In today’s update we highlight progress in the three central areas we are monitoring closely —monetary policy, fiscal policy, and biology as it relates to COVID-19 — then wrap up by sharing some investment strategies that we believe are particularly relevant.

Although it is still too early to determine the exact economic fallout of this virus pandemic, in recent days, there have been developments related to potential treatments and eventual vaccines for COVID-19 that seem positive in terms of public health and investor and economic sentiment. As we have discussed before, in our view the path of virus cases and containment will, to a large degree, inform the path of investment markets and the economy.

Monetary Policy and Restoration of Bond Market Liquidity

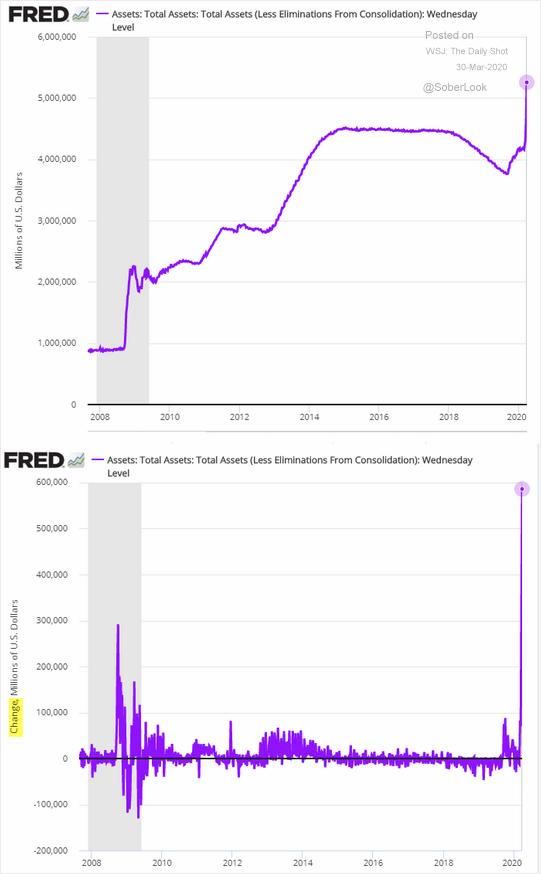

The coordinated policy response to the current Global COVID-19 Crisis (GCC) has been immense and decisive, both in the monetary and fiscal arena. This is very different from the response during the past financial crisis when policymakers were slower to react than at present. Since the COVID-19 crisis began, the Federal Reserve has cut rates to zero in two emergency meetings, announced an “open-ended” quantitative easing program, and explicitly communicated that it will do whatever it takes to restore liquidity to financial markets when needed. Lack of liquidity was a significant problem in 2007-2009. Although U.S. fixed income markets faced a sharp liquidity crunch in mid-March and some pockets of the fixed income market are not yet fully back to “normal”, the Fed’s intervention (along with that of other global central banks) has largely restored order to the market for U.S. government bonds and provided liquidity and increasing stability to corporate bond markets.

The total assets held by the Federal Reserve Bank will continue to grow for the foreseeable future, which in our view, should continue to facilitate the progressive normalization of U.S. credit markets.

Fiscal Policy

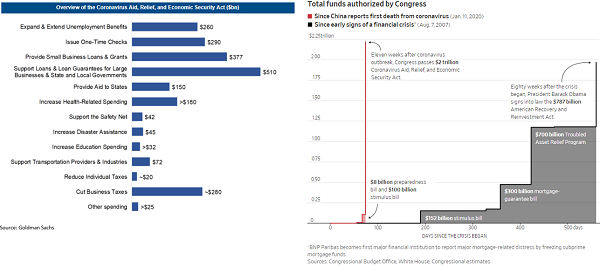

Fiscal policy has moved at light speed as elected officials on both sides of the aisle have disregarded the deficit in the face of the ongoing pandemic. While there are different types of economic recessions, elected officials have apparently learned from past mistakes when they were slow to assess the situation and act decisively. In our view, the massive stimulus package – the $2.3 Trillion Coronavirus Aid, Relief, and Economic Security (CARES) Act – will help cushion the current economic downturn (though not offset it completely). Key programs include cash payouts and expanded unemployment benefits to reach the part of the population most affected by the “stay at home” restrictions, which you can see from the breakdown of the CARES legislation below on the left-hand side. The stark contrast between the fiscal policy response during the global financial crisis in 2007-2009 and the response during the COVID-19 crisis in 2020 can be illustrated in this way: It took 80 weeks to reach $2 trillion in the 2007-2009 crisis compared to 11 weeks in 2020 (which you can see in the graphic below on the right-hand side).

Biology (Virology and Immunology)

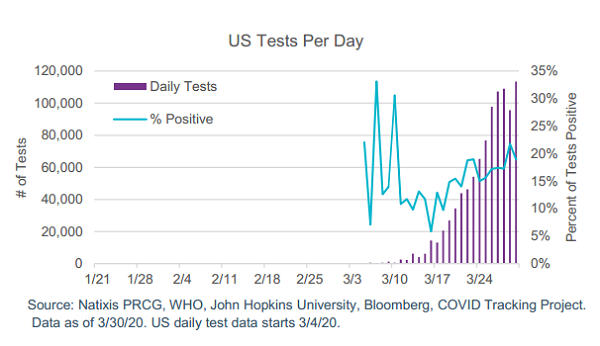

In terms of biology related to SARS-CoV-2 (the virus that causes the disease called COVID-19), three major recent developments are (1) the ramping up of testing for confirmed cases of infection in the U.S., (2) some potentially positive new treatments for patients who have the virus, and (3) work on an eventual vaccine to help prevent infection. The graph below shows the current state of testing in the U.S., dating from March 4th through 30th.

It is important to understand that the spike in confirmed cases is largely a result of testing and that knowing who and how many people actually have the virus will also help investors and economists know how to look ahead to the recovery period.

Scientific developments have helped in two key areas:

- Potential treatment: The U.S. Food and Drug Administration (FDA) on Monday approved the emergency use of hydroxychloroquine and azithromycin to fight COVID-19. This combination of an anti-malaria drug and antibiotic has been reported to be effective in clinical trials in China, South Korea, and France. Clinical trials also remain ongoing in the U.S. (more data to come later this week), but the FDA saw sufficient promise to grant emergency approval. In the meantime, the 30 million doses donated by Novartis and one million doses donated by Bayer are now approved for use at hospitals. The hope is that they will help to reduce both the duration of hospital stays by patients (which will help to relieve the ongoing pressure on the health system) and the levels of infection severity and mortality.

- Potential vaccine: In terms of a possible vaccine, Johnson & Johnson (JNJ) and the U.S. Biomedical Advanced Research and Development Authority (BARDA) announced yesterday that they will invest more than $1 billion to ramp up their promising coronavirus vaccine. JNJ has selected its own lead vaccine candidate and will start human testing by September, with an eye toward having it ready under an emergency use authorization in early 2021. Many reports suggest January as the target launch date, which is faster than the typical 18-month process.

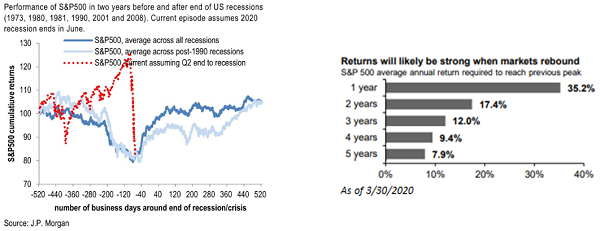

Investment Perspective

Lastly, we want to reiterate that we still believe in stocks for the long-run. Nobody, including Warren Buffett, knows the exact tops and bottoms of the stock market. We do believe, though, there is much to be learned by studying history. However, we think it is important to remember that by historical standards, markets tend to bottom approximately 3 months before recessions end. If the S&P 500 gets back to its prior high in three years, the annualized return will be 12%. The time period may be shorter or longer than three years, but as indicated in the table below, under most scenarios, future returns could be attractive.

From an historical perspective, nine of the past ten recessions have seen market bottoms before the recession ended (exception was 2000-2001 due to accounting scandals). In the past recession, markets bottomed in March 2009, while the economy exited the recession in June 2009 (approximately 4 months before). The chart below shows the average of market returns related to recessions according to three categories: (1) all past U.S. recessions, (2) post-1990 recessions, and (3) the current recession.

Many of the tailwinds that were present before February 2020 will still be present when the current recession ends, including low-interest rates and high dividend yields relative to history. While we do not necessarily think that stocks will make a “V-shaped” recovery and return swiftly to all-time highs, if history is a guide, we do think that equities will recover to prior levels within a reasonable timeframe. As shown in the chart above on the right side, if stocks take 3 years to return to their prior all-time highs, the annualized returns necessary are 12.0%, which is in line with the 3-year annualized returns over the decade following the global financial crisis that ended in 2009.

In our view, owning equities proportional to your risk tolerance and investing time horizon, is a powerful way to growth wealth and provide income over the long term.

Subject to any extraordinary events, we plan to communicate again on Thursday. In the meantime, please reach out to us directly if we can provide you with any additional support or to discuss anything that may be on your mind.

Previous Posts

An Update on The Markets and The Continuing Response to COVID-19

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please click here or contact us directly.

© 2020 Sage Financial Group. Reproduction without permission is not permitted.