In the interest of keeping you informed of Sage’s thoughts regarding the recent volatility in the stock market, we are providing you with an update on our perspective.

What has happened?

It has been a volatile start for stock markets in the first month of 2022. Last year was an abnormally calm year for U.S. equities, and that can make drawdowns feel even more uncomfortable and unusual. The sharp oscillations in stock prices we are currently seeing are primarily a result of investors’ reaction to U.S. monetary policy and a weaker start to earnings season than expected.

U.S. Large Cap stocks, as represented by the Russell 1000 Index, have fallen 11% from all-time highs reached earlier this month, entering a period known as a correction (i.e., losses greater than 10%). The technology-focused Nasdaq Index is even further in correction territory, falling 15% lower from its last all-time high set in late December. International stock indices have fared more favorably. The most widely quoted international stock index (MSCI ACWI Ex-USA) is only down 1% year-to-date, and emerging market stocks have, so far, provided a positive investment return. Additionally, nontraditional bond funds and alternatives have provided diversification during this period of volatility.

The market is digesting an evolving Fed policy focused on fighting inflation and a tight labor market (i.e., signaling that it will raise interest rates shortly). Interest rate markets currently expect four to five rate increases of 0.25% by the Federal Reserve in 2022, which has increased significantly from a couple of months ago. This shift to restrictive monetary policy will end two years of extraordinarily accommodative measures by the Federal Reserve and other global central banks and decreases investors’ comfort with risk (i.e., bonds became relatively more attractive than stocks).

Additionally, corporate profits have disappointed in the early innings of earnings season. Companies like J.P. Morgan (JPM), Goldman (G.S.), and Netflix (NFLX) reported worse than expected profit margins (JPM/GS resulting from higher labor costs, NFLX from slowing user growth).

Sage’s Perspective

We have three takeaways from this recent sell-off: 1) volatility in stocks is normal, 2) diversification still works, and 3) the macroeconomic backdrop is still strong.

1. Volatility in Stocks is Normal.

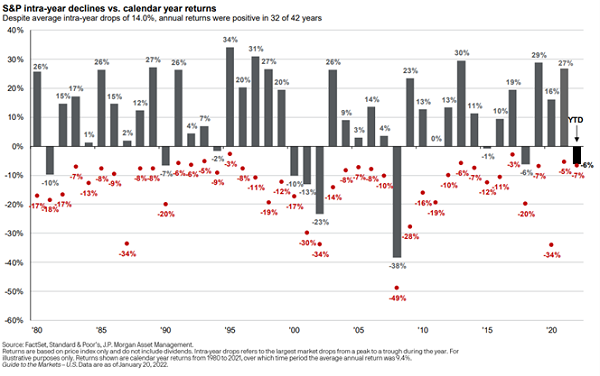

The first thing we like to point out in times of volatility is that these fluctuations are a part of investing. As shown below, corrections happen about every other year, but that does not necessarily lead to negative annual returns. For example, stock markets experienced corrections in 2015, 2016, 2018, and 2020. In addition, 2018 and 2020 saw “bear market” sell-offs (i.e., losses greater than 20%), but only 2018 saw a full year of negative returns.

2. Diversification Still Works.

2. Diversification Still Works.

The carnage in specific stocks and some indices, such as the Nasdaq and Russell 2000, is a good reminder that diversification works. In contrast to the volatility in U.S. indices, international markets are holding up much better and are providing a source of stability. The MSCI All Country World (excluding U.S. stocks) is down only 1%, while the MSCI Emerging Market Index is up 1% on the year. Bonds have also provided diversification, particularly those nontraditional bond strategies and alternatives.

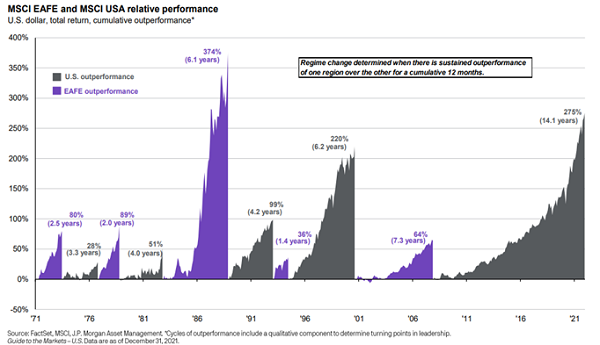

As we wrote in our 2022 Investment Outlook, we continue to encourage investing in a geographically diversified allocation for many reasons, including participating in the benefits of growth both in the U.S. and abroad. As shown below, growth in the U.S. and developed international markets (defined by MSCI EAFE) has rotated over time. The current period of U.S. outperformance has been the longest in duration, but developed international market equities outperformed the U.S. at various times throughout history. For example, international stocks outperformed over seven years in the 2000s and by a more significant margin in the 1980s. Accordingly, we advise clients to remain diversified and keep a longer-term view of the benefits of diversification through the fluctuations in individual markets.

3. Macroeconomic Backdrop is Still Strong.

Despite tightening monetary policy by the Federal Reserve, we believe the macroeconomic backdrop remains strong. Historically, stock markets do not peak until an average of more than two years after the beginning of each Fed rate hiking cycle. Therefore, given the stable economic backdrop, we remain constructive on stocks.

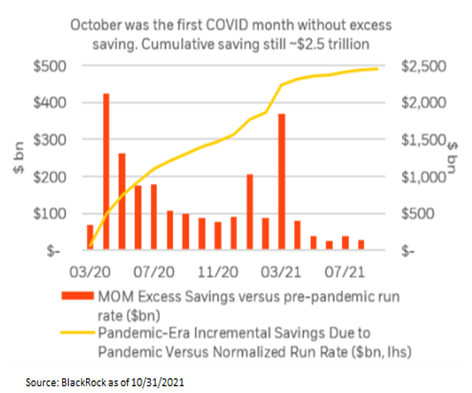

In our view, there is still significant pent-up demand from both businesses and consumers. Companies built up cash reserves during the pandemic, and consumers have over $2.7 trillion of excess cash on their balance sheets. Despite a drop-off in government spending compared to 2021, we expect consumers to start spending their $2.5 trillion of excess savings in 2022. According to BlackRock, October 2021 marked the first month without excess savings since the pandemic began, meaning consumers began spending more in the year’s final quarter. Historically, excess savings are spent over three to five years following an economic downturn, but we expect the suppressed demand for services (e.g., travel, restaurants, etc.) to pull even more spending into 2022.

Concluding Thoughts

The most important advice we have for you is, unless something has changed in your financial life, try to keep the market volatility in perspective. More volatility is likely to continue as it is a common and natural characteristic of equity markets. However, your portfolio is well-diversified and structured with a multi-asset class approach to reduce volatility. The investment strategy we designed for you continues to be most appropriate because it aligns with your investor profile (risk tolerance, time horizon, and return objectives) and financial goals.

Previous Posts

Sage 2022 Annual Letter: A Year in Review

Sage 2022 Investment and Market Outlook

Insights: Market Volatility in November, Omicron, and Tapering

Learn More About Sage

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks, or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks, or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks ,or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please click here or contact us directly.

© 2022 Sage Financial Group. Reproduction without permission is not permitted.