The month of September saw stocks and bonds move lower as market participants responded to the Federal Reserve’s decision to likely begin tapering monthly bond purchases toward the end of Q4, the ongoing Evergrande situation in China, and upcoming policy decisions out of Washington, D.C.

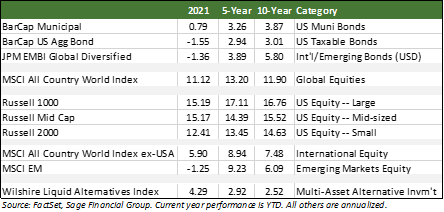

The MSCI ACWI Index, which represents global equities (i.e., both U.S. and international stocks), declined by 4.13% in September, the U.S. large-cap Russell 1000 Index fell 4.59%, the U.S. small-cap Russell 2000 Index declined by 2.95%, and the MSCI ACWI Ex-USA Index (international stocks) posted a loss of 3.20%. While we have observed some recent volatility in equities, the upcoming earnings season for U.S. corporations begins next week and should provide more insight into company fundamentals.

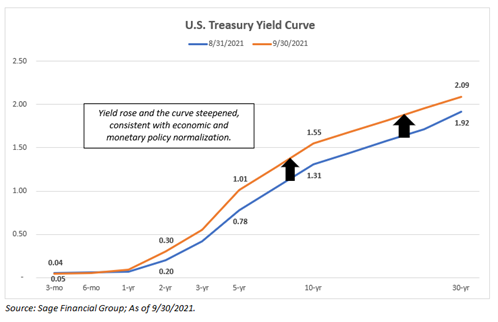

Core U.S. taxable bonds represented by the Bloomberg Barclays Aggregate U.S. Bond Index and Barclays Municipal Index ended the month lower by 0.87% and 0.72%, respectively, primarily due to higher interest rates driven by economic and policy normalization.

In this edition of Insights, we discuss what we see as the most relevant developments and themes driving financial markets, including (1) the Federal Reserve’s indication of bond purchase tapering, (2) the evolving solvency situation of China’s Evergrande, which does not appear to present systemic risk in our view, and (3) uncertainty regarding the U.S. debt ceiling.

Federal Reserve Monetary Policy

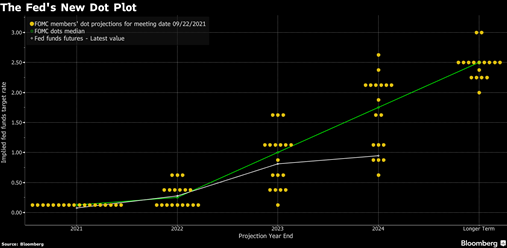

Federal Reserve policy decisions tend to have some of the most significant impact on financial markets in general and interest rates in particular. The September FOMC meeting concluded on 9/23, and the Fed’s statement signaled that members are prepared to begin tapering bond purchases in Q4, which means the central bank will begin decreasing the amount of bond purchases it makes each month going forward until the purchases are zero. In terms of pace, Chair Powell expects that it will take 8 months to decrease from $120bn to $0/month. The FOMC also expects that it will raise the Fed Funds rate once in 2022, three times in 2023, and three times again in 2024. The chart below shows the Fed’s current expected path of rate hikes.

Slowing bond purchases is an important step towards normalizing the economy, as is raising policy rates. But the moves can create some volatility. As shown below, interest rates have risen in conjunction with the Fed’s announcement in September that the U.S. central bank would slow its bond-buying program. However, rates are at historically low levels, and there remains significant demand as it pertains to yield from both U.S. and global investors for U.S. Treasuries. (i.e., we do not expect a massive rate spike, but we believe that rates may move higher).

In our view, as the current economic situation evolves, the speed of tapering and raising of interest rates are subject to change. At present, the Fed seems incrementally more focused on inflation and issues such as the backup at seaports and the shortage of semiconductor chips, which may get increased attention in the coming months. Chair Powell reiterated last week that he believes the rise in inflation is really a consequence of supply constraints meeting very strong demand.” He went on to say that these pressures are “related to the reopening of the economy, which is a process that will have a beginning, middle, and an end.” Interest rates are likely to rise modestly over that time if economic conditions continue to normalize. Still, structural pressures should keep a lid on how high rates climb (e.g., an aging population creating the need for more investment income, increased globalization creating downward pressure on prices, and technology creating increased pricing transparency).

Normalization of monetary policy typically accompanies a growing economy as is the case today. Equities typically perform well when the economy is growing, as a larger economy creates more opportunities for company profits. But the moves can create some volatility, which can occur during periods of changing policy.

China Evergrande

Evergrande, China’s second-largest property development company, has seen its financial situation deteriorate in recent weeks. Market participants expect the Chinese developer will default, which has decreased their appetite for risk. According to the Wall Street Journal, the company “launched project after project in every Chinese province, selling apartments years before they were completed and scratching together enough cash to stay just ahead of massive interest bills.” This excessive borrowing has caught up to the company, and with more than $300bn of liabilities, the Chinese government has essentially instructed banks to stop lending to them.

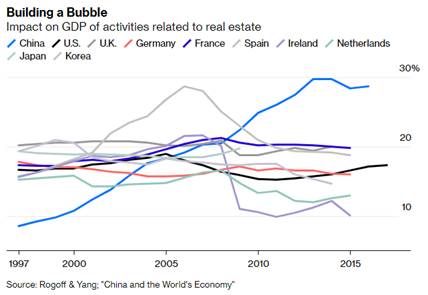

China’s real estate industry has accelerated in growth in recent years. As shown below, real estate now represents nearly 30% of the Chinese economy, and 90% of Chinese citizens own homes. During the U.S. housing bubble, real estate totaled 20% of GDP, and 70% of U.S citizens owned homes.

While some may view this growth as a “bubble,” we believe it is more likely to deflate than pop. China has and will likely continue to inject capital into the industry to prevent its collapse, and the government has the ability to print money to mitigate any dangers. As a result, the real estate deflation should be more orderly than in other countries such as the U.S. China’s central bank recently reiterated its intention to keep monetary policy “prudent, flexible, and targeted,” but it also called the economic recovery “not solid” and “unbalanced,” while vowing to further push lending rates lower and ensure healthy property market development.

Slowed growth in China’s real estate sector could mean slower growth in the economy overall. China’s zero-tolerance policy toward COVID, pollution controls ahead of the Winter Olympics in February 2022, and the regulatory assaults on various industries (technology, Macau gaming, etc.) are also concerning. At this time, however, we believe the Chinese Communist Party will look to mitigate any economic drag by implementing more accommodative monetary and fiscal policy measures and that stocks and bonds will not be significantly impacted beyond the near term.

Government Shutdown Solved, but Debt Ceiling Still Looms

In what seems to be a recurrence observed every few years, the U.S. government is in the middle of a political standoff over spending following the July expiration of the U.S. debt ceiling suspension. In the final days of September, Congress passed a stopgap spending bill funding the government at current levels through December 3rd and averting a shutdown ahead of the September 30th deadline.

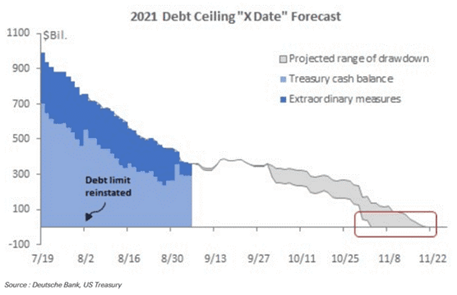

With the shutdown deadline temporarily out of the way, the debt ceiling is now the pressing issue for congressional leadership. Whereas the shutdown would temporarily suspend our government’s non-essential operations, reaching the debt ceiling means that the U.S. Treasury can no longer issue debt to pay its obligations. The congressionally-mandated debt ceiling, which limits the amount the U.S. can borrow from the U.S. Treasury, has been raised or suspended several times in the past few years. In fact, it has been raised or suspended 80 times since 1960 [1], and the U.S. has never defaulted on its obligations. Once the debt limit suspension expires, the U.S. Treasury typically prioritizes payments to avoid immediate delays or even a default on its debt obligations. U.S. Treasury Secretary Janet Yellen estimates that the government will need additional funding by October 18th, while the Congressional Budget Office (CBO) estimates by the end of October. Below is a snapshot of the “X Date,” which shows when current projections estimate that the government will run out of money to pay items such as social security, debt interest payments, et al.

In our view, there is a wide range of outcomes. Currently, Congress is trying to raise the debt ceiling in a bill combined with infrastructure spending. If Congress can reach a compromise and pass this bill, there could be a modest increase in corporate taxes to 25% from the current 21% rate and an increase for the top marginal tax bracket from 37% to 39.6% (pre-2017 level). From the market’s perspective, an increased corporate tax rate could be a modest headwind, although the increase is much smaller than what has been previously proposed, and we think it is at least partly priced in today.

While we have an optimistic outlook on the situation broadly, we anticipate some volatility in the short term. Indeed, if the government defaults temporarily, the “full faith and credit” of Treasury Bonds could be damaged. But we think that Congress will ultimately extend the debt ceiling suspension, thereby avoiding technical default of certain Treasury Bills and the negative reputational consequences.

The bottom line is that this remains a binary outcome and a moving target, like so many political situations. The shutdown/ceiling issue seems to crop up every 1-2 years and goes right to the deadline. The silver lining now is that one party can avoid these adverse outcomes without a bipartisan agreement, but the fracture within the Democratic Party has not made that easy.

In our view, an infrastructure and debt ceiling agreement should be a net positive for portfolios. A higher corporate tax rate could be a modest headwind for stocks, and an increase of only 4 percentage points is not overly burdensome. Additionally, the incremental spending programs may offset some concerns regarding less expanded government spending in 2022 versus 2021 (i.e., the “fiscal cliff”). We expect this will be a major story with twists and turns throughout October, potentially with some short-term volatility, but we do think it will be solved prior to a default.

Closing Thoughts

September ended the 7-month “winning streak” of positive monthly returns, with a pullback in global equity indices. There were several notable developments, including the Fed’s decision to begin tapering soon, the evolving Evergrande situation in China, and the moving target that is the debt ceiling.

We continue to closely watch the Federal Reserve’s actions regarding its dual mandate of employment and inflation. The U.S. economy still has room to add significant jobs, as payroll figures remain 4.5 million below pre-pandemic levels, but economic normalization has progressed enough to warrant tapering the bond-buying program. In China, the demise of the property developer Evergrande is unlikely to cause systemic issues, although we do think it could be a drag on growth. Lastly, while the debt ceiling remains a risk, Congress is very likely to solve the problem before having to default on obligations. Still, there could be some volatility in the near term.

While we have seen some volatility in recent weeks related to the developments discussed in this piece, we continue to believe that the U.S. economy is on solid footing. Both U.S. consumers and businesses remain extremely well-capitalized, which is likely to boost economic activity over the next 12 months. To be clear, risks remain as the COVID pandemic continues and upcoming events such as the debt ceiling create fresh uncertainty, but we advise our clients to stick to their financial plans and avoid emotional decisions when markets experience volatility.

[1] ABC News: “What the debt ceiling is, and why you should care about it”

Previous Posts

Insights: What Drove the Markets in August 2021 (September 8th, 2021)

Insights: Financial Markets in July 2021 (August 6th, 2021)

Revisiting 2021 Themes and Second Half Outlook (July 6th, 2021)

Our Perspective: Current Trends in Inflation (May 24th, 2021)

Learn More About Sage

Disclosures

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks, or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks, or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks, or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please click here or contact us directly.

© 2021 Sage Financial Group. Reproduction without permission is not permitted.