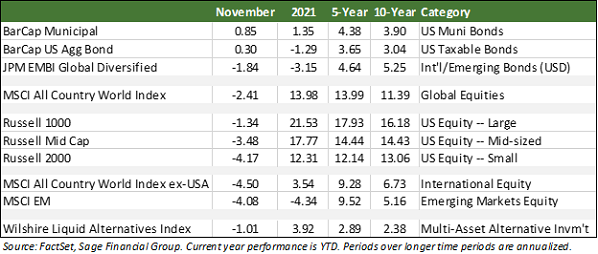

In November, stocks moved lower, and bonds provided a positive return as market participants responded to the uncertainty around the Omicron variant of COVID and the Federal Reserve’s statements that it may speed up tapering in response to inflation and strong employment.

The MSCI ACWI Index, which represents global equities (i.e., both U.S. and international stocks), declined by 2.41% in November, the U.S. large-cap Russell 1000 Index fell 1.34%, the U.S. small-cap Russell 2000 Index declined by 4.17%, and the MSCI ACWI Ex-USA Index (international stocks) posted a loss of 4.50%. While we have observed some recent volatility in equity markets in response to the Omicron variant, we remain encouraged by the medical advancements made around COVID and the fact that we better understand the disease today than we did in early 2020. As a result, we believe it will be easier to respond to new developments without implementing economically impactful shutdowns.

Core U.S. taxable and tax-exempt bonds represented by the Barclays Municipal Index and Bloomberg Barclays Aggregate U.S. Bond Index ended the month higher by 0.85% and 0.30%, respectively, as economic uncertainty towards the end of the month caused investors to reduce risk within investment portfolios.

In this edition of Insights, we discuss what we see as the most relevant developments and themes driving financial markets, including (1) uncertainty created by the new COVID variant “Omicron” and (2) the Federal Reserve’s evolving policy regarding inflation.

New Omicron COVID Variant

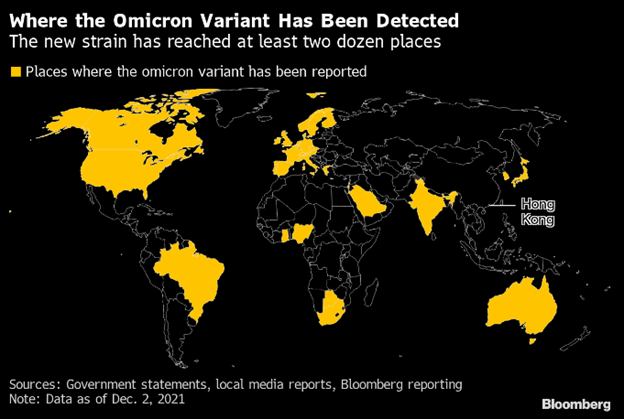

A new variant of COVID was discovered on November 11th in Botswana. On November 26th, the World Health Organization (WHO) labeled it “a variant of concern.” This is the organization’s most serious label. WHO cited that this variant has an “increased risk of reinfection…as compared to other strains, such as Delta.[1]”

The new Omicron variant has 32 mutations of the spike protein alone. In comparison, the Delta variant had only 9. According to Tulio de Oliveira, director of South Africa’s Centre of Epidemic Response and Innovation, this is a very large degree of mutation not seen within previous variants. As a reminder, vaccines target the spike protein based on its three-dimensional shape, so the more severe the topographic mutation of the spike protein, the greater the risk that the variant could evade current vaccines. As of December 1st, cases of Omicron have been identified in more than two dozen countries, as shown on the below map.

We need more data points to understand better how Omicron will impact the world beyond the market volatility experienced towards the end of November. In our view, the actual risk the variant poses will depend on three critical variables: its (1) increased transmissibility, (2) virulency (i.e., how harmful/deadly each case is), and (3) potential ability to evade current vaccines. While early reports suggest that Omicron is more contagious, some medical experts have said that the new variant is likely to be less virulent and that vaccines and prior infection may still protect against serious infection.

From a market perspective, it is still very early, and we would caution against reading too far into any particular headline or data point. For example, if vaccines are effective against serious illness or the virus is less severe than prior variants, markets could revert to prior trends (higher rates, higher equity prices). Conversely, if the virus is more impactful than feared or if vaccines are not broadly effective against serious illness, we may see the reverse (lower rates, lower equity prices). Generally, Sage’s equity allocation is diversified by market capitalization and geography while including flexible bond funds in addition to the traditional fixed-rate fixed income securities.

All said, in our view, even in a downside scenario for the virus, we think it is prudent to remember that this is not March 2020 when the virus was a complete unknown. That is, at the start of the pandemic, there was a very sharp drop in stock prices due to virus uncertainty and lockdown measures, but that “dash for cash” type of reaction from consumers and policymakers is unlikely to be repeated. For example, the White House recently stated that “no new federal lockdowns are coming[2],” while Pfizer, BioNTech, and Oxford stated that they expect vaccines to remain effective against serious illness. Moderna has begun developing Omicron boosters with plans to start clinical testing in 60-90 days. Additionally, the medical community now has COVID treatments such as monoclonal antibodies, dexamethasone, remdesivir, etc., along with others in development, such as Merck’s antiviral, which is likely to get approval later this month. While governments may have exhausted most of their fiscal powers over the last two years, we may not need large government programs. The significant medical advances and a dramatically improved understanding of the virus to us mean that it is highly unlikely governments will impose the preventive lockdown measures of 2020. We will closely follow the situation and pass along relevant information as we find it.

Federal Reserve Policy and Inflation

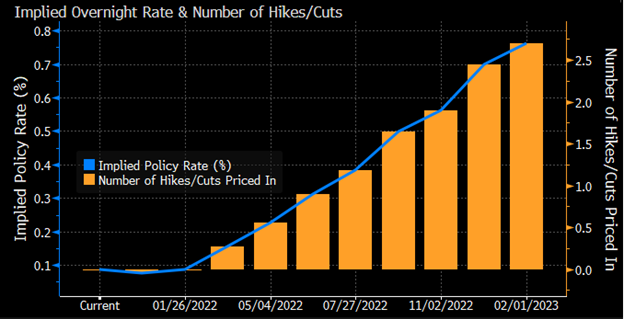

In early November, the Federal Reserve met and decided immediately to begin “tapering” their monthly bond purchases. Each month, since March of 2020, the Fed has been buying $80 billion of U.S. government bonds and $40 billion of mortgage-backed securities ($120 billion total). Bond buying programs tend to suppress interest rates, as the central bank is an additional buyer in the marketplace (i.e., extra incremental demand). At the November meeting, Fed Chairman Powell announced the U.S. central bank would begin slowing its bond purchases by $15 billion each month due to an improving labor market and higher than targeted inflationary pressures. This taper would lead to the Fed no longer buying bonds by June 2022, and perhaps even sooner if it deems necessary. This taper precedes any potential interest rate hikes that may come in the back half of 2022 and represents a moderately less accommodative Federal Reserve moving forward.

On inflation, we wrote earlier this year that that price pressures were likely to begin to wane by the end of 2021. While we still believe inflation is unlikely to persist over the long term, the period of higher inflation has gone on longer than expected, largely due to lingering COVID disruptions in Southeast Asia contributing to general supply chain disruptions in the U.S. However, as we expected, inflation has led to higher corporate profits due to companies having the pricing power to offset input cost increases for the time being (i.e., inflation has been a positive for equities). Also, we have seen the increases in rates become modestly detrimental to bond returns, primarily due to demographics creating a high demand for yield.

Further, as shown below, the key factors contributing to higher inflation readings today are expected to become a drag on inflation by mid-2022. That is, we would expect that the ~4% inflation (via Core PCE) that we are experiencing today should trend below 3% by mid-2022.

Some pockets of inflationary pressures could prove to be stickier than originally anticipated. However, we still think that structural headwinds for inflation are in place, namely aging demographics and increased technology leading to consumer choice and price transparency. For example, the proportion of the population above the age of 65 (the more price-sensitive part of the population) has grown from single digits in the 1960s to 17.5% in 2021. This increase should exert pressure on rising prices.

In addition to supply and demand forces within the market, we believe the Fed continues to have the adequate tools to fight inflation, if necessary. As shown below, markets currently expect two 0.25% increases in the Fed Funds rate by the end of next year. Said differently, market participants now expect the Fed to raise rates twice next year.

This is not to dismiss claims of disruptive inflation, as we do think that wage gains may prove to be stickier than some specific products and services. COVID also seems like it will linger throughout the winter and may further delay normalization in some sectors. Labor may continue to be an issue, although we expect a return of 2 million people that left the U.S. labor force by Q1 2022 and return to pre-pandemic employment levels in the middle of 2022. In the case of higher inflation than expected, the Federal Reserve has the ability to dampen inflation by slowing demand in the economy. We think it will be able to do so much more easily than in the 1970s, primarily due to demographics and technology. That is, the Fed does not need to raise rates by a sizable magnitude to see a demand reduction.

Overall, while inflation may stay elevated above 2% for some time, we believe it is still likely that we should see a deceleration in inflation (i.e., disinflation) in 2022 as some of the temporary pressures begin to fade and the Federal Reserve tightens its monetary policy. COVID-related issues have prolonged the supply-chain disruptions, but these have improved somewhat, particularly in Asia, as countries such as Vietnam have abandoned “zero COVID” policies. In addition, most U.S. corporations seem focused on solving supply-chain issues within the U.S., alongside the government task force. In terms of Fed policy, we think its taper of bond purchases will be completed by April and that the first-rate hike could occur in the second half of 2022.

Closing Thoughts

In November, the market volatility that we saw was primarily a result of uncertainty in response to the new COVID variant, Omicron, and Federal Reserve policy. It is too early to know what will happen regarding the new variant. Still, we expect to learn more about its transmissibility and virulence and the effectiveness of prior vaccine/infection in preventing severe illness over the coming weeks. Additionally, we continue to closely watch the Federal Reserve’s actions regarding its dual mandate of full employment and price stability. Fed Chairman Powell is focused on curtailing inflationary pressures as of late by pulling back on the bond purchasing program and likely raising rates 1-2 times in 2022.

While we have seen some volatility in recent weeks related to the developments discussed in this piece, we continue to believe that the U.S. economy is on solid footing. Moreover, both U.S. consumers and businesses remain extremely well-capitalized, which is likely to boost economic activity over the next 12 months. To be clear, risks remain as the COVID pandemic continues and upcoming events such as the debt ceiling could potentially create fresh uncertainty. Still, we advise our clients to stick to their financial plans and avoid making emotional decisions when markets experience volatility.

If you have any questions about this month’s commentary, please do not hesitate to get in touch with Sage at 484-342-4400 or thecohns@sagefinancial.com.

Previous Posts

Insights: A Strong Start to the Fourth Quarter and a Close Look at Inflation (November 5th, 2021)

Insights: Market Commentary for September 2021 and A Look Ahead (October 5th, 2021)

Revisiting 2021 Themes and Second Half Outlook (July 6th, 2021)

Learn More About Sage

[2] Reuters: Biden warns against Omicron panic, pledges no new lockdowns

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please click here or contact us directly.

© 2021 Sage Financial Group. Reproduction without permission is not permitted.