In these unprecedented times, we want to encourage an open dialogue with our clients and communicate our thoughts on the ever-changing market environment on a regular basis. It can be challenging to understand market moves in times like these when health-related matters and the economic issues are changing at such a rapid pace.

Financial markets are likely to continue to experience price volatility (both up and down) in the near-term, but we continue to think that the long-term view remains sound, especially considering the recent actions by authorities, which we believe will help contribute to the recovery. As we communicated to you recently, the stock market is a leading indicator. We believe that much of the negative health and economic news now making headlines has been expected, or “priced in” already by the equity markets. An example of this is the fact that today the U.S. set a record for initial unemployment claims of 3.2 million, but the S&P 500 Index rallied more than 6% on the day.

As we outlined in our e-mail yesterday, markets are seeking clarity on three fronts: (1) monetary policy, (2) fiscal policy, and (3) biology.

Monetary policy, which is action by the Federal Reserve and other global central banks, has been swift and decisive. The Federal Reserve has committed to an open-ended quantitative easing (QE), or bond-buying, plan with many crisis-era lending facilities to help businesses and banks get through tough times. Central banks do not need to draft legislation or vote, making their process more efficient and less politically entangled. In our view, central banks have largely learned from past mistakes (e.g., acting too slowly in 2007-09), and they are taking the steps more quickly to guide the economy through these difficult times.

Fiscal policy has been slower to respond than monetary policy, and, because it requires legislation to become operative, it has included more political posturing. At the same time, the scope and size of the fiscal policy response has exceeded initial expectations. The official U.S. fiscal stimulus package (also being referred to as “crisis aid”) is $2 trillion, or 10% of GDP. Among the most important economic provisions are:

- $377 billion (1.8% of GDP) small business program that will provide affected businesses with loans that they will not need to repay if the proceeds are used to pay wages or other necessities.

- $500 billion (2.4% of GDP) in capital for loans and loan guarantees, including $454 billion that the Treasury may use to backstop Federal Reserve facilities to provide business credit.

- $250 billion (1.2% of GDP) in payments to individuals ($1200 per adult, $500 per child) in certain income brackets.

- $250 billion (1.2% of GDP) in expanded unemployment insurance that will replace a worker’s lost wages, on average.

- $150 billion (0.7% of GDP) in fiscal aid to states, which should mostly offset the effects of COVID-19 on state/local budgets.

- $340 billion (1.6% of GDP) in federal spending, of which $130 billion is directed to hospitals and health care efforts.

It has been estimated that the $500 billion in point (2) above can be leveraged through lending into $4-5 trillion of ultimate aid through the Fed’s various tools. This calculation is how many people get to the “$6 trillion” stimulus number, which is closer to 25-30% of GDP.

The legislation, which is to be taken up shortly by the House of Representatives and then sent to the president for signing, is unlikely to avert a recession given the expected decline in economic activity as a result of social distancing requirements. The stimulus is huge, but it is not likely enough to offset the downturn in terms of GDP in the near term. However, these programs should reduce the medium-term damage to affected businesses and the labor market, and they should allow for a faster recovery when the lockdown restrictions are lifted.

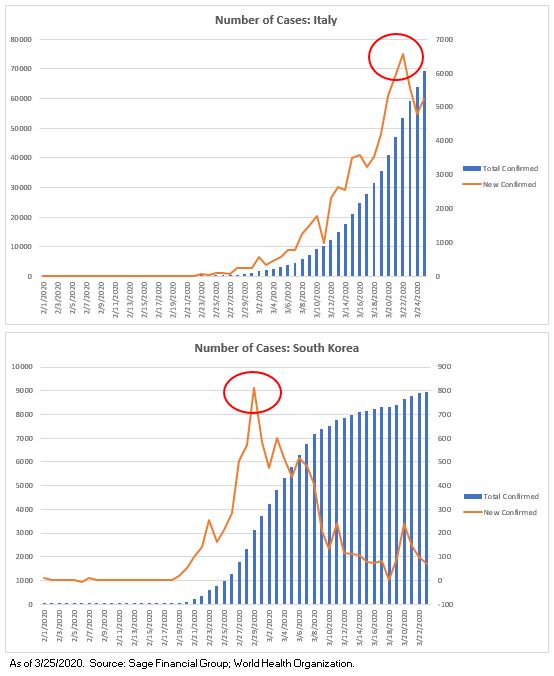

Lastly, we think that looking at the number of new cases around the world is a useful way to begin to determine if efforts to flatten the curve have been successful and how they may affect financial markets.

An example of a country that has been heavily hit is Italy. The human toll has been severe, and our hearts go out to the people impacted. In analyzing the number of new cases, it seems as if the path of the virus in Italy may have peaked. As shown below on the top graph, Italy has had three days in a row of fewer new cases. It took Italy longer than South Korea (below on the bottom graph) to reach this point, but it gives some hope that the lockdowns are helping to flatten the curve.

The more countries we can add to the list of places where mitigation policies have led to a peak in daily new confirmed cases and a slowdown in the rate of infection (such as China, Italy, and South Korea), the more other countries (such as the U.S.) may take note and find a faster path forward from crisis to recovery.

All of us remain poised to support you at any time. If there is more we can be doing for you, or questions we can help answer, please reach out to us. As always, we hope you and your loved ones are safe and healthy.

Previous Posts

Our Perspective: An Update On The Markets and The Continuing Response to COVID-19

Insights: COVID-19 Uncertainties Rattle Investors and Fuel Psychological and Market Volatility

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events which were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please click here or contact us directly.

© 2020 Sage Financial Group. Reproduction without permission is not permitted.