Market Update

The markets finished the week largely unchanged, in a week that had generally positive Q2 earnings reports and an agreement on a fiscal stimulus package in the E.U. The MSCI ACWI Index, which represents global equities (i.e., both U.S. and international stocks), closed the week down 0.1%, while the MSCI ACWI Ex-USA (international stocks) gained 0.1%. The S&P 500 finished down 0.3%, while the U.S. small cap Russell 2000 declined 0.5%. Core U.S. bonds on the Bloomberg Barclays Aggregate U.S. Bond Index traded higher, closing the week up 0.4%.

Q2 Earnings Reports

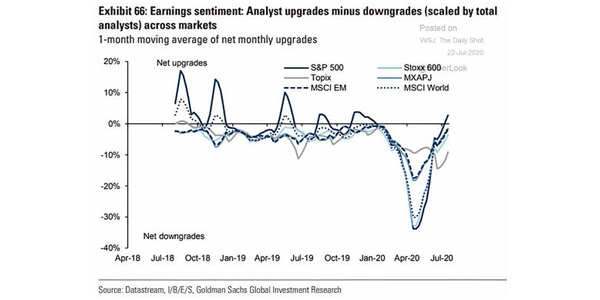

After a strong overall start to Q2 earnings season last week, this week brought another round of better-than-expected company earnings reports. As we mentioned last week, the key focal point for these reports is the qualitative metrics and guidance that companies are providing for the coming year, not the backward-looking metrics like Q2 earnings per share. Analysts, who, in the midst of the pandemic in the spring, were perhaps a little too bearish (i.e., overly pessimistic), have started upgrading stocks in response, as the chart below indicates.

The chart also shows geographic breadth to these adjustments, meaning that analysts both in the U.S. and abroad are feeling more optimistic about corporate earnings during the second half of 2020 and into 2021 as companies adapt to conducting business during a global pandemic. From an investor perspective, this data indicates that there is an emerging consensus that companies (on average) may be better valued relative to their future earnings than was initially thought.

Economic Activity & Consumer Sentiment

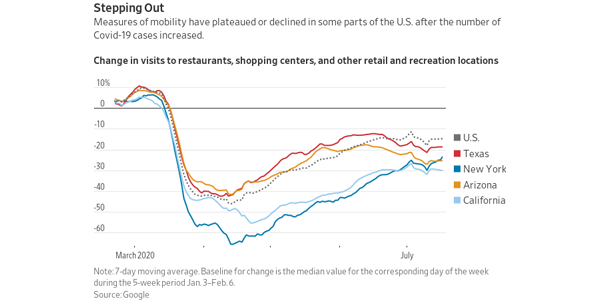

While optimism is improving among analysts, consumer activity and sentiment will need to be closely watched in the coming weeks. New data shows that overall consumer spending has increased significantly since the March/April trough. However, continued gains in such high-frequency indicators may depend on consumer psychology, which is inevitably influenced by COVID-19 case counts and restrictions in “hot spots.” As the chart below shows, consumer activity to restaurants, shopping, and other retail businesses, steadily increased between March and June, but it has leveled off over the past month.

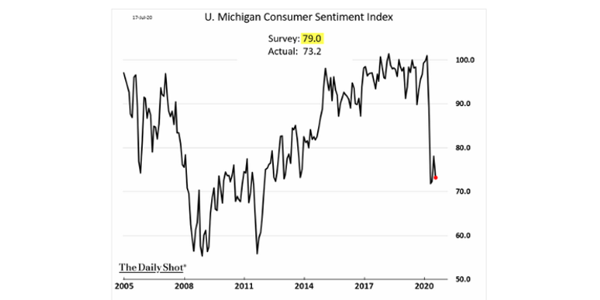

This leveling-off trend is likely due to the continued increase in new COVID-19 cases in key areas and the lack of an extension of the enhanced federal unemployment benefit. The extra $600 a week provided by the CARES Act is set to expire at the end of this month, although a technicality in the calendar for filing claims means that people in a number of states may not be able to qualify after this week. As the chart below shows, after a strong rebound in May, consumer confidence dipped in June as COVID cases began to rise again. If COVID cases stay higher or enhanced unemployment is not extended in a meaningful way, consumer confidence and spending could take longer to improve than currently expected, which is a risk to the pace of the current recovery and could push equity markets lower in the near-term.

Fiscal Stimulus in the U.S. and E.U.

On Tuesday, E.U. leaders reached an agreement on a €750 billion pandemic recovery fund. The initial proposal allocated €500 billion in outright grants to member nations. That amount was lowered to €390 billion in the final agreement, with the remaining €310 billion in the form of low-cost loans.[1]

This announcement is significant because, historically, it has proven difficult for European countries and leaders to reach a consensus regarding fiscal policy since the economic situation varies wildly between individual E.U. member nations and because the bloc has a centralized monetary/currency policymaking body but not a similarly centralized fiscal authority. The lack of fiscal policy support from the E.U. is one reason why European stocks have lagged U.S. equities during the coronavirus pandemic: the markets have seen fiscal policy as extremely beneficial but have also been skeptical that an accord could be reached. As a result, even though the finalized pandemic relief agreement was lower than originally proposed, the fact that fiscal relief passed is likely to provide some support to E.U. financial markets — particularly cyclical stocks — in the coming months.

In the U.S., where fiscal relief has been central to the pandemic policy response, negotiations on a fifth fiscal stimulus are underway, with Senate Republicans expected to unveil their proposal this weekend.[2] As of this writing, the proposal is likely to include another round of stimulus checks of $1,200 for individuals. The GOP’s proposal is not expected to include means-testing despite Senate Majority Leader Mitch McConnell’s previous suggestions that future stimulus checks would be limited to those earning $40,000 or less per year.[3] Enhanced unemployment benefits are likely to be included in the fifth package, although likely lower than the $600/week currently being paid. Additionally, reports have suggested that funds will be provided for state and local governments, schools, COVID testing, and vaccine development.

Negotiations have been slow to date and any delay in finalizing this deal could cause a degree of volatility. Given continued elevated unemployment (currently at 11%), the additional unemployment benefit is crucial to helping people make rent payments, staying current on credit cards and auto loans, and spending on discretionary goods. As we have said throughout this crisis, Congress and the Federal Reserve have emphasized supporting individuals, companies, and markets, but they are also conscious of the political role this agreement could play in an election year.

Investor Implications

We continue to encourage investors not to react too strongly — whether negatively or positively — to daily headlines and breaking news reports. Such news can affect the path of asset prices in the short-term but not typically their eventual destination. So far, the Q2 earnings numbers have been a positive sign that companies are in a better position than they were perhaps thought to be earlier in this pandemic. Investors will continue to closely watch guidance numbers, in which corporate executives estimate earnings into the future. Because markets are looking into the future, guidance numbers that fall short could cause volatility in the near-term. Developments of this variety, which look beyond the next week, or month, or even quarter, are what ultimately determine the destination of asset prices and why investors would do well to remain focused on their end-game, including the time horizon of their financial needs and goals, as well as their strategic, personalized portfolio.

We will continue to monitor any new developments regarding COVID-19, fiscal policy, and the financial markets overall. If you have any questions about this week’s newsletter or the markets, please do not hesitate to reach out directly to your advisor or either of us.

[1] Reuters, EU Reaches historic deal on pandemic recovery after fractious summit.

[2] Forbes, New Stimulus Package Expected Today—$1,200 Second Stimulus Checks, Unemployment Benefits May Be Included.

[3] Forbes, Second Stimulus Checks Now Possible, Says McConnell.

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please visit Accolades page or contact us directly.

© 2020 Sage Financial Group. Reproduction without permission is not permitted.