Market Update

Core U.S. bonds on the Bloomberg Barclays U.S. Aggregate Bond Index closed the week slightly higher, up 0.2%. Equity markets also drifted higher, with the MSCI ACWI Index, which represents global equities (i.e., both U.S. and international stocks), finishing up 2.0%, and the S&P 500 finishing up 1.8%. International stocks had a similar showing, as the MSCI ACWI Ex-USA (international stocks) was up by 1.9%. The U.S. small cap Russell 2000 closed the week lower by 0.7%.

COVID-19 Updates

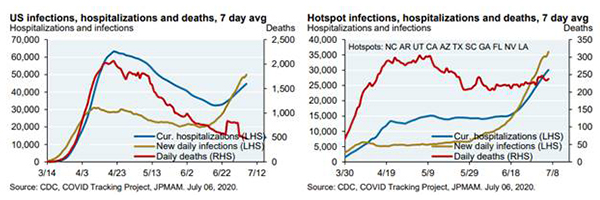

New COVID-19 cases and hospitalizations have increased at a high rate across parts of the United States; however, daily deaths attributed to the virus continue to decline. Even in “hotspot” areas like Texas, Arizona, and Florida, reported COVID-19 deaths have remained steady since May 29, as the chart below, on the right illustrates.

The key takeaway for investors from these charts is the disparity between daily deaths (red line) and new daily infections (yellow line). Despite the increase in new daily infections, we have yet to see an equivalent increase in the number of new deaths each day. The exact reason for this disparity remains unclear, but it is a number we will continue to watch closely.

In the months between the initial wave and the current surge, we have developed a better understanding of COVID-19 and ways to combat its toll that are less economically destructive than shelter-in-place orders. For example, while ventilators still are in short supply, the medical community has identified alternative oxygen treatments for COVID patients that can slow or even eliminate the need for one.[1] These alternatives, along with new treatment modalities like remdesivir and dexamethasone, give providers more options for effectively treating COVID patients.

The gains in understanding virus transmission and the development of more effective treatments are significant for investors because they boost confidence in our nation’s ability to gradually return to normal. Financial markets have been — and will continue to be — focused on policy responses, and policymakers are primarily concerned with the death rate rather than the rate of new infection.

Going forward, we believe the bar is now set higher for widespread closures than it was in March. Given the economic effect of shelter-in-place orders, state and local officials are unlikely to take such extreme measures unless absolutely necessary, and we believe that any further shelter-in-place orders would be much more targeted than those implemented earlier this year. For now, social distancing protocols and protective measures seem to be enough to keep the pandemic reasonably under control and promote gradual (if sometimes uneven) re-openings, which should limit the greatest economic consequences to specific sectors and populations.

Stimulus Updates

On Tuesday, President Trump reiterated his desire to see another round of stimulus checks in the next fiscal bill. The income threshold for stimulus payments will likely be lower than it was under the CARES Act. Senate Leader McConnell has expressed a preference to limit stimulus payments to individuals earning $40,000/year or less.[2] To that end, the bill also is expected to extend federal unemployment benefits beyond July 31st to avoid a potential sharp decrease in income for unemployed workers. These benefits are anticipated to be lower than the current rate of $600/week in order to further incentivize workers to go back to work.

It appears that Congress will focus further aid on companies and workers that have been hardest-hit by COVID (i.e., targeted programs as opposed to broad stimulus). The details are still coming into focus, but we could see fiscal packages similar to the Payroll Protection Program (PPP) that are only available to businesses in specific industries. In addition, some of the largest companies in the U.S. — including Coca-Cola, Hyatt, and American Express — jointly sent Congress a letter expressing their support for a bill that would provide approximately $120 billion in relief for the restaurant industry.[3]

This is important for investors because, as we have noted before, financial market movements tend to look beyond the present and ahead to the likely future effects of policy actions such as fiscal stimulus. Another stimulus package would demonstrate that lawmakers are still taking seriously the continued economic threat posed by COVID-19. At the same time, the targeted approach favored by Congress suggests that lawmakers have confidence in the pace of recovery. In aggregate, we believe that a fifth stimulus of significant size ($1 trillion or more) would be positive for investor sentiment and, therefore, may also provide an additional boost to global equity markets.

Sage’s Perspective

The bulk of the media’s coverage of the pandemic has focused on the negatives, which can obscure the larger picture. We continue to believe that the pace of recovery is cause for cautious optimism. Even if the recovery periodically takes one step back and two steps forward, now is the time to stay focused on your time horizon, financial goals, and your personalized strategic portfolio.

In the coming weeks, our commentary will increasingly address the November elections. We will continue to monitor all developments regarding COVID-19 and its potential impacts on economic activity and equity markets. If you have any questions about this week’s newsletter or the markets, please do not hesitate to get in touch with our team.

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please click here or contact us directly.

© 2020 Sage Financial Group. Reproduction without permission is not permitted.