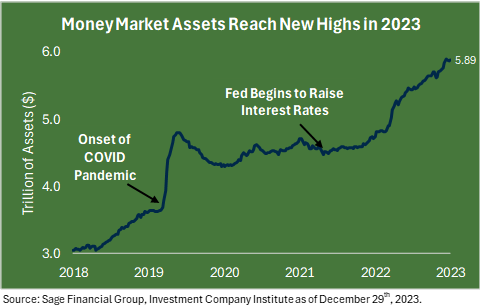

- Theme #2: Cash Moves Off the Sidelines

- Money-market assets reached all-time highs in 2023, as the asset class seemed to offer a haven for investors concerned about volatility. As the Fed appears poised to cut rates in the first half of 2024, Sage anticipates investors will begin to move capital back into stocks and bonds.

- Theme #3: A Productive Economy is a Stronger Economy

- A concerted effort to ease pressure on supply chains and advance technologies should increase economic output and reduce consumer costs.

Theme #1: Central Banks Begin to Cut Rates

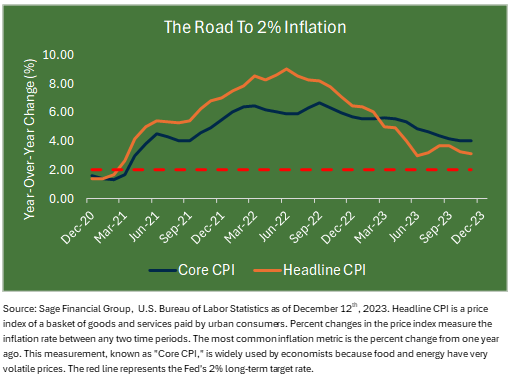

Over the last 18 months, global central banks in the developed world, including the Fed, have relied on higher interest rates (policy rates) to curb inflation. Their approach has gained traction, and inflation seems to be decelerating more meaningfully. The consensus in the U.S. and abroad is that rates will be cut several times in 2024.

The timing and quantity of these cuts will be critical. Currently, central bankers are treading water in the soft-landing pool. Global economic growth continues to cool, but labor markets have not.

Inflation could re-emerge if rates are cut too much or too quickly in 2024. However, a more meaningful slowdown could emerge if rates are held too high for too long. A slowdown would be expected to impact the labor market through a rise in the unemployment rate and a lack of job creation. Current unemployment levels remain near 50-year lows.

In 2023, U.S. economic growth was more robust than it was for developed market peers, primarily due to the resiliency of U.S. consumers, who account for roughly 70% of the economy. However, higher rates take time to manifest results, and if the labor market softens, disposable income will decrease, and consumer spending may tighten over the coming year.

Economic growth outside of the U.S. is expected to remain primarily muted in 2024. As a result, we expect central banks to avoid a reactionary outcome and cut rates before inflation levels return to long-term targets. Lower interest rates should support stocks and bonds if the economy continues growing.

Theme #2: Cash Comes Off the Sidelines

Despite 11 Fed interest rate increases since March 2022, the road to 2% target inflation has gradually slowed.

In response, the allure of cash as a defensive asset increased in 2023, with money market assets nearing $6 trillion in the latter half of the year.

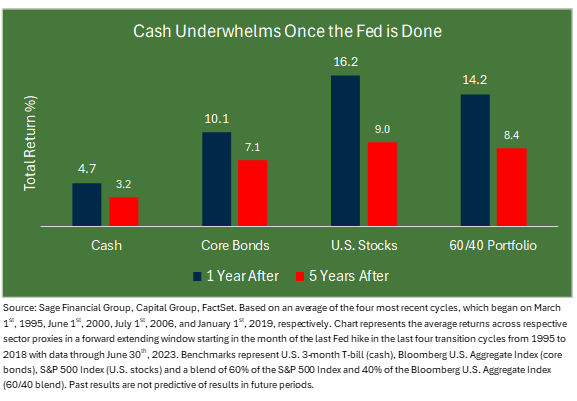

Historically, however, cash has been an underperforming asset class in periods following a final Fed rate hike, and money markets see asset outflows as the Fed cuts rates.

In 2024, we expect a shift away from cash as interest rates decline, creating a performance tailwind for stocks and bonds.

Theme #3: A Productive Economy Is A Stronger Economy

In addition, we believe two key factors related to productivity will help lower domestic inflation toward the Fed’s 2% target: the recent ramp-up in corporate capital expenditures alongside ongoing initiatives to further utilize technology and integrate artificial intelligence to boost operational efficiencies and increase corporate productivity.

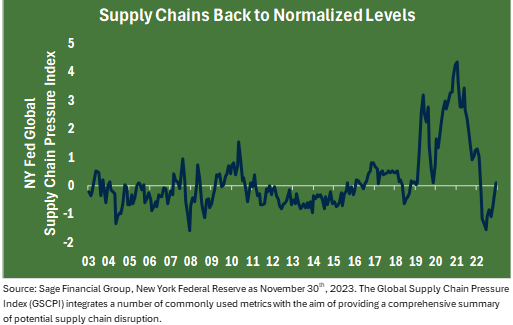

Supply chains were some of the most impacted features of the global economy in 2020 and 2021. At the onset of the COVID pandemic in March 2020, the shock of dramatically increased demand and lack of corresponding supply caused prices to soar. As inflation increased in 2022, supply chains felt even greater stress and sometimes ground to a halt.

Higher manufacturing and transportation costs were passed along to the consumer to keep corporate profit margins strong. These global supply chain challenges have reshaped trade over the last three years, with companies now focused on supplier diversification, nearshoring, and automation to create more efficient processes.

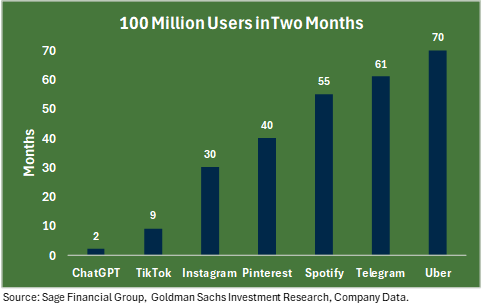

Emerging technologies are poised to boost global economic productivity. In 2023, ChatGPT became the fastest-growing consumer application, reaching 100 million users just two months after launch.

Companies are optimistic that generative AI could automate tasks, putting downward pressure on wage inflation. As such, companies believe this automation can complement existing jobs without widespread layoffs while creating new jobs and occupations.

Less pressure on global supply chains and reduced costs to corporations should support the continued easing of inflation, allow for less restrictive monetary policy, and support both stocks and bonds.

The sections below look at how we expect these three themes to play out by asset class.

Fixed Income Outlook: Income Has Returned Following A Great Reset

As we have discussed, to quash inflation, the Federal Reserve increased the Fed Funds rate from 0.0% at the beginning of 2022 to 5.25% by the end of 2023. On December 13th, 2023, the Federal Reserve Open Market Committee (FOMC) suggested a “pivot” in policy is underway. Consensus projections among FOMC committee voting members expect three rate cuts in 2024. The aggressive campaign to push inflation back toward 2.0% appears to be winding down two years later.

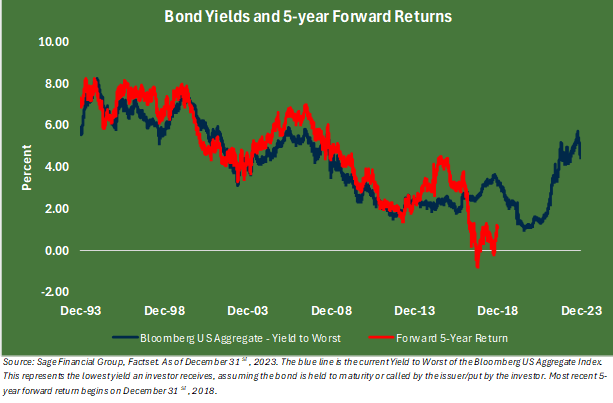

As the market focus shifts in 2024 from concerns around elevated inflation to potential slowing economic growth, we believe fixed income will provide portfolios with an important pillar of stability. Therefore, even as rates begin to decline, current yields have returned to more normal levels. When the 10-year Treasury yield is between 4% and 6%, markets have historically experienced positive performance. The U.S. 10-year yield is currently at 3.9%, right around this lower bound.

In line with our overall perspective on diversification, we value balance within the fixed-income portion of a portfolio and like to pair core-investment grade bonds with selective credit exposure and an allocation to bonds issued outside of the U.S. where appropriate.

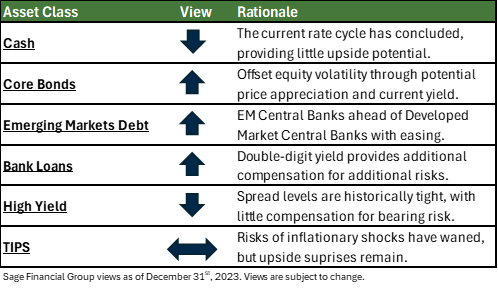

We are avoiding cash unless there is a liquidity need, as the Fed’s next move will likely be down rather than up. Cash does not stand to benefit from price appreciation as rates decline.

We favor investment-grade intermediate-term bonds, which now offer higher income levels than we have seen in more than a decade. Moreover, these bonds allow for potential price appreciation in a controlled manner, effectively mitigating the impact of interest rate fluctuations, especially if rates fall.

Outside the U.S., several central banks, including Brazil, have begun their easing cycle. Given the high coupon bonds issued by EM countries and support from declining rates, we believe emerging markets debt provides attractive investment return opportunities.

Bank loans and high-yield bonds are two portfolio areas that performed strongly in 2023. Economic resilience contributes to spreads tightening to near historical levels. Credit investments have tight spread levels during positive economic environments as the market believes borrowers will be able to repay their debt with little difficulty.

In our view, the double-digit income produced by bank loans offers a cushion if defaults increase. High-yield bonds provide less downside protection in a more adverse environment since high yield is less senior in the capital stack than bank loans. We believe investors are not being adequately compensated for this risk.

We continue to think that allocating to Treasury Inflation-Protected Securities (TIPS) makes sense for more conservative portfolios with significant fixed-income exposure. Inflation expectations are currently 2.2% over the next five years. TIPS provide a defensive posture if inflation surprises again and rises significantly above this target.

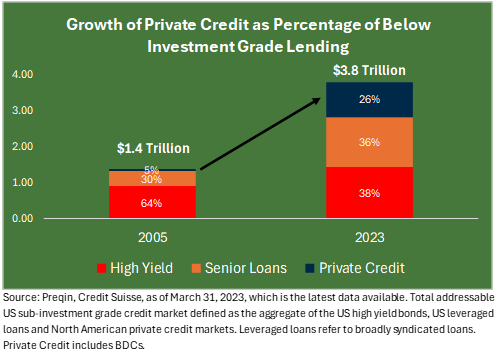

Private credit has become a major part of the debt ecosystem and is growing rapidly. Banks began to step back from traditional lending in 2005, creating an opening for more private credit. The 2023 banking troubles accelerated the process. Private credit has grown from accounting for 5% of below-investment-grade lending to 26% currently over an 18-year time period.

We believe private credit remains increasingly attractive, offering higher yields that can enhance income while providing downside protection. This dynamic creates a position characterized by attractive income and a low correlation to traditional fixed income, thus contributing to portfolio diversification.

Tactically, we continue to seek opportunities across global credit and sovereign markets that can provide differentiated return streams to complement a high-quality U.S.-focused bond portfolio.

Equity Outlook: Opportunity Awaits Those Who Look

2023 pleasantly surprised investors in U.S. equity markets. While we expected the economy to slow in 2023, we were cautiously optimistic about equities coming into the year. This cautious optimism was met as equity investors experienced double-digit returns.

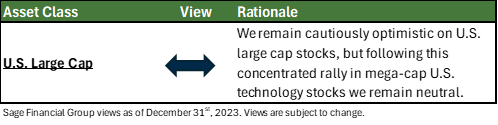

The strong performance came from a handful of U.S. mega-cap technology-oriented companies. Better known as the “magnificent 7”, these companies became investor favorites due to their resiliently high margin and sales growth. While U.S. large caps rose by 26.3% overall, an equal-weighted version of the index rose only 13.9% (see chart below). In the year ahead, we believe these companies can help maintain the momentum of U.S. large-cap stocks, but at a moderated pace.

In the year ahead, we remain cautiously optimistic about U.S. large-cap stocks. However, following the concentrated rally in 2023 in mega-cap U.S. technology stocks, we are concerned about concentration risks in this part of the market and find more opportunities in their U.S. mid and small-cap counterparts.

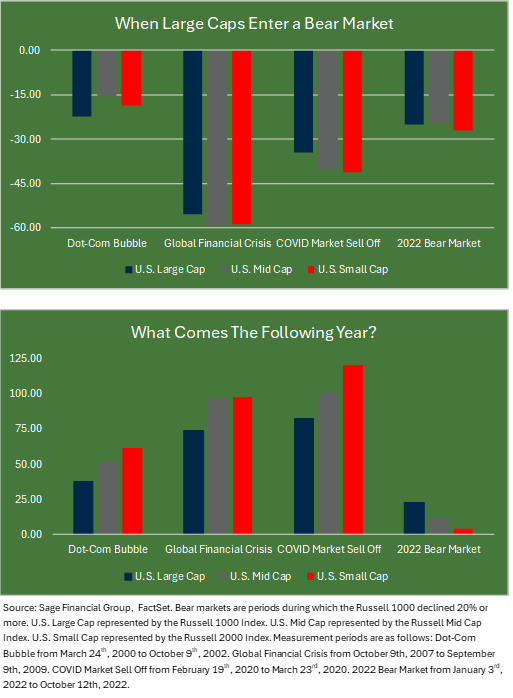

We are finding attractive investment opportunities that may not be immediately apparent. Historically, when U.S. large-cap stocks decline by 20% or more, it serves investors to shift portfolio exposure toward mid and small-capitalization stocks. While this was not the case in 2023, smaller companies have historically performed strongly in past bear markets.

These smaller companies are more sensitive to the direction and level of interest rates in an economy, which should provide a performance tailwind as the Fed begins to cut rates.

Looking beyond the U.S., we continue to believe that international equities are attractive from a value standpoint and can enhance returns of portfolios both in absolute terms and relative to the domestic market. We think the broader composition and more attractive valuations in place across international markets can provide beneficial diversification given the correlation levels across U.S. large-cap equities.

We see a greater variety in returns and potential opportunities outside our home market. Our approach involves selectively exposing portfolio countries with compelling valuations and robust earnings growth.

The conviction is that the performance of U.S. equities versus international equities will rotate over time. While U.S. equities have outperformed global markets for much of the past decade, we think the broader composition and more attractive valuations of international markets can provide diversification from the concentrated nature of U.S. large-cap equities.

Another contributing factor to the potential success of international equities is the recent weakening of the U.S. dollar, which declined by more than 2.11% in 2023. This decline was driven by anticipating the “soft landing” that emerged in the fourth quarter. As shown below by the red line, lower interest rates should put additional downward pressure on the U.S. dollar, potentially boosting international equities, represented by the blue line, as foreign currencies strengthen.

Though we remain constructive on the broader opportunity outside the U.S., we are deliberately allocating portfolios to mitigate exposure to specific regions or countries, such as China, that have shown a recent propensity to impact equity markets negatively.

Within China, the scale currently feels more shifted towards risk relative to reward. While we value selective exposure to Chinese equities, we maintain an underweight position relative to the MSCI All Country World Index.

Despite being the world’s second-largest economy, Chinese markets were the largest underperformer among major global markets in 2023 due to concerns surrounding the embattled property sector and geopolitical tensions. We believe sour investor sentiment will likely carry into 2024.

Monitoring China’s fiscal policy stance is crucial. Additional stimulus measures from the government could create a reflationary environment, potentially reversing the prolonged period of underperformance relative to other major global market indices.

In Europe, central bankers continue to keep policy rates elevated despite the economic indicators pointing toward a more significant slowdown relative to the U.S. Looking ahead, we see European equities battling higher rates and risks of a recession. Current valuations are enticing, but we prefer to remain cautiously balanced in the region as we see no clear catalyst for earnings growth.

“The pessimist sees difficulty in every opportunity. The optimist sees the opportunity in every difficulty.” — Winston Churchill.

As we look ahead, we believe that managing portfolio equity exposure with balanced optimism should help Sage clients grow their portfolios over investors’ particular time horizons. We anticipate slower global growth in 2024, which has tempered our expectations. However, if companies sustain earnings growth and defend profit margins, both U.S. and international equities should provide another year of positive performance.

Concluding Thoughts

Navigating financial markets year upon year can present challenges influenced by macroeconomic, geopolitical, and company-specific factors. Short-term periods of turbulence can conflict with longer-term objectives, particularly if we do not remain disciplined and focused on your goals and time horizon.

We are reminded that markets can quickly improve as the year closed with a “noteworthy financial markets rally” in the fourth quarter that provided an uplifting finish.

So, while we remain prepared for potential stressors, we believe our purposeful approach and integrated strategic personalized financial planning help position our clients for long-term success.

[1] Source: Putnam Investments from 12/31/2007 to 12/31/2022. Data is historical. Past performance is not a guarantee of future results.

Previous Posts

- Our Perspective: The Recent Market Rally

- Sage Insights: A Month of Optimism

- Sage Recognized By Leading Financial Journals

Learn More About Sage

Disclosures

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks, or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks, or assumptions should not be construed to be indicative of the actual events that will occur. These projections, market outlooks, or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, product, or any non-investment-related content referred to directly or indirectly in this newsletter will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer reflect current opinions or positions. All indexes are unmanaged, and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in managing an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her situation or any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.