[Read Sage 2022 Investment Outlook]

Introduction

2020 was a year that no market strategist could have foreseen. Within financial markets, nearly all major asset classes globally exhibited positive returns despite extreme volatility, an unprecedented health crisis, a historic economic downturn, a hotly contested election, social unrest, and other systemic shocks. The 11-year U.S. bull market came to a crashing halt in March. Yet, the U.S markets rebounded, reaching pre-COVID market highs in August and continuing their upward trajectory through the end of the year. Despite success in the financial markets, the year tragically was one in which over 350,000 Americans died in a global pandemic. As the global economy continues to recover and the health crisis begins to ease, Sage remains cautiously optimistic about the future environment. In this 2021 annual letter, we recap how the financial markets behaved in 2020 and share our thoughts on how 2021 could unfold.

2020: A Year in Review

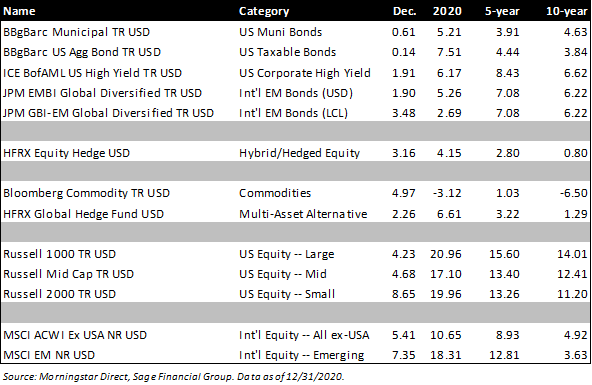

Nearly all major asset classes posted positive returns in 2020. In fixed income, the Bloomberg Barclays U.S. Aggregate Index, advanced 7.51% for the year, lifted by falling interest rates following the Fed’s actions to lower the yield curve and soften the economic downturn. Lower yields boosted investment grade bond returns. U.S. high yield bonds gained 6.17%, thanks to an economy proving to be more resilient than originally feared in March when below investment grade bonds dropped approximately 20% in a matter of weeks. While the number of bond defaults did climb in the second quarter of 2020, the wave of defaults some expected did not occur, and high yield bonds outperformed. Domestic large cap equities, as measured by the Russell 1000 Index, finished up 20.96% for the year. International equities, as measured by the MSCI ACWI Ex-USA Index, gained 10.65%, and the MSCI EM Index, measuring emerging market equities, advanced 18.31%. After a tumultuous start in Q1, global equities rebounded throughout the final 9 months of the year.

2020 began in a relatively positive manner, as the U.S. and China ended a tumultuous, multi-year negotiation process and reached a trade agreement. At that time, many market strategists expected trade tensions to decrease, globalization to continue, growth to accelerate, and volatility to decrease. Instead, the world experienced a global pandemic and shelter-in-place orders that ground the economy to a halt. Despite being hit earliest by the pandemic, China was the only major country to report positive GDP growth in 2020. While we do not have the final GDP growth statistics, it is widely estimated that China grew 2.0-3.0%, while the U.S. declined 2.5-3.5%. Other major developed countries fared worse than the U.S., with the Euro Area declining 7.0-8.0%, Japan falling 5.0-6.0%, and economic activity in the U.K. dropping by a staggering 11.0-12.0%.

Three central themes drove markets in 2020, which many readers may find familiar from our communications throughout the year: (1) monetary stimulus, (2) fiscal stimulus, and (3) biology (i.e., virology and epidemiology).

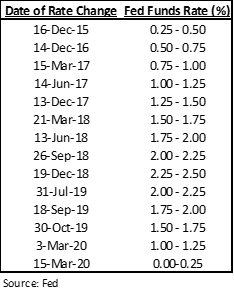

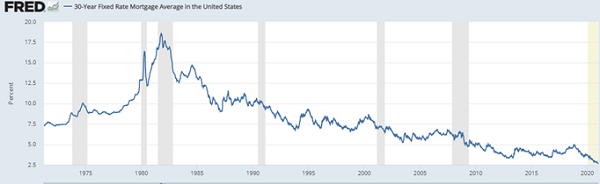

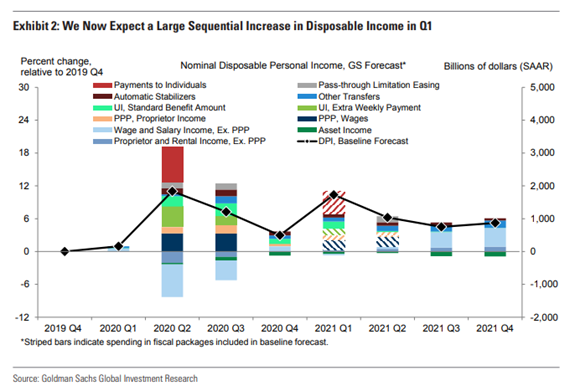

Monetary stimulus came as global central banks decreased borrowing rates and increased asset purchases (i.e., quantitative easing). The Fed lowered the Federal Funds rate to 0% in March, which effectively lowered the yield curve’s short end. Fed Chairman Powell also kicked off a new quantitative easing program that injected massive amounts of liquidity through bond purchases and helped push down the long end of the yield curve. As shown below, the Fed acted aggressively in early March to cut the Fed Funds target rate from 1.50-1.75% to 0.00-0.25% in just 2 weeks, including a full 1.00 percentage point cut at the emergency meeting on 3/15/2020.

The lowering of short-term rates discourages saving in cash due to the absence of yield while encouraging investment in riskier assets such as stocks or high yield bonds and/or increased consumer spending. Lower long-term rates decrease the cost of borrowing for consumers and companies alike. Currently, consumers can refinance a home for 30-year mortgage rates in the 2.75-3.0% range, which would have been unheard of even 5 years ago. Consumers who refinance can, in turn, increase discretionary spending. Given that consumer spending comprises approximately two-thirds of the U.S. economy, these measures are extremely powerful in boosting the economy and market returns. As shown below, through 2020, 30-year mortgage rates are well below any prior recessionary period over the past 50 years.

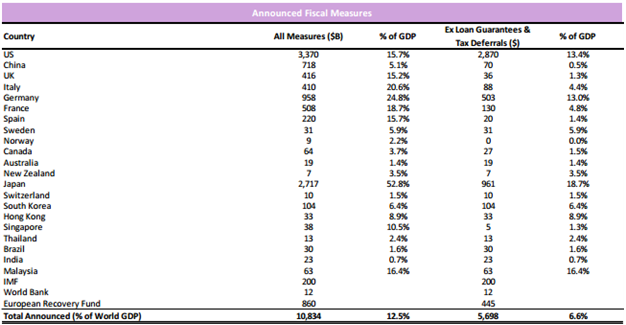

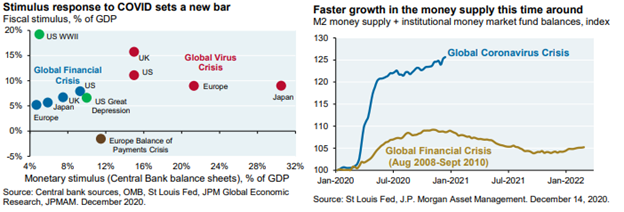

Fiscal stimulus was a second major driver of financial market returns in 2020. To call the fiscal policy response in 2020 “massive” would somehow be an understatement. As shown in the chart below, many major countries around the globe launched fiscal measures in excess of 10% of GDP. The U.S. fiscal response was the largest since World War II, totaling 15.7% of GDP. The packages enacted throughout the year included money sent directly to citizens, aid for businesses, enhanced unemployment benefits, and funding for hospitals, education, and vaccines. These measures provided support for economies around the globe that dropped as much as 8-12% through the second quarter of 2020 when shelter-in-place orders were widely in place. Without such drastic measures, the economic impacts of the shutdowns would likely have been more permanent. While many businesses have sadly shut their doors for good, many others were saved by the Paycheck Protection Program and will remain operational for years to come.

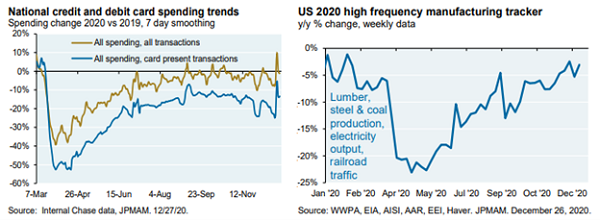

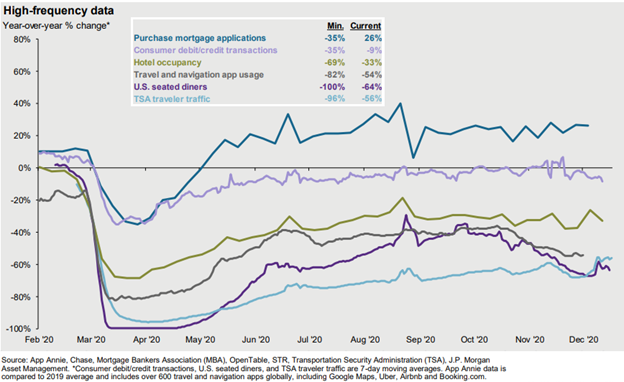

Biology (i.e., virology and epidemiology) was incredibly important to the economy and market returns in 2020. When the virus first catapulted to the forefront, the mortality rate was unclear and known effective treatments were limited. Fear was palpable, particularly in March and April when governments implemented wholesale lockdowns and scientists struggled to determine the potential impact of the virus. In what amounted to a herculean effort by the scientific community, healthcare professionals learned how to treat the virus better and reduce its mortality rate through the use of specific antivirals and steroids, among other measures. Drug companies developed monoclonal antibody treatments to reduce hospitalizations as well as multiple vaccines over an unprecedented timeframe. Pfizer and Moderna each received approval from the FDA in 2020 for vaccines that had a greater than 95% efficacy, which was higher than expected. The vaccine is currently seen as “the beginning of the end” in terms of the pandemic. As shown below, “high-frequency” data points such as consumer spending and manufacturing traffic bottomed in April, when shelter-in-place orders were in place and then rose in line with positive news about vaccines. The progress on multiple fronts allowed the U.S. economy to open with more targeted restrictions, which helped aid economic activity.

Over the long-term, real economic growth, inflation, and productivity growth (i.e., innovation) drive financial market returns. On the other hand, the effect short-term returns have on the markets is extremely dynamic and sometimes irrational in nature.

If short-term market returns were directly tied to economic growth, inflation, etc., it would be quite easy to predict the behavior of baskets of securities. What confounded many market participants and strategists last year is that markets are forward-looking, cash-flow discounting machines and do not necessarily care about current conditions. For example, while unemployment has remained high on a historical basis, and many strategists in the financial media were predicting that a second decline was likely, the U.S. economy was consistently adding jobs beginning in May. Further, a vaccine was highly probable after efficacy data was released over the summer, taking “worst-case” scenarios out of the equation, which in turn lifted markets.

In practice, the short-term returns of any individual asset class are nearly impossible to predict consistently, which is why Sage’s best thinking recommends a diversified approach to portfolio construction, and we prefer to take longer-term views on asset class returns when making investment decisions. We do not try to time the markets, but rather stick to a disciplined strategy that involves rebalancing through volatility.

2021 Outlook

We expect 2021 to be a year marked by global synchronized growth, particularly in the back half of the year, assuming an orderly recovery from the pandemic and no surprising economic developments. While risks remain and are outlined in this outlook, our base-case scenario is that the U.S. economy rebounds from a 3.0-3.5% contraction in 2020 to post a gain of 4.5-5.5% in 2021 year-over-year.

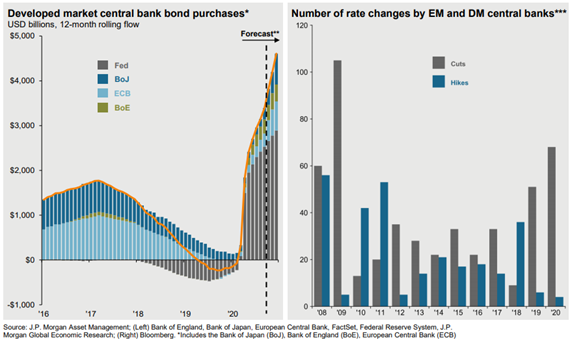

Such a positive environment is not guaranteed, and we outline the risks on the left side of the table below. In our view, the most prominent risks pertain to (1) challenges in rolling out the COVID vaccine or a mutation that evades the vaccine, (2) potential increased regulation of corporations, including big technology, and (3) the negative effects associated with interest rates or inflation, which could lead to compressed profit margins, lower equity valuations, and potentially restrictive monetary policy.

Conversely, a more positive market environment also remains possible and is outlined on the far-right column in the table below. A market environment that surprises to the upside would likely include (1) a faster than expected vaccine rollout leading to a meaningful reopening of the economy in the first quarter of 2021, (2) a weaker dollar, boosting U.S. exports and international asset prices (from a domestic investor’s perspective), and (3) U.S. / China tariffs are lifted following an agreement between both nations.

Major Themes

We expect six major themes to have the most impact on 2021: (1) accommodative monetary and fiscal policy, (2) the vaccine rollout, (3) consumer spending driven by pent up demand, (4) the acceleration of secular trends, (5) inflation, and (6) a new political regime in the U.S. These themes drive our outlook on major asset classes around the world for 2021.

Coordinated Monetary and Fiscal Policy Leads U.S. Recovery

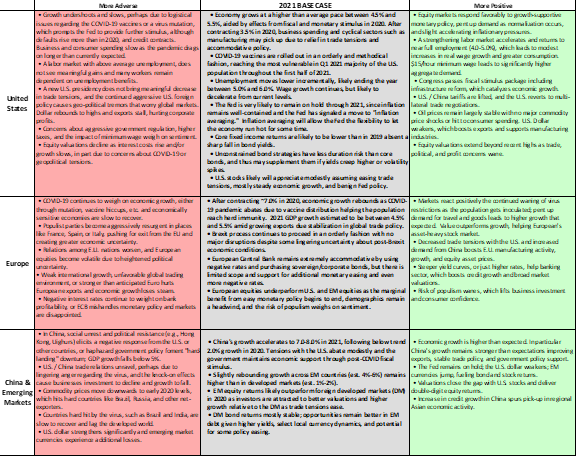

In our view, stimulus remains the most important thing to watch in terms of short-term market activity and the long-term possibility of returning to pre-COVID GDP levels. The coordinated policy response has been unique to this recession, perhaps because the economic environment resembles a war more than a natural recession. The most recent $900B fiscal stimulus package follows three consecutive quarters of accommodative fiscal policy from Congress. The largest components of fiscal policy remain direct payments to individuals and enhanced unemployment benefits. At the end of 2020, the year-over-year increase in disposable income rose approximately 3%.

In the U.S., many individuals and businesses have elevated cash balances as a result of stimulus checks distributed to the public, enhanced unemployment benefits, and the fact that many large corporations temporarily paused capital expenditures and dividend payments in order to conserve cash in the face of uncertainty. From the perspective of the financial markets, cash should provide an important tailwind for consumer spending and business capex and thus help dampen market volatility. As shown below on the left, commercial deposits spiked approximately $3tn around the time of the stimulus payments. The chart to the right illustrates the elevated cash levels in November versus early 2020 in terms of money market funds.

Monetary stimulus specifically works by keeping rates low. Lower rates enable individual consumers to afford higher home prices and, for those who own homes, refinance at lower rates (i.e., more cash in consumers’ pockets each month). Low interest rates for businesses lower the cost of debt, which can encourage companies to finance more growth projects. All of this activity should positively impact the economy.

Further, in terms of the effect on U.S. GDP, the rapid policy response has provided a supportive backstop. Following the Great Financial Crisis (GFC) in 2008, a delayed response from Congress contributed to the long, slow recovery of the U.S. economy. Through measures targeted at the labor market and price stability, it is more likely than not the most significant COVID-related economic headwinds have passed. As shown below on the left, fiscal stimulus in 2020 far exceeded GFC levels. As shown below on the right, the swiftness of the increase in money supply during this “Global Coronavirus Crisis” dwarfed the GFC in both speed and size

Given the swift action from global central banks and governments, the cumulative decline in GDP was less than 20% of what occurred in the Great Financial Crisis, which should limit permanent economic damage and allow the U.S. economy to recover to 2019 levels by mid-2021. Company profits, which are a slice of GDP, also are expected to recover and reach 2019 levels in 2021.

Vaccine rollout mitigates the COVID pandemic

As of the beginning of 2021, the U.S., U.K., and Canada have approved the Pfizer/BioNTech and Moderna vaccines. They are currently being distributed across several countries, and the U.S. is currently giving the first shots to healthcare workers and long-term care residents. Currently, the U.S. is administering approximately 500 thousand shots per day, and recently Dr. Anthony Fauci said he expects to grow that number to 1 million per day in the coming weeks.

In our view, the vaccine is a true game-changer in that it provides more assurance for households, companies, and governments that we are getting closer to a post-Covid-19 economy. While no one knows exactly when everyone will be inoculated, the high likelihood of approaching a return to normalcy should dampen volatility and provides Sage with increased confidence that the economy will continue to grow in 2021.

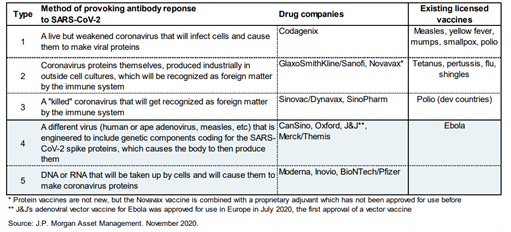

Both Pfizer and Moderna vaccines have demonstrated greater than 95% efficacy, and Moderna’s version does not have some of the logistical challenges that the Pfizer vaccine does (e.g., cold storage). The next promising vaccine candidates are coming from Johnson & Johnson and AstraZeneca/Oxford, who are expected to release data on their candidates in the first quarter 2021. Below is a list of Top 10 advanced vaccine candidates.

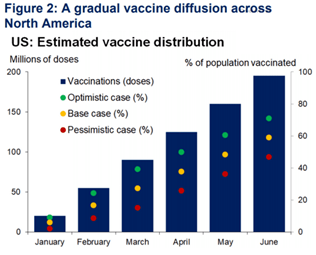

The approval of the Pfizer and Moderna vaccines were historic moments and likely the beginning of the end for the COVID-19 pandemic. In terms of the financial markets, the approval and administration of vaccines likely removes the worst-case scenario that we would need to achieve natural herd immunity. As a result of a vaccine, the volatility experienced in early 2020 is unlikely to be repeated, but distribution will still affect the course of a 2021 rebound. Current estimates suggest that frontline healthcare workers and long-term care residents will be inoculated by February, with 65+-year-old people and other essential workers next in line. The base case is that approximately 40% of the adult U.S. population will be inoculated by April. Combined with natural antibodies, this number may bring us close to scientific estimates of herd immunity.

The likelihood of further vaccine approvals and current estimates of vaccine distribution suggests that the first quarter will be focused on inoculation, and the following months will be mainly about reopening. With the high transmission rate currently and vaccine distribution in progress, the end of this horrible ordeal is in sight and, in our view, will lead to a spending boom in 2021.

Consumer spending is driven by pent-up demand

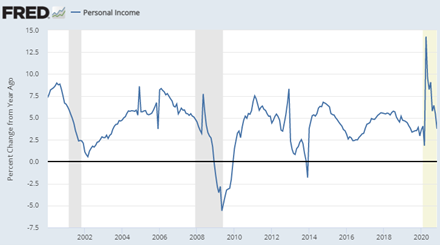

In a typical recession, income growth declines for workers as the labor market becomes weaker and employers avoid raising wages and decrease hiring. This can be seen in a metric called “personal income,” shown below over the past 20 years. However, the amount of fiscal stimulus provided in the 2020 COVID-induced recession has kept personal income growth higher than pre-recession levels. Further, the chart below does not capture the $600/month distributed in early January.

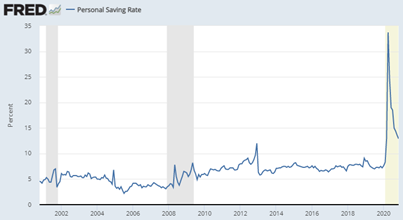

Another metric that is worth watching is the “personal saving rate,” which captures the amount of income that workers save and spend. This measure of savings typically rises modestly in recessions, as consumer sentiment declines and people opt to save precautionarily. In 2020 the savings rate spiked significantly, and it remains extremely elevated (i.e., current 13% savings rate is higher than any point from 2000-2019).

As shown below, high-frequency data at the sector level show activities have rebounded from March lows, although less “socially-distant” activities remain depressed. For example, as of 12/31/2020, the number of travelers screened at TSA Checkpoints was down 56% year-over-year, while the number of mortgage applications was up 26%. While travel, hotel occupancy, and indoor dining remain suppressed, travel frequency is increasing from March lows, and we expect it will return to pre-pandemic levels in the second half of 2021 as the population is inoculated and consumers want to resume activities that include travel. Currently, we think that the many individuals who have not lost income and are saving more will want to “make up for lost time” by going on vacation, out to dinner, etc., once they receive the vaccine.

Taken together, these factors (higher income, higher savings, and pent-up demand) suggest that there is a significant amount of cash in consumer bank accounts to be spent when regular activities can resume. We expect that normalization will occur in 2021, and consumer spending growth to fuel economic growth. In terms of financial markets, we believe that the primary beneficiaries of this pent-up demand are equities and lower-quality bonds.

Acceleration of secular trends

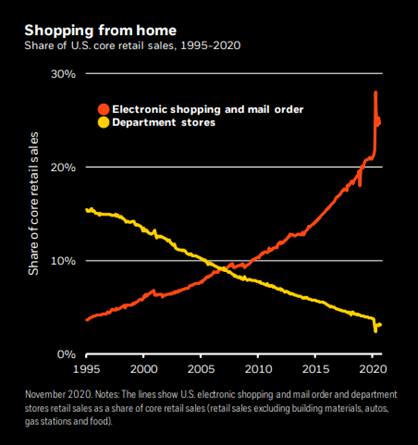

Where our first three themes focused on macro events (i.e., broad market and economic implications), several trends also caused major shifts under the surface. The pandemic and associated shifts in consumer behavior acted as a spark that accelerated many secular trends that were already in place. For example, e-commerce as a proportion of U.S. retail sales has been steadily rising since the late 1990s. It spiked in the midst of the pandemic and remains elevated.

This acceleration benefited larger companies that had the infrastructure in place and/or could adapt to the shift in the marketplace. One clear beneficiary is Amazon, but companies such as Home Depot, Target, and Wal-Mart all were able to quickly meet consumers’ desire not to enter a bricks and mortar store. Other companies such as PayPal and Square benefitted from consumers not wanting to hold physical money. We expect many of these trends to continue in 2021, although valuations in sectors that have benefited remain elevated. Markets such as the U.S. and emerging markets, which have a higher concentration in technology stocks, are positioned well to take advantage of these trends.

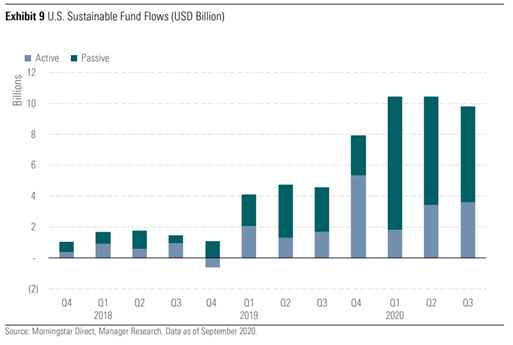

Another secular trend that has been accelerated in the investment space is sustainable investing, or Environmental, Social, and Governance (“ESG”). Sage thinks that the trend towards sustainability will continue to pick up steam in the coming years, given the importance many people place on issues such as climate change (Environmental), inequality (Social), labor standards and fair wages (Social), and diverse boards of directors (Governance). As shown below, new investments into sustainable funds has increased five-fold since 2018, and options for sustainable investments in the U.S. have been improving both in quality (performance) and the impact they have on companies.

Inflation

There is little evidence that inflationary pressures will drive up prices excessively in the near term in terms of inflation. We think inflation will rise modestly in 2021, but not to the point where the Federal Reserve will need to act. In fact, the Fed has formally adopted a change in the way it targets inflation, namely, that it will follow average inflation targeting as opposed to its current policy, better described as targeting a 2% inflation every year regardless of previous inflation rates. Under the new “average inflation targeting” process, the Fed would aim for 2% inflation on average over a multi-year business cycle. In practice, this means that inflation must run a little higher than 2% during expansions to make up for an expected or actual shortfall during periodic downturns.

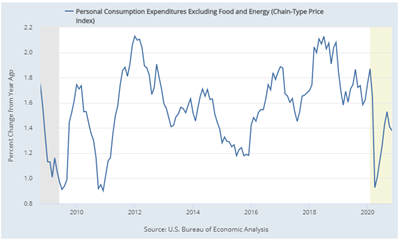

Since the beginning of the current economic cycle, for instance, the Fed’s preferred measure of inflation, the core PCE price index, has stayed at or below its target of 2% in all but two brief periods, which occurred in 2012 and 2018. In contrast, a move to inflation averaging may mean that the Fed would allow inflation to run at 2.5% (or higher) for an extended period. In practice, this policy implies it will take a much higher level of inflation, which we have not seen in more than a decade, for the Fed sto implement aggressively restrictive monetary policy through higher interest rates.

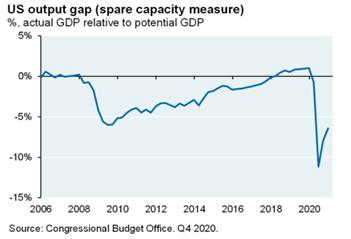

Further, it is important to note that inflation tends to be muted following recessions for various reasons, including slow wage growth, excess capacity, etc. The output gap, which measures excess capacity, remains very low and is still below the depths of the Great Financial Crisis of 2007-09 (shown below).

While our core view is that we will not see significantly higher inflation in 2021, the exact ramifications of the coordinated monetary and fiscal stimulus programs are unknown at this time. In our view, inflation is a possible risk at the current time as opposed to a probable event. A meaningful rise in inflation may return in future years, but we consider it unlikely to occur in 2021.

A new political regime in the U.S.

President-elect Biden’s win was certified by Congress on 1/6/2021, and the results of the Georgia Senate elections have placed control of the Senate in the hands of the Democrats.

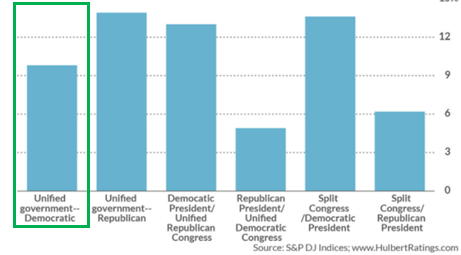

Politics affect market returns in the short-term, but over time, history has shown them to be largely inconsequential. Over the course of American history, the variance we see in returns when regimes change mostly depends on factors other than politics (e.g., economic growth, inflation, innovation, etc.).

The markets could have a mixed reaction to the major agenda items that Democrats may want to pass. However, some of the potentially damaging items are unlikely to be supported by some Democrats. Below is a list of what we see as the most impactful items for financial markets:

- Further fiscal stimulus:

- The near-term implications of this new political regime are that Congress is likely to pass more fiscal stimulus, including state and local aid and further support for consumers.

- Such a deal could also include credits for renewable energy infrastructure. We think it will be short of a “Green New Deal,” but it will likely be a large deal ($1 trillion or more).

- Higher minimum wage:

- Our view is that a higher minimum wage (e.g., $15/hour) is likely to be a priority for President-elect Biden and Congressional Democrats.

- Increasing the minimum wage will increase aggregate demand and be a net positive for some companies, although a negative for those with thinner margins.

- Higher corporate and personal taxes:

- A change in tax rates by a Democratic administration is typically a chief concern of most market participants. Still, a Biden administration is likely to release a relatively moderate agenda in this regard.

- Our view is that Biden will likely propose increasing the corporate tax rate from 21% to 28% (mid-way between 21% now and 35% before 2017) and an increase to the top tax bracket to at least pre-2017 levels (from 37% to 39.6%), but not in his first two years. 2021 will likely be a year to focus on recovery and raising taxes in a mid-term election year (2022) seems improbable in our view.

- Regulation and Anti-trust Actions:

- We expect that certain companies and industries (e.g., technology) will face additional anti-trust scrutiny over the next few years.

- Our view is that despite increased scrutiny, most of these companies offer products that people like and/or are free (e.g., Google, Facebook). While these companies have some monopolistic characteristics, they do not dominate industries in the same way that AT&T and other previously broken-up companies did in the 1980s.

- De-escalation with China:

- It is unclear how the U.S. will handle trade relations with China at this time, but we think that President-elect Biden will somewhat de-escalate the situation and that the possibility of incremental tariffs in the future is off the table.

- We think that the President-elect will favor multi-lateral negotiations as compared to President Trump’s bilateral strategy.

In aggregate, we think these policies could be viewed positively by financial markets, although higher corporate taxes remain a risk for profits. Further fiscal stimulus also presents a risk of higher interest rates, as the budget deficit is rising, which could negatively affect large cap stocks.

Fixed Income Outlook

In Sage’s view, accommodative monetary policy and continued steady economic growth will lead to a range-bound fixed income environment in both (1) interest rates and (2) credit spreads (i.e., additional return for which investors are compensated above government bonds). However, some risks are present, particularly that accommodative fiscal policy may expand government budget deficits.

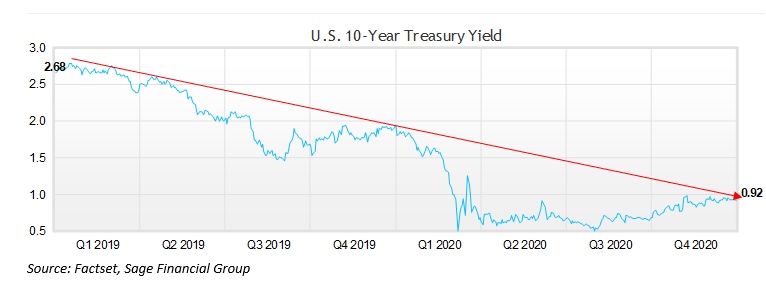

Interest rates have fallen significantly over the past decade due to central bank bond purchases, along with expectations for muted inflation and slower growth. There has been a demand for bonds from insurance companies, endowments, foundations, etc. As shown in the chart below, the U.S. 10-year Treasury yield fell precipitously throughout the first 3 months of 2020 but steadily rose throughout the rest of the year.

Looking forward to 2021, in the context of a growing economy but accommodative central banks, Sage expects rates to continue to rise modestly. Still, the demand for yield should keep rates lower than we have seen in recent years. Yields could creep higher due to improving economic conditions and expanding government deficits, but we think they will remain contained throughout 2021.

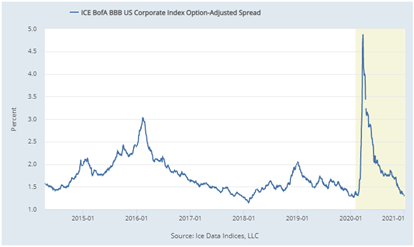

The other element of fixed income returns is known as bond “spreads,” which remain low on a historical basis both in investment grade and high yield. Bond spreads measure how much investors are being compensated for investing in risky debt versus government debt, and it tightens (i.e., get lower) to reflect improving economic conditions. When spreads get lower, bond investors benefit. When spreads widen (i.e., get higher), bond investors see losses. As shown below, the spreads for lower quality investment grade bonds have already reached the incredibly tight levels seen pre-pandemic. Sage does not think that spreads can get significantly tighter, and this initial condition will create a lower total return environment for fixed income investors going forward.

Further, there are some risks in corporate credit, particularly as it pertains to bonds with longer duration, which is a measure of interest rate sensitivity. As fiscal deficits continue to expand, we expect that rates will rise modestly in 2021. While it is not our base case view, bond prices could see declines if interest rates were to rise with inflation. Bonds with more interest rate sensitivity (i.e., duration) may see declines in value if interest rates rise. These two reasons – tight corporate bond spreads and historically low rates – are why we continue to remain “shorter” on the bond spectrum than we would expect over the long-term and opt to remain flexible in our allocation through the use of unconstrained bond funds.

Overall, we think that rates will rise modestly over the next year but largely trade within a tight range. Demand for yield will likely cap rates below what we saw earlier in the current economic cycle. From a spread perspective, we think that conditions can improve to further spread compression in high yield, but historically low yields limit the upside opportunity. Our base case is that an environment of slightly higher rates and stable spreads will likely leave fixed income investors with a positive return in 2021, but lower than experienced in 2020. Risks are present in fixed income, particularly in longer maturity assets, which is why we continue to utilize unconstrained bond funds.

Equity Outlook

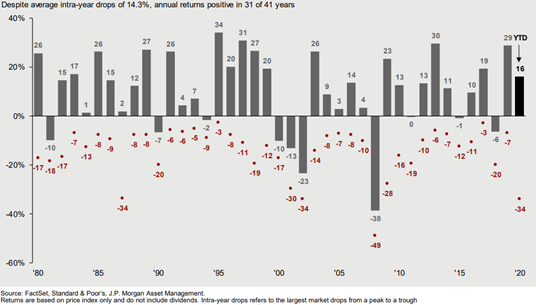

Following 2019, when equities rose on a straight line, 2020 was more volatile. As shown below, U.S. large cap stocks dropped 34% intra-year but finished up 16%, as measured by the price of the S&P 500 Index excluding dividends. While equity markets have had a sharp rally, we continue to think that we are in the midst of a multi-year expansion on the back of the recovery, as opposed to a “cyclical catchup.” As noted above in our section on themes, pent-up demand and cash balances remain high for consumers. The vaccine rollout should help investor sentiment and dampen volatility, but the recent and future fiscal stimulus measures are likely to boost profits in 2021 via state/local aid, infrastructure spending, and enhanced unemployment benefits.

As we survey global conditions, we think that easing trade tensions, accommodative coordinated monetary and fiscal policy efforts, and an uptick in global economic growth will boost stocks. However, the gains are likely to be lower than in 2020, partly because of higher valuations. Companies that are focused on faster-growing emerging markets are likely to lead the way. At the same time, Europe may remain challenged due to structural issues such as demographics and fragmented politics, along with the ECB having very little room to boost growth through monetary policy.

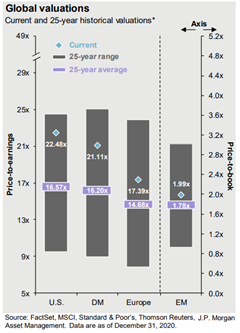

As you can see from the graph below, as of 12/31/2020, U.S. stocks (measured by the S&P 500) were trading at a next-12-month-valuation level above the index’s historical average over the last 25 years. The same holds true for developed market stock indices as a whole, with Europe in particular just peeking out above its average valuation level.

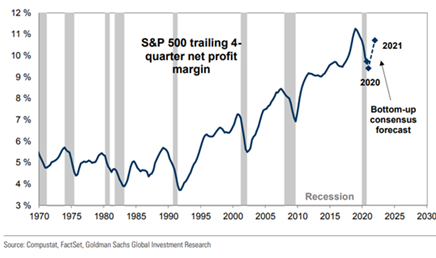

Looking at earnings estimates on U.S. large cap stocks, market participants are expecting 2021 earnings per share of large cap stocks to match 2019 earnings and 2022 to see a jump of 12-15%. These growth estimates suggest higher than average valuations are currently warranted. Further, the estimates may have some upside if profit margins expand. The ongoing decline in margins is on track to rival the largest margin contraction in decades, but we expect a rebound in 2021. As of Q1 2021, trailing 12-month profit margins are expected to decline to 9.8% from a high of 11.2% in 2019. However, in 2021, we think it is likely that profit margins will expand back to near 2019 highs, driven by synchronized global growth and pent-up demand in consumer spending. As the labor market continues to strengthen, wages are not likely to increase substantially, but newly employed workers’ increased income should provide a tailwind.

E.M. stocks are closest to their historical average valuation and support why we are constructive on E.M. stocks currently. Against the backdrop of decreased U.S./China trade tensions, coordinated fiscal and monetary policy, a recovering global economy amid vaccine distribution, and China’s relative strength, E.M. equities appear to be the more attractive opportunities within global equities.

Two related risks to our positive outlook on equities are (1) heightened optimism and (2) the possibility that interest rates could rise, lowering valuations.

A risk in our view to 2021 performance is the current frothy market sentiment. Recently, Bank of America’s December Global Fund Manager Survey revealed that optimism about “risk-on” assets (equities and commodities) has seen a significant increase to a net 69%, the highest since February 2011. Optimism specific to stocks now stands at a net 51%, the highest level since January 2018. A record net 78% of participants expect earnings will improve in 2021, while 42% expect the availability of vaccines to start positively impacting the economy in 2Q21.

After a year of strong returns for equities in 2020 and the currently high valuations, it would not be unexpected to see some bouts of price volatility or a correction to occur in 2021. Lower interest rates are hard to understate in importance and have wide-ranging implications from consumer lending to asset valuations.

Overall, we think that equity markets have many tailwinds, including improving economic growth and a better trade environment. However, we take both of these factors — global valuation metrics and record-high optimism — as signals to investors to have more modest expectations about returns for the next 12 months. These expectations are still positive, but there are reasons to keep them modest.

Portfolio Implications

Our outlook for 2021, as outlined above, influences our thinking about portfolio positioning in the following ways:

- Fixed Income:

-

- United States: In the U.S., bond yields will likely rise from historically low levels but not suffer a sustained spike higher. With expanding fiscal budget deficits and the potential for above-trend economic growth, we have slightly less duration in our portfolios than we would generally expect to have over the long term.

- Foreign bonds: The persistence of low and in some cases negative bond yields in developed market countries such as Japan and Europe, renders E.M. bonds, with higher yields and a backdrop of likely increasing growth, more attractive to us on a relative basis. Many E.M. bonds offer yields above 5-6%, which we think adequately compensates investors for the risk. A decline in trade disputes should also be supportive of international assets.

- Alternative Investments:

-

- In our view, given low current interest rates, tight spreads (from a fixed income perspective), and average or somewhat elevated stock valuations (from an equity perspective), we will continue to monitor opportunities to add diversifying strategies in 2021.

- Incorporating non-traditional asset classes and strategies into our current portfolios could allow for additional sources of potential return since we think portfolios may not be able to rely as heavily on traditional stocks and bonds in the coming years as they do now.

- Equities:

- United States: Given our outlook for above-trend (4.5-5.5%) GDP growth in this continued recovery, we anticipate maintaining our slight overweight to U.S. stocks with a relative bias for small-caps.

- Foreign stocks: Based on lower valuations, we have a bias towards overweighting foreign equities. E.M. stocks, specifically, may present attractive return opportunities because of fast-growing populations, fair valuations, and commercial innovation.

Concluding Thoughts

We expect global growth to recover from the 3-4% decline in 2020 to grow at a pace higher than 5% in 2021. This expansion may be led by China and other emerging markets. A combination of easier monetary policy/financial conditions and stabilization in trade disputes should provide a backstop that allows the U.S. economy to avoid recession and continue to grow. While we think that a recession in the U.S. is unlikely, we do think that full equity valuations (at or above 25-year averages) and the possibility of delays in the rollout of vaccines could introduce the risk of corrections at times. Overall, we believe the current recovery will continue and even accelerate in the back half of 2021, led by more accommodative monetary policy by other global central banks, improving employment, and pent-up demand all helping boost consumer spending.

2020 was a reminder that no one can predict how the markets will behave in the short-term or what political and world events will unfold. We are ever mindful of our clients’ long-term goals so that we can position their portfolios for a wide range of potential present-day economic outcomes. While markets experienced massive volatility in 2020, maintaining a balanced strategy that did not react to any single data point or price tick rewarded many investors. Over multi-year periods, stocks and other related investments are still likely to be the highest returning asset class despite a series of mostly unpredictable ups and downs along the way. We continue to recommend a mix of bonds and other diversifying investments not because of a guarantee that one of them will perform spectacularly in a given year, but because history has shown that over time, portfolios appropriately mixed with diversifying assets are more likely than not to help clients advance toward their financial goals in a manner that is consistent with their risk-return profile.

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. Get more specific information about these rankings, or contact us directly.

© 2021 Sage Financial Group. Reproduction without permission is not permitted.