Overview

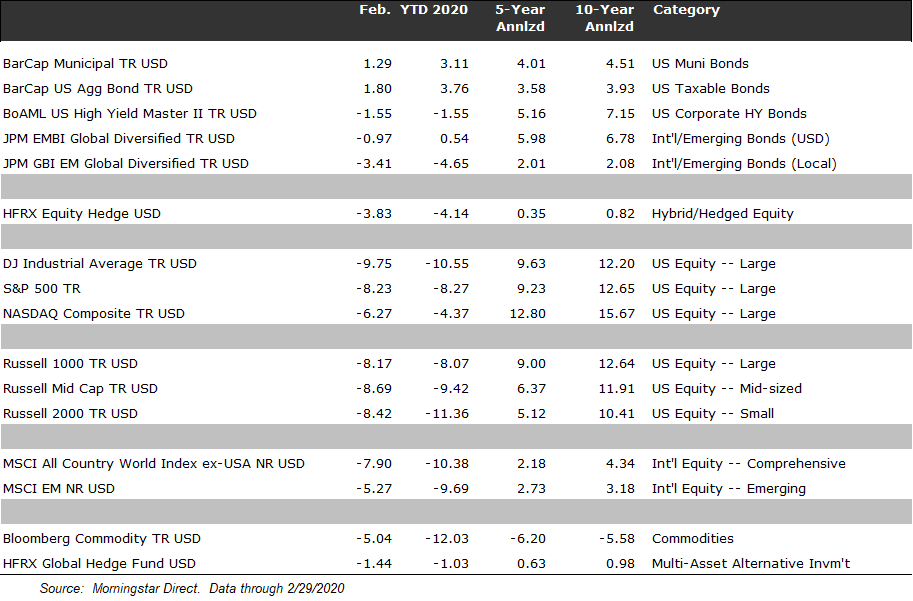

In February, major stock indices dropped sharply, and core bond indices rose largely due to heightened worries about the global economic implications of the coronavirus (COVID-19; however, the U.S. presidential primaries also played a part. Equity markets seemed to respond more skittishly to wins by Senator Sanders than by former Mayor Buttigieg and Vice President Biden. The monthly return for the S&P 500 was -8.23%, the Russell 2000 (U.S. small-company stocks) fell 8.42%, and the MSCI ACWI ex-USA (non-U.S. stocks) lost 7.90%. In contrast, core U.S. bonds rose last month. The Barclays U.S. Aggregate Bond Index was up 1.80%.

In this issue of Insights, we primarily expand on our recent comments about the potential economic and investment implications of the COVID-19 virus. Our view is that the upcoming quarterly GDP figures will reflect decreased global economic activity, particularly in East Asia, and that COVID-19 could hinder economic growth for at least the first half of the year. There will likely be more short-term volatility as market participants digest incoming data about the virus’s severity. Investors will closely scrutinize emerging information about COVID-19’s contagiousness, geographic spread, mortality rate, and effects on the public’s psychology and behavior, as well as the response by governments (federal, state, and local), central banks, and healthcare organizations. But successful investing requires keeping the big picture in mind during periods of turmoil. When we zoom out, we continue to see a foundation of encouraging trends that existed prior to the COVID-19 epidemic, such as de-escalation in global trade friction especially between the U.S. and China, a smooth Brexit transition, and supportive U.S. Fed and global central bank policies.

Performance

Core bonds gained in February and equities tumbled due to intensified worry about COVID-19 (see table below).

The S&P 500, which had closed January nearly even, dropped 8.27% in February. Similar to January, the first half of February was strong. Declines came swiftly toward the end of the month. The Russel

\\l Mid Cap Index also fell more than 8% (down 8.69%), as did the Russell 2000 Index of small companies (down 8.42%). Small-cap and mid-cap stocks have more cyclical sensitivity than large-cap stocks and thus typically fare worse during times of stress. The MSCI ACWI Ex-USA Index, a measure of all stocks outside the U.S., and emerging market stocks fared somewhat better. The broad foreign index was down 7.90%, whereas the MSCI Emerging Market Index declined just 5.27% in February, likely because it was harder hit in January when reports of infections were still largely found in China.

The Bloomberg Barclays U.S. Aggregate Bond Index jumped 1.80% in February as more investors joined the flight to safety. The Barclays Municipal Bond Index also rose sharply by 1.29%. Relative U.S. Dollar strength helped USD-denominated emerging market bonds last month, which slid by only 0.97%, as reflected in the JPMorgan EMBI Global Diversified Index. The local currency EM bond index, the JPMorgan GBI EM Global Diversified Index, however, fell 3.41%. A 50/50 blend of the two EM bond indices is down approximately 4% in 2020 through February.

Outlook

Our current view about the remainder of 2020 is evolving but begins with a concession that there remains a tremendous amount that we still do not know. To say this is to acknowledge the increased uncertainty that exists about the effects COVID-19 may have on the global economy and global markets over the next several months from both fundamental economic and human psychological perspectives.

Successful investing, however, involves sorting through what is important and what is noise in the short term in order to focus in a more informed way on the long term. The situation is currently too fluid for us to say with certainty what will happen in the near term, but we are confident in a recovery over the longer-term. We wish to remind investors that this longer-term consideration likely matches their actual investment time horizons and should, therefore, guide their decision-making more than short-term fluctuations.

No one knows at present with certainty, which of three potential outcomes — best, moderate, or worst — will play out from health, economic, and investment perspectives. Data remains insufficient for scientists to formulate more than educated guesses about the numerical extent of global infection from COVID-19 and the magnitude of its health effects.

There are conflicting opinions, for instance, among leading epidemiologists about whether the COVID-19 virus will wane with warmer weather in the northern hemisphere like the normal influenza virus, whether it will flare again in the southern hemisphere’s winter, whether it will circulate throughout the year in the tropics, and whether it will return annually like other virus strains.

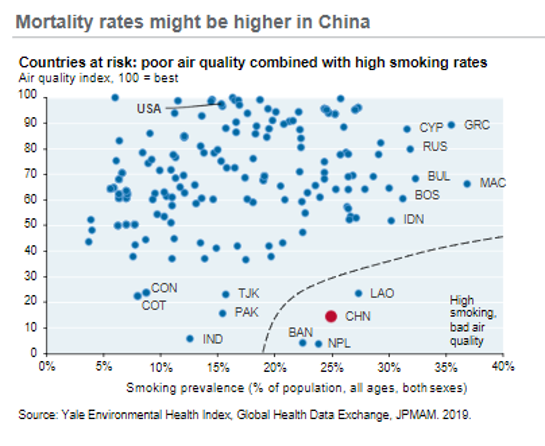

Even the current estimated mortality rate may be skewed by studies conducted primarily on affected Chinese citizens because the country has a large population of people with underlying respiratory illnesses, often unique environmental conditions, and uneven access to health care. For instance, China’s population compared to other countries has more cigarette smokers and poorer air quality (see the nearby chart). China also has a less developed healthcare system than developed countries such as South Korea, which has seen a mortality rate of just 0.58% at the time of writing. Put simply, we need more data to fully understand COVID-19. It is possible that the magnitude of fear surrounding the virus does not match its actual nature and consequences.

Economists and market strategists occupy an even more difficult position with forecasting than scientists. The situation of the former two groups is made more difficult because investor, business, and consumer psychologies are playing a huge role in forming current expectations about the future and in influencing current behavior. It is important, therefore, to acknowledge how much is unknown, to confess that some things will remain unknowable, to admit that we cannot predict certain things like changes in human emotion, and to maintain a position of some humility.

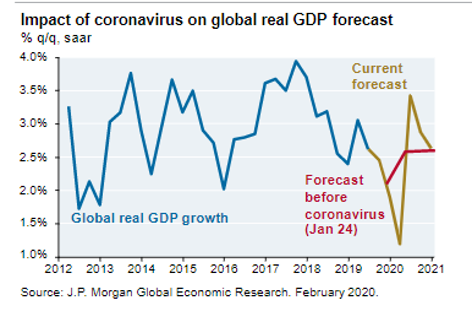

Nevertheless, we need not shirk from expressing an informed opinion. At present, the question on everyone’s mind is to what extent the coronavirus surprise will disrupt the generally optimistic stance with which we started the year. The short answer is this: Currently we believe that the COVID-19 pandemic will disrupt global (including U.S.) economic growth through at least the first half of 2020 and that a recovery will begin to follow at some point in the back half of the year. Goldman Sachs like other groups had anticipated 3.0% to 3.5% global GDP growth for 2020, but it has recently said that its “full-year global growth forecast [has been adjusted down to] about 2%. All else equal, this would imply a short-lived global contraction that stops short of an outright recession.” This dynamic is reflected graphically in a similar analysis by J.P. Morgan: The chart depicts a short-term hit to GDP growth, followed by higher GDP than previously expected in the second half of the year, and a return to prior expectations heading into 2021.

That forecast seems to be a reasonable expectation for the U.S. economy as well: slow growth or even a single quarter of contraction in the first half of the year followed by a gradual pick-up of growth in the second half of the year. If a technical recession involves two consecutive quarters of negative growth, then at present, we do not think that most probable. The risk of recession in the U.S. has increased in recent weeks, and we cannot rule it out; however, we think it more likely that full-year U.S. growth will end positive for 2020. Calendar-year U.S. economic growth, however, may be marked by uneven quarterly growth rates (one possibly negative) throughout the year. Moreover, although growth may be positive, it may not always feel like that to consumers. The current situation, though, is not a systemic threat to financial institutions. Banks are exceedingly well-capitalized as compared to time periods preceding previous recessions. There have been significant changes to strengthen (i.e., raise) the capital ratios of banks, and the health of banks is one of the key components for predicting recessions. In our view, the financial system is much more prepared to handle a shock like this than it was prior to the financial crisis of 2008. We are not ruling out further Federal Reserve action to support the economy. We think that the global financial system and the Fed, in particular, will be proactive in preventing systemic shocks.

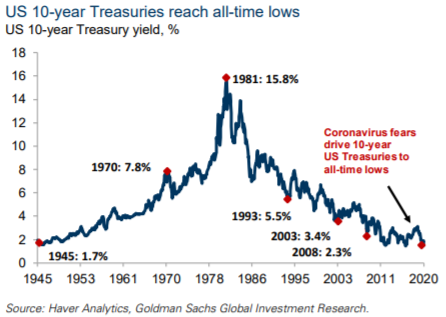

How are financial markets likely to react from here? Government bond yields have fallen to historically low levels. The 10-year Treasury, for instance, briefly traded below 1% at times during the first few days of March. Could it go even lower in the near-term as investor emotions drive the flight to safety? Yes, although longer-term investors will once again need to face the prospect of lower-than-historical-average bond returns given the initial low yield conditions for income and the prospect for rising yields as the economy stabilizes and recovers, which will have a negative effect on prices. Core bonds retain a well-deserved diversifying role within portfolios, but it may not be prudent to count on them to provide total returns in line with those generated over the last 40 years.

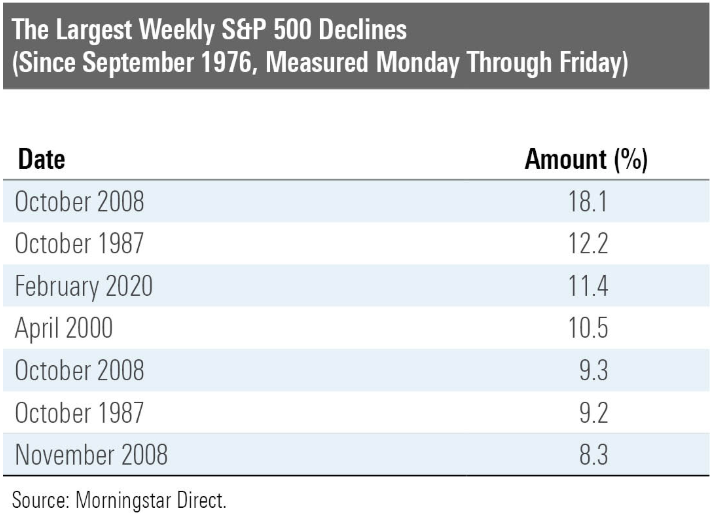

The last week of February, with a loss of 11.4% from Monday through Friday, was the third-worst weekly return on record for the S&P 500 Index since 1976. Since that time, there have only been seven weeks with losses of 8% or more. These instances cluster around events in 1987, 2000, and 2008, which all had very different contributing causes. We mention this not to draw any particular implication for what might ensue from here but to put into perspective the magnitude of the sell-off that played out during the final week of last month. Given the sharply positive days for the S&P 500 the first week of March (up 4.6% Monday and up more than 4% on Wednesday), we hasten to point out the fast-changing (and often emotional) perceptions driving stock prices in either direction. In such situations, it can be adverse to change portfolio positioning radically in any direction, especially if one is starting with a well-diversified portfolio that was constructed precisely to withstand periodic market corrections.

To illustrate the dramatic swing in emotions that has occurred within financial markets, contrast the two readings of the same CNN Fear & Greed Index on the graphs shown side by side below. The one on the left is dated from the start of the year and was included in our 2020 outlook letter; the one on the right is dated March 4. As we pointed out in January, it is possible that positive sentiment (greed) after such a strong year in 2019 was exaggerated, and now it is possible that negative sentiment (fear) is similarly excessive.

The nearby chart shows how the current fear reading compares with other such low points over the last three years. Although the negative sentiment can persist for several months (e.g. in 2018 when there were worries about trade wars), equity markets, which correlate closely with this sentiment indicator, eventually moved sharply higher after reaching similar a low point as reflected in the current fear reading. The causes for fear over time may differ, but the underlying mechanisms of human psychology and the implications for investor behavior remain generally constant.

To say this is not to predict a specific temporal turning point for market movements, but rather to point out that fear and greed tend to move in cycles and typically do not last for long periods of time. It is also not to downplay the potential effects on the broad U.S. or global economy if consumer psychology prompts reduced spending, canceled travel plans, or even avoidance of public places. It is, however, to underline that human emotions are liable to change, sometimes even to polar swings, and that what seems either sublime or ghastly one moment eventually will pull back from that pole. We do not know when that will occur in connection with the COVID-19 pandemic, but we are confident that it will happen. When it does, we believe that stock markets will respond in kind.

Until that occurs, and perhaps as a way to hasten its occurrence, it may be helpful for us to remind investors of what facts we do have about COVID-19. Demystification may help to de-escalate some of the worries.

- COVID-19 is a type of coronavirus, novel in its particular expression, but part of a family of known viruses.

- It is called a coronavirus because its shape looks like spikes on a crown.

- A study by China’s Center for Disease Control found that 80% of confirmed cases are mild; many more cases may go undetected because symptoms are so mild and/or are similar to other common cold or flu illnesses. This is a factor that can skew the numbers on a true mortality rate.

- Symptoms are mild to severe respiratory illness with cough, fever, and difficulty breathing, especially for those with other underlying medical conditions and who have a history of smoking or respiratory illness and/or live in conditions with poor air quality.

- The elderly seem to be more affected than other age groups; cases of children with the virus have been relatively mild.

- The mortality rate is currently not precisely known.

- As the Washington Post reported, “About 2 percent of reported cases have been fatal, but many experts say the death rate could be lower. That’s because early in an outbreak, mild illnesses may not be reported. If only people with severe illness — who are more likely to die — seek care, the virus will appear much more deadly than it really is because of all the uncounted people with milder symptoms. … Under counting cases can artificially increase the infection’s mortality rate.”

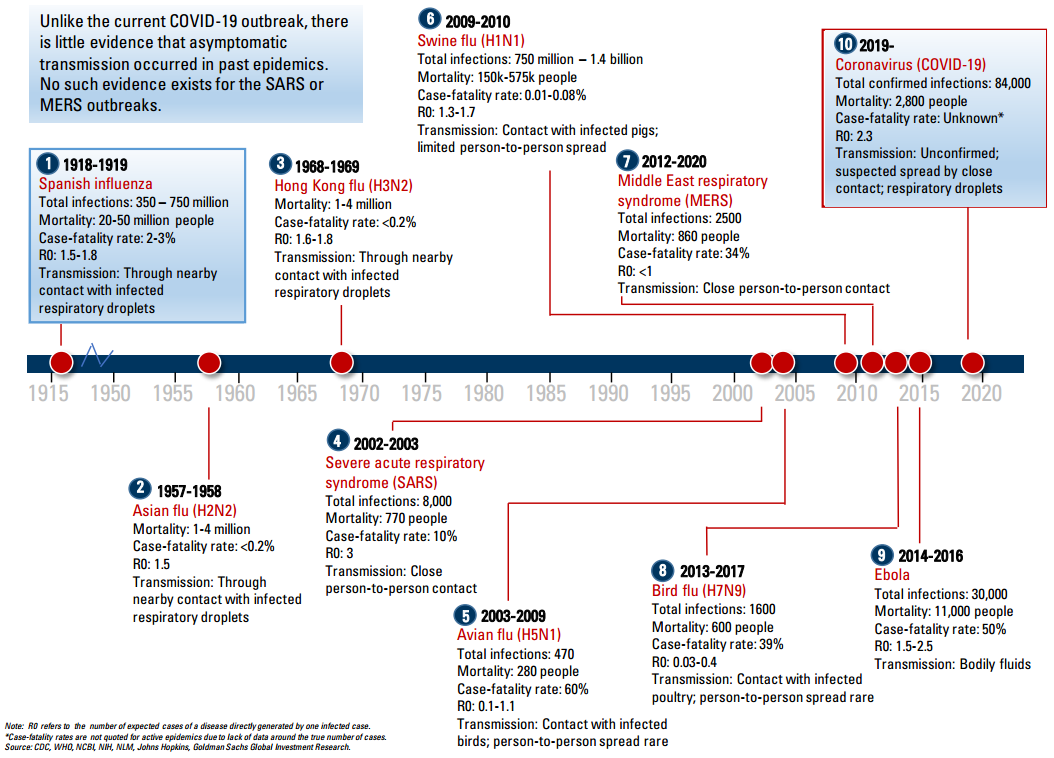

- COVID-19 is related to prior SARS (2003) and MERS (2012) epidemics, but there are differences: COVID-19 is less lethal but more contagious.

- Michael Osterholm, director of the Center for Infectious Disease Research and Policy at the University of Minnesota, explains it this way: For the prior SARS and MERS episodes, “the majority of transmissions occurred well into patients’ illnesses, meaning that patients experienced four to six days of critical illness before they became infectious. So while these prior episodes had much higher case-fatality rates—with SARS about 10% and MERS as high as 25-30%— we could address those illnesses fairly easily, by recognizing cases early on, and getting patients into isolation while still in very low states of infectiousness. That’s not the case with COVID-19. While the case-fatality rate is much lower, the transmission is quite dynamic, and many more people will get it.”

- It is spread person-to-person via a respiratory droplet from cough or sneeze, as well as via contact with infected surfaces or objects.

- Remaining prudent with hygiene and calm in disposition are two things that you can do to prepare.

It is not clear when the viral incidents of infection globally are likely to peak or how many there will be. Investors should expect the global spread of the disease, but investors should not expect global Armageddon.

The graphic below maps the history of 10 major global pandemics and health outbreaks over the last 100 years. It can be helpful to view the longer sweep of history in order to put similarities and differences into greater perspective.

Governments and central banks are responding increasingly proactively to the health outbreak, although the response so far has not always been coordinated or smooth. The public should not expect a silver bullet from a single government agency or arm to quell potential economic effects, market sentiment, or epidemiological worries. The successful response will involve a multi-faceted approach and time.

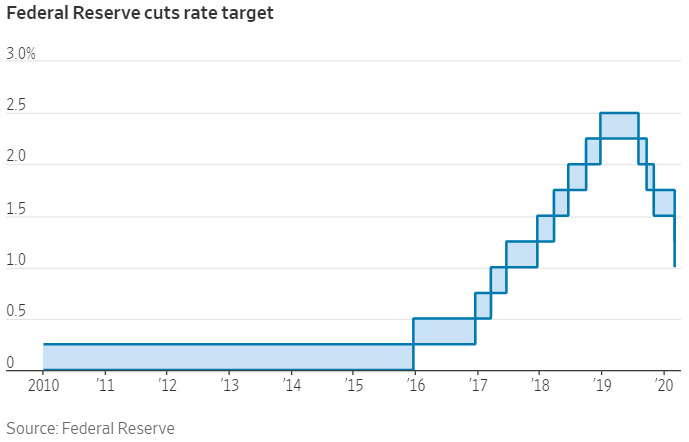

For instance, the Federal Reserve announced on Tuesday, March 3, an intra-meeting interest rate cut of 0.50% to a range between 1% and 1.25%. Ostensibly, the Fed wished to reassure jittery markets that it stood ready to support the U.S. economy according to its mandate because there were increasing concerns about the economic drag that the business and consumer response to COVID-19 might have. Although the intention was to reassure, the effect of this isolated move seemed to be to alarm, based on the equity market sell-off later that day. The following day, U.S. equity markets rebounded significantly higher (the S&P 500 closed up 4.2%), and it was already up sharply before Congress announced that it had reached in principle an agreement on an $8.3 billion spending package related to COVID-19. The point is that the government response will likely increasingly be multi-pronged.

Conclusion

The U.S. economy remains solid, despite understandable worries about the potential implications of Coronavirus. In Sage’s view, the global economy remains on track to continue to grow over the course of the full year, albeit with some short-term slowdown (or even single quarter contraction) in the first half of 2020. Although risks of a recession have increased, at present, we do not think that the COVID-19 scare will tip the U.S. into recession. Emotions are running particularly high right now, and understandably so; however, we think that the initial alarm will eventually wane, and that will pave the way for a more fundamentals-oriented recovery. While it is difficult to think long-term in the face of rapid market declines, we remain assured by the risk diversification in place in our clients’ portfolios. Of greater concern, is the public’s medical health and the human toll related to this outbreak. Our hearts and thoughts go out to all affected by COVID-19.

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events which were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please visit Accolades page or contact us directly.

© 2020 Sage Financial Group. Reproduction without permission is not permitted.