The first half of 2022 has continued to present a challenging environment for stock and bond markets. Those challenges came back into focus this week as markets fell sharply on the heels of higher-than-expected inflation numbers and anticipated actions from the Fed.

In turbulent times like these, we seek to be a source of insight and advice. As news coverage and speculation reaches a fever pitch, we prefer to offer clear, consistent communications that provide vital context on the factors at play and what we believe they mean for your portfolio’s positioning and your personal financial goals. With that aim in mind, here is a brief overview of where we are today, along with Sage’s perspective.

What has happened?

Inflation has remained persistently high this year.

- Last week’s Consumer Price Index showed year-over-year inflation of 8.6% as of May, the highest reading since 1981. Higher prices continue to weigh on consumers in 2022.

- For more on inflation and its impacts, read our most recent Insights piece.

U.S. large-cap stocks officially entered a bear market.

- Equity markets came into this year pricing in high growth, while not expecting an “exogenous shock” from outside the economic system. Russia’s invasion of Ukraine provided exactly that “shock”, limiting the supply of food and energy without reducing demand, which has contributed to higher prices.

- Government stimulus was one of the primary factors that led to higher demand for goods and services in 2021, and has contributed to elevated inflation. In 2022, in addition to Russia/Ukraine, China’s continued zero-COVID policy, resulting in the shutdown of some important manufacturing cities such as Shanghai and Beijing, has exacerbated supply chain issues.

- Driven by these factors, global equities have dropped by 20% on average year-to-date through June 14, and U.S. large-cap stocks have fallen by nearly 22% from the all-time high closing price in January, following average yearly gains of over 20% in 2019, 2020, and 2021.

Fixed income markets have been disrupted by a shift in the Federal Reserve’s policies in response to inflation.

- The Federal Open Market Committee (FOMC) remains hyper-focused on inflation as part of its dual mandate of full employment and price stability. Given the strong, relative health of the labor market and the spike in energy prices, the FOMC has placed greater focus on getting inflation under control through tighter policy, including increasing interest rates.

- The Fed hiked interest rates by 0.75 percentage points today, which was the largest increase in the key policy rate since 1994 to put downward pressure on inflation.

- Fixed income markets expected only 0.50 percentage points of Fed policy rate hikes in all of 2022 as recently as November 2021, but investors now expect rate hikes totaling 3.50 percentage points this year.

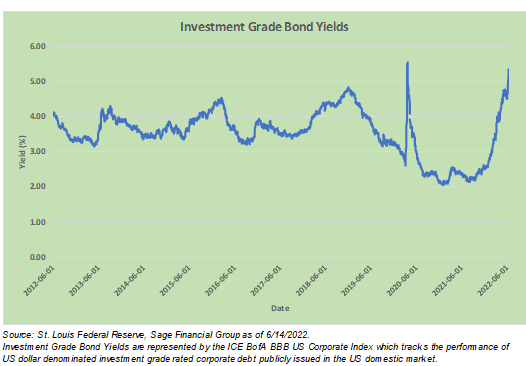

- This dramatic change in expectations has contributed to higher rates and, unfortunately, sharply lower bond prices. Investment Grade Bonds have fallen by 12% this year, and U.S. High Yield Bonds have fallen by 14%. In contrast, many alternative investments have “only” declined 3%-5%.

Sage’s Perspective

As we shared in our April Insights piece, our disciplined investment approach demands that we address periods of increased volatility with an increased focus on strategy. Here are a few key points we’d like to stress to our clients and their families.

Market volatility feels uncomfortable at the time, but it is a reality of investing.

- Historically, large-cap equity corrections of 10% or more happen every 1-2 years, and bear markets of 20% declines happen every 3-4 years. Over the past five years, we have experienced three bear markets, including 2018, 2020, and 2022.

- Short-term swings are largely driven by investor reactions to current events, but over longer periods the growth of the economy and profitability of companies generally drive equity returns. That is, while there are sharp short-term fluctuations in stock markets, U.S. large cap stocks1 have returned 10% per annum since 1926.

Stock Market valuations have improved.

- As stock prices continue to decline, valuations have improved significantly, and are trading at price-to-earnings ratios in line with average levels over the last 15 years.

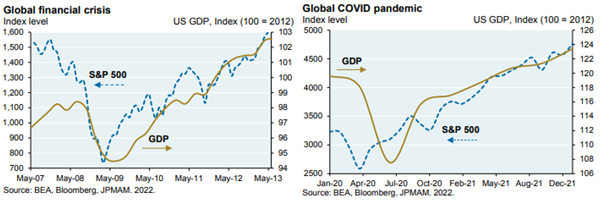

Equities bottom out before a rebound.

- Equity markets typically bottom before the economy rebounds – because they are forward-looking. This dynamic was seen in both the Global Financial Crisis and the COVID pandemic. While inflation is hurting the economy, we expect markets to bottom before the slowdown hits its lowest point.

Fixed income shows promise.

- While fixed income returns have been painful this year, we believe that future returns are likely to be higher. For example, Investment Grade bond yields are at their highest level in over a decade, outside of a brief period in March 2020. We expect these higher yields to bode well for future bond total returns.

Long-term equity returns remain strong.

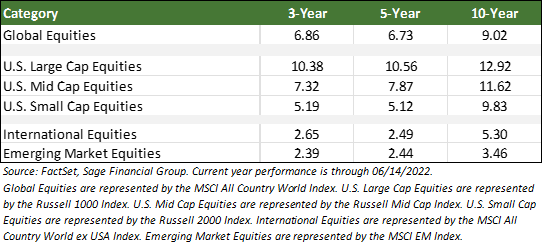

- Longer-term historical equity returns remain strong over the 3-,5-, and 10-year time periods. Specifically, global equities have returned 9.02%, annualized over the last 10-years as of June 14.

Concluding Thoughts

Based on our analyses, we expect that volatility is likely to continue. Nevertheless, the market turbulence we are experiencing is not unusual. In fact, it’s a natural characteristic of equity markets and historically happens every three years or so.

So, while it may feel unsettling now, know that your portfolio is well-diversified and structured with a multi-asset class approach with less sensitivity to interest rates to reduce the impact of volatility. We believe the investment strategy designed for you continues to be appropriate because it aligns with your risk tolerance, time horizon, long-term return objectives, and broader financial goals.

Our team is committed to taking care of your investment portfolio based on your personal situation. We are well-prepared to help you navigate this uncertainty and plan for what comes next. It’s our continued goal to provide you with the peace of mind that comes from knowing Sage is monitoring new market developments and working to keep your financial future secure. If you have any questions about the market, your portfolio, or anything else, please reach out to your Sage Advisor or call us directly at 484-342-4400.

[1] The S&P index returns start in 1926 when the index was first composed of 90 companies. The name of the index at that time was the Composite Index or S&P 90. In 1957 the index expanded to include the 500 components we now have today. The returns include both price returns and re-invested dividends.

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks, or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks, or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks, or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, product or any non-investment-related content, made reference to directly or indirectly in this newsletter will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please click here or contact us directly.