Market Update

The key drivers of this week’s market movements were positive updates on COVID-19 treatments and vaccine candidates, as well as continued optimism surrounding a fifth stimulus package. The MSCI ACWI Index, which represents global equities (i.e., both U.S. and international stocks), closed the week up 1.1%, while the MSCI ACWI Ex-USA (international stocks) gained 1.0%. The S&P 500 finished up 1.2%, while the U.S. small cap Russell 2000 finished out the week up 3.6%. Core U.S. bonds on the Bloomberg Barclays U.S. Aggregate Bond Index also saw a slight bump, closing the week up 0.3%.

A generally positive start to the Q2 earnings season also helped the markets this week. Earnings reports will be closely watched this quarter, but we think that market participants will focus less on the backward-looking metrics from these reports — like Q2 earnings per share (EPS) — and more on the qualitative metrics and guidance that companies provide for the coming year. Fundamentally, financial markets are most interested in forecasting future company profits (i.e., discounting future cash flows) in light of the COVID-19 pandemic. Equity and bond markets tend to look ahead and keep the big picture in focus, which is what we encourage investors to do as well when considering this earnings season.

COVID-19 Updates

California’s economic re-opening took a step back this week, as Governor Newsom issued orders to close indoor restaurants, movie theaters, and wineries, along with all bars in response to a surge in new COVID-19 cases in the state. The L.A. and San Diego school districts, the two largest in the state, also announced that due to persistent COVID transmission risks, classes will be online-only in the fall.

While the media focused on California’s backward movement, we believe that the limited scope of the closure is the key takeaway for investors. This was a targeted response to increased infection rates. Other areas of California’s economy have continued their return to normalization, and elsewhere in the country, some “hot spots” saw incremental improvements this week: the strain on the hospital systems in Arizona appears to be easing slightly, and the northeast continues to improve. In areas where cases have risen, state and local officials have opted for incremental measures (e.g., closing bars), not a return to full lockdown. So far, this strategy has moderately curtailed additional surges while also minimized the economic impact.

On the treatment and vaccine front, this week brought more encouraging data. Gilead Sciences (makers of COVID treatment remdesivir) released a study showing that COVID-19 patients treated with remdesivir had a 62% lower risk of mortality.[1] Separately, the results of Moderna’s Phase 1 clinical trial, published Tuesday in the New England Journal of Medicine, showed that the vaccine provoked “robust” antibody responses in all participants.[2] The results are from a small sample group, and the vaccine is still in the early stages of testing, but they are nonetheless causing optimism.

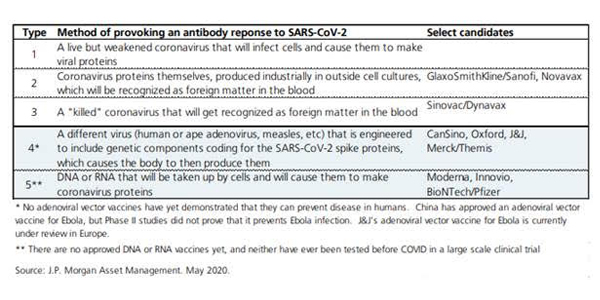

There are more than ten viable vaccine candidates of varying types (i.e., different methods of provoking antibody response) with large-scale funding that could be produced in large numbers by the end of the year, as this chart shows:

We encourage investors to avoid focusing too much on any specific vaccine candidate and instead look at the larger picture: there are multiple promising vaccines in development with significant government backing to scale up quickly. We think that the probability of a safe and effective vaccine being identified for large-scale production is increasing.

As it relates to investment markets, the increasing probability of a safe, effective, and scalable vaccine should contribute to more optimism about a return to normal and the economic activity associated with it.

Stimulus Updates

With just a few weeks remaining before the enhanced unemployment benefits from the CARES Act expiration, lawmakers continue working toward an agreement on a fifth stimulus package. It seems likely that one will pass by the end of July or early August. Republicans are considering a compromise whereby the current $600/week in federal benefits will be lowered to somewhere in the $200–$400 range, with another one-time payment issued to soften the blow. These payments will probably be subject to more aggressive means testing, and fewer checks will likely be issued than under the CARES Act in March.[3]

House Speaker Pelosi told reporters this week that she is willing to delay the House’s annual August recess until a deal is done.[4] The two sides are far apart on the size and scope of the package: the GOP’s proposal is around $1 trillion, while the HEROES Act that Democrats passed in the House is in the neighborhood of $3 trillion. With the Democratic and Republican National Conventions coming up, both parties want to be able to point to the fifth stimulus as an example of leadership in a time of crisis.

In the event of a stalemate, equity markets could see some volatility, although any upheaval is likely to be short-lived, as we believe both parties are highly motivated to reach an agreement. We continue to urge our clients not to let short-term market swings overshadow the long-term economic and mobility trends that reflect the broad-based, positive trajectory of recovery.

Investor Implications

There were certainly some setbacks this week in progressive re-openings. As we have said before, hiccups are inevitable as we continue the recovery, but the broader data picture, more effective treatments, and continued progress towards a vaccine support the case for cautious optimism. We encourage our clients to focus on this bigger picture and to remain focused on their investment time horizons and financial goals.

We will continue to monitor new developments regarding COVID-19, economic activity, financial markets, and what it all means for investors. If you have any questions about this week’s newsletter or the markets, please do not hesitate to get in touch with our team.