This week was positive overall for financial markets. The S&P 500 finished the week up 3.5%, the technology-focused Nasdaq rose 6.0%, the small cap Russell 2000 advanced 5.5%, and international stocks, as represented by the MSCI ACWI Ex-USA, rose 3.0%. Investment-grade bonds, as measured by the Barclays Aggregate Index, finished the week down 0.4%.

Four of the most significant developments this week pertained to (1) U.S. corporate earnings, (2) de-escalation in U.S. / China trade tensions, (3) vaccine developments, and (4) U.S. employment report.

Corporate earnings season for the first quarter saw a number of companies report year-over-year declines in profits, but investors had already by and large expected negative results. Since the sudden onset of the pandemic, equity investors have largely discounted Q1 and Q2 earnings-per-share (EPS) estimates, and they have been accordingly looking to the companies’ future earnings guidance and industry trends. In recent reports, the majority of companies have pointed towards actual, if modest, economic improvements in the second half of April and beginning of May. As a result, investors have started to look ahead and consider how these incipient advances may influence earnings in the second half of 2020 and 2021. We find this phenomenon noteworthy because it provides additional empirical evidence that equity investors are looking beyond recent or even upcoming corporate reports and emphasizing how earnings, revenue, and profitability will improve in 2021 and beyond.

U.S. and Chinese trade tensions improved this week when officials from both sides pledged to create favorable conditions for the implementation of the previously negotiated “phase one” trade deal. Each country’s representatives reported that they are making “good progress” on smoothing out remaining impediments. This week’s reconciliatory tone and reported progress have removed much of that uncertainty for the time being and contributed to this week’s equity gains.

U.S. biotechnology company Moderna was reported Thursday to be producing substantial quantities of a COVID-19 vaccine. Although the vaccine has not yet proven its efficacy, Moderna, in partnership with $500 million of U.S. government funding, plans to make 1 billion doses of this vaccine by the fall, to be poised to distribute it on a widescale as soon as the trial results are completed. Other companies in the U.S. and across the globe are also racing for a vaccine to help bring a swifter end to the pandemic. While it remains uncertain whether Moderna’s developmental vaccine will prove successful, this degree of advance preparation is a sign of the company’s confidence in its vaccine. Investors are hoping that a vaccine from Moderna, or another company, will be available before a potential “second wave” of infection in the winter. The availability of an effective vaccine is an important factor in formulating a medium-term economic outlook, and the prospect that it may be realized has likely helped boost stock prices higher this week.

Lastly, the U.S. jobs report for April, released on Friday, showed a staggering 14.7% unemployment rate, the highest since the 1940s. Although the magnitude of job losses in April was no surprise because of the government’s weekly unemployment claims report, Friday’s report confirmed a disturbing fact. Last month 20.5 million jobs were lost, and the leisure and hospitality industry was hit particularly hard. However, markets reacted positively. Why? Many clients often, understandably, find this sort of response puzzling. The reason is that the 20.5 million jobs reportedly lost were mildly better than the economists’ consensus of an even higher 22 million. Further, the unemployment rate came in at 14.7% when Wall Street had expected 16.0% (and some expected a figure as high as 18%).

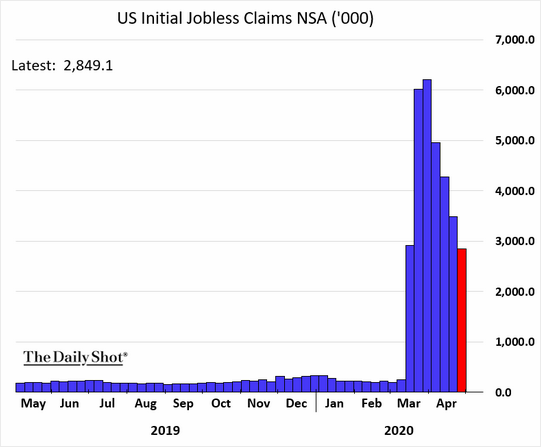

A bright spot in the labor report was an increase in the number of those classified as “temporary layoffs” in the report. In fast-moving markets such as the current environment, the initial weekly claims report has become more important than the monthly report due to its timeliness (i.e., a real-time, week-by-week status report instead of a once-a-month retrospective). In addition, the relative rate of change (visually depicted in the directionality of the employment data graph) is more important than its absolute levels, because the rate of change reflects improvement or its opposite. As shown below, the number of weekly jobs lost has declined in recent weeks (i.e., the rate of change has improved by being “less bad”), and equity investors see that as good. For financial markets to continue to look favorably upon this situation, the number of weekly claims will likely need to continue to decline to a normalized level over the coming months.

These kinds of job losses are truly unprecedented, at least since World War II. While the economic and human toll that such joblessness takes is awful, companies and individuals would be far worse off without the stimulus measures taken by the central banks and governments around the world. The U.S. government has injected upwards of $2.3 trillion of stimulus into the hands of individuals and companies, while the Federal Reserve has expanded the size of its balance sheet by more than $3.0 trillion since the beginning of April. In our view, it remains more likely than not that another stimulus bill will be passed and designed to include more aid for state and local governments, along with other measures to help normalize the economy in a more timely fashion than would otherwise be the case. Financial markets would likely welcome additional stimulus because of its tendency to incrementally boost investor sentiment, as it has in prior phases.

Related Posts

An Update on the Markets and COVID-19 (5.6.2020)

End-of-Week Update on the Markets and COVID-19 for May 2, 2020

End-of-Week Update on the Markets and COVID-19 for April 25, 2020

COVID-19 Scams: A Guide to Help You Stay Safe

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please click here or contact us directly.

© 2020 Sage Financial Group. Reproduction without permission is not permitted.