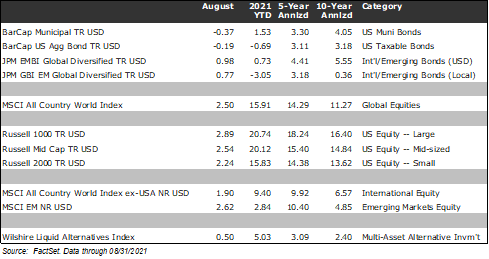

Financial markets were generally positive in August as equities advanced, bonds were mixed, and the optimistic economic backdrop continued despite uncertainty regarding the Delta variant of the novel coronavirus. The MSCI ACWI Index, which represents global equities (i.e., both U.S. and international stocks), advanced by 2.50% in August, the U.S. large-cap Russell 1000 Index rose 2.89%, the U.S. small-cap Russell 2000 Index rose by 2.24%, and the MSCI ACWI Ex-USA Index (international stocks) gained by 1.90%. Stocks were lifted by continued momentum from strong earnings results and Federal Reserve Chairman Powell’s steadfast stance that the central bank is not going to overreact to the rise in inflation statistics.

Core U.S. taxable bonds represented by the Bloomberg Barclays Aggregate U.S. Bond Index and Barclays Municipal Index ended the month lower by 0.19% and 0.37%, respectively, primarily due to modestly higher interest rates.

In this edition of Insights, we discuss what we see as the most relevant developments and themes driving financial markets, including (1) the U.S. economic landscape and monetary policy, (2) global COVID trends, and (3) China’s economic slowdown and regulatory environment.

U.S. Economics and Monetary Policy

U.S. stocks finished the month up 2.90%, which marked their largest monthly rise since April 2021 and seven consecutive months of gains. This seven-month “winning streak” is the longest since January 2018, at which point the index had risen for ten straight months. Similar to January 2018, the U.S. economy is in a “Goldilocks” state of not-too-hot-but-not-too-cold growth. The economic backdrop has been strong but not so strong that the Federal Reserve is likely to step in prematurely and slow down activity by stopping bond purchases and raising rates since its framework explicitly mandates it to consider “full employment and price stability.”

Employment growth has been strong, with the most recent jobs report on Friday, September 3rd, showing that 235,000 jobs were added to the economy in August, following 1,053,000 in July. However, while jobs continue to be added and job openings are at an all-time high, there is room for further growth before the Fed will want to slow the economy down as over 5 million fewer people are employed now than were pre-pandemic.

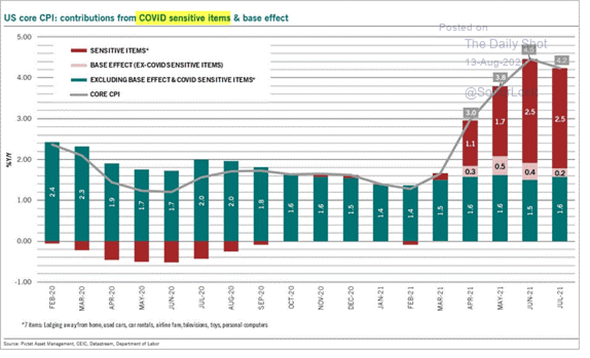

From an inflation perspective, the Consumer Price Index (CPI) was a relief by slightly undershooting expectations while certain hot categories (e.g., used cars and airline fares) are “coming off the boil” (to quote the White House, which called the release “encouraging”). The CPI may help ease some of the Fed’s concerns about the need to accelerate tapering, but there is a lot more data to come before a final decision on pace can be made. As shown below, excluding sensitive items and considering base effects, core CPI only shows increases of 1.6% YoY.

Risks do remain regarding persistent inflation, including issues around the global supply chain. For example, China partially shut down its Ningbo-Zhoushan port in August, adding to the existing global supply chain strain. In addition, the COVID situation in southeast Asian countries, such as Vietnam, which many U.S. companies use for production, has also been quite dire and adds further complications.

While supply-chain issues persisted in August, markets viewed the totality of the inflation-related news as a positive. The Federal Reserve and many market participants expect inflation to moderate through the end of the year. The most recent inflationary figures show that the key drivers of price increases are home prices, cars, and hotels (75% of CPI print), which are likely to revert to the mean over the rest of the year, contributing to moderation, all of which is good for investors.

While we continue to believe that inflationary pressures will wane in the medium-term, we are constantly re-assessing our position and could change our outlook if inflationary expectations become unanchored or we see sharp price increases across a wide variety of goods and services. The important thing to emphasize is that Sage seeks to build diversified portfolios designed to withstand a variety of environments and pressures, including inflation.

COVID Trends

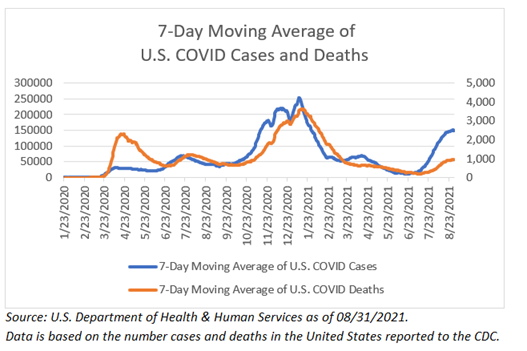

As we noted last month, one of the key risks to the continued economic recovery is that COVID variants are contributing to a sustained rise in cases. Unfortunately, the current Delta variant has shown to be a more contagious strain of COVID and has led to an increase in cases across many countries, including the U.S. and U.K. Looking at the U.S., which is a key driver of the global economy, new daily coronavirus infections recently topped 100,000 for the first time since February, and the 7-day average rose from about 75,000 cases per day at the end of June to 150,000 by the end of August. Moreover, as shown below, while the new case count has increased almost to January levels, deaths have not risen commensurately (i.e., good news as deaths matter greatly to policymakers and thus the economy).

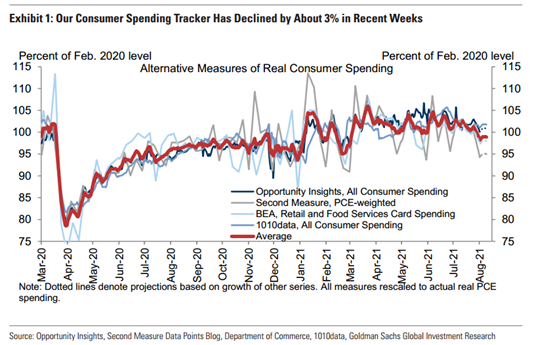

From the perspective of the financial markets, stocks and bonds are most sensitive to the economic implications of COVID, particularly regarding consumer sentiment and government restrictions on activity. Shown below, real-time activity trackers illustrate that consumer spending is softening off of its high point earlier in the year, although certainly not collapsing in the way that we saw in 2020.

Leading infectious disease officials remain reluctant to support future lockdown measures in part because the medical community understands the virus much better than a year ago, and we understand the potential economic destruction of lockdowns. Governments have broadly avoided further restricting economic activity, although some areas have reinstated indoor mask-wearing. In our view, if the number of cases, deaths, and hospitalizations improves, it is likely to be positive for economic growth generally, as well as for lower credit quality bonds and equity prices. Interest rates would likely move higher, which could cause headwinds for investment-grade bonds.

To be clear, the risk exists that cases could rise more than is currently expected. Still, we are in a different place than a year ago with respect to therapeutics for treating COVID, antibodies in the general population, and our general understanding of the virus and the markets should be more resilient.

Chinese Data and Regulatory Constraints Regulatory Crackdown

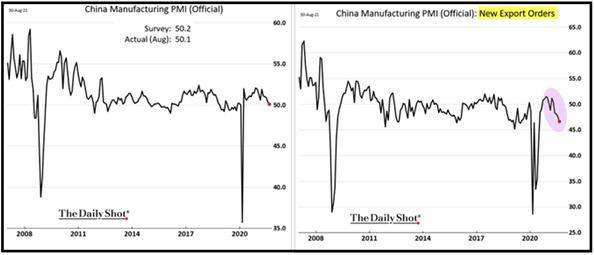

China has continued to be a source of significant developments, both in economic data and regulatory concerns. As it relates to financial data, the world’s second-largest economy has shown some signs of weakening. For example, China’s manufacturing PMI declined in August to 50.1, slightly above the expansionary level of 50.0 (shown on the left below). In addition, the leading “new export orders” have steadily declined to nearly 46.0. While China has been shifting to a consumption-based economy similar to the U.S., its growth is still heavily dependent on the export of goods. Thus, the weakening of export orders could be indicative of future weakness in economic growth similar to what was seen in 2015 and 2018.

However, the Chinese government has communicated that it wants to foster sustainable growth. If markets become more stable and prosperity spreads, the integrated, global business community would benefit, even if, in the short term, building that vision entails pain for some of the country’s biggest companies. In contrast to the U.S. and Europe, Chinese regulators have acted quickly and swiftly to implement new rules under which Chinese-based companies must operate. Recently, the government has scrutinized companies such as Alibaba and Meituan concerning anti-competitive practices and their treatment of workers. In addition, government officials have also acted decisively to restrict the high costs imposed by after-school tutoring businesses and video game providers, which are believed to affect family finances adversely and unintentionally slow the population growth rate.

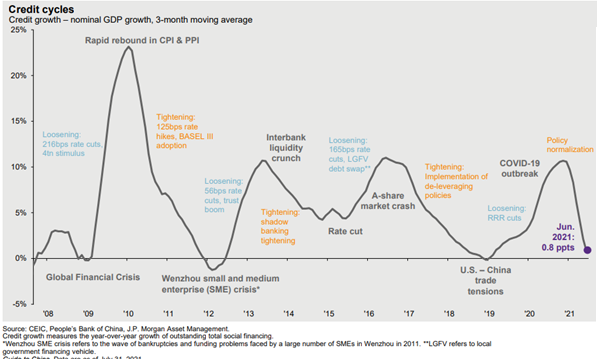

Furthermore, short-term weakness is only one part of the story when trying to predict future market performance. We think we also need to ask the question: “What does China do in response to such weakness, and what is the result?” As the graphic below illustrates, weakness in economic activity typically follows China’s natural credit cycle, and its officials appear to be aware of this pattern. In both 2015 and 2018, the Chinese government took action to boost credit growth and economic activity (shown below). In 2015, they loosened borrowing rates, and activity picked up. In 2018-2019, due to tensions with the U.S., the CCP loosened the reserve requirement ratio (RRR), leading to a sharp increase in economic activity. In our view, China will respond to the current economic weakness by spurring credit demand and generating increased economic output. Further, we continue to believe in the growth of the Chinese middle class and think that the Chinese government is taking actions that will grow the economy long-term. Both of these factors historically have tended to be supportive of financial markets.

Closing Thoughts

August was a relatively quiet month for the financial markets, but there were several notable developments, including a continued positive U.S. economic backdrop, improving albeit mixed COVID trends, and heightened Chinese regulatory pressures.

We continue to closely watch the Federal Reserve’s actions regarding its dual mandate of employment and inflation. The U.S. economy still has room to add significant jobs, as payroll figures remain 5 million below pre-pandemic levels. Regarding inflation, our current base-case scenario is that the pressures will likely prove to be transitory over the long term (i.e., the Fed should not have to raise rates to squash inflation prematurely). Nonetheless, we recognize that higher prices are a risk and have already incorporated strategies into portfolios to address inflation, including diversified bond strategies. Further, equities tend to do well in periods of modestly higher inflation as companies have more pricing power. Our portfolios are invested to take into consideration the wide variety of potential outcomes.

Previous Posts

Insights: Financial Markets in July 2021 (August 6th, 2021)

Revisiting 2021 Themes and Second Half Outlook (July 6th, 2021)

Our Perspective: Current Trends in Inflation (May 24th, 2021)

Learn More About Sage

Disclosures

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks, or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks, or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please view our Accolades or contact us directly.

© 2021 Sage Financial Group. Reproduction without permission is not permitted.