In this communication, we provide updates on financial markets, government policy, and some statistics on how coronavirus infection numbers are shaping up.

Market Update

In the rapidly changing world of the COVID-19 pandemic, the pace of news and developments this past week was relatively slow compared to the pace in March and early April. While the S&P 500 experienced a modest 5% sell-off between Monday and Tuesday when the price of oil plunged, the large-cap index finished the week essentially flat (-1.3%). Small-cap stocks outperformed their large-cap counterparts, with the Russell 2000 rising 0.3%. International stocks, as represented by the MSCI ACWI Ex-USA Index, also ended the week essentially even.

A slew of companies reported earnings for Q1, and many were better than expected, which positively affected performance in key sectors. For example, Snapchat’s positive earnings report was welcome news for other technology stocks, which make up 20% of the S&P 500 (e.g., Google, Facebook, etc.). Oil prices rebounded from the technical dislocation that temporarily pushed the price of oil futures into negative territory for the first time in history. If oil prices rise from their current low levels, then the price recovery could benefit companies in the energy sector, which shed a large number of jobs in connection with the fall in the price of crude. This means that higher oil prices may well turn out to be a net positive for economic and investor sentiment.

Government Policy Update

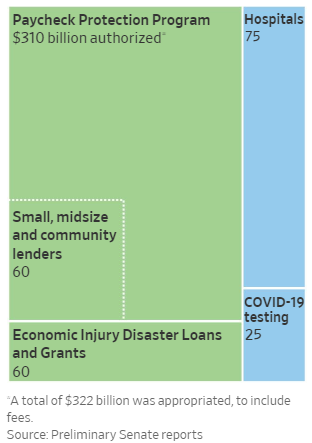

On Thursday, the U.S. House of Representatives passed the $484 billion stimulus bill that the Senate had approved on Tuesday. This fiscal package is essentially an expansion of the “Phase 3” CARES Act, and it will provide additional funding for U.S. small businesses, aid for hospitals, and increased resources for coronavirus testing. At the core of the agreement is approximately $320 billion of additional funding for the Paycheck Protection Program (PPP), which is aimed at helping keep small-businesses afloat and ensure that each company’s employees retain employment. Further, the bill includes $75 billion in funding for hospitals and $25 billion for manufacturing and purchasing coronavirus tests.

Government policy stimulus was not confined to the United States. On the monetary policy side, the European Central Bank (ECB) followed steps taken already by the U.S. Federal Reserve to help support “fallen angels” through bond purchasing programs. A fallen angel is an industry term for a company whose bond rating has been downgraded from the investment-grade category to the sub-investment-grade (or high yield or “junk”) category: fallen from above to be an angel within its new cohort. More specifically, the ECB added fallen angels to the list of acceptable collateral for banks to post in order to obtain liquidity from the central bank. Given that Italy is at risk of being downgraded to junk status, the ECB wanted to expand its mandate to continue to hold its third-largest country’s bonds. The decision came during an unscheduled call of the ECB’s governing council Wednesday night, with the hopes of limiting market stress should a larger downgrade cycle occur as a result of the coronavirus pandemic. The move is decidedly positive for European credit markets in general and banks in particular.

On the fiscal policy side, European Union (EU) leaders discussed a €1 trillion aid plan for the next phase of the pan-European fiscal response to the coronavirus pandemic. Although the leaders agreed to ask the European Commission to establish a recovery fund, they reached no consensus on its size, the balance between transfers and loans, or the general path ahead. The recovery fund’s purpose is to aid the economies most negatively affected by the COVID-19 pandemic through various forms of investment and spending, which would be implemented over the next few years. In practice, the fiscal stimulus would assist the southern European countries most, including Italy, Spain, and Greece. This recovery plan, which remains in the discussion stages, is distinct from the €500 billion already authorized by European finance ministers, which will provide credit lines, loans, and unemployment support by June 1. Fiscal coordination is much more difficult in the eurozone than the United States because although the eurozone has a single currency and centralized monetary policy administered by the ECB, it has no similarly centralized and ultimate legislative body to determine joint fiscal policy.

Biology

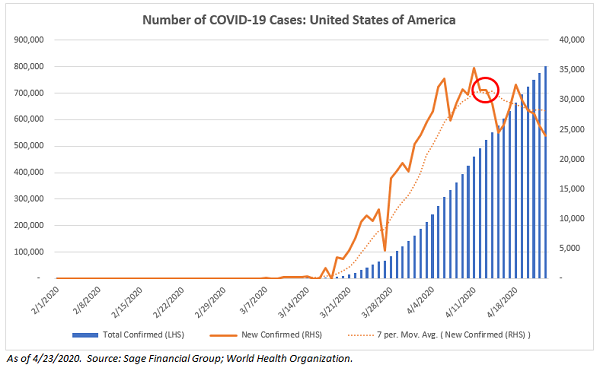

The path of transmission for the virus that causes COVID-19 is important to financial markets because investors look to it for hints about when businesses may begin to reopen. The trajectory of cases of infection provides a window into the trajectory of company earnings, consumer behavior, and investor sentiment. As we noted in our last communication on Tuesday, the dominant subject of talk has shifted from new government-imposed lockdowns to questions about when and how to reopen the economy. This pivot, along with the combined fiscal and monetary policy responses here and abroad, has led to improved investor confidence and broadly higher asset prices and liquidity. As shown below, the number of new cases in the U.S. seems to have peaked around 4/11, and new daily cases dipped below 25,000 yesterday for the first time since late March. We include the 7-day moving average in the graph via the dotted line so as not to focus overly on any one day’s data, which tends to be lumpy, and states will be using various types of moving averages to guide their decision making about reopening.

The downward trend in new cases of infection has been encouraging, and state governors have begun to roll out reopening plans. Warmer states with lower population densities are likely to go first. States that begin to reopen in the near-term will be closely monitored by health officials and other states: by health officials, to project how the virus may spread in a phased reopening approach; by other governors, to design their own state’s plan for reopening by repeating the successes and avoiding the missteps of the first-movers. How states such as Texas or Florida do as they reopen may signal to financial markets a potential timeline for broader normalization across the country.

In terms of vaccines and treatments, while we still do not expect any one drug in particular to be a “silver bullet,” we find it encouraging that so many in the medical community are focused on a singular problem. For example, this week a company in Germany, BioNTech, received approval to begin a COVID-19 vaccine trial on humans, and studies on other specific treatments are likely to be released by the end of the month. If these trials and studies yield positive results, investor sentiment and consumer behavior could begin to rise. There are 10+ treatments currently being studied, including both existing and new drugs. Of these potential treatments, the most closely watched drug is Gilead’s remdesivir. The antiviral drug has been undergoing rigorous clinical trials for severe cases, the results of which are scheduled to be released in the next few days. There are also ongoing trials into blood plasma treatments that have shown early promise. In our view, if an effective treatment that decreases both duration of infection and the mortality rate is available and officially approved for use, consumers will likely feel safer getting back to normal. That would, in turn, likely speed the economic recovery, and asset prices likely would begin to anticipate that gradual improvement, too.

We will continue to monitor what the movement from triage to adaptation to resilience means for the economy at large, the markets, and individual investors.

Related Posts

An Update on the Markets and COVID-19: Reopening the Economy

COVID-19 Scams: A Guide to Help You Stay Safe

COVID-19 and Long-Term Investing

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please click here or contact us directly.

© 2020 Sage Financial Group. Reproduction without permission is not permitted.