As we approach the year’s final weeks, we want to share our thoughts on the current market landscape and recent positive developments.

What Has Happened?

In early November, optimism surfaced around the likelihood that central banks, including the U.S. Federal Reserve (Fed), were finally getting ready to end a historical period of interest rate increases. Globally, the central banks communicated mostly united plans to allow the data, rather than a need for intervention, to dictate the path forward. The markets responded well, and interest rates have fallen steeply from intra-year highs, with the U.S. 10-year Treasury Note yield falling from 5.0% in mid-October to 3.9% today.

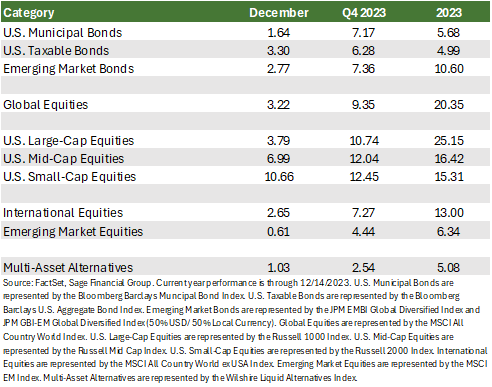

Amid strong incoming data in the 4th quarter, optimism grew, and markets realized significant gains across various sectors during the first two weeks of December. For example, U.S. small-cap stocks are up over 10.7%, and U.S. investment-grade core bonds have gained 3.3% as of December 14th.

This week, the optimism culminated in increasingly dovish messages from the Fed and the U.K. and European central banks. The “foot on the pedal” approach to interest rates appears to have eased.

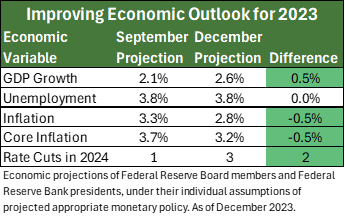

On December 13th, the Fed shared a notably positive “Summary of Economic Projections,” which reflects the combined thinking of Federal Reserve Board members and Federal Reserve Bank presidents. Specifically, it projected that, in the U.S., inflation will moderate even as growth and the labor market remain in good health.

Fed Chair Jerome Powell’s acknowledgment that rate cuts had been part of this recent meeting’s discussion substantially boosted both equity and bond markets. Previously, Powell had pushed back on the market’s anticipation of a lower Fed Funds rate in 2024, holding out the possibility of further increases.

We view this latest market rally as reflective of a growing widespread belief that, through the Fed’s policy decisions to combat inflationary pressures, they and other leading central banks may well have engineered a “soft-landing” that will allow the global economy to avoid a significant recession.

What is Our Perspective?

Perhaps one of the most crucial messages and investor lessons the past few weeks have reinforced is the importance of staying the course with your investment strategy. Patient investors are often rewarded for remaining invested during periods of volatility.

While these recent developments are encouraging, and we are cautiously optimistic about 2024, we acknowledge the presence of ongoing risks and uncertainties that may contribute to future volatility in our investment portfolios.

We are steadfast in our commitment to preparing our clients’ portfolios for a range of outcomes aligned with their specific financial goals and tolerance for risk. We continue to believe a disciplined, diversified, and sensible approach provides the greatest opportunity to meet this objective.

Previous Posts

- Sage Insights: A Month of Optimism

- Sage Insights: Market Observations Through Uncertain Times

- Sage Recognized By Leading Financial Journals

Learn More About Sage

Disclosures

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks, or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks, or assumptions should not be construed to be indicative of the actual events that will occur. These projections, market outlooks, or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, product, or any non-investment-related content referred to directly or indirectly in this newsletter will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer reflect current opinions or positions. All indexes are unmanaged, and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in managing an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her situation or any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.