October was a very strong, yet volatile, month for the equity markets driven by aggregate positive corporate earnings. Bonds prices declined modestly as interest rates continued to rise. For most investors, this widespread historic selloff has created bumps in their investment journeys, underscoring the value of custom investment plans.

The unfortunate reality is that large declines in the stock market occur every few years. Experienced investors are likely somewhat accustomed to these drops. The bond market, on the other hand, has presented a different story in 2022. Bond prices have seen a sharp decline this year that we have not experienced in recent history. In fact, 2022 is the largest calendar-year decline in U.S. bonds over the last 100 years. Through October 31, the Bloomberg Barclays Aggregate has declined by a startling 15.72%.

This year’s historic sell-off has impacted all traditional asset classes and has made a tailored financial plan more important than ever. The future is impossible to know, but narrowing the potential range of outcomes through diversification can help maintain direction and resolve pressures during periods of uncertainty.

In this edition of Insights, we recap recent market performance, discuss the impact of the Federal Reserve’s record policy measures, discuss China’s volatile political environment, and provide some perspective on remaining invested despite volatility and uncertainty.

Performance Recap

Inflation continued to rear its ugly head in October, as the Core Consumer Price Index showed 5.4% year-over-year price increases, well above the Fed’s 2% target. The hotter-than-anticipated inflation figure is widely expected to keep the Federal Reserve on a path of tightening financial conditions this month and subsequently maintaining a drag on equity and fixed-income returns.

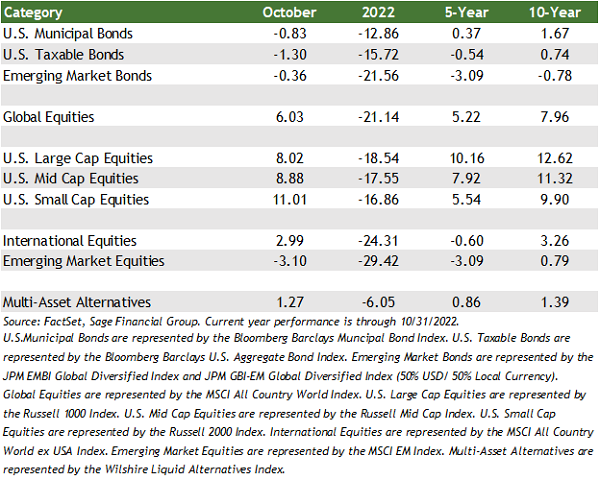

- Equity markets had a strong rebound in October, but returns remain down sharply overall in 2022. Global equities rose by 6.03%. U.S. large-cap stocks increased by 8.02%, and the most widely quoted international stock index also increased by 2.99%[1].

- We continue to remind investors that global equities have returned, on average, 7.96% annually over the past 10 years. With that being said, it is extremely rare for the market to realize this return in a given year. More common are wider returns. For example, this year’s decline (21.14% year-to-date through October) stands in stark contrast to average yearly gains of more than 20% in 2019, 2020, and 2021.

- In the bond market, continued momentum behind Federal Reserve policy actions contributed to modestly higher rates and, unfortunately, moderately lower bond prices. Investment grade bonds have fallen by 15.72% and remain a beaten-down asset class in 2022.

Federal Reserve Action Beginning to Fix Economic Imbalances

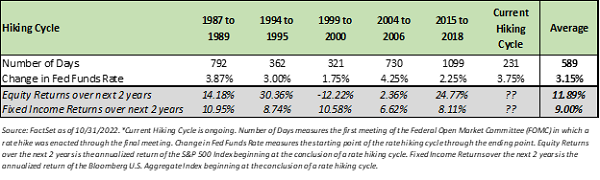

The Federal Reserve raised rates by another 0.75% this past week, which brought the overnight “Fed Funds Rate” to 3.75%, up from 0% at the start of the year. The pace of these hikes is truly historic. While it is unclear when the rate hike cycle will stop, our analysis suggests that we are closer to the end than the beginning. Although the end of a rate hike cycle typically accompanies an economic slowdown, average returns over the subsequent two years historically have been strong. Looking at rate hike cycles since 1987 over the two years after rate hikes stopped, the average annualized U.S. stock and bond returns are 11.89% and 9.00%, respectively.

As the Fed continues to work quickly, the U.S. central bank is pushing interest rates higher than some sectors can absorb, with the ultimate goal of fixing economic imbalances.

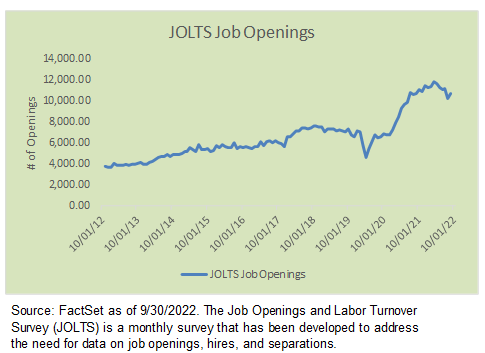

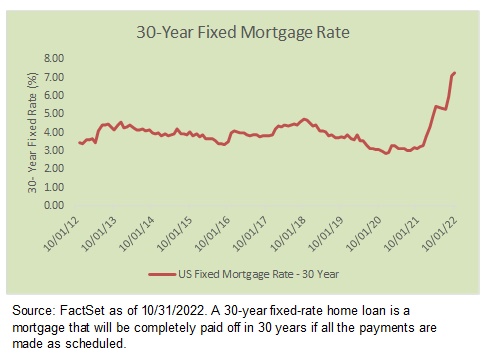

Two key economic imbalances that the Fed’s action has impacted are labor and housing. A year ago, it was extremely difficult for businesses to find qualified labor. At the same time, every house for sale was seemingly in a bidding war. Below are some notes on the progress toward balancing each of those two markets:

- Labor: The number of job openings hit a new record in March of 2022 but has started to roll over. In recent months, the number of job openings has fallen, and the sectors with the greatest demand are beginning to see some signs of labor supply re-emerging.

- Housing: The cost of borrowing has risen quickly. New home buyers are most acutely feeling higher borrowing costs as mortgage rates eclipsed 7% towards the end of October, the highest level since 2002. This rise in borrowing costs has led to some additional new supply of housing on the market.

From a market perspective, it isn’t easy to project the path of interest rates. But we do know that the future returns for bonds are now higher, as yields on most U.S. Investment Grade bond funds are now 5-6% on average. Equity indices are down 20-25% this year on average and are now below 25-year averages, indicating some level of bad economic news to come. Valuations, or the price an investor pays, have steeply declined over the first ten months of the year.

In Sage’s portfolios, we’ve taken steps to address these challenges proactively. We exited international small-cap stocks earlier this year, and we have added to non-traditional asset classes such as infrastructure, real estate, and floating-rate loans in many portfolios. We have also looked to tactically add bonds that have more attractive yields, as many traditional bonds are yielding 5% or more.

Navigating a Volatile Political Environment in China

One area that’s drawn particular focus in our portfolios this year has been emerging markets. While all asset classes have struggled, emerging markets have been dragged down by China. Beginning in late 2021, President Xi Jinping raised concerns with regulatory crackdowns on the Chinese technology sector, the elimination of the private tutoring industry, and his repeated use of “Common Prosperity,” a term that signals threats to corporate profits. An extreme COVID policy and tensions with the U.S exacerbated the situation.

More recently, the Chinese Communist Party (CCP) convened in October for its 20th National Congress. President Xi Jinping secured his third term as leader of the CCP, which will last for five years through 2027, marking the longest-running leadership tenure since Mao. Xi appointed no successor and will likely remain in power for at least a fourth five-year term starting in 2027. A key takeaway from the Congress was Xi’s consolidation of power, which increased uncertainty regarding the impact of the leader’s continued focus on “Common Prosperity.”

From an investment perspective, the world’s second-largest economy has failed to provide portfolios with any form of diversification. Since the beginning of 2021, Chinese equity markets have declined by 55%, and the country’s currency has fallen by 11%.

The current political environment has raised the question of whether China remains a reasonable investment landscape for foreign buyers, which has, in turn, led to outflows of investment capital.

All told, government interference may prohibit businesses from achieving their full economic potential. However, China’s economy is massive, and not every sector and industry will be impacted equally. Sage recognizes an opportunity for active management to navigate the situation and invest in those companies that are operating in sectors not caught in the ire of the policy direction. While the political risk is still uncertain, a more widespread re-opening from COVID-19-related lockdowns in 2023 would likely benefit certain consumer-oriented companies and the economy more broadly.

In Sage’s portfolios, direct China exposure makes up a small percentage of the overall allocation. In most portfolios, Chinese stocks and bonds in totality range between less than 1% and 3%.

Sage’s Perspective on the Journey of Investing

It’s often useful to think about investing as a journey, with a financial plan as the map and an advisor as the guide. Every person’s journey through their financial life is unique, with obstacles presenting themselves differently along the way.

We try to minimize the bumpiness of this journey by making sure that our investment recommendations take into account a client’s time horizon and are informed by a specific plan. We believe that with a guided plan, clients improve their probability of staying on their financial course and arriving at their target destination.

In today’s environment, we encourage our clients to keep two key investment principles in mind.

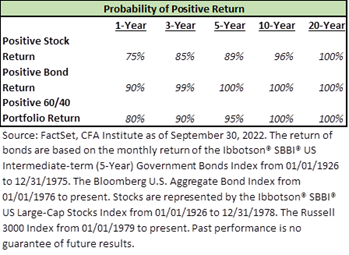

- Historically, the probability of positive returns increases with a longer holding period.

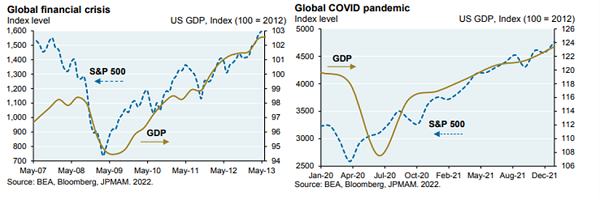

- Historically, stocks have bottomed before the economy.

First, the holding period of an underlying investment is critical to its returns. Using history as a guide, over time, the probability of an investor earning a positive return generally increases, thus rewarding market participants for remaining invested (see table below).

Second, the forward-looking nature of equity markets means they typically bottom before the economy rebounds. This dynamic was seen in both the Global Financial Crisis and the COVID pandemic. While inflation is hurting the economy, we expect markets to hit bottom before the slowdown hits its lowest point.

In the journey of investing, it’s important to remember that being invested for a longer time increases the probability of positive returns. At the same time, equity markets offer an important mile marker in hitting bottom before the economy overall. While the discipline to stay on course with a diversified portfolio is tested in years like 2022, we believe strongly that financial markets reward rational optimism over the long term.

Closing Thoughts

Your multi-asset portfolio is purpose-built to help you achieve your financial goals while navigating the specifics of market performance and external influences.

We believe that while market volatility will continue in the near future, our overall outlook on the economy remains balanced. There are several possibilities in play, and not all of them are positive. We will continue to respond to market developments with thought and care while maintaining our focus on your personal circumstances and short and long-term financial goals.

If you have any questions about the topics covered in this month’s commentary or wish to discuss any aspect of your goals or future, please do not hesitate to contact us directly.

[1] U.S. Large Cap stocks represented by Russell 1000 Index, Global Equities by MSCI All Country World Index, International Equities by the MSCI All Country World Ex-USA Index, Emerging Market Stocks by the MSCI Emerging Markets Index, and U.S. Investment Grade Bonds by the Bloomberg Barclay’s U.S. Aggregate Index. Performance as of 10/31/2022.

Previous Posts

Sage Insights: Global Growth Slows and Valuations Compress Amid Historic Central Bank Tightening

Sage Insights: Technical Recession, Economic Data versus Equity Markets, and A Broader Perspective

Our Perspective on Continued Market Volatility

Our Perspective on the Current Market Environment

Sage Recognized for Commitment to Clients

Learn More About Sage

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks, or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks, or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks, or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, product or any non-investment-related content, made reference to directly or indirectly in this newsletter will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please click here or contact us directly.