Market Update

Financial markets have started the week on an upbeat note. Through Tuesday’s close, the S&P 500 has risen 1.3%, the Nasdaq has advanced 2.3%, the small cap Russell 2000 has climbed 1.0%, and International stocks, as represented by the MSCI ACWI Ex-USA, have risen by 1.0%. The Barclays U.S. Aggregate Bond Index has been flat this week, while fixed income assets continue to trade with ample liquidity in most pockets of the marketplace thanks to the Federal Reserve’s monetary policy support via bond purchases.

The two main developments so far this week have been (1) a softening in the recently reprised U.S. and China trade tensions and (2) talk of further federal fiscal stimulus.

As we noted in our communication on Saturday, tensions between the U.S. and China had ratcheted higher over the past two weeks, and that contributed to market volatility at the end of last week. However, this week U.S. officials have softened their rhetoric. In particular, Treasury Secretary Mnuchin suggested that the U.S. will not financially retaliate for China’s unspecified role in the coronavirus pandemic so long as Beijing fulfills its commitments to “phase one” of the trade deal. Mnuchin’s comments were immediately well-received by market participants, and they may help to lessen fears that trade hostilities will flare again.

Discussions about a fifth round of fiscal stimulus are ongoing in Washington, D.C., now that the Senate has returned after an extended break. The size and provisions of this new stimulus bill remain uncertain, but the final form is likely to include compromises that help both parties’ constituents and policy agendas. For example, President Trump and some Republican politicians have been pushing for a payroll tax cut, while Democrats want more aid for state budgets. It remains to be seen if there is an appetite for further spending stimulus when faced with already large deficits, but a new bill in excess of $500 billion would likely boost investor sentiment in the near term because of its potential positive effect on the economic recovery.

Power of Staying Invested

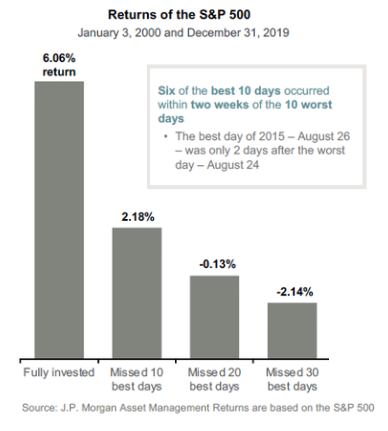

Investing inherently comes with short-term fluctuations. There will be good and bad days, weeks, months, and sometimes even years. Using history as a guide, however, long-term success is aided by staying invested through periods of volatility, not unlike what we have been experiencing during the COVID-19 pandemic. J.P. Morgan recently completed an analysis that illustrated how missing even just the best 10 trading days could significantly alter an investor’s returns. An investor who stayed fully invested in the S&P 500 from January 2000 to December 2019, for instance, returned 6.06% annualized while missing the 10-best days resulted in a 2.18% return.

*Note the title of this chart should read: January 3, 2000 through December 31, 2019.

Typically, the best days in financial markets occur shortly after the worst. In August 2015, for example, the best day occurred only 2 days after the worst. This year, March 16th was the worst day so far (down 11%), while March 24th and 26th saw rallies of 9.3% and 6.4%, respectively, two of the best performing days. The size of these daily moves understandably may have elicited a powerful emotional response for some investors. However, missing even a few of these positive days can hamper long-term returns.

Research on Treatments and Vaccines

Healthcare companies have been racing to find effective treatments and vaccines to save lives and help the world reclaim some sense of normalcy. The distinction between a treatment, which provides restorative care for someone already infected, and a vaccine, which prevents infection, is important to keep in mind. While a successful, low-cost, globally-scalable, and easily administered vaccine is the “silver bullet” in terms of helping all people return to life pre-COVID-19, an effective treatment could help reduce pressure on hospital systems by shortening hospital visits, reduce fear returning workers might feel about what will happen if they contract the virus, and perhaps even boost investor confidence by decreasing the mortality rate. All of these benefits from a treatment may promote a fuller and faster economic recovery.

Last week, the FDA issued emergency approval for remdesivir, a treatment developed by Gilead that has shown efficacy against patients suffering from COVID-19. Separately, Regeneron is working on an antibody therapy that has shown some very early promise. On the vaccine front, Johnson & Johnson and AstraZeneca are working on vaccines and may release data from their respective trials in early Summer (AstraZeneca’s results may be shared as early as late-May). Even if they are found to be effective, it will likely be at least nine months before these vaccines could be distributed at scale. But an intermediate step could be to provide vaccines to healthcare workers, and, in our view, the active development of treatments and vaccines is an important part of a comprehensive response.

Related Posts

End-of-Week Update on the Markets and COVID-19 for May 2, 2020

End-of-Week Update on the Markets and COVID-19 for April, 25, 2020

COVID-19 Scams: A Guide to Help You Stay Safe

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please click here or contact us directly.

© 2020 Sage Financial Group. Reproduction without permission is not permitted.