|

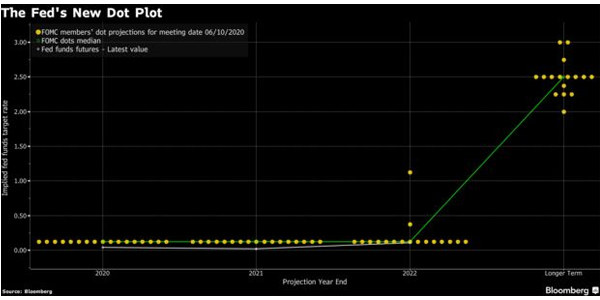

Market Returns The bond market was a source of relative stability this week, as the Barclays U.S. Aggregate Bond Index finished up 0.6%. This week’s equity market performance, however, was more negative than it has been in recent weeks. Trading was choppy during the first half of the week, followed by sharp selling on Thursday across all major indexes. The MSCI ACWI, which represents global equities (i.e., both US and International stocks), dipped by 1.2% between Monday and Wednesday before finishing the week down 4.3%. The small cap Russell 2000 Index fell by over 5% on Thursday, ending the week down 8.2%. The S&P 500 finished the week down 4.8%. The week’s equity performance suggests we are not yet out of the woods, but the market has shown resilience, considering how dismal the economic data was just a few months ago. The pullback this week after a few negative headlines (e.g., concerns around coronavirus stats in specific states, a negative Federal Reserve briefing, etc.) was not particularly surprising given how much stocks have rallied from the March 23rd lows and especially how much they gained during the last few weeks. The S&P 500’s performance since March (+36%) is a good reminder that the best strategy during volatile markets is often simply to remain disciplined and adhere to your investment plan, which is designed to help you accomplish your financial goals aligned with your time horizon. Monetary Policy On Wednesday, the Federal Reserve released its first economic projections since the COVID-19 pandemic hit the United States. The statement made clear that the Fed will continue its very accommodative approach until both the risks from the coronavirus subside and unemployment and inflation return to the Fed’s longer-term targets of 4.5% and 2%, respectively. To that end, the Fed said it would continue purchasing Treasury bonds and mortgage-backed securities and keep its benchmark federal funds rate in the 0-0.25% range (i.e., with no rate increases) through 2022, which is reflected in the Fed’s new dot plot (shown below). [1] On this chart, each dot represents the interest rate projections made by each individual member of the FOMC.

Although there were no surprises in the content of the Fed’s policy statement, the tone was gloomier than anticipated. The general expectation heading into Wednesday was that the post-meeting statement would highlight the positive developments we have seen in recent weeks. Instead, the statement and subsequent press conference from Fed Chairman Jerome Powell emphasized the long road to economic recovery that still lies ahead. The Fed and Inflation Throughout this crisis, the financial press has raised some concerns that the enormous stimulus measures taken by the Fed could lead to inflation. We see no cause for alarm at present. Although the Fed stimulus and increased Congressional spending could theoretically contribute to demand-pull inflation — too many dollars chasing too few goods — the bulk of the Fed’s asset purchases will stay on the federal balance sheet rather than making its way to Main Street and changing hands. For an historical reference, we can refer to early 2009 when investors were concerned that unconventional Fed stimulus would drive inflation. As it played out, the Fed actually had to work to increase inflation over the next decade, not fight it, as evidenced by the fact that inflation rates remained low for the following 10 years. It is possible that additional stimulus packages, coupled with the reopening of more businesses, could eventually lead to an increase in discretionary spending and, therefore, growth higher than the Fed’s targeted 2% inflation. However, all the data currently available suggests such a scenario is unlikely. We will continue to monitor this in the coming months and years. Fiscal Policy The movement toward a fifth stimulus package has slowed to a crawl, and lawmakers in Congress remain at odds on the size of the package and provisions that should be included. Although Senate Republicans have expressed concerns over the already-mounting deficits, White House economic advisor Kevin Hassett still rates the odds of a fifth fiscal stimulus bill as “very, very high. [2] The sense of urgency has faded somewhat in part because of improving economic data, including the surprisingly good May employment report and the consensus expectation that the U.S. may add another 3.5 to 4 million new jobs in June. We still believe it is likely that another stimulus package will pass before the August recess and Congress will turn its attention to the November elections. A new package would continue to support markets in their recovery. Implications for Investors Assuming that Congress passes a fifth stimulus package, the legislation will likely include support for state and local governments, particularly those especially hard-hit by the COVID-19 pandemic. The federal assistance would decrease the likelihood that state and local governments will need to cut services or lay off additional workers. Likewise, the Fed’s commitment to providing ongoing support should reassure investors as the U.S. economy continues its recovery. Moving forward, we believe that investors are best served by sticking to their diversified portfolio that aligns with their financial objectives and time horizon. Once all states have reopened for business, we believe market participants will likely concentrate on how long it will take for people to resume typical consumer activities, such as going out to eat, attending events, and the like. As we have mentioned in past publications, a potential recurrence of the COVID-19 virus will be something to keep an eye on until a vaccine is developed and distributed. [1] Bloomberg, Dovish Powell Sees Fed Keeping Foot on Gas Until Jobs Come Back

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please visit Accolades page or contact us directly.

© 2020 Sage Financial Group. Reproduction without permission is not permitted.

|

98%

Sage Financial

Client Retention

Client Retention

1/2025

98%

Sage Financial

Team Retention

Team Retention

1/2025

For the "Best Places to Work" recognition, Philadelphia Business Journal requires a submission fee for consideration. Sage has not paid any other fees for our rankings or recognitions.

Our client retention rate is calculated annually and based on one year. We adjust this number when the change in either direction is equal to or greater than 2%. Our team member retention rate is calculated annually and reflects the average of five years. We adjust this number when the change in either direction is equal to or greater than 2%.

Learn more about Sage Financial accolades.