February was an uneasy month for financial markets, primarily because Russia invaded Ukraine. But even though equity markets have fluctuated sharply in 2022, we remain encouraged by the strong economic backdrop supporting the expected increase of interest rates in March. As a result, we continue to think companies should have a positive environment for continued revenue and earnings growth in 2022.

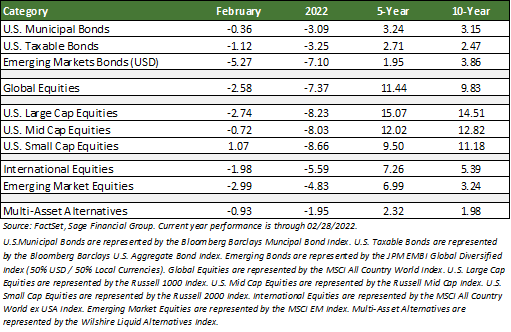

The MSCI ACWI Index, which represents global equities (i.e., both U.S. and international stocks), declined by 2.58% in January. The U.S. large cap equities fell 2.74%, U.S. small caps rose by 1.07%, and international stocks posted a loss of 1.98%. In addition, core U.S. taxable and tax-exempt bonds ended the month lower by 0.36% and 1.12%, respectively, as higher interest rates negatively impacted bond prices.

In this edition of Insights, we discuss the month’s most relevant topics, including the Russian invasion of Ukraine, investing during times of volatility, and the persistently elevated inflation ahead of the Federal Reserve’s mid-March policy meeting. Finally, we conclude with advice for our clients about managing their investments during this time.

Russian Invasion of Ukraine

As widely reported over the final week of February, the Russian military pressed further into Ukraine, following months spent amassing troops along the border. This invasion thrust unwanted risks on a global economy already battling elevated inflation and supply-chain snags.

First and foremost, we sympathize with those adversely impacted and recognize that the ongoing conflict creates a humanitarian and an economic problem. From a humanitarian standpoint, the impacts have already been devastating. From an economic and financial markets perspective, Russia accounts for approximately 3% of global gross domestic product (“GDP,” which measures economic output), while Ukraine accounts for 0.4%. Thus, the potential direct impact on global growth is likely low, even though both economies are likely to fall into recessions in the near term. Sage client portfolios are geographically diversified by design and, on average, currently have modest Russian equity and bond positions, between 0.75-1.25%.

While the economies of Russia and Ukraine are smaller than those of several U.S. states (e.g., California and Texas both have larger economies than Russia), there are global economic implications to consider. These include commodity prices, the impact of the war on monetary policy, and the potential for an escalation towards broader conflict. Consequences for the energy market could be significant since Europe derives 40% of its natural gas supply from Russia. Russia additionally contributes over 10 million barrels of oil per day to the global oil supply and is a top supplier of precious metals like palladium and nickel. Ukraine is a leading exporter of corn, iron ore, and wheat. A protracted conflict threatens to exacerbate ongoing supply-chain issues and potentially places pressure on food inflation.

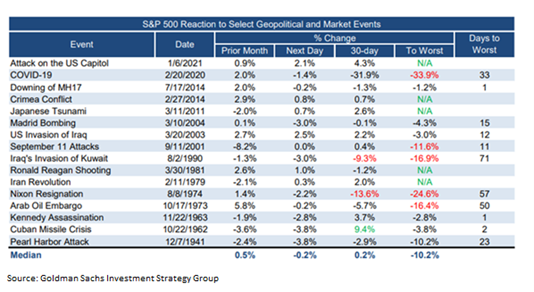

Historical context illustrates that similar events can lead to short-term pullbacks in equities, but investors tend to look through these events over time. The themes we noted at the beginning of the year still hold, including healthy consumer and business balance sheets, which should translate to higher demand for goods and services throughout the year. As a result, markets have historically experienced an average decline of up to 10%, but that drawdown could be short-lived. Midway through February, markets experienced a 14% decrease in the S&P 500, over 20% in the Nasdaq, and ~10% in international markets from market highs.

Long-term Investment Principles

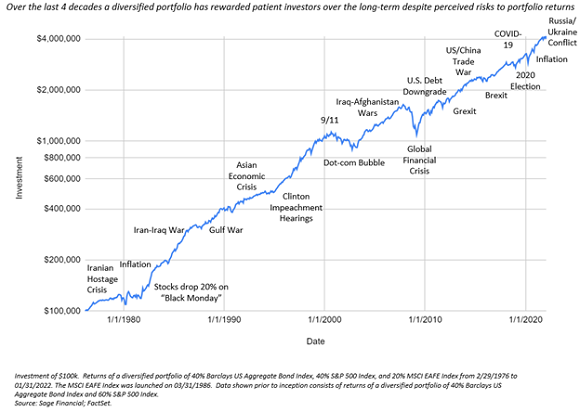

In 1994, Warren Buffett wrote, “Thirty years ago, no one could have foreseen the huge expansion of the Vietnam War, wage and price controls, two oil shocks, the resignation of a president, the dissolution of the Soviet Union, a one-day drop in the Dow of 508 points, or treasury bill yields fluctuating between 2.8% and 17.4%.” The legendary investor also predicted, “A different set of major shocks is sure to occur in the next 30 years.” The lesson here is that it is valuable to keep a longer-term perspective when considering lower stock prices in the face of geopolitical events.

Buffett was right that we would get a different set of major shocks, including a bubble in technology stocks, a global financial crisis, a variety of wars, and a global pandemic. Yet, despite these events, he was right again in terms of predicting stock returns. The 30 years preceding his 1994 quote saw U.S. large cap stocks return 9.8% annualized. Amazingly, in the 28 years since 1994, U.S. large cap stocks gained nearly the same amount: 10.6% per year.

The similarity of these returns is not a coincidence. Over time, the returns of broad stock indices are driven by population growth, moderate inflation, and innovation. Together, these three factors drive GDP growth and determine the size of the economic pie for corporations to take a bite of:

- Population growth leads to more potential jobs and spending, increasing economic output.

- Moderate inflation helps increase revenues and makes current debt worth less in future dollars (i.e., inflation incentivizes companies to finance growth projects in the present).

- Innovation accounts for how companies tend to become more efficient over time, thus driving further growth in profitability and the economy.

Economic growth is the key driver of returns in stocks and bonds. As shown below, a diversified portfolio has delivered consistent results over the past 40+ years, despite a variety of geopolitical events, concerns, recessions, etc.

Sage constructs portfolios for various scenarios, both in the U.S. and abroad. We take a long-term view and diversify with the expectation of elevated geopolitical risk from time to time. While current tensions could lead to some market fluctuations in the near term, we expect U.S. markets to be less impacted than Russian markets as uncertainty grows around an escalation of conflict.

Upcoming Federal Reserve Policy Change

Inflation readings have been elevated since the third quarter of 2021, but even higher price pressures have been building over the last few months. This dynamic has caused some Fed officials to pivot to a more aggressive approach, announcing support for the first hike to interest rates in over two years. The Federal Reserve has a “dual mandate” to seek full employment and stable prices. With the level of unemployment approximately near pre-pandemic levels, the Fed will sharpen its focus on controlling prices.

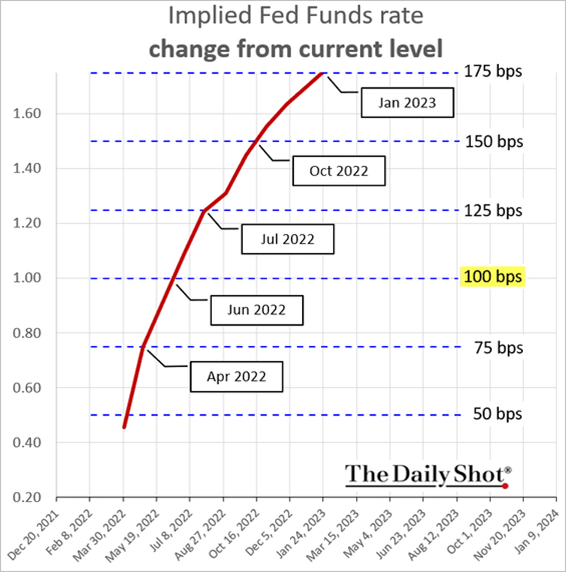

The most recent Consumer Price Index (CPI) report showed price increases of 0.6% month-over-month (higher than expected), and Fed rate hike expectations continued to move higher. As shown below, the rates market now expects seven hikes over the next twelve months.

Market participants have raised concerns that the Fed’s hawkish pivot was “behind the curve” and came too long after the inflation threat. In our view, the Fed risks slowing the economy too quickly if it raises rates in an overly aggressive manner. The Fed has communicated that they plan to begin raising the Fed Funds rate this month. Market expectations are for a 0.25% increase at the upcoming March 16th meeting. Our base case is that the Fed will raise rates in a gradual manner while remaining dependent on economic data to make policy decisions.

We think that energy prices will push headline inflation higher in the near term and that there is a wide range of outcomes over the next 6-12 months. However, the most likely path forward is that economic growth and inflation will slow later in the year. Rate hikes may weigh on economic activity in cyclical areas, and consumers will likely grapple with higher borrowing costs amid a tightening of financial conditions. Ironically, due to the risks posed by higher energy prices, the Russia/Ukraine conflict may actually help convince the Fed to be more patient with inflation than is currently expected, which we believe would boost equity markets.

Closing Thoughts

The market volatility we saw in February became more pronounced under the pressures of Russia-Ukraine geopolitical concerns, coupled with uncertainty regarding upcoming Federal Reserve policy decisions. We will continue to closely watch the evolving situation in Ukraine and the actions communicated by Fed Chairman Powell.

Sage constructs diversified multi-asset class portfolios for various scenarios, including further equity volatility and higher interest rates. Our expectations are for continued unsettled equity markets, and we would expect investors to turn to high-quality bonds during uncertain times. Different components of portfolios are intended to provide a stable footing through uncertain periods. We will make changes to your portfolio as we see appropriate.

While we have seen some sharp fluctuations in stock prices this year related to the developments discussed in this piece, we continue to believe that the U.S. economy should grow throughout 2022. Moreover, both U.S. consumers and businesses remain extremely well-capitalized, which is likely to boost economic activity over the next 12 months. A growing economy should provide a supportive backdrop for stocks. To be clear, risks remain within our outlook as inflation is still elevated, and there is the potential for a broader conflict in Europe. Still, we advise our clients to stick to their financial plans and avoid making rash decisions when markets go through periods of negative performance.

Previous Posts

Sage 2022 Annual Letter: A Year in Review

Sage 2022 Investment and Market Outlook

Insights: Federal Reserve Tightening, Corporate Earnings, and Russian-Ukraine Tensions

Learn More About Sage

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks, or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks, or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks ,or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please click here or contact us directly.

© 2022 Sage Financial Group. Reproduction without permission is not permitted.