October was a challenging month economically and geopolitically. Before we unpack what it meant for investors, we want to acknowledge a deep pain from the devastating Hamas terror attacks of October 7th in Israel and the ongoing concerns unfolding in the Middle East. The violence and distress have had a profound impact, not only in terms of the loss of human life but also in the repercussions throughout the world. Our hearts and prayers are with the many people directly impacted by the fighting, including a number of our client families.

In this edition of Insights, we examine recent market performance, assess the global macroeconomic environment, review the start of earnings season, and revisit the role fixed income plays within diversified investment portfolios. As always, we hope our insights help clarify and contextualize market behavior and underscore our commitment to providing guidance and support to help you achieve your financial goals.

Market Overview

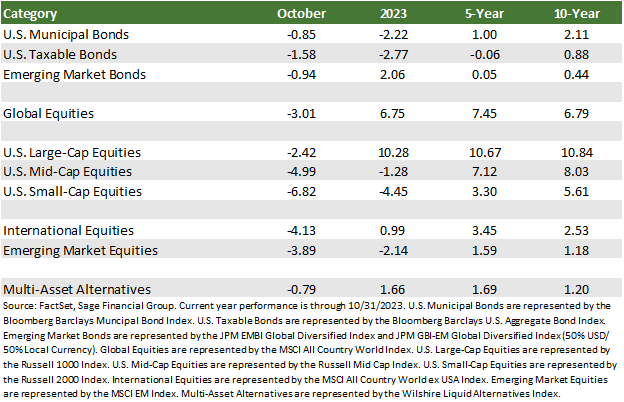

In October, market indices declined for the third month, influenced by political turmoil in the U.S. and abroad. Without a Federal Reserve meeting during the month, market participants relied on commentary from monetary policy officials to help them understand what the evolving news headlines might mean for the financial markets and their portfolios. Several Fed officials, including San Francisco President Mary Daly and Governor Michelle Bowman, reinforced investors’ expectations that the Fed will be more patient before raising rates further.

Nonetheless, investors sold U.S. bonds throughout the month, and the yield on the U.S. 10-year Treasury surpassed 5% for the first time since 2006. Despite the selling pressure, incoming retail sales and industrial production data indicated that the economy remains resilient, leading to high-quality bonds declining by 1.58% in October and extending year-to-date performance into negative territory. [1]

International bond markets did not offer investors much of a diversifying opportunity away from the ongoing U.S. bond selloff as they, too, declined by 0.94%. The strength of the U.S. dollar, driven by continued high U.S. real interest rates, has negatively impacted this asset class.

Higher interest rates and geopolitical uncertainty also negatively impacted equity markets in October. U.S. large-cap equities, supported by a more favorable than expected start to corporate earnings season, exhibited the smallest decline, falling 2.42%. Still, the Russell 1000 index intra-month fell from its July 31st closing high, officially below the threshold for a 10% correction. This marks the fourth 10% correction for large-cap equities since January 2022.

In contrast, U.S. small-cap equities saw a more substantial decline of 6.82% in the month. The combined impact of higher interest rates and geopolitical uncertainty disproportionally affects smaller stocks, which are seen as more susceptible to market volatility.

International equities provided minimal diversification benefits in October, with the most widely referenced index declining by 4.13% and emerging markets equities weakening by 3.89%. Negative global sentiment weighed on equity performance, although earnings results and the European Central Bank’s announcement that it would maintain current interest rates provided some glimmers of optimism for the future.

Mixed Signals from Global Economies

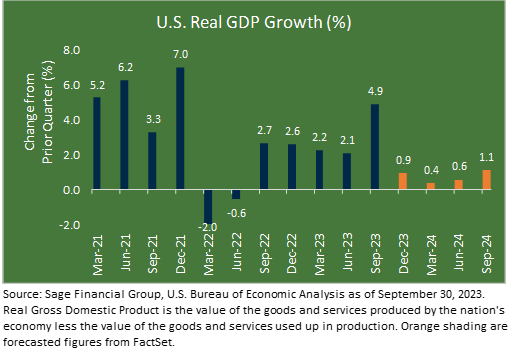

The debate regarding a potential economic softening in the United States persists. The disruptions that began around the start of the pandemic in March 2020 — extraordinary government spending and historically low interest rates, followed late in the pandemic by an unprecedented hiking course for interest rates — continue challenging the market indicators traditionally used to help contextualize economic activity. This can lead investors to question their commitment and choices.

At Sage, we prepare for various market outcomes and adjust our clients’ portfolios as appropriate. However, we remain committed to our core strategies and conviction that properly balanced portfolios will have positive returns over time. We seek to make measured changes to portfolios rather than abrupt, reactionary changes that may deviate from a plan to achieve financial goals. It is helpful to understand at a more micro level that economic signals are not all responding to the same forces.

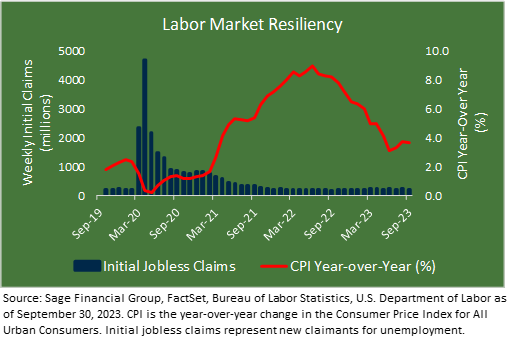

On the upside, recent data, such as the addition of 336,000 jobs in September and a robust third-quarter GDP figure of 4.9%, tempered concerns about a recession. In addition, twenty months into the Fed’s hiking cycle, inflationary trends appear to be closing in on the 2% long-term target, and several Fed officials recently suggested a possible pause in rate hikes.

But economic risks remain, and we are still balancing between a recession and a reflationary boom.

For example, despite some relief from the peak price levels of 2022, policymakers face challenges in reducing inflation without harming the labor market. So far, the labor market has shown little movement over the past year, which suggests companies are not engaging in widespread layoffs of employees.

In addition, fiscal uncertainties, the prospect of another potential government shutdown due to political discord, economic frictions such as auto union strikes, and the resumption of student loan repayments pose risks to the U.S. consumer and temper our near-term growth outlook despite encouraging incoming data points.

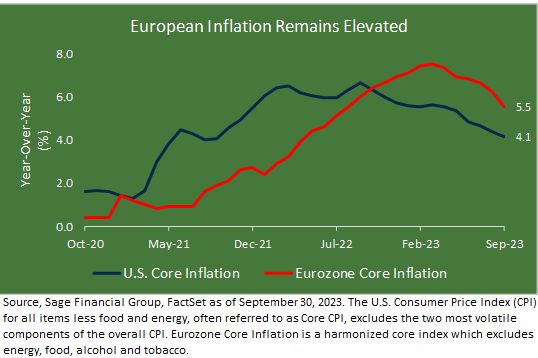

A more sluggish economic picture in Europe is emerging, particularly in Germany and Italy, hinting at a potential contraction in the Eurozone in the third quarter. European policymakers held interest rates steady in October after ten consecutive meetings that resulted in rate increases.

Unlike the U.S., Europe is grappling with higher inflation and slower economic growth. But the European Central Bank’s dovish stance suggests it feels confident about reaching its 2% inflation target without further hikes.

European monetary policy appears to have a more pronounced impact on the Eurozone’s economy, with signs of stagnation emerging. Nonetheless, the European Central Bank seems inclined to take a wait-and-see position to allow a decline in consumer sentiment and manufacturing to cool down inflation rather than relying on higher interest rates.

Meanwhile, the ongoing property market correction and geopolitical tensions are hindering economic stability in China despite robust third-quarter growth. Here, policymakers favor incremental, measured interventions, indicating a tolerance for credit stress.

The mixed signals from economies around the globe can make investors uncomfortable. Over the past 18 months, much of the world has experienced synchronized tighter monetary policy, negative equity and fixed-income returns, and tremendous macroeconomic uncertainty.

As mentioned above, we remain tightly focused on preparing our clients for various market outcomes.

We maintain a substantial portion of portfolio equity exposure in U.S. companies while utilizing active management in our international equity strategies to look to exploit opportunities across geographies. Diversification through alternative strategies has proven successful in 2023 year-to-date, with tactical weightings to floating rate loans, differentiated total return-oriented multi-asset strategies, and focused private real estate performing well.

Earnings Season Is Off to the Races

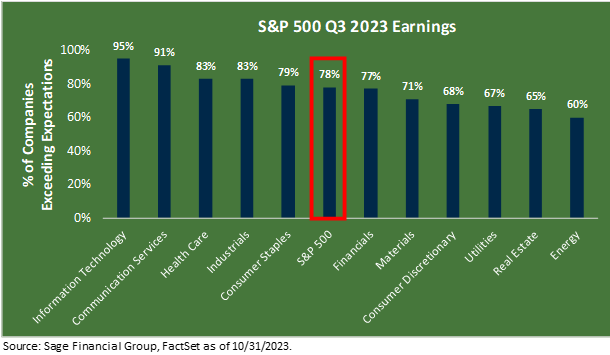

As October drew to a close, roughly half of S&P 500 companies reported their financial results for the most recent quarter. So far, the results have been generally in line with expectations across sectors, with 78% of companies reporting positive earnings surprises, slightly above the 10-year average of 74%.

At the end of the month, the spotlight was on the earnings results of the “Magnificient seven” stocks that have driven U.S. equity returns in 2023 due to the enthusiasm around artificial intelligence.[2]

Microsoft led the way, reporting revenue growth and earnings that exceeded estimates due to the strength of its cloud business. In contrast, Alphabet (Google) discussed a “continuing focus on making AI more helpful for everyone” on the earnings call but faced market repercussions due to declining operating income growth in October.

If the positive trend in corporate earnings continues, we expect U.S. and international stocks to respond favorably. However, paying close attention to the commentary on earnings calls is crucial. During the first half of the year, corporate and investor enthusiasm focused on the benefits of artificial intelligence. We believe the focus now will be on how corporations manage higher capital costs and how that may influence their businesses in the future.

We acknowledge that risks remain, and we should expect and be prepared for market volatility. While equities serve as a primary driver of investment growth, we believe that a well-diversified portfolio is in our clients’ best interest because it protects against market volatility while helping them accomplish their financial goals.

While we are encouraged to see Corporate America display positive earnings growth, it is apparent that ongoing geopolitical tensions have eroded investor demand for risk assets. More specifically, investors’ concerns about political turmoil here and abroad are competing with their traditional interest in the health of corporate balance sheets, and they are being more cautious. We believe an environment like this underscores the merits of a multi-asset class approach.

Longer-Term Perspective: Role of Fixed Income

Fixed income plays an important role in diversification, and we want to spend some time discussing the role of the asset class today. At the end of October, investment-grade fixed-income returns were on track to register a third consecutive year of negative returns, unprecedented in modern financial history and closely tied to persistently high rates and yields.

We have continuously reassessed our forecasts and outlook throughout this enduring market downturn. We continue to believe that bonds are poised to provide better returns in the near future, especially with their enhanced ability to absorb higher interest rate volatility due to higher levels of current income.

Another reason supporting an allocation to bonds is that bonds appear to be relatively fair valued. Even as some equities remain expensive relative to history, investment-grade bonds remain more in line with their historical median levels.

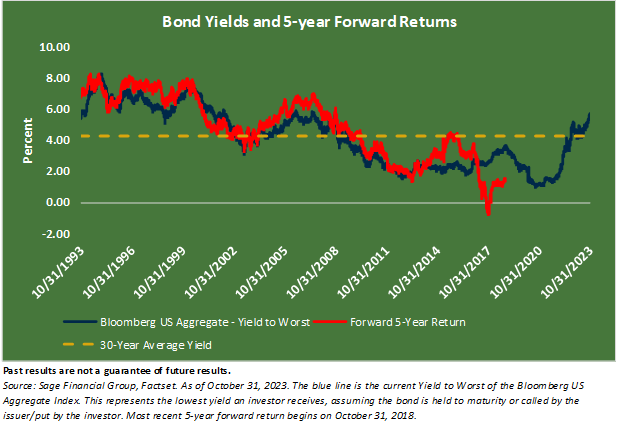

The final reason we still support bonds is that the lion’s share of the increase in yields is attributed to rising yields at the front end of the curve. Higher current bond yields are forecasted to have a positive impact on the future total return of intermediate-fixed income. Over the last thirty years, 91% of a bond’s future 5-year total return (price and income return) is foreshadowed by the bond’s current yield, which today is relatively high.

Our position remains that holding fixed income is prudent as part of an investment portfolio because when yields do begin to fall, bond returns will increase by a magnitude greater than cash.

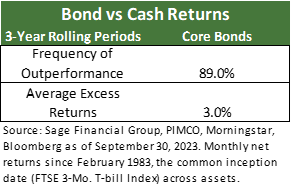

Dating back over 40 years, traditional core intermediate duration fixed income has outperformed cash instruments throughout rolling 3-year periods in 89% of instances. On average, when the Federal Reserve adjusts its policy, intermediate bonds have outperformed cash by 3% annually across rolling 3-year intervals.

In our client portfolios, we are focused at this time on fortifying protection and furthering stability through strengthened bond quality. We expect bonds to reassert their more traditional position in many portfolios as a buffer during stock market drawdowns. Traditionally, the price of bonds experiences less fluctuation and loss in value. At the same time, bonds offer the potential for elevated income.

Closing Thoughts

The recent months have presented investment performance challenges as we navigate a transitioning economic environment and multiple bouts of geopolitical turmoil. Just as inflation created headwinds for financial goals, we must contend with the evolving economic outlook as the impact of monetary policy on markets becomes more pronounced. We are closely monitoring the risks posed by widespread geopolitical conflict in Ukraine and the Middle East and plan to be nimble in response to the fast-changing situation.

Our strategic approach remains sharply focused on preparing for differentiated responses from global economies in the period ahead. While the appeal of cash is undeniable, from an asset class perspective, we believe that equities will continue to be the primary return-enhancement component of investment portfolios and that bonds also offer the prospect of attractive future returns.

[1]Emerging markets debt is represented by the JPM EMBI Global Diversified Index and JPM GBI-EM Global Diversified Index (50% USD/ 50% Local Currency). The Russell 1000 Index represents U.S. large-cap stocks. The Russell 2000 Index represents U.S. small-cap stocks. International stocks are represented by the MSCI All Country World ex USA Index. The MSCI EM Index represents emerging market equities.

[2] Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL), Amazon (AMZN), Nvidia (NVDA), Tesla (TSLA) and Meta Platforms (META)

Previous Posts

- Sage Insights: Market Observations Following a Rocky Month and Quarter

- Sage Recognized By Leading Financial Journals

- Sage Insights: Market Observations At Summer Ends

- Sage Insights: A Mid-Summer Look at Markets, Inflation, & Earnings Season

Learn More About Sage

Disclosures

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks, or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks, or assumptions should not be construed to be indicative of the actual events that will occur. These projections, market outlooks, or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, product, or any non-investment-related content referred to directly or indirectly in this newsletter will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer reflect current opinions or positions. All indexes are unmanaged, and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in managing an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her situation or any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.