Introduction: 2021, A Year of Strong Performance Through Uncertainty

Stock markets generated strong returns in 2021, while the performance of bonds was mediocre. Following the 2020 U.S. elections, many investors expected higher taxes and a difficult environment for corporations. Instead, corporations registered staggering profit growth, navigating through choppy markets fraught with pandemic-related economic issues (e.g., global supply-chain disruptions, and labor shortages).

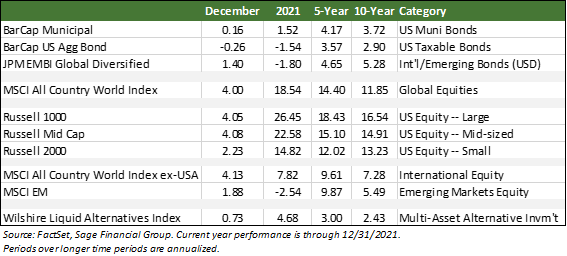

As a result, equities delivered positive returns to investors this year. In particular, U.S. large-company stocks surged 26.5% for the year in what proved to be a record year of profits. Companies fared well internationally, too. Overall, international stocks gained 7.8%, although emerging market stocks declined by 2.5%. U.S. company stocks outperformed their global peers, thanks largely to more easing of government lockdown restrictions in the U.S. relative to Europe and Asia. In fixed income, rising interest rates caused high-quality investment-grade bonds to fall 1.5%. As a result, 2021 was the first negative year for investment-grade bonds since 2013. Supported by strong economic growth and consistent demand for tax-exempt assets, municipal bonds rose 1.5%. Emerging market debt fell 1.8% in 2021 as COVID-related headwinds weighed on economic growth.

But as the old joke goes, “Why did God create economists?… To make weathermen look good.”

In the 2021 edition of Economic Predictions Gone Wrong, many forecasters expected inflation to wane by the end of 2021. Instead, however, inflation has remained elevated into 2022, caused by disruptions in Southeast Asia and extended government transfers to citizens in the U.S. We still cannot say exactly when inflation will dissipate, but we do expect that the Fed’s actions and changing supply/demand dynamics should effectively contain inflation in the near term.

Sage’s approach to portfolio management is not to try to time the markets. Instead, we stick to a disciplined strategy that involves rebalancing through market fluctuations and diversifying how we allocate investments within portfolios. In our view, this disciplined and diversified approach creates the highest probability that each of our clients will reach their financial goals because it is nearly impossible to predict the short-term returns of any individual asset class.

In 2021, our portfolio positioning performed very well. We used nontraditional bonds, equities, and other asset classes that tend to perform well in inflationary environments. We also used asset classes such as alternative and traditional bonds for diversification.

While it is important to evaluate each year’s performance and consider how it impacts your unique financial picture, we prefer to focus on long-term returns. This is because economic growth, inflation, and productivity growth (i.e., innovation) drive financial market returns over the long term.

2022 Outlook: A Year of Evolution

We predict that 2022 will be a positive year, although complex for financial markets. This edition of Outlook discusses three major economic themes and provides our expectations for fixed income and equity asset classes.

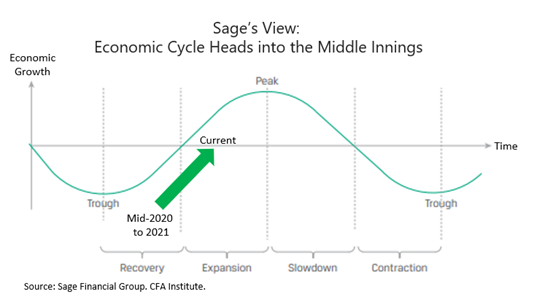

We believe the economy will begin to shift from the early to middle innings of the economic cycle after the initial rebound in economic growth following the 2020 recession. Three themes could be driving this change in gears from initial recovery to a more stable expansion: consumer spending (particularly in service industries), higher but declining inflation combined with a tight labor market, and the continued unpredictability of the COVID pandemic.

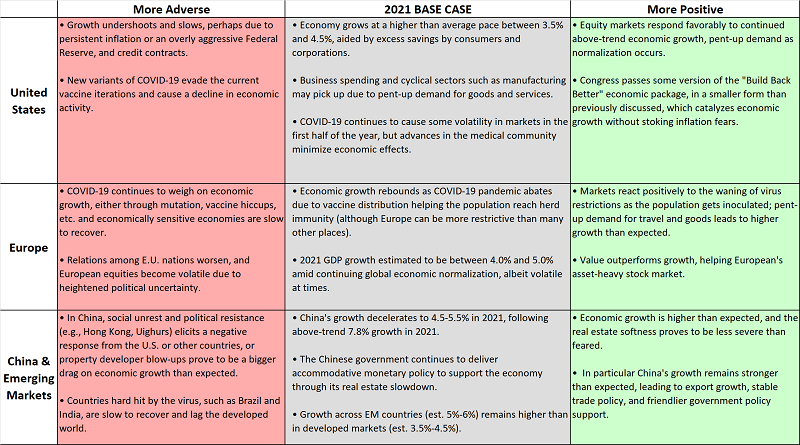

These three themes inform our base-case scenario that the U.S. economy will continue to grow at an above-average pace, likely between 3.5-4.5% in 2022, above the long-term historical average of 3%. In addition, conditions for corporations should remain positive (i.e., revenue growth, margins, etc.) and should support equity returns.

In Europe, we expect economic growth to rebound as government leaders start to soften COVID restrictions. European leaders have been much more restrictive than most other countries, but high vaccination levels and a milder Omicron variant should bring a more normal economic environment in 2022. Additionally, we expect emerging market growth to rebound following a year of poor performance.

We remain prepared for a variety of outcomes. For example, the economic backdrop could be more positive than expected, or we could experience a more adverse scenario.

A market environment that surprises to the upside would likely include inflation that declines faster than expected, a weaker dollar, which could boost U.S. exports and prices for international assets (from a domestic investor’s perspective), and international growth.

Conversely, a positive environment is not guaranteed. In our view, risks to economic growth include COVID variants that evade existing vaccines, the negative effects associated with rising interest rates, and prolonged higher inflation.

We highlight some of the key points in each case below.

Major Economic Themes: A Year of Evolution

We expect three major themes to have the greatest impact on financial markets in 2022:

- Global growth is set for a strong year driven by consumer spending

- Less accommodative monetary policy around the globe

- Evolution of the COVID-19 virus

These economic themes drive our outlook on major asset classes for 2022.

Theme #1: Consumer Demand Remains Strong

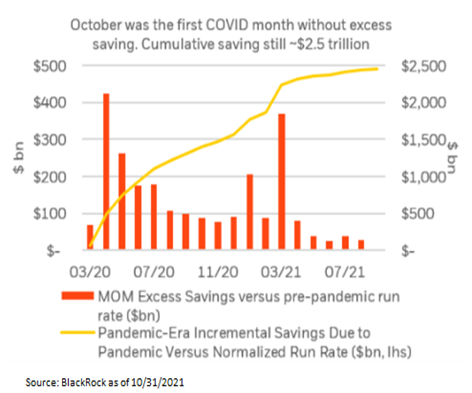

U.S. consumer spending comprises roughly 70% of the U.S. economy and is a significant global economic driver. Moreover, after saving extra money over the last 18 months by choice or through limited options, U.S. consumers have enormous “excess savings” (i.e., savings above what would have been natural without the pandemic), which they will likely spend in the coming years.

Despite a drop-off in fiscal spending compared to 2021 (i.e., “the fiscal cliff”), we expect consumers to start to spend their $2.5 trillion of excess savings in 2022. According to BlackRock, October 2021 marked the first month without excess savings since the pandemic began, meaning consumers began spending more in the year’s final quarter.

Historically, excess savings are spent over 3-5 years following an economic downturn, but we expect the suppressed demand for services (e.g., travel, restaurants, etc.) to pull more spending into 2022. In addition, the labor market has recovered ahead of expectations, as evidenced by low unemployment levels. This should encourage consumers to feel increasingly confident in spending and create a tailwind in boosting corporate profits in 2022.

Theme #2: Less Accommodative Monetary Policy

2022 is likely to be a challenging year for central bankers. Most central banks worldwide have the “dual mandate” of promoting stable prices and maximum sustainable employment. On inflation, Chairman Powell and the Fed view stable prices as “inflation that averages 2% over the long-term.” Sustainable maximum employment is subjective, but overall the Fed does not want to see the job market too hot or too cold (like Goldilocks). We discuss how both of these items (inflation and employment) have progressed in 2021 and led to shifting monetary policy that will characterize 2022.

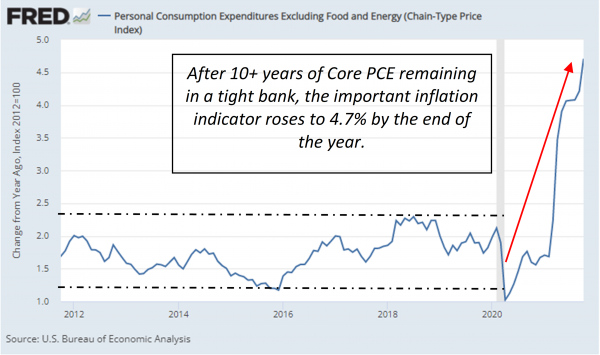

Unexpected inflation reared its head in 2021, and central banks responded with tighter monetary policy by reducing monthly bond purchases and eventually introducing higher interest rates. As a result, as shown below, the Fed’s preferred inflation index, Core Personal Consumption Expenditures Price Index (“Core PCE”), rose 4.7% year-over-year, breaking free from a range of 1.25% to 2.25% over the past decade.

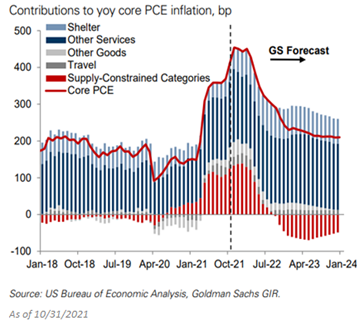

However, we believe that many of the pressures that led to inflation in 2021 are beginning to fade, leading to what we expect to be a year of declining inflation (i.e., “disinflation”). Importantly, “supply-constrained ” categories that contributed strongly to inflation in 2021 are expected to reverse direction and weigh down inflationary figures beginning in the second quarter of 2022.

Central banks also want to aim for “maximum sustainable employment.” Over the past year, global central banks began raising rates and/or reducing bond purchases to balance supply/demand for labor and fight inflation. Currently, the U.S. employment market is as tight as it has been in decades, with an unemployment rate of only 3.9%. However, when unemployment gets too low, wage growth can become too high for the economy to handle (i.e., employers can no longer afford to hire for new positions, expand operations, etc.), which is why the Fed wants to control employment.

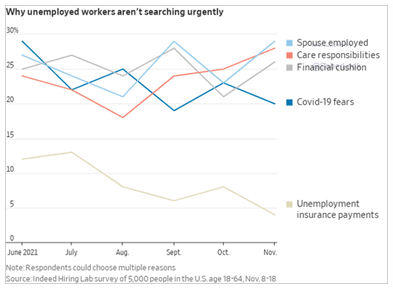

2022 will be unique because the economy has not added enough jobs to reach its pre-pandemic employment levels in terms of jobs counted. This creates a difficult situation for central banks because a large population of workers should be available for open jobs; however, they are currently sidelined due to financial cushions, childcare responsibilities, or fear of COVID (see below). More jobs could be added than traditional measures currently show and could warrant patience from central banks if these workers return from the sidelines.

The bottom line is that central banks are becoming moderately more aggressive in response to inflationary pressures and a tight labor market. In practice, tighter monetary policy should slow economic growth, but it also is expected to slow inflation. We think that price increases will decelerate enough to allow central banks to be patient and not move too quickly in their rate increases. In addition, “supply-constrained” categories may help decrease inflation in 2022, although wage inflation seems stickier to us.

Because economic growth remains strong, we believe that the backdrop for equities and credit remains positive. However, a less accommodative monetary policy could mean higher volatility for stocks and bonds.

Theme #3: Evolution of the COVID-19 Virus

COVID continues to evolve in terms of the virus itself and the response by government officials, citizens, and the medical community. There were three impactful new COVID variants in 2021, and Omicron was the most contagious.

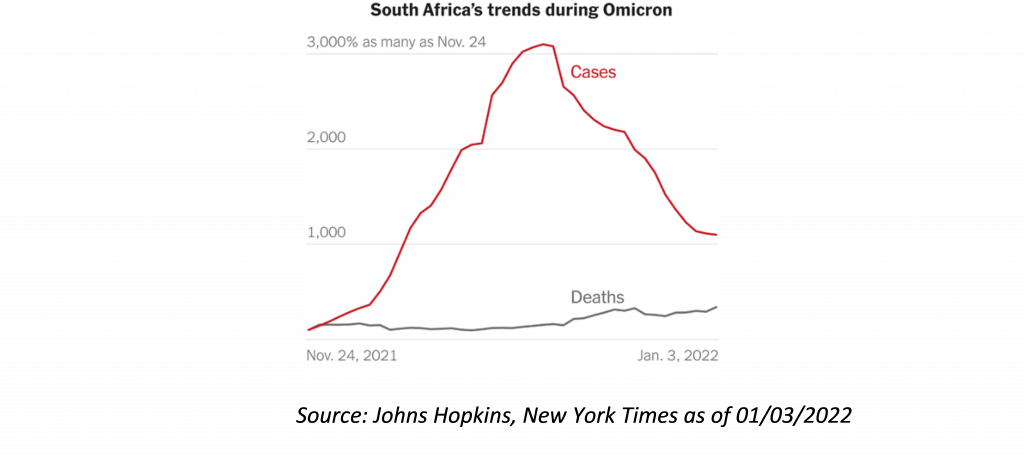

New Omicron case numbers exploded higher in South Africa around late November but fortunately began to decline relatively quickly. This quick rise and fall in cases suggests that this new variant comes on very strong but flames out just as quickly. A series of studies have confirmed what we have written about in recent months: Omicron is less severe than prior variants, which means reduced instances of severe illness and hospitalizations.

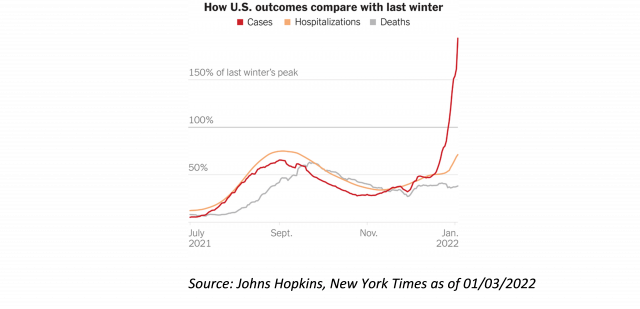

The evolution of the virus remains vital to financial markets and is likely to remain significant in 2022. The most critical variable with Omicron, and any other new variant, has become disease severity. While the virus spread quickly in countries like South Africa, the infection waves receded faster than expected, without significant increases in hospitalizations or deaths (see chart below).

In the U.S., deaths have remained lower than at the peaks in past waves. Previously, the number of hospitalizations and deaths closely followed the number of cases (chart below). However, while cases have spiked in recent weeks, a commensurate increase in either hospitalizations or deaths has not yet occurred.

We anticipate higher case numbers around the globe in the near term, but hospitalizations/deaths will not inflect materially higher. From a market perspective, the lower severity (so far) of Omicron is a positive because it is unlikely to cause additional economic restrictions.

These three themes drive our outlook on fixed income and equity markets.

Fixed Income Outlook

In Sage’s view, tighter monetary policy and strong economic growth should lead to modestly higher interest rates and stable credit spreads (i.e., the additional return investors earn to take the risk of owning non-U.S. treasury bonds).

We expect interest rates to trend moderately higher throughout 2022. Interest rates increased in 2021, and we expect the next 12 months to be similar, perhaps with more volatility. In a period of rate fluctuations, we expect investment-grade bonds to provide diversification benefits.

The chart below shows that the U.S. 10-year Treasury yield followed a choppy path throughout 2021 but finished approximately 0.60% higher. In fact, the highest point for bond yields occurred early in 2021, during March. In our view, rates should continue to remain lower than historical average levels, supported by the demand for stable income from insurance companies, endowments, foundations, and an aging population, which tends to create a cap on rates.

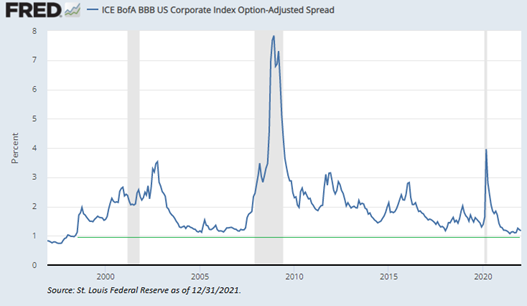

The other element of Sage’s fixed income portfolio returns depends on bond “spreads,” which are the compensation for investing in debt outside of risk-free U.S. treasury debt.

Bond spreads remain very low on a historical basis both in the investment-grade and high-yield spaces. All else equal, spreads tighten (i.e., move lower) to reflect improving economic conditions. As spreads move lower, bond investors should benefit. Conversely, bond investors are expected to see losses when spreads widen (i.e., move higher). In the graphic below, spreads for lower-quality investment-grade bonds have reached incredibly tight levels, last seen more than 20 years ago (see chart below). Sage thinks that spreads are unlikely to move significantly lower, and this initial condition should create a lower total return environment for fixed-income investors in the future.

In our base case view, bond returns will likely be challenged in 2022 as rates increase. The combination of tight corporate bond spreads and rising interest rates is why we continue to remain “shorter” on the bond spectrum than we would expect over the long term. It’s also why we opt to remain flexible in our allocation by using unconstrained bond funds and other nontraditional bond strategies. We also expect to explore floating rate options in 2022, which would be consistent with our outlook and potentially accretive to investment portfolio returns in a rising rate environment.

We think it is important to note that investment-grade fixed income offers diversification benefits because high-quality bonds have historically tended to perform well during equity sell-offs. While we expect stable credit conditions along with higher rates this year, if the economy were to slow more than expected, we want high-quality bonds in portfolios to balance out losses in more risky asset classes.

Fixed Income Portfolio Implications:

- United States:

- In the U.S., bond yields are likely to move higher but sustainably and gradually.

- With expanding fiscal budget deficits and the potential for above-trend economic growth, we have positioned portfolios with less duration than we would generally expect to have over the long term.

- High-quality bonds continue to give investors equity diversification during volatility.

- Foreign bonds:

- Many developed market bond yields remain negative and/or significantly below U.S. bond yields, lessening investment attractiveness.

- We prefer emerging market bonds with higher yields (greater than 5% annualized) and a backdrop of expected economic growth. Emerging market countries maintained a “zero-COVID” policy throughout most of the year, which materially weighed on economic growth. However, as this policy is disbanded, it should provide a growth tailwind in 2022.

Equity Outlook

The environment for corporations continues to be strong this year, driven by consumer spending and pent-up demand for service activities such as travel, restaurants, and other social events.

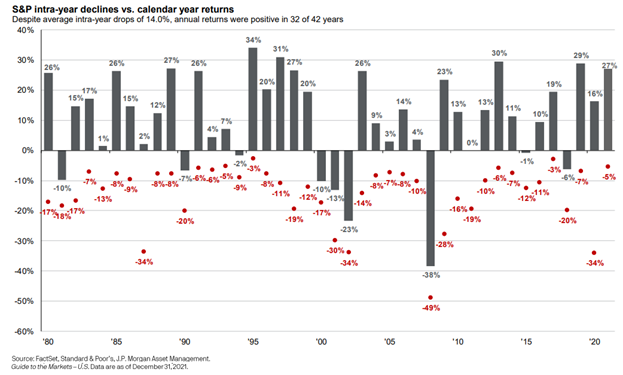

There are always risks as an investor, and the setup for 2022 is no different. An old Wall Street saying is that markets tend to “climb a wall of worry” over time, which is just a way to say that there is usually something to worry about (geopolitics, Fed actions, etc.), but that markets are resilient and focus on fundamentals (revenue, profit, free cash flow of companies). It is hard to believe, but despite multiple concerns regarding inflation, supply chains, COVID, etc., in 2021, U.S. stock returns had a relatively uneventful ride compared to other calendar periods over the last 40 years. As shown below, U.S. large-cap stocks dropped 5% intra-year (intra-year drawdown shown by the red dot), which was the least volatile calendar period in over 25 years, and finished the year up 27%. That is, markets climbed the wall of worry last year (and some).

So, what do we expect is next, and can equity markets continue to perform with tremendous resiliency in 2022? In our view, caution remains warranted, but there is still upside potential for equity market investors.

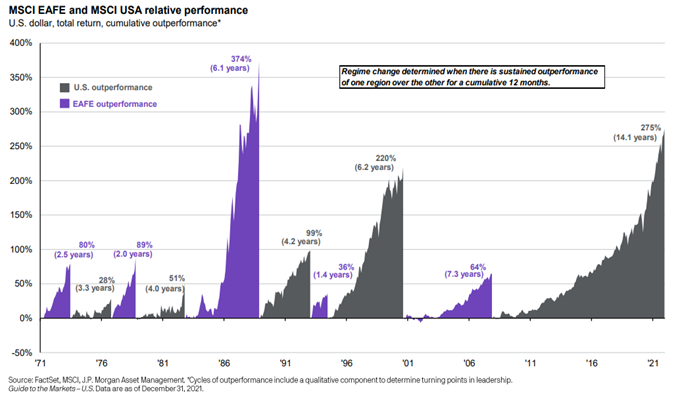

We continue to maintain that it is prudent to shift capital into a geographically diversified allocation. Equity diversification is important in our view because it allows investors to participate in the investment benefits of global growth both in the U.S. and abroad. As shown below, the U.S. and developed international markets (defined by MSCI EAFE) have rotated over time. The current period of U.S. outperformance has been the longest in duration, but developed market equities actually outperformed the U.S. by a larger margin in the 1980s. Accordingly, we advise clients to remain diversified and keep a longer-term view of diversification through the fluctuations in individual markets.

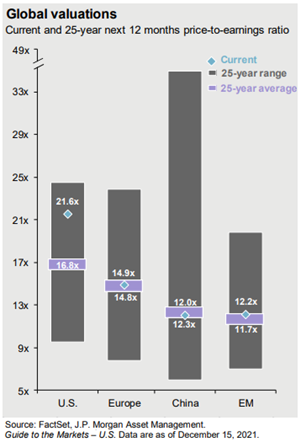

As you can see from the graph below, as of 12/31/2021, U.S. stocks continue to trade at a next-12-month-valuation level above the index’s historical average over the last 25 years. In contrast, developed market stock indices as a whole, with Europe in particular, currently register an average valuation level.

After a third consecutive year of strong returns for U.S. equities in 2021 and high valuations at the moment, it would not be unexpected to see some bouts of price volatility or for a correction to occur in 2022. In addition, the impact of tightening monetary policy, particularly in the U.S., on asset valuations will be a key focus in 2022. Nevertheless, we think that geographical rotation in outperformance is possible using history as a guide and considering valuation measures globally.

Emerging market stocks are also around historical average valuations and support why we are constructive, despite the weakness of their investment performance. 2021 was a challenging year for the investment performance of this asset class due to increased regulations in China and the adverse economic effect of “zero-COVID” policies. But we expect the world’s second-largest economy to bounce back in 2022, which should provide a supportive backdrop for emerging market stocks. China comprises roughly 35-40% of the emerging market investible equity universe. It is also possible that U.S./China trade tensions will decrease, and China will move away from restrictive “zero-COVID” policies. In our view, emerging market equities appear to present an attractive opportunity within global equities.

Overall, we think that equity markets have many tailwinds, including continuously improving economic growth and strong corporate profit margins. However, we interpret both factors — global valuation metrics and record-high optimism — as signals for investors to have more modest expectations about returns over the next 12 months. These expectations are still positive, but there are reasons to remain humble.

Equity Portfolio Implications:

- United States:

- Given our outlook for strong economic growth in this continued recovery, we anticipate maintaining our continued slight overweight to U.S. stocks with a relative bias for small caps.

- Foreign stocks:

- We have a small bias towards overweighting foreign stocks based on lower relative valuations. We continue to believe strongly in diversification over time, despite fluctuations.

- Despite weakness throughout most of 2021, emerging market stocks may present attractive return opportunities due to fast-growing populations, fair valuations, and commercial innovation.

Diversification

Diversified asset allocation is the cornerstone of some of the world’s largest and most successful portfolio management companies. It is also how Sage Financial Group has approached investment management since its founding in 1989.

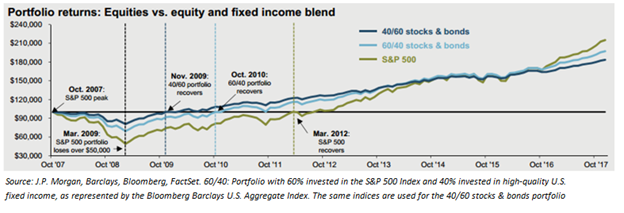

As investors have come to experience, sell-offs do occur from time to time. Historically, individual markets typically recover, but, as the graphic below illustrates, this can take a long time — sometimes measured in years, not months. While markets recovered very quickly after COVID, such a swift rebound is not always the case. For example, during the Global Financial Crisis, the S&P bottomed in March 2009, and it did not recover to its October 2007 peak until March 2012, three years after the trough and five years after the peak. In contrast, diversified portfolios lost less during the downturn and recovered much sooner (by a couple of years) because they did not have to dig out to the same degree. Moreover, it took the S&P 500 seven-and-a-half years to go from its pre-crisis peak in October 2007 to a return level equivalent to the two diversified portfolios post-crisis in approximately October 2014.

In our view, given the low current interest rates and tight bond spreads (from a fixed income perspective), and average or somewhat elevated stock valuations (from an equity perspective), a diversified portfolio should deliver a more consistent return over time.

We will continue to monitor opportunities to add diversifying strategies in 2022. In addition, integrating more diversified strategies into our current portfolios could allow for additional sources of potential return, given the possibility that rising rates could challenge traditional fixed income and equities over the coming years.

Concluding Thoughts

Markets had a strong year in 2021 after a tumultuous 2020, although this past year presented its own challenges. Corporations registered staggering profit growth in 2021, despite navigating through choppy markets fraught with pandemic-related economic issues (e.g., global supply-chain disruption, labor shortages). Rates ended the year higher, as inflation soared in the back half of the year, but a diversified sleeve of bonds still performed well.

We construct portfolios for various scenarios, which last year included higher growth and inflation than we would expect in the future. We use nontraditional bonds, equities, and other asset classes that tend to perform well in inflationary environments, and alternative and traditional bond strategies for diversification.

In 2022 we expect three themes to drive financial market returns: strong consumer spending, inflationary pressures leading to tighter monetary policy, and the evolution of the COVID-19 virus.

We expect these dynamics to lead to continued high economic growth and above-average inflation. Accordingly, our portfolios focus on flexible and nontraditional fixed-income funds, along with investment-grade corporate bonds for diversification. We also expect that the favorable environment for corporations will foster continued higher profits and a favorable backdrop for stocks.

To be clear, risks remain due to the COVID pandemic and the uncertainty of global monetary policy. Therefore, we continue to advise our clients to stick to their financial plans and avoid making emotional decisions when markets experience volatility.

If you have any questions about this month’s commentary, please do not hesitate to get in touch with us.

Previous Posts

Insights: A Strong Start to the Fourth Quarter and a Close Look at Inflation (November 5th, 2021)

Revisiting 2021 Themes and Second Half Outlook (July 6th, 2021)

Sage 2021 Investment Outlook (Jan. 4th, 2021)

Learn More About Sage

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please visit the Accolades page or contact us directly.

© 2022 Sage Financial Group. Reproduction without permission is not permitted.