2022 has presented us with stock and bond markets that may create a feeling of uncertainty. In these times, we favor over-communicating so that you are fully informed on our current actions and thinking as it relates to market volatility and your personal financial goals. With that objective in mind, we’d like to share a brief update and hopefully provide you with some clarity and peace of mind in the coming weeks.

What has happened?

During the first five months of 2022, the stock and bond markets have both been volatile. Most analysts agree the cause is two-fold.

The first is inflation, which remains high. The Consumer Price Index was up 8.3% year-over-year as of April month-end. That’s a significant increase, although technically “down” from 8.5% in March. Elevated inflation levels were already on investors’ and analysts’ radars coming into 2022. Then came the one-two punch of China’s zero-COVID policy straining supply chains and Russia’s invasion of Ukraine driving aggressive action from global central banks to combat higher prices. The resulting higher interest rates created even more uncertainty in financial markets.

The second factor driving recent volatility is consumer spending. Just this week, consumer demand has come into question following reports from Target and Wal-Mart. Both major retailers reported weaker than expected profits, attributing the gap to consumers buying fewer “big-ticket items” such as televisions and appliances. Given that consumer spending accounts for over two-thirds of the U.S. economy, we are not surprised that markets reacted sharply in recent days.

Sage’s Perspective

As we shared in our recent Insights piece, we believe the best way to address periods of increased volatility is to focus on strategy. Our investment philosophy is anchored by the reality that while volatility is painful in the moment, it is inherent to investing. It’s worth remembering that amid a global pandemic and significant political and social upheaval, the diversified portfolios we favor experienced strong gains in 2019, 2020, and 2021.

Nevertheless, our read of current market conditions and future projections indicates that, after three years of solid gains, we may, unfortunately, be in the midst of a bear market (i.e., where stock indices are down 20% or more).

However, our team does not believe that current conditions suggest that a recession is imminent, even though inflation and softer consumer spending have increased the risk of a recession in recent weeks.

The U.S. economy is slowing, but both consumers and corporations have record cash on hand at a time of historically low unemployment and strong wage growth. Our projections and analyses indicate these variables could provide some cushion for the economy as it slows. Additionally, markets are now pricing in a moderate probability of a near-term recession, which may limit further downside or provide an upside surprise if a recession is avoided.

Here again, a little historical context regarding investment time horizons is valuable. U.S. stocks have risen on average about 10% per year since 1928 but have experienced 50 corrections and 22 bear markets during that time period. That means bear markets have historically occurred, on average, once every five years.

Stock markets go up over time because of growth in economic output (Nominal Gross Domestic Product, or “GDP”), which is driven by the combination of real GDP (population growth and technological innovation) and inflation. Corporate profits essentially provide a stable, but fluctuating, piece of that economic output, which continues to push up the price of stocks.

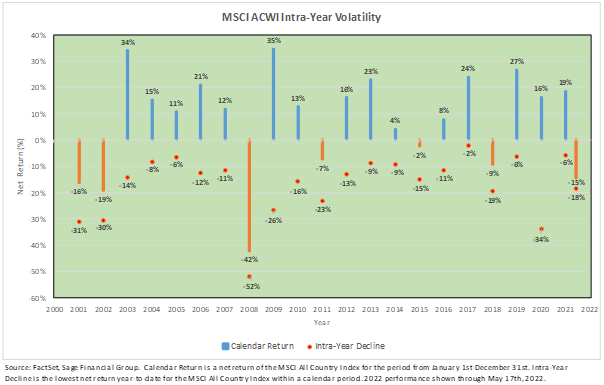

However, volatility in intra-year periods is not infrequent within global equity markets. Despite having an average intra-year drawdown of 16.9%, the MSCI All Country World Index rose in 15 of 22 calendar years. It’s one more example of the benefits of staying focused on the longer term. Despite bad days, weeks, and months of market performance, a majority of the time, market prices tend to increase year-over-year.

Concluding Thoughts

Our advice during this recent bout of volatility remains consistent with how we counsel clients and invest for ourselves and our families – try to keep the market volatility in perspective.

Our team has prepared for these conditions, and we are actively monitoring the markets and their headwinds and tailwinds. Our attention to nontraditional bond funds, infrastructure, and alternatives, for example, is helping provide a degree of downside protection. Unless something has changed in your financial life, it’s unlikely that a significant adjustment in strategy is warranted as a result of this volatility.

Based on our analyses, we expect that volatility is likely to continue. It is a common and natural characteristic of equity markets. However, Sage portfolios are well-diversified and structured with a multi-asset class approach to reduce the impact of volatility across holdings.

Our relationship with our clients is built on the strength of our understanding of their goals and the comprehensive support we provide. We hope that they have the confidence and clarity to sleep well at night knowing that Sage is carefully monitoring the markets and stewarding their portfolios to help keep their financial futures secure. If at any time you would like to talk to us about the current state of the market, your portfolio, or anything else, please reach out to us directly at 484-342-4400.

Previous Posts

Sage Insights: Geopolitics, Earnings, and Investing Principles

Sage 2022 Annual Letter: A Year in Review

Sage 2022 Investment and Market Outlook

Sage Recognized for Commitment to Clients

Learn More About Sage

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks, or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks, or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks ,or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please click here or contact us directly.

© 2022 Sage Financial Group. Reproduction without permission is not permitted.