In this communication, we share an update about market returns and discuss some new developments in the government’s policy actions and the scientific community’s health response. We also include, and close with related perspectives about what these mean for you and your investment portfolios.

Market returns

Financial markets have been mixed this week as investors continue to digest news regarding the ongoing COVID-19 pandemic. Monday’s market action was largely uneventful, judged in light of recent volatility. Tuesday saw broad and steep advances, while Wednesday has seen declines similar in size to Tuesday’s gains. Taken together, the week’s returns as of the end of Wednesday, come to about a net 0%. These types of sawtooth patterns can often be expected following a rally as significant as we have seen from the intra-year lows. Through today’s trading day, the S&P 500 has bounced 27% from its March 23rd low and is down approximately 14% on the year.

As we have noted in the past, markets were generally acknowledged to be fully pricing in a recession in late March. Now they are adjusting to questions about the length and depth of the current recession, along with the impact of the policy response.

Policy Response

On the fiscal policy response side, the U.S. government has, in cooperation with banks, made over $300 billion of small business loans through the Paycheck Protection Program (PPP), a figure quickly approaching the planned target of $350 billion in loans. Given this strong demand for such financing, officials are now discussing expanding the total amount of the program from $350 billion to $600 billion. Both political parties support the PPP expansion, but Democrats are seeking an additional $250 billion of funding for hospitals and municipalities. Negotiations between the two sides are ongoing. We continue to believe that a Phase 4 fiscal package along these lines is necessary and will eventually be passed, although the exact timing and provisions remain uncertain.

In terms of monetary policy response, Fed Chairman Powell’s actions have been truly historic in their swiftness and scope. In particular, his statement late last week about the Fed’s commitment to supporting the smooth functioning of markets and economically stimulative lending is extremely important to note. Powell stated that the Fed “will continue to use these powers forcefully, proactively, and aggressively until we are confident that we are solidly on the road to recovery.” Furthermore, referring to the sacrifices and losses that American people are suffering as a result of the sudden economic stop caused by COVID-19 mitigation measures, Powell said plainly, “We should make them whole. They did not cause this. This is what the great fiscal power of the United States is for, to protect these people from the hardships they are facing.” These statements reinforce that the Fed will do everything in its vast power to backstop large and small companies, as well as individuals

It is hard to overstate how important the combined fiscal and monetary policy response has been — and will be — for financial markets. The fiscal programs are targeted to keep businesses and consumers afloat during the storm, while monetary policy is designed to backstop some of Congress’s legislated programs (via buying loans) and provide liquidity across the fixed income complex. For example, the PPP allows small businesses to resume their operations when lockdowns end, as opposed to what would almost certainly occur absent these policies: a much larger number of businesses would close, and these business closures (more of which would be permanent, by the way, not just temporary) would delay the re-hiring of employees, capital spending, replenishing inventories, and other normal activities. The coordinated policy response provides a cushion for the economy while lockdowns are in place, and it positions the U.S. economy and the markets for a faster rebound than would likely occur if these actions had not been taken.

Developments in Health-Related Policy

Over the past week, investors have begun to shift their focus from asking the question, “Will we resume normal life?” to asking, “When and how will we resume normal life?” Some major hotspots of virus outbreaks in the U.S. and across the globe have begun to report a decline in new confirmed COVID-19 cases, and governors have started to discuss plans to resume business activity.

The development of declining new COVID-19 cases and the move by officials to discuss initial steps to resume parts of normal economic and social life have together improved investor sentiment. While we remain cautiously optimistic that a re-opening of economic and social life may start in the coming weeks, we also believe that re-opening the economy will be an incremental process that does not happen in a straight line. The announcements of multi-state coordination (such as on the west coast and in the mid-Atlantic region) are encouraging, but the shift towards re-opening the economy will likely vary widely at the country, state, and even county level. The Trump administration, in fact, is currently constructing a plan focused on county-level restrictions, as opposed to larger state-level restrictions.

The sort of sudden economic stop we have experienced, because of the health-related physical distancing requirements and remaining virus-related unknowns, cannot be turned back on immediately like a light switch. But the discussion itself is a positive development following weeks of shutdown that has been largely characterized by an absence of discussion of resuming nonessential businesses. Investors proverbially and truly hate uncertainty, and so the more clarity that government officials give, the more likely it is that sentiment (and perhaps asset prices) will move higher and volatility will decline in the marketplace.

Long-term Investing

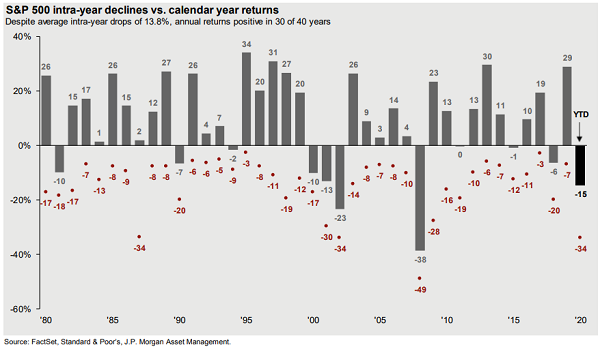

Below is a chart that we think provides context for this year’s equity market declines. It shows full, calendar-year returns (grey bars) and intra-year drawdowns (red dots) dating back to 1980. We can’t know precisely what the future holds, but we do think that we can use history as a guide to gain perspective and even reassurance. As of 4/15/2020, the S&P 500 is down 14% YTD and experienced a maximum drawdown of 34%. Prior to the COVID-19 pandemic, the S&P 500 only experienced 4 occurrences of 30%+ drawdowns since 1980, including the 1987 crash, tech bubble 2001-2002, and financial crisis of 2008.

While the tech bubble and the global financial crisis occurred more recently, the 1987 crash is also important to keep in mind. In that time, there was a similar 34% decrease as the most recent peak-to-trough drawdown, but the S&P 500 finished 1987 positive returns. While the future is always uncertain, and there are periods of time when it will feel that way more than others, it is important to keep your time horizon in mind and remember that your portfolios have been constructed with that in mind. Remember that we have been here before (and will likely be here again at some point in the future, and drawdowns like this will occur, and recoveries will happen, too. We also want to remind you that the market movements we have been experiencing, while sudden and surprisingly caused by a virus not known about before last December, are of a magnitude that has also been factored into your investment plan and financial goals.

Each recession feels like “this time is different” because each recession is unique, but they all follow similar patterns. Luckily, unlike many deep periods of economic contraction, the current recession has come with supportive policy response from authorities and highly capitalized banks.

Related Posts

Weekend Update on the Markets and COVID-19 (4.11.2020)

A Reference Guide to the COVID-19 Assistance Package

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please click here or contact us directly.

© 2020 Sage Financial Group. Reproduction without permission is not permitted.