In terms of financial markets, this past week was less volatile than recent weeks. What were daily equity market moves of 6% or greater throughout most of March, have mostly been within a band of ~3% this week. It was also quieter on the news front. After several weeks chock full of major developments in monetary policy, fiscal policy, and biology, this past week marked something of a transition to the wait-and-see phase of the COVID-19 crisis. Although economic data has been poor, the decreased price volatility seems to reflect a situation that we have previously noted, namely, that equity and bond markets may have already priced in a large portion of the negative economic data. Stock and bond markets may have begun to look for emerging clues about the path of COVID-19 infection and the implementation of fiscal and monetary policy measures to offset the economic impact of lockdowns across the nation. Put differently, market participants may have shifted their focus from fear about the virus to the success of measures to mitigate contagion and economic deterioration because they are attempting to determine when the economic recovery from the current economic recession will begin.

There may be fewer headlines about major government policy initiatives or medical revelations over the next couple of weeks while we await testing results for infection and trial results about potential COVID-19 treatments. We believe that this relatively quiet period will be important for investors for several reasons. First, it is to be expected that confirmed cases about infection will rise as testing continues. From the markets’ perspective, we believe this is positive because more information will allow governments, citizens, and investors to map out the rate of infection and when the rise in daily new confirmed cases may peak so that they can better plan their steps forward. Second, some relative quiet may help investors prepare themselves for sifting through news headlines in order to focus on and digest substantive analyses that go beyond sensationalism.

In the vein of focusing on substantive developments that may be most useful to investors, we provide updates to the three major themes that Sage is watching. We do so with an eye on both the U.S. and global response.

Monetary policy

As we have noted in past emails, the Federal Reserve has not held back from using its crisis toolkit, starting early in March with an inter-meeting rate cut and continuing with what has become most of the kitchen sink. The Fed’s balance sheet has grown to a record $5 trillion, and we expect that the balance sheet will continue to grow eventually to a level above $7 trillion. The announcement of an open-ended quantitative easing (QE) program and other facilities first explored during the global financial crisis in 2007-2009 has boosted liquidity and returned a significant degree of confidence to the financial system.

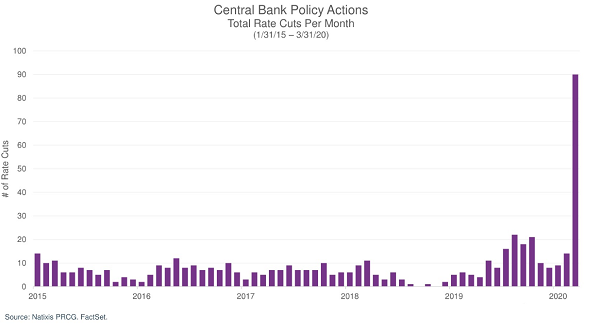

Overall, the number of rate cuts from global central banks spiked in March to an astounding 90. Since 2015, the highest reading for a single month was 22, which occurred in mid-2019. This spike in interest rate reductions signals that monetary policymakers are acting swiftly around the world to help their respective economies through this tough time. What is more, they are often doing this in coordination with other central banks.

Fiscal policy

The U.S. federal government has been quick to act, especially as compared with its responses to past crises. However, what is often called execution risk remains; that is, the risk of effectively and quickly getting needed money into the hands of households and businesses who need it.

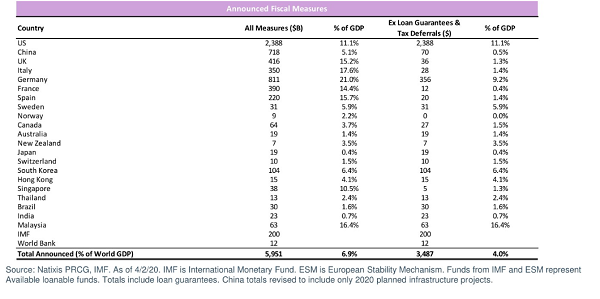

Governments around the world also have been using fiscal stimulus to help soften the blow of lost income for households and businesses. The list below shows the major countries that have announced fiscal policy packages along with the percentage of GDP that the packages represent. The U.S. policy response is the largest in terms of dollar figures, but typically fiscally conservative Germany has the largest as a percentage of its GDP.

Biology

Based on data from the World Health Organization and others, countries such as China, Italy, and South Korea likely have seen their peaks,, which may inspire hope that social distancing measures and stay-at-home lockdowns can work. China and South Korea specifically also may serve as examples of how to re-open economies and return to social interaction without a massive second wave of infections, although that does remain a risk. Unfortunately, the number of new cases and deaths has continued to rise in the U.S. The timelines of other countries points towards a peak in the U.S. during April as it seems to take 4-6 weeks from lockdown restrictions for the rate of new infections to peak.

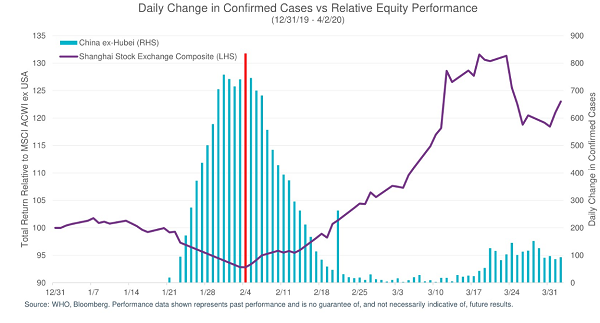

The reason that Sage, along with other financial firms, has focused so much on the path of the virus in our communications is that it is key to understanding the eventual economic recovery. Stock markets are forward-looking, discounting mechanisms that attempt to efficiently gauge future cash flows of individual companies on a micro level and entire stock indices on a macro level. The current social and economic lockdown does not lend itself well to positive cash flows for companies in Q2, but the timing of when COVID-19 infections peak tends to coincide with when policymakers discuss how and when to re-open the economy (i.e., it relates to the timing and magnitude of economic and investment recovery). In the case of China, markets bottomed when new confirmed infections peaked (see the chart below). China is the first country to have passed through an infection cycle, and thus it is a unique example; however, we think it provides a guide for investor sentiment and buying behavior.

We realize that there are questions about the integrity of China’s health reporting data, but we see similar curves and responses from the emerging data about South Korea and Italy.

The world is eagerly awaiting clinical trial results of potential treatments. Two drugs that have received much positive press are Gilead’s Remdesivir and the combination of existing anti-malaria (hydroxychloroquine) + antibiotic (azithromycin). Gilead’s Remdesivir originally was developed to fight Ebola, but the company is testing it now against COVID-19. Further, a Chinese study was published this week on the efficacy of hydroxychloroquine + azithromycin, which, although covering a limited sample size, showed promising results for moderate cases of COVID-19. We expect more comprehensive studies to be published and trial results to be released in the coming weeks.

In our opinion, it is important to remember that in each of the major areas, we as humans are not giving up the fight against the virus and what it could do to our society, including our economy, if left to its own devices. The contributions of the scientific community are likely the most important piece of the puzzle moving forward. But continued support will be needed from global governments and central banks as well to keep consumers and businesses afloat and financial markets functioning properly.

Previous Posts

A Reference Guide to the COVID-19 Assistance Package

Our Perspective: An Update on the Effects of COVID-19

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events which were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please click here or contact us directly.

© 2020 Sage Financial Group. Reproduction without permission is not permitted.