Market Update

At the end of September, financial markets experienced a modest sell-off; since then, however, performance has been positive. The MSCI ACWI Index, which represents global equities (i.e., both U.S. and international stocks), has risen 3.2% to date in October, while the MSCI ACWI Ex-USA (international stocks) has increased by 2.8%. U.S. large cap stocks dipped over the course of September, but they have since risen 3.4% month-to-date. The U.S. small cap Russell 2000 has climbed 8.8% in the same time frame. Finally, core U.S. bonds represented by the Bloomberg Barclays Aggregate U.S. Bond Index have moved slightly lower this month and are down 0.3%.

A key contributor to the general uptick in the equity markets this month has been consumer spending: headline retail sales rose by 1.9% in September, far exceeding Dow Jones consensus estimates of 0.7%. Retail sales are 5.4% higher this year compared to September 2019.[1] Overall, economic data suggests the economy is continuing to rebound — albeit in a nonlinear fashion — from its trough during March and April.

Another driver of recent equity market performance has been the U.S. Purchasing Managers’ Index (PMI) figures, which measure purchasing activity in key economic sectors. The baseline for PMI performance is 50: a sub-50 PMI indicates shrinking activity in a given sector, while a PMI over 50 suggests sector growth. After falling to the low 40s in April and May, U.S. manufacturing and non-manufacturing PMIs have remained above 50 since June.[2] Finally, strong economic data out of China for the third quarter has contributed to recent positive market performance.[3]

Despite encouraging economic data, risks still remain for the stock market and the economy; in our view, one of the biggest risks is the potential for a slowdown in consumer spending. Federal unemployment benefits have expired, and the stimulus funds provided by the CARES Act in March have been mostly utilized. Though continuing jobless claims and new unemployment claims have steadily declined over the past few months, the number of jobless citizens remains high relative to pre-COVID levels, suggesting that many Americans have yet to return to full-time employment.[4] As the last of the stimulus money is spent, we could see retail sales lose momentum.

From an investor’s perspective, retail sales growth is significant because consumer spending accounts for roughly two-thirds of the U.S. economy. A downturn in retail sales could lead to volatility in the markets that could be heightened if lawmakers cannot reach an agreement on another fiscal stimulus package. While we continue to believe that an agreement is a matter of “when” rather than “if,” this too presents uncertainty and risk.

New COVID cases in the U.S. have been rising, which also remains a risk, but policymakers continue to avoid the wholesale lockdowns that were so economically detrimental in March-May. In our view, policymakers are likely to continue to stop short of issuing full shelter-in-place orders because the medical community better understands how to treat the disease, the mortality rate is lower than initially feared, and therapeutics such as remdesivir/dexamethasone have been identified. We will continue to watch the case and hospitalization trends.

Stimulus Developments

Progress on negotiations for a fifth fiscal stimulus package remains fluid, with the White House taking a direct role in discussions with House Speaker Pelosi. When negotiations began over the summer, there was a $2 trillion gap between Speaker Pelosi and Treasury Secretary Mnuchin’s proposals. This gap has narrowed significantly to “only” approximately $200 billion, and Speaker Pelosi told reporters Thursday that Democrats and the White House were “just about there” on an agreement.[5] The specifics of the proposed stimulus remain unclear, but it is expected to include financial support for citizens, relief for businesses, federal aid for state and local governments, and increased funding for expanded COVID testing and contact-tracing infrastructure.

Despite encouraging movement on negotiations, the two parties’ difference in opinion regarding the stimulus amount and allocation presents a potential risk for the markets. Republicans hold a majority in the Senate, and Senate Majority Leader McConnell is opposed to a large stimulus deal before the election.[6] However, McConnell has also agreed that if a White House-endorsed stimulus package passes the House, he will bring it to a vote in the Senate. Some moderate Republicans have expressed support for the package being negotiated between Pelosi and Mnuchin.[7] In our view, it continues to seem unlikely, albeit possible, that a bill is agreed upon and signed prior to the election, given the complex political calculus involved.

From an investor standpoint, the outcome of stimulus negotiations will likely be reflected quickly in market prices. Equity markets are more likely to respond positively to a large stimulus package; conversely, if negotiations reach an impasse or a smaller than expected bill is passed, investors could see increased volatility in the markets. Both sides seem to agree that a fifth fiscal stimulus is needed, but investors should remain prepared for the potential for volatility until a formal agreement is reached.

2020 Election

With less than two weeks until the U.S. presidential election, Real Clear Politics (a poll aggregator) has Joe Biden leading President Trump by an average of 8 points in national polls and 4 points in key battleground states.[8],[9] As we saw in 2016, polling data is an inexact science that can miss the mark; still, at this point in 2016, Hillary Clinton held a 3-point lead over Trump.[10] Mail-in voting and the fact that we are in the midst of a global pandemic may affect turnout and could make polls even less reliable.

In August, we shared our perspective on the key policy differences between Trump and Biden and how they could relate to market movements.[11] To briefly recap, it might seem that the higher tax rates implicit in Biden’s policy proposals could hurt equity markets if he were to win. However, other portions of his policy — such as an infrastructure deal and de-escalation with China — would likely offset any negative tax impact. Biden is unlikely to focus on tax increases until year two of his presidency when the economic rebound is on firmer footing. In our view, Biden’s economic policies and approach to relations with China would likely have a neutral or even slightly net-positive impact on markets from current levels, though possibly not as positive as Trump’s.

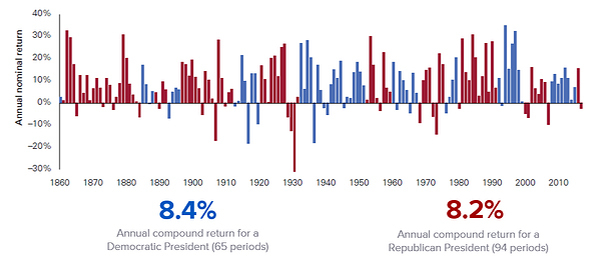

We continue to believe that investors should use history as their guide: historically, control of the White House has had very little effect on the performance of U.S. equity and bond markets. Since 1880, Republican presidencies have returned 8.2% annually in a balanced portfolio, while Democratic administrations have returned 8.4% annually, as this chart shows:

Many market participants are expecting the 2020 election to be an “election week” as opposed to a single day because there are states, such as Pennsylvania, that may be slower to count votes due to state regulations that prohibit processing votes before 12 pm on election day. There also are states such as Florida and North Carolina that have handled large numbers of mail-in votes in the past, which could mean we know more than expected on election day. There are also near-term risks such as a contested election and the need for recounts in close states. But we believe the markets have accounted for these as short-term events and that the long-term implications for markets and investors will be relatively small.

While investors should prepare for short-term market volatility during this period of time, this potential volatility is not tied to any structural issues in the markets. Surprise events tend to provoke the strongest market reactions, but we believe markets are sufficiently prepared over the long term for election uncertainty.

Investor Implications

Over time, market performance is driven by growth, productivity, and innovation — not party affiliation or government policy alone. We believe investors should avoid reacting to political developments and be prepared for short-term volatility while focusing on maintaining an appropriately diversified portfolio aligned with their time horizon and financial objectives.

We will continue to monitor market data closely and advise you of any developments that could impact your portfolio.

[1] CNBC, Retail sales post big gain in September as consumers show unexpected strength.

[2] YCharts, US ISM Manufacturing PMI. (Link)

[3] Business Insider, Global stocks jump after Pelosi sets Tuesday deadline for US stimulus vote; China posts strong economic data. (Link

[4] Yahoo! News, Another 870,000 Americans likely filed new unemployment claims last week. (Link

[5] Bloomberg, Pelosi Says ‘Just About There’ on Stimulus; Senate Hurdle Awaits.k

[6] New York Times, McConnell Moves to Head Off Stimulus Deal as Pelosi Reports Progress.

[7] CNBC: Marco Rubio: I’m open to voting for higher Covid stimulus because Americans need help

[8] RealClearPolitics, General Election: Trump vs. Biden.

[9] RealClearPolitics, Top Battlegrounds: Trump vs. Biden.

[10] RealClearPolitics, General Election: Trump vs. Clinton.)

[11] Sage Financial, Insights: The Markets This Week and The 2020 U.S. Elections.

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please visit Accolades page or contact us directly.

© 2020 Sage Financial Group. Reproduction without permission is not permitted.