The financial markets performed well in May, supported by continued positive developments throughout the global economy. The MSCI ACWI Index, which represents global equities (i.e., both U.S. and international stocks), advanced by 1.56%, the U.S. large-cap Russell 1000 Index rose 0.47%, the U.S. small-cap Russell 2000 Index increased by 0.21%, and the MSCI ACWI Ex-USA Index (international stocks) led the markets, moving up 3.13%. Core U.S. bonds represented by the Bloomberg Barclays Aggregate U.S. Bond Index ended the month up 0.33%, primarily due to modestly lower interest rates.

In this edition of Insights, we share our thoughts on economic growth and inflation, the global COVID situation, and the value of portfolio diversification.

Economic Growth and Inflation

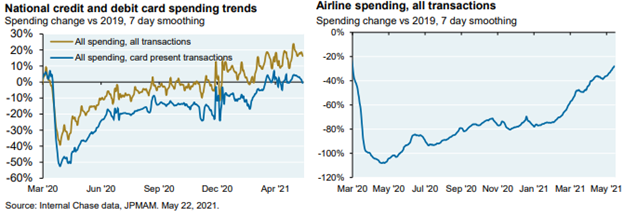

Economic growth in the U.S. has garnered steam as the reopening process continues across the country. Several states have moved into the final stages of reopening their economies and businesses, which has fueled the release of pent-up consumer demand. As shown below, spending from all consumer transactions is now approximately 20% higher than at the same time in 2019, pre-pandemic, with airline spending normalizing even further than in April. We expect these trends and growth to continue.

The pandemic-induced recession and recovery have been unprecedented, largely due to the extraordinary supply and demand shock to the economy in 2020. Typically, recessions are caused by economic imbalances such as household debt, interest rates, and commodity prices. When COVID emerged, these imbalances did not exist. This fundamental strength, coupled with government policies enacted to limit the damage, made it possible for the economy to recover rapidly.

What does this rapid growth mean for markets and inflation? Strong economic growth is mostly positive for financial markets, as it increases the overall “pie” from which companies derive revenue and profits. Over time, equity markets are driven upward by key growth factors such as population increases and innovation. Yet, over shorter periods, high economic growth can lead to inflation through increased commodity prices, supply-chain pressures, etc., which are a result of an imbalance between supply and demand. Inflation can be a risk as it typically results in the Federal Reserve trying to slow rapid growth with more aggressive monetary policy (i.e., raising interest rates).

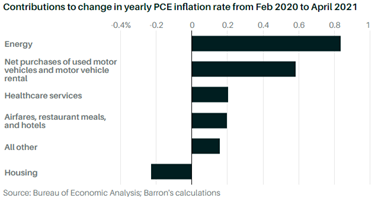

The most current readings of price increases through May, using the Federal Reserve’s preferred Personal Consumption Expenditures Price Index (PCE inflation), show that on a 1-year basis, headline prices rose 3.6%, and core prices rose 3.1% (excluding the more volatile food/energy categories). Looking into the numbers more closely, as shown below, energy and automobiles made up the bulk of the recent price increases, but neither component’s price increase is expected to persist through 2021 and beyond. In terms of tracking inflationary pressures in housing, PCE measures the change in the implied cost of housing for homeowners. As a note, the housing component of PCE measures what is known as “owner’s equivalent rent,” which is the cost of living for homeowners, or the rent that would have to be paid in order to substitute a currently owned house as a rental property. The Fed’s preferred inflation figure excludes higher home prices because they are primarily investment gains for the homeowners (i.e,. a consumer is not buying a new home each month and can use equity for subsequent purchases).

In our view, while the year-over-year PCE number was the highest in decades, it was generally expected due to the unusual economic conditions of the past 15 months. June is likely to produce another high reading. But beginning in July, the catalysts that have pushed up inflation over recent months are likely to become headwinds because consumers have not become insensitive to price increases. For example, as home prices have risen, recent new and existing home sale numbers have been modestly lower than expected. We feel that we will see a moderation in inflationary figures in the back half of the year.

Further, while inflation is a risk, we believe that structural headwinds remain, including demographics, low wage growth, and increased price transparency due to technological advances. In the case of demographics, the older U.S. population should help keep prices subdued. As we discussed last month, demographics in the U.S. have shifted over time. We now have a significantly higher concentration of the population in the older generations who rely on fixed incomes than when we last saw inflation in the 1980s. In addition, globalization has led to lower wage growth over the past five decades, which is a dynamic that we believe is likely to continue overall. While some companies have been offering higher hourly rates and bonuses to entice workers back, this trend is unlikely to continue once the labor market normalizes. In our view, the current unusually high pay increases are probably one-time adjustments to address an extended period of low wage growth. Finally, persistently higher inflation could lead to a more aggressive Federal Reserve. However, this is not our base case projection, and officials have said they will remain patient amid higher inflation readings while supply chain dynamics should get resolved.

From a market perspective, modest inflation tends to be a positive for equities. Companies with increased pricing power can further widen profit margins, allowing corporations to increase dividends and repay future debts more easily. On the other hand, inflation can mean higher interest rates over time, which may weigh on the performance of government and other fixed-rate high-quality bonds (lower expected value of payments received). While we recognize the risks of higher inflation, our view is that the current inflationary pressures should be temporary instead of persistent and that clients’ portfolios are appropriately positioned with an underweight to interest rate sensitive bonds relative to long-term targets and an overweight to equities.

Global COVID Trends

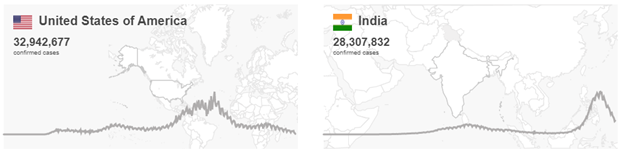

The global COVID trend continues to improve considerably. According to the WHO, the United States had 12k new cases reported on May 31st, down 95% from a peak of over 300k earlier this year in January. The most recent hotspot globally has been India, which sadly saw a spike in cases just over one month ago. However, new COVID cases in India began to improve in the second half of May and have declined by 70% in the past few weeks.

From a policy standpoint, the raw number of COVID cases has become less important over time as officials focus on a wider variety of statistics to make decisions regarding reopening. However, situations such as the spike in India last month do matter for financial markets. India is the world’s 7th largest economy and has the 2nd most amount of people, marginally behind China. Although current COVID protection is still largely concentrated in larger countries, vaccines have become more widely available globally as production continues to ramp up. The increased availability should help limit the voracity of future outbreaks.

While risks of future COVID hotspots and a vaccine-resistant variant remain, we remain cautiously optimistic that the positive trend in global reopening will continue over the rest of 2021. We are encouraged to see the improvement in India alongside current stable situations in the U.S., U.K., and Canada, spurred by the fact that more than 50% of the population has received at least one shot of a COVID vaccine. Further, government agencies have paved the way for the approval and dissemination of booster shots to be expedited[1].

From the financial markets perspective, the improving COVID situation is an important factor as the continued reopening of businesses is expected to lead directly to increased consumer confidence, economic activity, and job growth. Equity and bond markets alike will respond to these data points, although likely in a less dramatic way than a year ago.

Portfolio Diversification

Nobel prize winner Harry Markowitz coined the phrase in the 1950s, “diversification is the only free lunch in finance.” What Markowitz meant by this famous quote is that a diversified portfolio, including multiple uncorrelated asset classes, should create a better risk-adjusted return. For example, a portfolio consisting of 60% stocks and 40% bonds is likely to experience periods when stocks decline in value, but bonds deliver a positive return. The result is that overall portfolio volatility is dampened. Remaining diversified and disciplined over time can also prevent an investor from chasing the new “hot themes,” which seemingly tend to repeat over time. In his blog, A Wealth of Common Sense, Ben Carlson recently focused on investments that had performed well in 2020 but had the opposite outcome in 2021, which has often been the case. His point is that while many asset classes have reversed from outperformance to underperformance and investor enthusiasm for trendy asset classes comes and goes quickly, diversified portfolios performed well in both years.

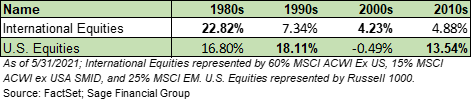

A prime example of diversified investment discipline can be observed in international equity markets, which over time have performed better during different periods than U.S. markets. As shown below, since the 1980s, international and U.S. equities have rotated outperformance from one decade to the next. There is no guarantee that past performance trends will continue, but we think it is noteworthy that these rotations have provided diversification benefits over time.

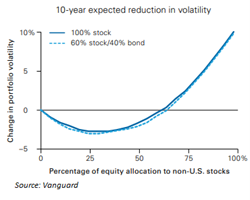

Further, from an overall risk (i.e., volatility) perspective, Vanguard recently published a research paper that showed investing globally provides an expected diversification benefit. Specifically, Vanguard’s research shows that volatility is optimally reduced when a portfolio holds 30-35% of its equity allocation in non-US stocks.

This is consistent with Sage’s recommendation for portfolios. We build portfolios based on each client’s risk profile and future financial needs. We expect our clients to enjoy lower volatility with a diversified portfolio.

Closing Thoughts

The first five months of 2021 have proven to be positive for financial markets and client portfolios. We continue to recognize that we are in an unprecedented period as the economy recovers from a global pandemic, and government spending policies create some unnatural situations. Our current base case scenario is that current inflationary pressures are transitory. Nonetheless, we recognize that higher prices are a risk and have already incorporated strategies into portfolios to address inflation. We will continue to closely monitor the effect of these actions from an investment perspective. Currently, we are closely watching the “tea leaves” of inflation and its impact on economic growth and financial markets. We want to prepare you that inflation measures are likely to fluctuate throughout the year and caution against reading too much into any one data point.

[1] WSJ: FDA Looks to Quickly Authorize Covid-19 Vaccine Booster Shots as New Variants Emerge

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please visit Accolades page or contact us directly.

© 2021 Sage Financial Group. Reproduction without permission is not permitted.