On the eve of the U.S. election, we want to share our perspective on potential effects the elections may have on the markets and your investment portfolios.

As we have noted periodically over the past several months, heightened volatility is normal around key elections because markets dislike uncertainty. This year, we also are contending with COVID. For example, in our view, last week’s sell-off was, in large part, a reaction to both new restrictions in the U.K., Germany, France, and other countries in the region as COVID case numbers climbed and the decision in the U.S. to pause fiscal stimulus negotiations until after the election. These two developments intensified the uncertainty we expect around presidential elections.

Many market participants are expecting the 2020 election to be an “election week” as opposed to a single day because some states, such as Pennsylvania, may take longer to count votes due to state regulations that prohibit processing mail-in ballots before election day. Pennsylvania could very well turn out to be the most important race, and state officials expect it to take until the end of the week to finish counting. However, states such as Florida and North Carolina have handled large numbers of mail-in votes in the past, which could mean we know more than expected on election day. There are also near-term risks such as a contested election and the need for recounts in close states, which could drag out the process and add uncertainty into financial markets over the short-term.

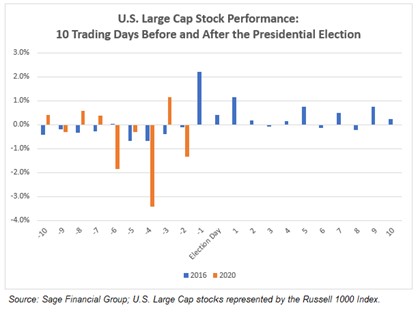

As shown below, although 2016 was a less volatile year, general election uncertainty led to stocks selling off in 9 of the 10 days leading up to election day.

While investors should prepare for short-term market volatility, we caution against allowing political beliefs to influence investment decisions, which can trap even the most seasoned investors. There is evidence of this behavioral trap in a forthcoming paper from the Journal of Behavioral Finance paper, which finds that after the 2016 election, Democratic-leaning equity hedge fund managers underperformed their Republican-leaning competitors over the 10 subsequent months. Many Republican-leaning investors suffered the same fate in the 10 months following the 2008 election.

More interesting research shows that over the past 17 presidential elections in the United States since 1950, each of these elections led to changes in tax policy, trade policy, foreign policy, and domestic policy. During this time, the S&P 500 was positive over 80% of the time, and increased 19%, on average, in the two years following each of those elections. While tomorrow’s election could certainly result in near-term volatility, and future performance may not reflect history, the outcome, no matter the winner, is unlikely to have a significant impact on the long-term profitability of American corporations, and hence, the stock markets.

Equity markets tend to react differently based on the party that wins, however, we humbly acknowledge that no one has a “crystal ball” in the very short-term. How the equity markets will respond to this election is particularly difficult to predict. Increased regulation and taxes are usually expected after a win by a Democratic Congress and Presidency. Still, this year, such a win could also include a larger stimulus package and fewer tensions abroad. On the other hand, a Republican victory in the White House and Senate may result in a smaller fiscal stimulus package but also continued de-regulation and decreased risk of a higher corporate tax rate. We think a smooth/clean election process may be as important to the markets over the short-term, as who wins.

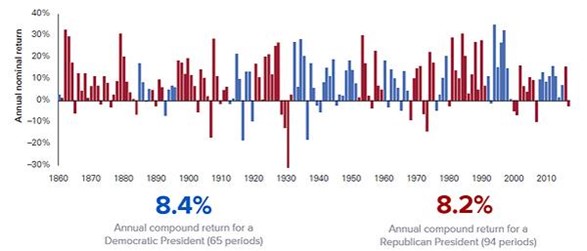

We continue to believe that investors should use history as their guide: historically, control of the White House has very little effect on the performance of U.S. equity and bond markets. Since 1880, Republican presidencies have returned 8.2% annually in a balanced portfolio, while Democratic administrations have returned 8.4% annually, as this chart shows:

As we mentioned in our previous communications, we believe strongly that over time market performance is driven by growth, productivity, and innovation — not party or government policy alone. We continue to encourage investors to avoid reacting to political developments and be prepared for short-term volatility while focusing on maintaining your appropriately diversified portfolio, which is aligned with your short term capital needs, investment time horizons, and financial objectives.

We will continue to closely monitor everything related to our clients’ portfolios, including the election, and advise them of any new developments that could impact their investment strategy. If you have any questions about this week’s commentary, please do not hesitate to get in touch with us.

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please visit Our Accolades or contact us directly.

© 2020 Sage Financial Group. Reproduction without permission is not permitted.