Market Update

At the time of our last commentary in August, markets were on a steady upward trend. So far this month, however, we have seen a modest — albeit sharp — sell-off in equity markets, particularly in technology stocks.

Since September 1st, core U.S. bonds, as represented by the Bloomberg Barclays Aggregate U.S. Bond Index, have increased slightly, up 0.2%. The MSCI ACWI Index, which represents global equities (i.e., both U.S. and international), has fallen 3.1%, while the MSCI ACWI Ex-USA (international stocks) has dropped slightly by 0.7%. U.S. large cap stocks, as represented by the Russell 1000, have slipped by 4.8%. The U.S. small cap Russell 2000 stocks have performed similarly month to date, closing out down 4.1%.

Several factors have contributed to the equity market’s downturn, including a breakdown in negotiations between the White House and Congressional representatives on a fifth fiscal stimulus. Additionally, on Tuesday, AstraZeneca paused Phase III clinical trials for its COVID-19 vaccine after a participant developed potentially serious neurological symptoms. The trial is expected to re-start next week.[1] These developments have occurred as the U.S. economy continues to reopen. Last Friday’s report that Japan’s SoftBank Group recently purchased $50 billion worth of options on technology stocks further stoked concerns about overbought conditions (i.e., that one bank had pushed markets too far) and raised questions about the recent run-up of the technology-heavy NASDAQ index.[2]

In our view, the recent dip is natural following the steady rally since early-July. In fact, we feel the volatility is healthy and necessary: both U.S. large and small cap stocks are up more than 50% since March, and equity markets had five straight weeks of strong gains. We urge investors to remember that corrections are a natural part of how equity markets perform over time.

COVID-19 Developments

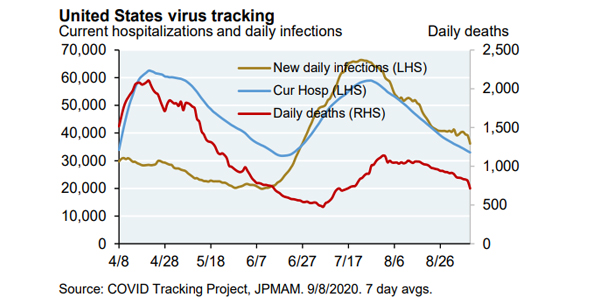

The rate of new COVID-19 cases, hospitalizations, and deaths in the United States has continued to decelerate.

However, as we have noted in previous commentaries, the risk of a surge in new cases nationwide remains until a viable vaccine is approved and distributed.

As mentioned above, AstraZeneca halted its Phase 3 clinical trials, which likely contributed to some of the volatility we have seen since the beginning of September. We advise investors not to react too strongly to any single headline. Pauses are relatively common, and AstraZeneca’s CEO stated after the announcement that the company aims to re-start the trials next week. In addition, multiple vaccine candidates are being developed simultaneously, so a setback in one trial should not be cause for alarm.

Meanwhile, new case rates are rising in France and Spain, which is concerning. But it appears that both countries are prepared to live with the virus without the wholesale shelter-in-place orders that severely inhibited economic activity in the spring. Late last month, French President Emmanuel Macron told reporters that the government was “doing everything to avoid another lockdown, and in particular a nationwide lockdown.[3] For its part, the Spanish government has imposed stricter restrictions on social gatherings in response to the surge in new COVID-19 cases, but these restrictions are largely a continuation of existing measures.

Reopening of the U.S. Economy

The deceleration of new COVID-19 cases, hospitalizations, and deaths here in the U.S. has allowed reopening efforts to continue with both positive and negative developments in recent weeks. Most universities remain primarily online, and some schools that have tried to open have had to send students home or suspend in-person classes due to local outbreaks. On the positive side, announcements regarding reopening businesses have continued, including here in PA and in NY. Pennsylvania Governor Wolf recently announced that, as of 9/21, the state’s indoor dining capacity will be bumped up from 25% to 50%. Earlier this week, NY Governor Cuomo announced New York City’s restaurants will be allowed to resume indoor dining at 25% capacity at the end of September.

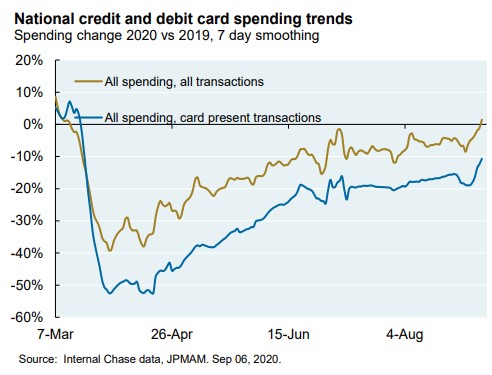

A proxy for mobility and economic activity is consumer spending, which recently eclipsed 2019 levels on a year-over-year basis. The U.S. economy is dependent on consumer spending, which makes up approximately two-thirds of Gross Domestic Product.

While the virus continues to pose persistent risks, particularly as the weather starts to cool down, pushing more people indoors, and the flu season beings to ramp up, investors should keep in mind that U.S. economic data – particularly around housing and consumer spending – remain encouraging.

Fiscal Stimulus

As noted above, stalled negotiations between the White House and Congressional representatives contributed to the September sell-off. The expectation in the market was that a fifth fiscal stimulus would be put together and passed at the same time as the budget for FY 2021. However, Congressional leaders decided to focus on the budget, which decreases the probability that a fiscal stimulus package will be done in the near-term. This was a negative for markets, as a fifth fiscal stimulus was long viewed as the most likely outcome and had been priced into some degree.

It is still possible that talks could resume heading into November’s election, but if a deal is not reached, the biggest impact will likely be on state and local governments: without stimulus funds, we may see budget shortfalls that could lead to job cuts. Investors should remain prepared for some short-term market volatility as stimulus negotiations remain at an impasse, and we approach the November election.

Investor Implications

As we have advised throughout the year, near-term volatility remains likely. We believe investors will be best served by compartmentalizing short and long term needs and sticking to their investment strategy, which is aligned with their financial objectives, time horizon, and appetite for risk. We will continue to monitor market data closely and advise you of any significant developments and their potential effects on your portfolio.

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please click here or contact us directly.

© 2020 Sage Financial Group. Reproduction without permission is not permitted.