As the U.S. government continues to debate the debt ceiling, we want to share our thoughts, provide some context on the current situation, and put the developments into a broader perspective.

What has happened?

Treasury Secretary Yellen sent a letter to Congress this past Friday (1/13/2023), informing members that the U.S. would hit the current $31.4 trillion debt limit on Thursday, January 19th, at which point, the Treasury would start to employ “extraordinary measures” to avoid a default. These measures, aimed at reducing spending, include actions such as suspending reinvestments of the Civil Service Retirement and Disability Fund and the Postal Service Retiree Health Benefits Fund.

We want to underscore that hitting tomorrow’s debt ceiling deadline does not signal that the U.S. is defaulting on its debt. Instead, this debt ceiling deadline represents when the Treasury can adjust the budget to avoid a default. Based on current spending, a possible default would not happen until the late spring or early summer. Congress will take the next few months to raise or adjust the borrowing limit to buy time. The negotiations involved in making these adjustments can be political and charged. But in prior standoffs, both sides eventually compromised.

While the impending debt ceiling can be worked around, a default on public debt would adversely impact citizens directly, whether through the furlough of federal employees or the failure of the government to make monthly payments to social programs such as Social Security, Medicare, and Medicaid.

What is the historical context, and what could happen next?

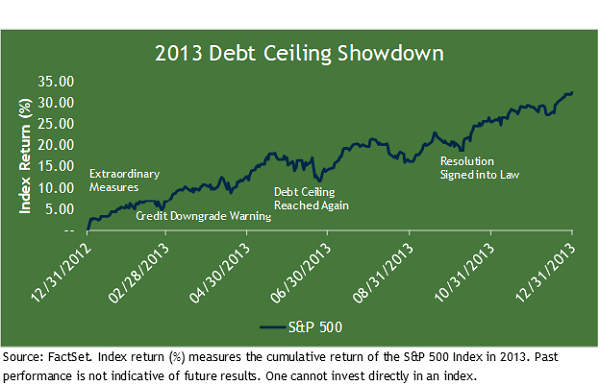

The most recent and relevant instance of a debt crisis in the U.S. occurred in 2013. At that time, the U.S. was less than five years removed from the bottom of the Global Financial Crisis. Congress reached a resolution in October 2013, although there was noise as the deadline approached.

We believe markets could remain volatile around certain dates pertaining to the debt ceiling, but the fluctuations are likely to be temporary. In the two most recent debt ceiling situations, 2013 and 2015, equity markets sold off but rebounded in the days after the debt ceiling resolution. Using 2013 as an example, the stock market steadily rose throughout the year, experienced brief volatility when the debt ceiling was reached, but then quickly recovered. As reaching the debt limit is mostly a technical issue, we would expect a similar dynamic regarding temporary market volatility.

We do not know how this will play out, but in the past, both sides showed motivation to get a deal done. Neither political party wants to bear the blame for default because both parties want to ensure older voters remain happy for two primary reasons. Older voters provide a high turnout base that neither party wants to lose, and the unfortunate reality is that breaching the debt limit would result in cuts to Social Security and Medicare. Allowing a default would be a politically odd strategy, despite the goal of fiscal prudence.

In terms of a resolution, Republicans and Democrats could reach a compromise by placing limits on discretionary spending. This is something that Nebraska Rep Dan Bishop (R) has mentioned. Congress only needs 218 YAY votes to raise the debt ceiling, which would include 213 Democrat votes alongside 5 of the remaining Republican votes.

What is the bottom line?

In the past, these events have caused temporary market volatility and significant noise from the media, but they prove to be blips on the radar over the journey of investing. For example, the U.S. Debt Downgrade in 2013 seemed like a momentous event at the time, but it proved to be temporary in nature. Portfolio returns after the downgrade were consistently strong for the better part of a decade. These types of geopolitical events typically seem like a much bigger deal in the moment than after they get sorted out.

So, while it may feel unsettling now, know that your portfolio is well diversified and structured with a multi-asset class approach with less sensitivity to interest rates to reduce the impact of volatility. We believe the investment strategy we have designed for you continues to be appropriate because it aligns with your risk tolerance, time horizon, long-term return objectives, and broader financial goals.

Previous Posts

- Sage 2023 Annual Letter

- Sage 2023 Investment Outlook

- Sage Insights: Markets Bounce as Economic Growth Slows and China Adjusts Its COVID Policy

- Sage Insights: Federal Reserve Rate Hikes Persist, Political Volatility in China, and Perspective on the Journey of Investing

- Sage Insights: Central Banks Seek Equilibrium, Europe’s Energy Problem, and A Broader Investment Perspective

Learn More About Sage

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks, or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks, or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks, or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, product or any non-investment-related content, made reference to directly or indirectly in this newsletter will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please visit Our Accolades page or contact us directly.

© 2023 Sage Financial Group. Reproduction without permission is not permitted.