The financial markets performed well again in April, supported by continued positive developments around the COVID vaccine rollout and fiscal stimulus. The MSCI ACWI Index, which represents global equities (i.e., both U.S. and international stocks), advanced by 4.37%, the U.S. large-cap Russell 1000 Index rose 5.38%, the U.S. small-cap Russell 2000 Index increased by 2.10%, and the MSCI ACWI Ex-USA Index (international stocks) moved up approximately 2.94%. Core U.S. bonds represented by the Bloomberg Barclays Aggregate U.S. Bond Index ended the month up 0.79%, primarily due to modestly lower interest rates.

The positive market performance we have experienced this year continues to be fueled by the three themes we have focused on throughout the COVID crisis. On March 28th, 2020, we wrote that “financial markets seek clarity on central catalysts for a turnaround: (1) central bank monetary policy, (2) government fiscal policy, and (3) biology.” In this issue of Insights, we first retrospectively view how major policy decisions have impacted the economy and markets over the last year, then we turn our attention to the current global COVID- situation and the state of U.S. corporations during earnings season. We finish with a note about recent developments pertaining to cryptocurrencies.

Policy Impacts Have Spurred Growth

In March 2020, Chairman Powell and the Federal Reserve committed to being “all-in” with efforts to encourage economic recovery. Shortly after their statement, Congress passed the $2 trillion CARES Act. Throughout the pandemic, global policy measures have been a vital force in limiting permanent economic damage and boosting the pace of economic recovery.

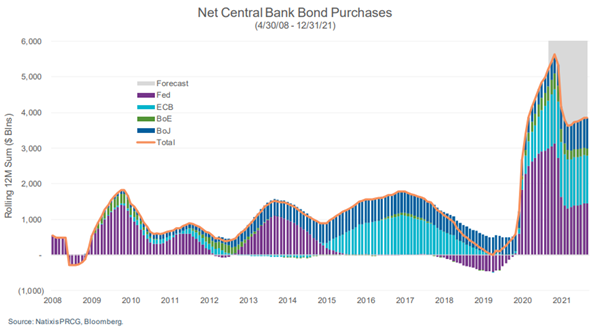

Monetary policy swiftly provided a backstop to the financial markets. In the U.S., Federal Reserve Chairman Powell reacted by cutting the Fed Funds rate in early March 2020 and beginning bond-buying programs. Over the past year, major global central banks also increased their bond purchases (chart below) while slashing borrowing rates in an effort to improve liquidity and encourage risk-taking. These moves strengthened financial markets at a time when uncertainty was sky high and liquidity had dried up. Without the action taken by Chairman Powell and other global central bankers, the economic and market performance of the past year would probably look significantly different.

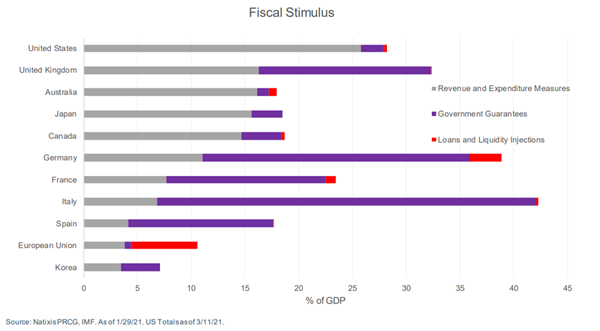

While fiscal policy was slower to be enacted, the CARES act was passed in late March 2020, and other governments around the globe responded similarly. Fast forward over a year to May 2021, and the United States’ fiscal stimulus has totaled 27% of GDP. Other countries have utilized similar plans, with the U.K. totaling 32% of GDP, Germany and Italy over 35%, and Australia, Japan, and Canada all around 18%. These fiscal stimulus packages helped keep the economy afloat even as COVID restrictions dampened economic activity (e.g., saved businesses from going bankrupt, consumers from defaulting on mortgages/rent, etc.) and helped equity and credit performance.

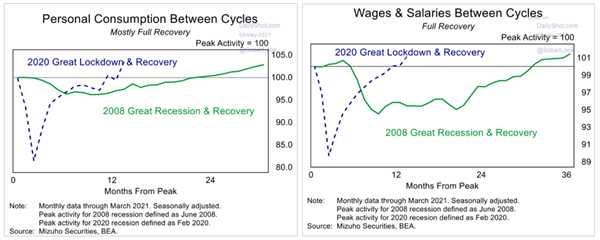

The subsequent result of these efforts has led to a faster recovery than expected based on previous cycles. While some areas, such as employment, still have a long way to go, other areas, such as personal consumption, have already made a full recovery. As shown in the charts below, it took only 12 months for personal consumption to reach the high levels experienced in prior cycles. By contrast, it took personal consumption 20 months to recover following the Global Financial Crisis (GFC). A recovery within wages and salaries tells a similar story, as the recent recovery took approximately one year, while post-GFC recovery lasted over two and a half years. As a note, these measures of income and spending are measured by the Bureau of Economic Analysis (BEA) and are published monthly. The Personal Consumptions Expenditures index reflects changes in the prices of goods and services purchased by consumers, and includes government payments as income.

The economic recovery is by no means complete, and risks remain, such as the potential for COVID variants that evade a vaccine, a slow return to the workforce, and inflation (discussed at length in the next section). The jobs report last week, in which the economy added only 266k jobs, not the 975k expected, highlighted a risk that many workers might remain on the sidelines, which could restrict economic growth. However, as the COVID situation improves and some government programs unwind (e.g., $300/week through Pandemic Unemployment Assistance expires in September), more workers are likely to re-enter the workforce in the coming months.

The important question we continue to ask ourselves is, “what does this mean for clients’ investments?” Over the past year, equity and credit prices have risen significantly, largely due to global governments and central banks’ swfit and decisive policy response. While risks do remain, and traditional valuation metrics are high on a historical basis, we think that strong economic growth will continue throughout 2021 and into 2022, providing a positive backdrop for stock markets and our clients’ equity holdings.

Inflation

The speed of the recovery has many market participants worried about the potential implications of the government’s fiscal and monetary response. The most current readings of price increases through April, using the Federal Reserve’s preferred Personal Consumption Expenditures Price Index (PCE inflation), show that on a 1-year basis, prices rose 2.3% and 1.8% (ex-food/energy). These inflation readings have been modestly increasing, while the price of items such as lumber, copper, and steel has been rising faster, leading to concerns that more price increases are to come.

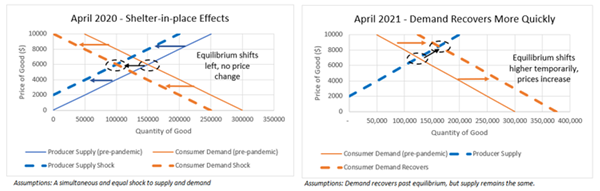

Expected inflation has been a major focus of Q1 earnings calls, and many companies have stated they have been passing through higher input costs to customers. While some inflationary pressures are certainly evident in the economy, we continue to think that inflation is more likely to be transitory rather than persistent. Following the simultaneous supply and demand shock of March 2020, demand has snapped back, while supply chains have been slower to recover to normal levels (shown below graphically).

Further, we believe that structural inflation headwinds remain, including demographics, low wage growth, and increased price transparency. In the case of demographics, the older U.S. population will help keep prices in check. Demographics in the U.S. have shifted over time, with a significantly higher concentration of the population in the older generations than when we last saw inflation in the 1980s.

The 60+ age group makes up a much larger proportion of the U.S. population than in 1980, and the average age has increased from 30.0 to 38.4 over the past four decades (source: Statista). On average, the older population has less ability to tolerate price increases due to the fixed nature of their income. Demand is likely to retreat in response to higher prices, as many retirees will not experience a rise in discretionary income to pay for higher-priced goods and services. In addition, the average worker has not seen positive real wage growth in a decade (e.g., wage growth above inflation), which also dampens demand and makes it difficult for companies to sustain increases in pricing.

We will continue to monitor inflation closely, paying particular attention to the effect of increased price pressures resulting from supply-chain disruptions, expansive fiscal stimulus, labor-market tightness in select industries, and higher prices across many commodities. Upcoming reports such as the Consumer Price Index and Producer Price Index should provide more insight, both due to be released this week. However, we would caution against reading too much into any one data point, as inflation measures are likely to be volatile this year. Persistently higher inflation could lead to a more aggressive Federal Reserve. However, this is not our base case project, and officials have said they will remain patient amid higher inflation readings as supply chain dynamics get resolved.

From a market perspective, modest inflation tends to be a positive for equities. Companies with increased pricing power can further widen profit margins, which allows corporations to increase dividends and repay future debts more easily. Inflation can mean higher interest rates over time, which may pull down the performance of government and other fixed-rate high-quality bonds. While we recognize the risks of higher inflation, we continue to think the current inflationary pressures are temporary instead of persistent and that clients portfolios are appropriately positioned with an underweight to duration bonds versus long-term targets and an overweight to equities.

COVID

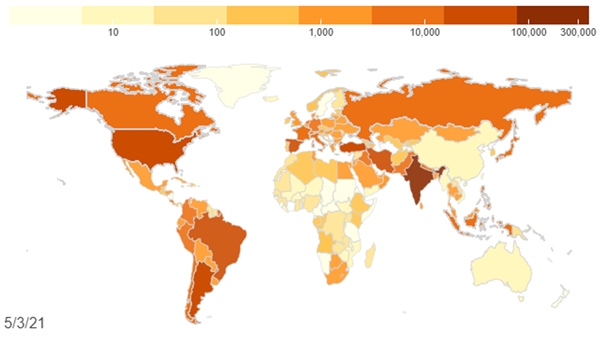

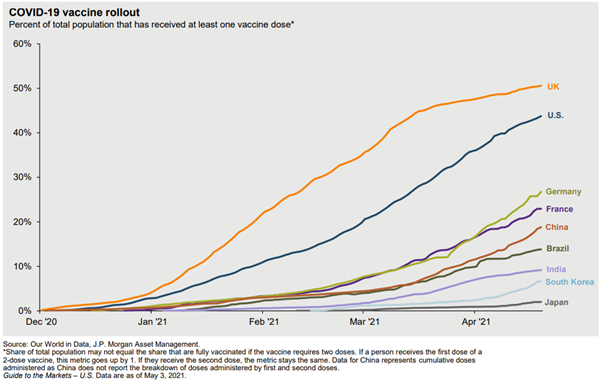

The ongoing COVID pandemic has been a tragedy, affecting the entire globe. The scientific community’s response was swift and impressive, delivering an effective vaccine about nine months after the virus began to spread appreciably. But every country has been impacted differently. On the whole, countries with more effective vaccine rollouts are faring better from an economic perspective (fewer cases lead to a faster re-opening and a stronger, swifter economic bounce-back). The U.S. and U.K. have had the quickest vaccine rollouts globally on a per capita basis, and both countries have seen a significant reduction in cases, hospitalizations, and deaths. Unfortunately, some emerging market countries continue to face challenges in mitigating the virus, including India and Brazil. As shown in the chart below, the pattern for infection within these countries followed that of the United States, but these countries lack the medical infrastructure needed to assist the general population.

In addition to the elevated level of cases, each nation has struggled to vaccinate its large populations. For example, Brazil has vaccinated 12% of its population compared to the United States, which has vaccinated almost half of its population. (Source: Johns Hopkins Coronavirus Resource Center). Countries that have a harder time containing the virus, such as Brazil and some European countries, should benefit if vaccination rates pick up in the coming months.

As discussed over the past year, there are still risks associated with COVID, such as the potential for variants and the disparity between how countries can respond. We are cautiously hopeful that companies such as Moderna and Pfizer will be able to distribute a booster shot to address specific variants[1]. In terms of large, developed countries, the U.S. economy has been leading the way out of the COVID crisis, and U.S. equity performance has been at the front of the pack. U.S. Purchasing Manager Indexes, a good measure of economic activity (PMIs), are the highest in the world, which has led to U.S. stocks having the best performance year-to-date.

However, in our view, there could be a convergence of economic growth later this year. That is to say that other areas of the world, such as Europe and emerging markets, have room to improve as their vaccination programs accelerate. Europe officially registered its second straight quarter of economic contraction in Q1 2021, but we think it will return to growth in Q2 and accelerate into Q3. Economic growth tends to follow stock performance, and we believe that international stock markets could see a convergence with performance in the U.S. in the coming months. We will be tracking the progress of vaccinations globally as well as new cases, hospitalizations, and deaths.

U.S. Corporate Earnings

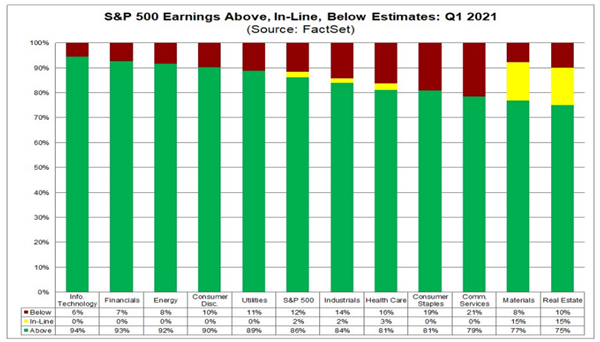

The first quarterly earnings season of the year is important in any year, particularly during an economic recovery. As market analysts and investors, we were hoping to see strong growth in earnings and revenue and positive guidance from corporations for the rest of the year. To summarize earnings reports broadly, companies have had an extremely positive Q1. Quarterly earnings figures were very strong, with companies beating earnings expectations at a record level. At the time of this writing on 5/10/21, approximately 90% of S&P 500 has now reported Q1 results, with beat rates running near record levels. According to FactSet, the blended S&P 500 earnings growth rate for Q1 now stands at 49%, up from 24.5% at the start of the earnings season. In addition, 86.0% of reporters have surpassed consensus EPS expectations, which is a record high and well above the 77% one-year average.

Overall, these results leave us feeling cautiously optimistic. Companies noted risks such as higher input costs (i.e., inflationary pressures) and remaining uncertainty regarding COVID concerns. However, from a financial market perspective, as has been the case over the last few quarters, upside surprises have been driven by a resilient macro backdrop underpinned by pent-up demand, improved business outlooks, and an expected increase in share buybacks in 2021.

Cryptocurrencies

Cryptocurrencies have quickly returned to the center stage for fervent and casual market observers alike this year. This is perhaps due to government spending discussed previously or genuine interest in cryptocurrencies or a combination of the two. An earlier type of cryptocurrency fervor happened in 2017 when Bitcoin sharply rose to $20k in January of 2018, only to crash to $3k by the end of that year. During that time, retail investors drove the price higher, and when the retail mania ended, the price dropped precipitously. Following the mania and crash, Bitcoin has climbed through April of 2021, ending the most recent month at $57,500, boosted over the past few months by concerns around fiscal and monetary stimulus potentially leading to inflation.

As shown below, using Google Trends’ “Interest over time” view, retail activity has picked up sharply beginning at the end of last year. We see this pick-up in Google searches as a potential negative as new buyers enter the market, potentially driving up the price, but the interest could not last permanently.

However, while retail enthusiasm may be worrisome, a few large corporations have bought Bitcoin for their balance sheets, giving the largest cryptocurrency a bit more legitimacy. The biggest corporate purchases have been $2.2 billion by MicroStrategy, $1.5 billion by Tesla, and $320 million by Square. Square, PayPal, MasterCard, and Visa all have announced plans to help users transact in bitcoin, although only Square holds it on its balance sheet.

Liquidity has improved in the market for Bitcoin, with spot activity well above levels seen in 2017. However, we believe that cryptocurrency adoption is still in its early phases, and risks abound. For example, more regulation is expected for cryptocurrencies and Bitcoin specifically.

Our perspective on cryptocurrencies is balanced at present. In our view, Bitcoin and some other cryptocurrencies are volatile assets, but improved liquidity should lead to more price stability over the long term. Blockchain is an impressive technology, and Bitcoin’s fixed cap of 21 million coins could prove useful for people in countries with hyperinflation (e.g., Turkey, Venezuela, etc.). However, if people lose interest in cryptocurrencies, even if temporarily, and/or regulation materially increases, there could be substantial price declines. As economic normalization continues, we think it is possible that the retail interest will decline, and Bitcoin will need future buyers to continue its ascent.

Closing Thoughts

We have observed truly remarkable forces impacting the financial markets over the last twelve months. The global central banks and federal governments acted in concert to support an economy tested by a once-in-a-century event. Globally, similar actions were taken by central banks and government officials to combat a viral pathogen adversely impacting large populations. While drastic and unprecedented, these actions kept the foundation of the global economy intact. As we move further into 2021, we will closely monitor the effect of these actions employed over the past year from an investment perspective. At present, we are watching the movement of interest rates and their impact on growth and corporate health. While Federal Reserve officials have stated at their meetings and in public interviews that they do not expect to begin raising rates for another two years, their communication should be viewed closely and is subject to change with economic conditions. Inflationary pressures will likely remain over the coming months, but in our view, will be transitory and return to closer to the Fed’s 2% average target by the end of 2021. Lastly, as the rate of vaccinations continues to increase, a return to the normalization of our daily lives appears insight.

Our perspective and advice have not changed. Investors should always be prepared for the possibility of short-term market volatility, but we believe they are best served by compartmentalizing short and long-term needs and sticking with a personalized investment strategy aligned with their financial objectives, time horizon, and appetite for risk.

As always, we will continue to monitor market data closely and advise you of any significant developments that could impact your investments.

[1] Pharmacy Times: Moderna Releases Positive Initial COVID-19 Vaccine Booster Data Against Variants of Concern

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please click here or contact us directly.

© 2021 Sage Financial Group. Reproduction without permission is not permitted.