Cryptocurrencies in general and Bitcoin in particular have been in the news recently, including daily articles in the Wall Street Journal. It seems like every day a different person has an opinion on this new, highly unpredictable currency. In our view, although the blockchain technology that underlies Bitcoin as a cryptocurrency has the potential to revolutionize aspects of the legal and financial services industries, no one knows if Bitcoin itself is a passing fad in a speculative mania or an emerging, highly volatile asset class with staying power, or some mix of both.

What We Know

- Before addressing Bitcoin specifically and cryptocurrency generally, it is worth taking a moment to review how we think about currency:

- As a medium of exchange

- As a common measure of value

- As a store of value

- Cryptocurrencies are digital “units” that use cryptography for security, run on decentralized networks, and are able to be used for payments as a medium of exchange at certain locations.

- They are anonymous by nature, and are not issued by a central authority, which may explain some of Bitcoin’s popularity among younger generations who tend to be skeptical of authorities in general.

- A decentralized network simply means that transactions are processed by linked computers which run specified software and which are not owned by one person or entity. These transactions are recorded on a public ledger. This ledger is known as the blockchain.

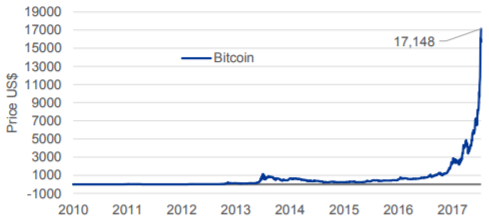

- Like any asset (e.g., houses, gold, diamonds), Bitcoin’s value is determined by supply/demand. Since there is a controlled supply, and because recently more people have been buying than selling, the price has gone up.

- Bitcoin differs from assets like stocks, homes, and gold in that Bitcoin has no intrinsic value from a fundamental perspective. It has no cash flows and no yield. In fact, bitcoin does not exist in the physical world and cannot be used for any purpose other than exchange. Its value is simply driven by the price that other people or institutions are willing to pay for one unit.

- Bitcoin has gained some mainstream acceptance the past few months. For instance, as of this past Sunday, the Chicago Board Options Exchange has facilitated Bitcoin futures trading, and the Chicago Mercantile Exchange will do so next week. China, however, has recently banned Bitcoin, sought to suppress its use, and has said that OTC (over the counter) platforms may violate Chinese law.

Our Perspective

- When talking to clients, we try to communicate clearly the extreme level of risk associated with owning Bitcoin.

- Whether Bitcoin is in a bubble is debatable, but the pervasive feeling of speculative mania is not. It is easy to get caught up in the excitement of “get rich quick” gains, but there is also heightened risk of permanent and potentially complete loss of capital overnight.

- Key to the popularity of Bitcoin has been a certain story. Many people across the world distrust traditional financial systems following the Great Recession. The potential for Bitcoin to serve

Source: Bloomberg, BlackRock as of 12/13/3017 as a store of value without the potential to be manipulated by central banks is an appealing concept for many.

- There is another potential story. The Bitcoin craze has been compared to both the “tulip mania” of the 17th century, which was the first recorded modern speculative bubble, and the dot.com bubble of the early 2000s. In both instances, swaths of society purchased tulip bulbs or stocks they knew nothing about in the hope that someone tomorrow would pay more than they did today. This comparison resonates because prices of Bitcoin have risen parabolically (up 1,000%+ YTD at the time of writing). If hope for higher prices tomorrow fades and speculators start to see losses, purchasers may quickly flee and sellers may abound, causing a dramatic drop in price.

- There is a long list of risks that come with buying cryptocurrencies. The biggest risk is that Bitcoin is in a bubble. Other risks include:

- Competition creates better technology. Currently, Ethereum is Bitcoin’s main competitor. Ethereum has a more open platform, and it is widely thought have better technology (e.g., Jamie Dimon and JPMorgan have begun working with the Ethereum platform for certain secure account transaction functions). Bitcoin has the advantage of being the first mover, but, if Ethereum can gain broader adoption through multiple business applications, it could replace Bitcoin. If so, Bitcoin would likely lose value.

- Bitcoin gets too big, which could force additional regulation. Scrutiny from the U.S. and other governments could cause regulatory challenges for the future of cryptocurrency.

- Sovereign governments could create a competing cryptocurrency. The Federal Reserve and other central banks have discussed the possibility of creating a digital currency to compete with Bitcoin.

We do not currently have an opinion on the future direction of Bitcoin or other cryptocurrencies. It is worth repeating that, although the blockchain is impressive technology that could be game-changing for certain industries, no one knows if Bitcoin as one particular cryptocurrency that uses the technology is a passing speculative fad that is in a massive bubble or a new, extremely volatile investment asset. What is undeniable is that many people are purchasing Bitcoin on hope, this is driving the price frenzy, and both are characteristic of manias.

For another interesting article on the mania around Bitcoin, check out Ben Carlson’s piece “How Does Something Like Bitcoin Happen?”

The information contained in this report has been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events which were not taken into account may occur and may significantly impact our opinion. Any projections, outlooks or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product or any non-investment related content, made reference to directly or indirectly in this communication will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. You should not assume that any discussion or information contained in this communication serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of this communication should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

© 2017 Sage Financial Group. Reproduction without permission is not permitted.