Market Update

Equity markets marched higher this week, with the MSCI ACWI Index, which represents global equities (i.e., both U.S. and international stocks), finishing up 3.5%. The S&P 500 finished up 4.0%, while the U.S. small cap Russell 2000 closed the week up 3.7%. International stocks had a strong week as well, as the MSCI ACWI Ex-USA (international stocks) rose by 2.7% this week. Core U.S. bonds on the Bloomberg Barclays Aggregate U.S. Bond Index continued to remain largely flat, closing out the week up slightly by 0.1%.

This week’s performance was largely driven by continuing improvement in the trajectory of the U.S. economy, as highlighted by Thursday’s Nonfarm payroll report that showed a gain of 4.8 million jobs in June (compared to expectations of 3.23 million) and an unemployment rate of 11.1% (compared to expectations of 12.5%).[1] Reports of progress regarding COVID vaccines, expectations for a fifth stimulus bill, and the testimonies of Treasury Secretary Steven Mnuchin and Fed Chairman Jerome Powell before the House Financial Services Committee also contributed to the week’s positive tone.

COVID-19 Developments

On Tuesday morning, Inovio Pharmaceuticals announced that a clinical trial of its new COVID vaccine yielded positive results, producing “immunological response rates” in 94% of trial participants. Inovio plans to begin Phase 2/3 efficacy studies this summer.[2] While Inovio has not yet confirmed whether the high percentage of “immunological response rates” are specific to coronavirus,[3] the early results are encouraging, as is the first clinical data on a vaccine candidate from Pfizer.[4] The positive data from these and other trials is a reminder of the considerable resources being marshaled globally to combat COVID-19.

The markets have responded well to these developments and the continued downward trend in COVID-19 deaths, even as new cases continue to rise in hotspots like Florida, Texas, and Arizona. We anticipated that incident rates might increase as reopening continued — a smooth and linear recovery was always unlikely, and stumbling blocks and setbacks are natural.

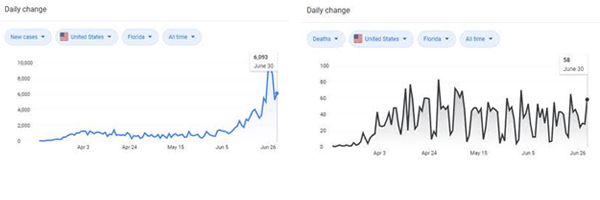

Thus far, while the number of new cases in Florida (a particular hotspot) continues to rise, the number of deaths has not inflected higher (chart below). For now, the question appears to be less about whether the spread of COVID-19 can be contained, and more about the hospital/healthcare system’s ability to manage increased infection rates.

From an investment perspective, we are primarily focused on the impact of policymakers’ actions on the economy and consumer confidence. Policymakers are increasingly focused on deaths and hospitalizations in specific pockets of the country, and their actions in response to those figures will impact mobility data and, by extension, consumer activity and equity markets. Higher mobility and spending have translated to higher equity markets since the trough in April. While cases continue to trend upward in certain areas, we remain cautiously optimistic that a second nationwide lockdown is unlikely, with state and local officials opting for more targeted approaches (e.g., restrict indoor dining). We will continue to monitor the course of COVID-19 closely in the coming days and weeks.

From an investment perspective, we are primarily focused on the impact of policymakers’ actions on the economy and consumer confidence. Policymakers are increasingly focused on deaths and hospitalizations in specific pockets of the country, and their actions in response to those figures will impact mobility data and, by extension, consumer activity and equity markets. Higher mobility and spending have translated to higher equity markets since the trough in April. While cases continue to trend upward in certain areas, we remain cautiously optimistic that a second nationwide lockdown is unlikely, with state and local officials opting for more targeted approaches (e.g., restrict indoor dining). We will continue to monitor the course of COVID-19 closely in the coming days and weeks.

Stimulus Updates & Mnuchin/Powell Testimony

On Tuesday, Treasury Secretary Steven Mnuchin and Fed Chairman Jerome Powell confirmed in testimony to the House Financial Services Committee that the Treasury and Fed are continuing to provide support for the economy and financial markets.[5] For the moment, an increase in monetary policy action seems unlikely, but further fiscal stimulus to aid unemployed workers, states, and municipalities remains on track for later this month.

As it pertains to fiscal policy, the House voted Wednesday to pass legislation extending the application deadline for the Payroll Protection Program (PPP) to August 8th.[6] Following the spike in new COVID cases, lawmakers are expected to begin negotiations on the size, scope, and timing of a fifth stimulus package when Congress returns from the July 4th recess.[7] The stimulus negotiation will be contentious, and the new unemployment numbers may decrease the sense of urgency around extending the additional $600/week in federal unemployment benefits set to expire on July 31st. Lawmakers may instead opt to add a smaller weekly dollar figure, for example, $300/week, and try to shape policy to encourage workers to re-start their employment.

Our view is that the long-term negative impact of this pandemic on U.S. businesses (and, by extension, equity indices) could be minimized by continued fiscal and monetary policy support. This supports our view that, although this pandemic is exceedingly challenging for investors, it is not cause to deviate from your personalized, diversified asset allocation strategy designed to meet your time horizon and financial goals.

As throughout this crisis, we will continue to monitor the spread of COVID-19 and how it might impact economic activity, equity markets, your portfolio and personal financial situation. If you have any questions about this week’s newsletter or the markets, please do not hesitate to connect with our team.

[1] CNBC, Record jobs gain of 4.8 million in June smashes expectations; unemployment rate falls to 11.1%. (Link)

[2] INOVIO Pharmaceuticals, INOVIO Announces Positive Interim Phase 1 Data For INO-4800 Vaccine for COVID-19. (Link)

[3] STAT, Inovio claims positive results on Covid-19 vaccine but critical data are missing. (Link)

[4] STAT, Covid-19 vaccine from Pfizer and BioNTech shows positive results. (Link)

[5] CNBC, Watch Jerome Powell, Steven Mnuchin testify before House finance committee on pandemic response. (Link)

[6] CNBC, House passes extension of coronavirus small business loan deadline. (Link)

[7] Washington Post, Pelosi, Schumer call on McConnell to start negotiations on new coronavirus relief bill as economic worries continue. (Link)

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please click here or contact us directly.

© 2020 Sage Financial Group. Reproduction without permission is not permitted.