Market Update

Equity markets have trended down so far this week largely for two reasons: (1) extended negotiations in Congress to expand relief for small businesses and (2) lower oil prices (discussed in the next section). The S&P 500 has fallen 4.7%, Nasdaq is down 4.4%, and the small cap Russell 2000 down 3.2%. International equity markets, as represented by the MSCI ACWI Ex-USA, have fallen by 3.6%.

We believe lower equity markets are more so a result of a change in momentum than any specific developments. The S&P 500 rose 30% from its lows in late March through last Friday thanks to the massive monetary and fiscal policy response, the flattening of the COVID-19 infection curve, and the wave of announcements about plans eventually to reopen economies here in the U.S. and globally. We now seem to be on the cusp of entering the phase in which government officials begin to reopen businesses and monitor new virus case trends. As we have noted in the past, the economy is not a light switch that can be turned back on immediately, given the lingering health-related factors. Financial markets will continue to discount the speed and magnitude of the recovery as more data comes to light.

Crude Oil Price Plunge

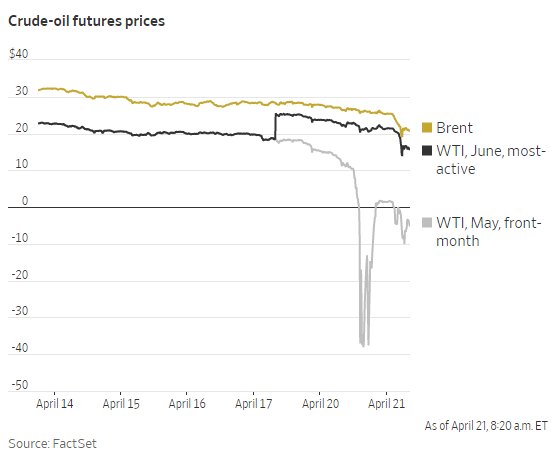

The biggest headline so far this week is that the price of U.S. West Texas Intermediate (WTI) crude oil traded in negative territory for the first time in history. Although a negative oil price is an interesting headline to mention because it is peculiar, it is not nearly as exciting from an economic or investment point of view as all the news alerts and press headlines make it seem. Oil trades on futures exchanges, and while the “front-month” May delivery contract traded negative on Monday, the June and July contracts have remained priced at approximately $20/barrel, and Brent (i.e., non-U.S. oil standard price) remained in the $20s as well (see nearby chart).

The underlying reason for how the price of a barrel of oil can go negative is “storage.” Essentially, oil futures contracts are an agreement for the seller to deliver oil and for the buyer to take delivery of the oil. Today is the last trading day for the May contracts (i.e., contracts stop trading 4/21 for delivery in May), which leads to higher trading activity as contract holders anticipate the adjusted supply and demand. Many market participants who were long (i.e., had bought) futures for May delivery have no storage capacity because of a lack of demand caused by lockdowns and the sudden stop to consumer and business activity. For example, airports, gas stations, drivers, and other entities have been using very little oil this past month, and so storage facilities have a backlog and little spare capacity to store new oil deliveries. Put simply, there is a crude oil glut near-term. Yesterday, therefore, some crude oil futures contract holders were likely panicking because they had nowhere to put the oil set to be delivered in May. As a result, the price of a barrel of WTI crude began to sell into negative territory because it was cheaper to unload the contracts than to take delivery of oil that the buyers had nowhere to store.

In terms of investment implications, low oil prices are certainly not helpful for the already hard-hit energy sector, but a negative price for a barrel of WTI crude is likely more of a technical market glitch than a lasting event. There is a positive aspect to low oil prices. When people can drive again, low prices at the pump can help the economy by providing consumers additional discretionary income for purchases. This leads us to consider the question of economic reopening.

Moving Toward Reopening the Economy

Although much about the current COVID-19 pandemic situation remains uncertain, the shift in conversation from a month ago marks the progress that we have made. In mid-March, talk centered around newly-imposed lockdown measures to mitigate virus transmission. Now in mid-April, talk has pivoted to questions about when and how to reopen the economy from government-imposed lockdowns. This pivot, along with the combined fiscal and monetary policy response, has led to improved investor confidence and broadly higher asset prices and liquidity.

Globally, as we have previously reported, it seems as though the daily number of new COVID-19 cases is peaking. Even hotspots in the U.S. appear to be turning a corner. Just a few weeks ago, New York, for instance, was requesting ventilators from anywhere it could get them, now it is sending ventilators to other places because it has a surplus. These improvements are encouraging, but we believe we need to move forward thoughtfully. Much of the improvement on the health front is, in our view, a direct consequence of social distancing, and reductions in the count of new virus cases could reverse quickly if people resumed their work and social activity too abruptly. We should be prepared for the process to be be gradual. We may even see some pauses and reversals punctuate the overall advance. It is worth thinking more specifically about how a future restart might unfold because it will impact financial markets, which typically price today what it anticipates for tomorrow.

It seems to be the case that the states in the U.S. will probably control the process to a greater degree than the federal government, although the CDC and other agencies may provide various guidelines or suggestions to the states. We believe that a state-by-state approach is prudent because it allows for different situations in different regions. It also could be beneficial for financial markets as investor sentiment would likely rise if there are successful early starts forward in places prepared for to transition.

The following criteria are among the most discussed or have played a role in countries that are farther along than the U.S. in terms of virus response:

Potential Criteria

- Officials must see a downward trajectory of documented cases within a 14-day period, or a downward trajectory of positive tests as a percentage of total tests, before the lockdown can be lifted in particular areas, and

- Hospitals must be able to treat all patients without resorting to crisis care (i.e. rationing ventilators, etc.) and must have testing programs in place for healthcare workers.

Next Steps (What Can Reopen)

- When the two conditions above are met, citizens can resume some activities. Authorities might say that citizens should avoid non-essential travel, but allow restaurants, schools, retail shops, and churches to reopen subject to strict social distancing rules.

- Out of concern for the most vulnerable populations, authorities may continue the lockdown of senior citizens and/or people with one or more underlying health complications.

- Any significant resumption of infection rates would result in lockdowns being re-imposed.

This is not an exhaustive set of criteria, and it may be supplemented or replaced by other potential procedures. However, this list does sketch out how reopening the economy might proceed responsibly. Approaches such as these aim to be data-driven and attempt to strike a balance between public safety and economic necessity.

We expect that many states will differentiate which industries and areas may be most safely reopened in a progressive fashion. For example, a governor may lift the state-wide lockdown restrictions in rural areas before they are lifted in cities or specific counties. While these steps are taking place, financial markets will be closely watching the slope of infection curves and other measures taken by government officials to combat future spikes. If a state like Texas, for instance, is able to reopen restaurants, gyms, and the like without a significant rise in COVID case numbers, it would be a welcome sight and perhaps a template for other states.

We will continue to monitor these developments with your financial picture in mind.

As always, please feel free to reach out to your advisor or us directly if you have any questions.

Related Posts

Weekend Update on the Markets and COVID-19

COVID-19 Scams: A Guide to Help You Stay Safe

COVID-19 and Long-Term Investing

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please click here or contact us directly.

© 2020 Sage Financial Group. Reproduction without permission is not permitted.