We hope that you and your families are doing as well as possible and safe and healthy. The amount of news and information (and some misinformation) has been truly remarkable in terms of speed and magnitude.

Friday was relatively quiet compared to the seeming relentless new developments that have peppered recent days and weeks. The day saw the S&P 500 Index, a broad measure of the largest U.S. publicly-traded companies, decline 3.37%. Although the final day of this week saw a decline in U.S. stocks, we found the orderly nature of the decline encouraging, particularly after weeks of limited liquidity in financial markets and wild price swings.

The week started off with additional equity losses despite welcome intervention by the Federal Reserve to ease liquidity constraints in the credit markets. The S&P 500 Index’s decline of 2.93% Monday followed three flat or down days in equity markets from the previous week. The S&P 500, however, then strung together three consecutive days of gains on Tuesday (+9.38%), Wednesday (+1.15%), and Thursday (+6.24%). Liquidity started to return to credit markets, and stocks rallied on hopes of the eventual passage and signing of a $2 trillion fiscal stimulus package designed to aid households and businesses, employees and employers, during the economic fallout from the COVID-19 health crisis. For the week, the S&P 500 finished 10.26% higher, which is 13.59% higher than the low on Monday. Although the Dow industrials fell about 900 points Friday, it posted the biggest weekly increase since 1938.

Over the recent weeks, Sage has highlighted the three major areas where clarity or progress is needed before U.S. equity markets may trough: (1) monetary policy, (2) fiscal policy, and (3) biology. This week, investors gained some clarity in each category. Policy developments clarified in particular how much the government is stepping into the fray (via both the central bank and Congress) to provide support, and the increase in testing in the U.S. is painting a more precise picture of where clusters of infection are located. Many questions pertaining to biology, particularly the rate and trajectory of infection, remain unanswered, but the natural spike in confirmed cases after testing began is a step toward plotting the slope of the infection curve and knowing when mitigation measures are achieving success. We note some of the key developments in each category:

- Monetary policy: The Federal Reserve has unleashed an open-ended bond-buying program (i.e., Quantitative Easing) that is helping liquidity to re-enter the financial markets.

- Fiscal policy: Congress passed a stimulus package that amounts to approximately 10% of GDP, which should significantly help replace some of the lost economic activity (GDP) due to social distancing and other virus mitigation measures.

- Biology: The number of new cases may have capped in Italy, after following a similar roadmap to that in South Korea. Spain has become a new problem area, and the number of U.S. cases continues to increase as testing ramps up, which is only natural. The timing of a sustained peak in the number of new cases continues to be unknown but could occur in the next two weeks if we follow the path of Italy.

New York has been hit particularly hard by the coronavirus, but there are encouraging signs there. Governor Cuomo has suggested in recent days that the social distancing measures taken have slowed the exponential nature of cases (i.e., flattening the curve), but the state remains in need of more ventilators and medical supplies.

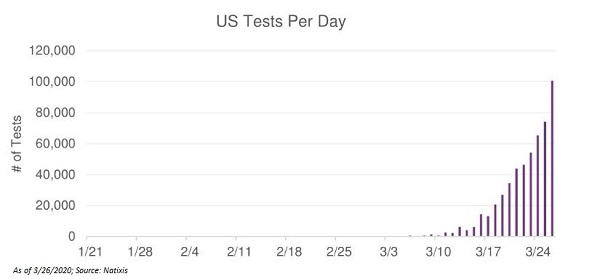

The chart below shows the number of tests being done in the U.S. over time. Given the sharp increase in recent days, the number of cases is expected to rise rapidly but is not necessarily a sign that social distancing is failing. U.S. officials are following the South Korean playbook of testing at scale, and while the number of new cases is expected to rise initially as tests are processed, there is the possibility that the level could flatten out within the next month. Properly counting the number of cases is paramount to understanding the virus’s effects (i.e., data analysis is aided by a broad and accurate sample size).

The market panic that was palpable last week has subsided modestly, although overall financial markets remain in a fearful state. The CNN Fear and Greed Index is still in the “Extreme Fear” category, but it has rallied from its low 10 days ago. At the beginning of last week, the index was a 3 (on a scale of 1-100) and has rallied to 21 as of yesterday’s close. For context, when the S&P 500 plummeted to a low on September 17, 2008, the index sank to 12. The index gained some ground to 28 before U.S. stocks finally bottomed on March 9, 2009. It is not clear what precise path the U.S. stock market will take this time, but it is helpful to realize that following the financial crisis stocks rallied sharply and that stocks tend to rally after the fear index reaches panic levels such as we have just seen.

During the peak of fear lasting through this past Monday, there was a race to cash, which decreased liquidity in all corners of financial markets, including the highest-quality portions of the global bond market. While banks remain well-capitalized and positioned to weather this storm, the cash crunch during peak panic affected liquidity. Thanks to the action by the Federal Reserve and the U.S. Congress, some elements of uncertainty that were causing panic have been lifted.

A more fearful environment could return if negative developments occur beyond the currently prevailing expectations, but we are encouraged that a more “normal” level of healthy pessimism has returned. While much still needs to be sorted out in terms of the path of the virus, treatments, cures, and the like, rallies that flow out of a period of extreme fear are generally more sustainable than those built near the peaks of euphoria.

We will continue to share our current thinking as there are more developments in each of these areas.

As always, we are available at any time to discuss anything on your mind and provide additional support in any way possible.

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please click here or contact us directly.

© 2020 Sage Financial Group. Reproduction without permission is not permitted.