Stocks and bonds had a broadly negative month in August. Bond returns were negative in most areas of the world as interest rates continued to rise. Stocks in the U.S. and other developed markets declined on average while emerging market stocks were positive. While the indices were mixed, persistent volatility in prices signaled that the economy is still very much in an uncertain period, and we continue to prepare for a wide range of outcomes in financial markets. At Sage, we closely monitor the range of factors influencing that volatility and actively prepare for that wide range of outcomes.

In this edition of Insights, we recap this fast-changing market environment, share our thoughts on the latest moves from the central banks, break down Europe’s energy problem, and provide a broader perspective on remaining invested through turbulent times.

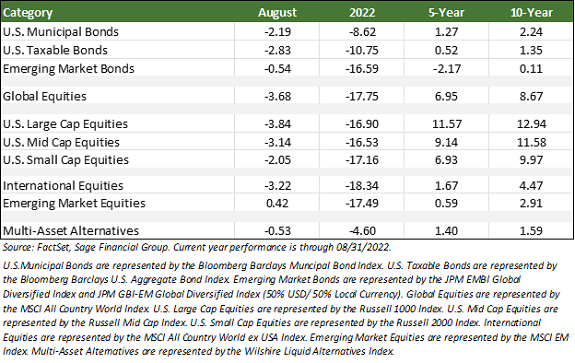

Performance Recap: Uncertainty Breeds Volatility

Uncertainty regarding the Federal Reserve’s policy remained high in August. Fed Chairman Jerome Powell’s speech at the Jackson Hole symposium highlighted the central bank’s determination to bring inflation down. Investors are taking that determination seriously. Just over a year ago, fixed income markets expected Fed policy rate hikes of only 0.50 percentage points in all of 2022, but investors now expect rate hikes to total 3.50-4.00 percentage points this year. Following the European Central Bank’s (ECB) decision to increase its policy rate into positive territory for the first time since 2013, expectations of future rate increases have grown, driving increased uncertainty about future economic growth and market returns.

- Equity markets were mixed in August, led by emerging market equities, which returned 0.42%. Global equities lost 3.68%. U.S. large-cap stocks declined 3.84%, while small-cap stocks fell 2.05%. The most widely quoted international stock index fell 3.22%[1].

- Global equities have dropped by 17.75% on average year-to-date through August, a stark contrast to average yearly gains of more than 20% in 2019, 2020, and 2021.

- The dramatic change in Federal Reserve policy expectations contributed to higher rates and, unfortunately, sharply lower bond prices. Investment grade bonds have fallen by 10.75% this year, and U.S. high yield bonds by 11%. In contrast, many alternative investments have declined by “only” 3%-5%.

Central Banks Seek Equilibrium

In 2021 and the first part of 2022, many markets were out of balance, primarily driven by government stimulus programs and pandemic-related shifts in behavior. The impact of a housing shortage has reverberated across the economy. At the same time, employers found it exceedingly difficult to hire workers in many sectors, and wage growth reached levels not seen in decades. Then, Russia’s invasion of Ukraine led to higher prices at gas stations and grocery stores. This confluence of factors led to aggressive actions from central banks determined to bring equilibrium back by cooling down the overheated economy.

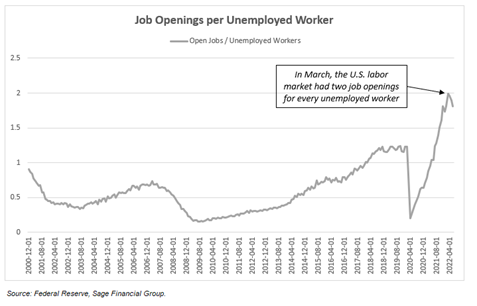

The Federal Reserve, along with other central banks around the globe, has attempted to keep aggregate supply and demand in balance through a goal of maximum employment and price stability. Fed Chair Powell noted in late August that “the labor market is particularly strong, but it is clearly out of balance, with demand for workers substantially exceeding the supply of available workers.” An example of labor market development in the U.S. is seen in the ratio of people looking for jobs versus the number of job openings, which stood at an all-time high earlier this year. While the number of job openings per unemployed worker continues to decline and signals some equilibrium between supply and demand in the labor market, there is still a long way to go.

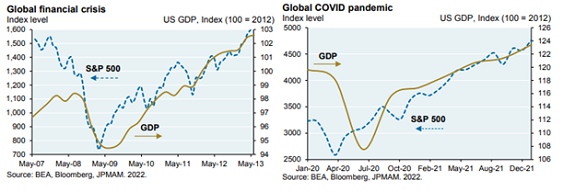

Globally, most central banks are intentionally slowing their economies rapidly by raising the cost of borrowing. Once the impact of this policy becomes apparent and makes its way through the economic system, a rebound in growth could be within sight. As we have written in recent months, many economic indicators are backward-looking. We saw this dynamic in the Global Financial Crisis and the COVID pandemic. Equity markets, however, tend to be forward-looking. While inflation is hurting the economy currently, we expect markets to bottom before the slowdown hits its lowest point. From an investment perspective, this should translate to stocks finding a bottom before it is clear that the economy is beginning to recover.

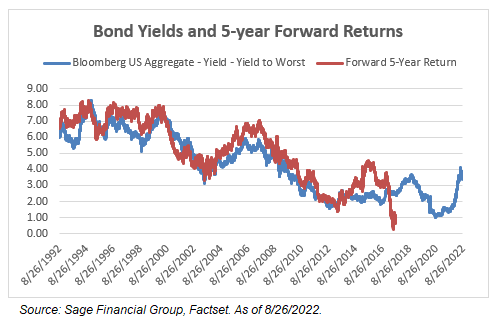

Turning to fixed income, higher bond yields have translated to higher returns over history. Looking back over 30 years, 5-year bond returns have closely followed current yields at the time of purchase. Two exceptions are investors who purchased in 2015 and 2017. Bond total returns outperformed the starting yield from 2015-2020 when yields fell sharply during the pandemic. Conversely, bond total returns underperformed yield from 2017-2022 due to the sharp rise in interest rates this year. In 2022, the yield on core bonds reached the highest rate since 2010, which we believe signals that future fixed-rate bond returns may be higher than we have experienced in recent years. Yields are likely to remain volatile, but we believe that the 3- and 5-year projected bond returns look better now than in recent years.

Europe’s Energy Problem

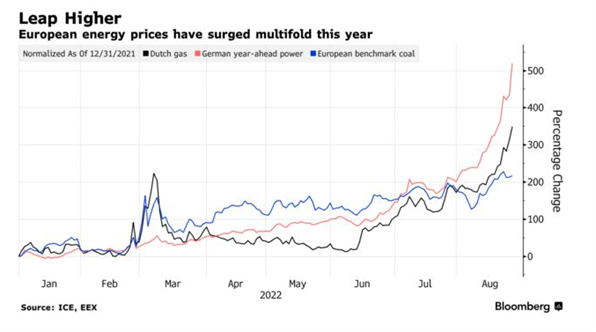

As the summer winds down, Russian aggression continues on two key fronts: the ongoing battle in Ukraine as well as energy supply limitations in Europe. While Ukraine has successfully repelled a westward advance by Russia, economic pain is being felt across most of the European continent due to higher energy bills for consumers and businesses alike.

Countries including Germany and France are facing the worst energy supply crunch in decades and are looking to build up supplies for the winter, which further exacerbates price increases. The result is that rising energy costs impose pain on economies, with households and factories bearing an indirect result of a military conflict.

In our view, a prolonged dependence on Russian energy has made the region susceptible to “supply side” disruption as Russia squeezes the continent. Following a Eurozone inflation reading of more than 9% year-over-year, European central banks may be forced to respond with large rate increases. These rate increases should lead to slower growth in the region and negatively impact bonds and stocks.

Sage portfolios hold minimal European bond exposure, and we proactively reduced equity exposure in anticipation of this slowdown. We exited the Europe-focused small-cap equity position earlier this year while shifting towards preferred infrastructure assets. These are indexed to higher inflation and have historically provided downside protection through turbulent markets.

A Broader Investment Perspective

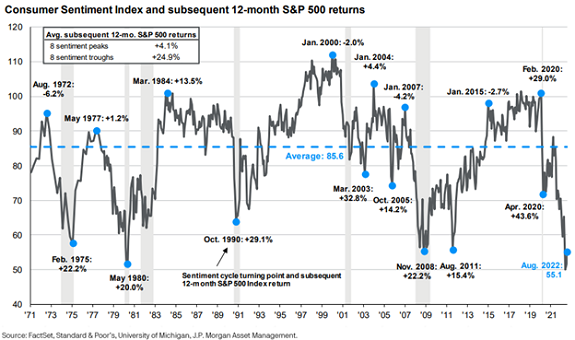

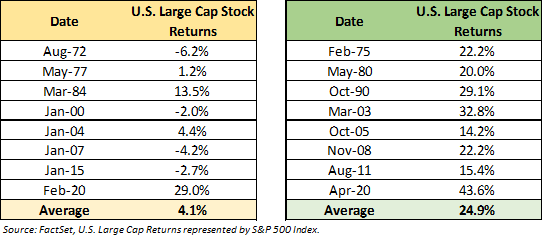

Without question, recent economic developments across the globe have been negative. Challenges like higher prices at the pump, elevated food prices, the war in Europe, and more have driven negative consumer and investor sentiment. Despite the negative sentiment, our focus on historic market performance and a long-term perspective actually reveal some opportunities for investors. Historically, negative consumer sentiment can be a signal to buy stocks as opposed to selling them. Case in point: the Consumer Sentiment Index reached the lowest level since 1980 last month (as shown below). When we look at the last five times sentiment reached this level, subsequent solid 12-month returns from U.S. Large Cap stocks followed (since 1970).

A more granular summary of the data, shown below, underscores this trend. Historic stock returns are better in periods after poor consumer sentiment, which seems counterintuitive. On average, U.S. large-cap stocks returned 4.1% in the year after a consumer confidence peak but nearly 25% in that same period after a trough. We do not know precisely when this “trough” will occur, but a review of past performance shows that the data points move in cycles over time, and the current day offers a historically bad reading.

While we expect volatility to continue and risks to remain, we anticipate that conditions will improve for consumers over the near term. When the storm clouds clear, we believe economic activity and asset prices will reflect the recovery. Because it is impossible to know exactly when that recovery will occur, we continue to recommend staying the course and relying on the strategies embedded in your personalized investment plan.

Closing Thoughts

Following July’s strong start to the second half of 2022, financial markets took investors for a bumpy ride in August. Volatile markets moved fast throughout the month, and near-term fluctuations became more pronounced.

As we’ve shared before, we understand that this environment can be unsettling. We feel it, too, and we recognize that when it feels like things are changing rapidly, “staying the course” can be the hardest advice to follow. Rest assured that Sage seeks to build your financial plan with your specific needs and goals in mind. We construct portfolios expecting some difficult times for returns and have taken proactive steps to minimize the impact over the short- and long-term.

Overall, our ultimate takeaway remains unchanged from previous months: Sage maintains a balanced outlook on the economy and the financial markets. Some of the macroeconomic picture remains mixed, with record low levels of unemployment but persistently high inflationary pressures. Ultimately, the path forward will depend foremost on how global central bankers respond to financial and economic data as it comes in.

We expect market volatility to persist, but note that this can create periods of opportunity for investors. Our research constantly challenges and ultimately reinforces the merits of a disciplined investment strategy. We are responding to market dislocations with thought and care, seeking to increase the likelihood that your financial goals will be met.

We will continue to rely on the investment principles that have anchored Sage since its founding in 1989. Our focus remains on crafting portfolios that are well-diversified, structured to reduce volatility over time, and informed by our understanding of your financial goals, risk tolerance, time horizon, and return objectives.

[1] U.S. Large Cap stocks represented by Russell 1000 Index, Global Equities by MSCI All Country World Index, International Equities by the MSCI All Country World Ex-USA Index, Emerging Market Stocks by the MSCI Emerging Markets Index, and U.S. Investment Grade Bonds by the Bloomberg Barclay’s U.S. Aggregate Index.

Previous Posts

Sage Insights: Technical Recession, Economic Data versus Equity Markets, and A Broader Perspective

Sage Insights: Ongoing Inflation, China’s Evolving COVID Policy, and Geopolitics in Europe

Our Perspective on Continued Market Volatility

Our Perspective on the Current Market Environment

Sage Recognized for Commitment to Clients

Learn More About Sage

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks, or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks, or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks, or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, product or any non-investment-related content, made reference to directly or indirectly in this newsletter will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please click here or contact us directly.