Inflation in the United States is receiving significant attention from the financial media and has some investors worried. In this issue of Our Perspective, we will explain why inflation matters, the trends in the current environment, and what they may mean for investors.

Why Does Inflation Matter?

Per the International Monetary Fund, or IMF, inflation is defined as “the rate of increase in prices over a given period of time.” Essentially, when inflation rises, it costs more to buy the goods and services we want.

From an investor’s perspective, persistently high inflation matters primarily because it can translate into lower corporate profits (and thus dividends) and higher interest rates for three reasons:

- Reduction of Corporate Profits: When the price of goods and labor rises, company profit margins may be pressured. Borrowing costs may also increase due to higher interest rates.

- Weaker Purchasing Power: Consumers tend to buy fewer goods/services when prices rise. We have seen this trend recently through a drop in consumer confidence, as measured by the University of Michigan Consumer Sentiment Index.

- Federal Reserve Action: When inflation rises above its long-term target, the U.S. central bank may become more aggressive and tighten monetary policy (i.e., intentionally slow the economy to get inflation under control by raising the Fed Funds rate). Tightening monetary policy has been an effective way to control inflation over the past 30 years, but it can negatively impact the strength of cyclical industries such as automobiles, construction, housing, etc. and negatively affect equity and bond prices alike.

What Is happening Now?

Overall, inflation readings have been rising. The price of items such as lumber, copper, and steel has been rising particularly quickly, leading to concerns that these price increases could spread to other commodities, goods, and services.

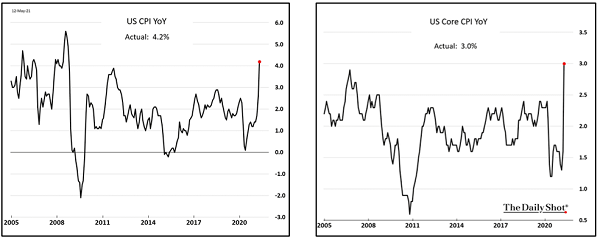

As per the charts below, the current readings of price increases through April, using the Consumer Price Index (“CPI”), show that on a 1-year basis, prices have increased by 4.2%. Core CPI, which excludes the volatile food/energy categories and tends to be a better measure of sticky inflation, rose 3.0%.

Additionally, during Q1 corporate earnings calls, many companies stated that they have been passing higher input costs through to customers. This fueled expectations that inflation could continue to rise and affect prices even more broadly. When market participants expect inflation to continue or increase, longer-duration assets such as long-term bonds and growth stocks tend to exhibit negative performance. The reason for this dynamic is that assets with cash flows further out in the future are disproportionately affected by higher inflation because of the discount rate applied to their future profits. For example, the principal and interest of a bond that matures in 2040 are going to be worth less in the future after inflation has eroded purchasing power. The same concept applies to a high-growth technology stock that is expected to have significant profits in a decade (i.e., investors prefer profits now rather than later when inflation could erode future profits).

Sage’s Perspective

Inflation is a risk to financial markets, as it is the primary obstacle to a continuation of the easy monetary policy exhibited by the Federal Reserve through both its bond purchasing programs and a 0% Federal Funds rate, as well as the accommodative fiscal policy via government stimulus programs. The easy monetary policy and accommodative fiscal policy have helped fuel the ongoing market rally. In addition, if persistent, inflation could be harmful to corporate profits.

It is our view that the inflationary pressures evident in the economy today are most likely transitory rather than persistent for three reasons:

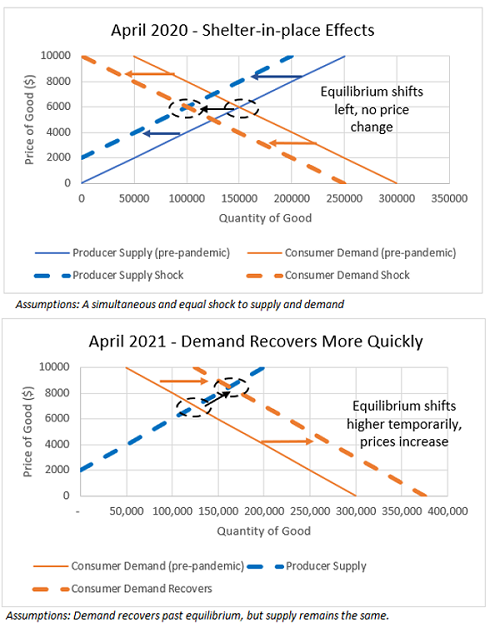

- Supply chains are slower to normalize than demand: When COVID first came into the forefront, the U.S. went into shelter-in-place mode. The broad lockdown orders resulted in a rare supply and demand shock. Companies that make consumer products forecasted low demand and slashed orders, while many citizens remained at home and purchased only consumer durables. As a result, suppliers, such as semiconductors, auto parts manufacturers, home builders, etc., made fewer products. But as the economy reopened, pent-up demand placed pressure on some of these industries to normalize production rates faster than they have been able to. We think an equilibrium will likely be reached over the next 6-12 months when both supply and demand normalize (i.e., demand decreases to sustainable levels while supply increases).

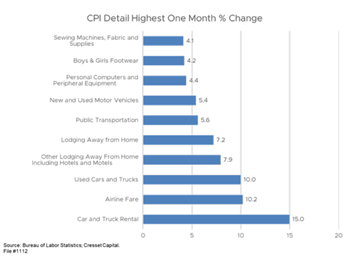

- Base Effects: After considering high price increases in semiconductors, used cars, and computers, the prices in the other 93% of the economy rose only 0.3%, which is in line with expectations. Some of these price increases are due to price declines a year ago amidst the pandemic (i.e., creating a low “base”).

- Structural headwind created by demographics: The U.S. population is statistically older than it was in the 1970s and 1980s when we last saw inflation. In fact, the average age has increased from 30.0 to 38.4 over the past four decades (source: Statista), and the senior citizen population (65+) in the U.S. has doubled from 25.5 million in 1980 to 54.4 million in 2020. An older population has less ability to tolerate price increases due to the fixed nature of their income, which should help keep prices (and inflation) in check.

It is also important to note that while the Federal Reserve may allow inflation to run above the 2% level for a period of time under its new “average” inflation mandate, members of the central bank, including Philadelphia Fed President Patrick Harker, have stated that they are focused on not letting inflation get out of control. The Fed’s tools have been extremely effective at keeping inflation contained for the past 25+ years, including relying on more restrictive monetary policy if necessary.

Concluding Thoughts

While inflation is real and needs our attention, we caution against reading too much into any small subset of data. We believe Inflation measures are likely to continue to be volatile throughout the year, although structural headwinds to higher prices such as aging demographics are likely to keep inflation from being a persistent issue.

Sage has been preparing for the possibility of an inflationary environment and modified client portfolios over the past several years. For example, we currently have less interest rate risk (i.e., duration) in our bond portfolios and a higher allocation to emerging market equities, which tend to perform well during periods of inflation. Further, looking at history, equities have tended to perform well during periods of low and rising inflation, as inflation typically accompanies a strong economic backdrop, and price increases can allow companies to realize greater profits. Since 1988, U.S. equities, represented by the Russell 1000 Index, averaged 11% annualized returns in the four periods of low and rising inflation, and EM Equities, represented by the MSCI EM Index, averaged 16%.

While there could be short-term market fluctuations, we continue to believe that the economic backdrop is strong as the economy continues to normalize, which, when using history as a guide, has led to generally positive performance from financial markets over time.

Related Posts

Insights: U.S. Economy, Inflation, COVID-19, and U.S Corporate Earnings (May 11th, 2021)

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please click here or contact us directly.

© 2021 Sage Financial Group. Reproduction without permission is not permitted.