Market Returns

After a mild correction last week — including significant volatility on Wednesday and Thursday — the markets bounced back this week. Through the end of Thursday, the MSCI ACWI, which represents global equities (i.e., both U.S. and international stocks), rose 2.2%. The S&P 500 gained 2.4% over the same 4-day period, and the Russell 2000 advanced 3%. Core bonds have mainly been unchanged so far this week, with the Bloomberg Barclays U.S. Aggregate Bond Index inching up 0.2%.

The market performance, as we near the close of the week, shows that the overall economic recovery remains on an upward trajectory. However, as last week demonstrated, the markets are not immune to bouts of volatility, particularly in response to headlines and COVID-related updates.

Data Updates: Mobility & Spending

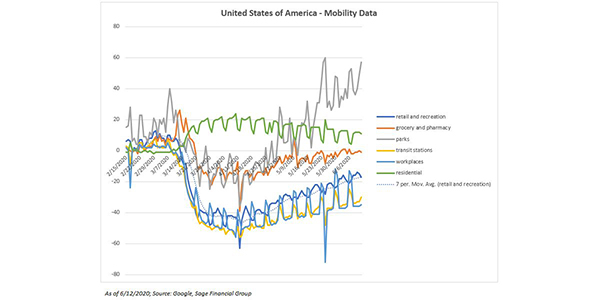

Following an event-driven market selloff, as we saw unfold in response to the COVID pandemic, real-time mobility data is a crucial tool for understanding the pace of recovery. The most recent Google mobility data[1] — including the uptick in transit station mobility — suggests that people are slowly returning to their daily routines as states continue to ease stay-at-home restrictions:

Mobility in most categories sharply declined in early/mid-March before bottoming out around mid-April. Since then, however, the data has slowly and steadily improved. Retail and recreation mobility, which is a good proxy for brick-and-mortar consumer spending, is down 20% relative to pre-COVID levels, a significant improvement over mid-April when it was down 60%.

The data from the home-buying category has been particularly encouraging: driven by historically low mortgage rates, mortgage applications recently hit an 11-year high, a good indicator of homebuyer optimism.[2] Some sectors will take longer than others to recover, including travel, which has been especially hard-hit by the pandemic. A new forecast from Tourism Economics projects domestic travel spending in 2020 will total $583 billion, a 40% drop from 2019’s total of $972 billion. Meanwhile, international inbound spending is projected to fall by 75% from last year ($155 billion to $39 billion).[3] Despite these projections, the mobility data supports our expectations that the economic recovery will continue on a gradual upward trajectory.

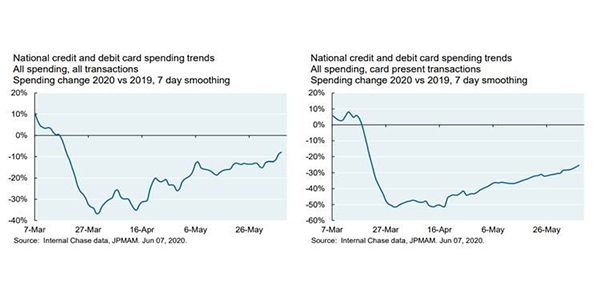

New credit and debit card spending reports from JPMorgan Chase also yields some interesting insights. As shown in the graph on the right-hand side below, “card present” transactions are 25% below pre-COVID levels, a dip that is largely attributable to social-distancing-conscious consumers spending less time in stores. However, total card transactions (on the left-hand side) are down only 8%. The data suggests that the recovery in consumer spending remains on track: consumers may be avoiding in-store shopping, but they are still shopping. This improvement in consumption (i.e., consumer spending) will be a key piece to the global recovery moving forward, considering the U.S. consumer is an important driver of the global economy.

These improvements could slow down or reverse if there is a surge of new coronavirus cases, which remains a risk. The number of new cases has increased in some states, including Florida, Arizona, California, and Texas. While this is a risk, states will likely be slower to impose “shelter-in-place” orders than they were in March and April, given what we know about the virus now versus then (i.e., more dangerous for specific parts of the population, spreads indoors, etc.) as well as new treatments that help those affected.

Update on COVID-19 Treatments

This week also brought promising preliminary results from a clinical trial by researchers at the University of Oxford on the effectiveness of dexamethasone as a treatment for COVID-19.

Corticosteroids like dexamethasone are commonly used to treat respiratory illness because they reduce inflammation. The results shared this week were encouraging about the efficacy of dexamethasone as a COVID-19 treatment, particularly for severely ill patients. Although the study notes that patients with less-serious cases did not benefit from the steroid, dexamethasone lowered the mortality rate for patients on ventilators by one-third; for patients on oxygen, it lowered the mortality rate by one-fifth. The WHO (the World Health Organization) said that it “welcomes” the results of the study.[4]

Now there are two clinically supported treatments for different severities of COVID-19 cases. Remdesivir, a broad-spectrum antiviral, was proven in a study by the National Institute of Health (NIH) to reduce the median recovery time in some COVID patients by up to four days.[5]

If dexamethasone can reduce deaths even further and remdesivir can lower the duration of hospital stays in less-severe cases, we could possibly look forward to a reduced strain on our hospital system and medical resources.

COVID-19 still poses risks, and we still do not have a complete picture of the long-term health implications of the disease. Nevertheless, the global community is marshaling a staggering amount of resources in the fight against COVID, and we remain cautiously optimistic about the work being done.

Investor Implications

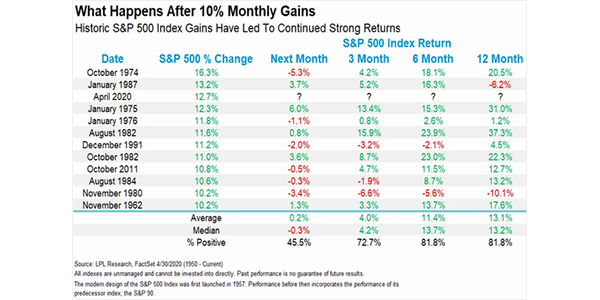

In recent weeks, the rapid rise of U.S. equity markets has prompted some people to question whether a near-term correction is likely. From a historical perspective going back to the 1960s, equity markets tend to be flat in the month after the S&P 500 has advanced by 10% or more. And following that one-month plateau, markets have gained 13.1% on average over the next 12 months. While past performance does not predict future results, it is valuable to look at a chart like the one below that compares the S&P 500’s recent performance to past periods of market declines and subsequent recoveries.

Overall, we remain cautiously optimistic about the pace of recovery. As the June 8th week’s market performance demonstrated, when the S&P 500 was down 5%, the recovery will likely have occasional bouts of market volatility. Our view is that while risks remain, the global economy broadly is still in the early stage of a new economic cycle (i.e., recovery). In this stage, we expect equities and other assets to outperform U.S. government bonds over the next 12–36 months.

[1] Google Mobility Data, Sage Financial Group; As of 6/17/20

[2] The Real Deal, Mortgage applications to buy homes hit an 11-year high.

[3] U.S. Travel Association, New Study: Travel Spending in the U.S. to Plunge 45% This Year.

[4] World Health Organization, WHO welcomes preliminary results about dexamethasone use in treating critically ill COVID-19 patients.

[5] The New England Journal of Medicine, Remdesivir for the Treatment of Covid-19 — Preliminary Report.

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks, or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks, or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks, or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged, and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please visit Accolades page or contact us directly.

© 2020 Sage Financial Group. Reproduction without permission is not permitted.